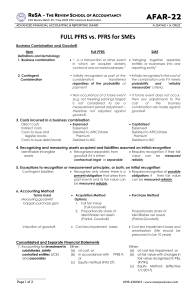

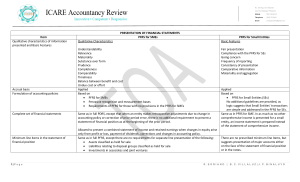

Palawan State University College of Business and Accountancy School Year: 2020 - 2021 Petrogen Insurance Corporation (A wholly-owned Subsidiary of Petron Corporation) Statements of Income Underwriting Income a. Nature and Composition Apart from life insurance, the Petrogen Insurance Corporation is now active in all sorts of insurance and reinsurance for products and property, as well as transportation and conveyance, both on land and at sea. The Corporation is implementing PFRS 17 to make it easier for insurers and their customers to evaluate and analyze the profitability of new and current business, as well as to have a better knowledge of the company's financial status. b. Recognition The company's insurance contract revenues are categorised under PFRS 4, whereas interest and other income are classified under PFRS 9 and 15, respectively. Revenue from customer contracts is recorded at an amount that reflects the consideration that the company expects to receive in exchange for those goods or services, excluding sums collected on behalf of others once control has been handed to customers. The corporation's other underwriting income is recorded during the period when benefits are received. They began recording revenue when they received the amount they had anticipated from their consumers. c. Measurement With the exception of financial assets classified as investments in debt securities at fair value via other comprehensive income (FVOCI), which are stated at fair value, the Corporation's financial Palawan State University College of Business and Accountancy School Year: 2020 - 2021 statements have been produced on a historical cost basis. Insurance contract groups are valued under PFRS 17 using fulfillment cash flows, which represent the risk-adjusted present value of the entity's rights and obligations to policyholders, and a contractual service margin, which represents the unearned profit the entity will recognize while providing services to policyholders during the coverage period. Insurance contracts mix financial instruments with service contracts. It's also worth noting that many long-term insurance contracts produce cash flows that vary dramatically over time. PFRS 17 (Philippine Financial Reporting Standards): This strategy combines the estimation of future cash flows and the recognition of profit over the life of a contract. Separates the results of insurance services (including revenue) from the income or expenditures of insurance finance; and It necessitates a decision by an entity as to which income and expenses should be recorded in profit and loss and which should be recorded in other comprehensive revenue. d. Presentation The financial statements of the organization are presented in such a way that the information can be trusted to be accurate and up-to-date. Note 25 examines recovery or settlement within 12 months of the report's publication date (current) and more than 12 months after the publication date (non-current.) For the time being, the company is assessing the new standard's impact on its financial statements thoroughly. e. Disclosure Both qualitative and quantitative disclosures are required by PFRS 17. The goal is for an entity to disclose information that, when combined with the information in the primary Palawan State University College of Business and Accountancy School Year: 2020 - 2021 financial statements, allows financial statement readers to assess the impact of insurance contracts on the entity's financial condition, performance, and cash flows. PFRS 17 requires particular disclosures of the following to accomplish this: amounts recognized in the financial statements; material judgments made in applying IFRS 17; and the nature and extent of risks arising from insurance contracts.