PERBANDINGAN ANTARA DUA METODE COSTING

advertisement

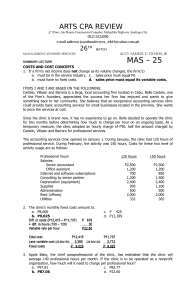

PERBANDINGAN ANTARA DUA METODE COSTING Zahra, Co developed the following standard unit costs at 100% of its normal production capacity, which is 50,000 units per year: Direct materials ……………………………………….. Direct labor ……………………………………………… Variable factory overhead …………………………. Fixed factory overhead …………………………….. $6 3 1 5 The selling price of each unit of product is $ 25. Variable commercial expenses are $1 per unit sold, and fixed commercial expenses total $ 180,000 for the period. During the year, 49,000 units were produced and 52,000 units were sold. There is no work in process beginning or ending inventories, and finished goods inventory is maintained at standard cost, which has not changed from the preceding year. For the current year, there is a net unfavorable variable cost variance in the amount of $ 2,000. All standard cost variances are charged to cost of goods sold at the end of the period. Required : (1). Prepare an income statement on the absorption costing basis. (2). Prepare an income statement on the direct costing. (3). Compute and reconcile the difference in operating income for the current year under absorption costing and direct costing. Answer : Zahra Corporation Income Statement For Year Ended 20--------------------------------------------------------------------------Sales ……………………………………………………. $ 1.300,000 COGS: Standard full cost ………………………….. $780,000 Net Unfavorable variable cost variance 2,000 Unfavorable volume variance ………… 5,000 787,000 Gross Profit …………………………………. 513,000 Less commercial expense: Less commercial expense: Variable expense (52,000 x $1) …………. $ 52,000 Fixed expense …………………………………. $ 180,000 Operating income under absorption costing Units budgeted for production during the year …. Units actually produced during the year …………... Fixed factory overhead charge to each unit ……… Unfavorable volume variance …………………………. 232,000 281,000 50,000 49,000 1,000 x $5 $ 5,000 2). Zahra Corporation Income Statement For Year Ended 20--------------------------------------------------------------------------Sales (52,000 x $ 25) ……………………………….. 1,300,000 Cost of Goods Sold: Standard variable cost (52,000 x $10) .. $ 520,000 Net unfavorable variable cost variance 2,000 522,000 Gross contribution margin ……………………….. 778,000 Variable commercial expense (52,000x$1) ….. 52,000 Contribution margin ………………………………… 726,000 Less fixed cost: Factory overhead (50,000 x $ 5) ………… $ 250,000 Commercial expenses ……………………….. 180,000 430,000 Operating income under direct costing .. 296,000 3). Operating income under absorption costing …… Operating income under direct costing …………... Difference …………………………………………………… $ 281,000 296,000 ($15,000) Units produced during the year ……………………. $49,000 Units sold during the year ……………………………. 52,000 Units decrease in finished goods inventory ……. (3,000) Fixed factory overhead charged to each unit under Absorption costing ……………………………………. X $5 Difference ………………………………………………….. $ (15,000)