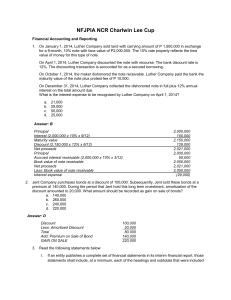

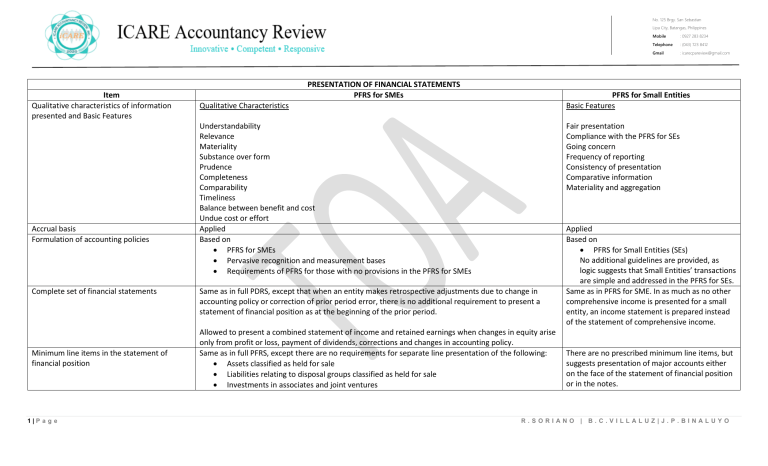

PFRS for SMEs vs. Small Entities: Accounting Treatment Comparison

advertisement

No. 125 Brgy. San Sebastian Lipa City, Batangas, Philippines Item Qualitative characteristics of information presented and Basic Features Accrual basis Formulation of accounting policies Complete set of financial statements Minimum line items in the statement of financial position 1|P a g e PRESENTATION OF FINANCIAL STATEMENTS PFRS for SMEs Mobile : 0927 283 8234 Telephone : (043) 723 8412 Gmail : icarecpareview@gmail.com PFRS for Small Entities Basic Features Qualitative Characteristics Understandability Relevance Materiality Substance over form Prudence Completeness Comparability Timeliness Balance between benefit and cost Undue cost or effort Applied Based on • PFRS for SMEs • Pervasive recognition and measurement bases • Requirements of PFRS for those with no provisions in the PFRS for SMEs Fair presentation Compliance with the PFRS for SEs Going concern Frequency of reporting Consistency of presentation Comparative information Materiality and aggregation Same as in full PDRS, except that when an entity makes retrospective adjustments due to change in accounting policy or correction of prior period error, there is no additional requirement to present a statement of financial position as at the beginning of the prior period. Allowed to present a combined statement of income and retained earnings when changes in equity arise only from profit or loss, payment of dividends, corrections and changes in accounting policy. Same as in full PFRS, except there are no requirements for separate line presentation of the following: • Assets classified as held for sale • Liabilities relating to disposal groups classified as held for sale • Investments in associates and joint ventures Applied Based on • PFRS for Small Entities (SEs) No additional guidelines are provided, as logic suggests that Small Entities’ transactions are simple and addressed in the PFRS for SEs. Same as in PFRS for SME. In as much as no other comprehensive income is presented for a small entity, an income statement is prepared instead of the statement of comprehensive income. There are no prescribed minimum line items, but suggests presentation of major accounts either on the face of the statement of financial position or in the notes. R.SORIANO | B.C.VILLALUZ|J.P.BINALUYO No. 125 Brgy. San Sebastian Lipa City, Batangas, Philippines Minimum line items on the face of the statement of comprehensive income or statement of income Statement of changes in equity Note: The full PFRS provides options for presentation of dividends: either in the statement of changes in equity or in the notes. Changes in accounting policies : 0927 283 8234 Telephone : (043) 723 8412 Gmail : icarecpareview@gmail.com Same as in full PFRS except that impairment loss is not required to be presented separately. There are no prescribed minimum line items. Same as in full PFRS, but does not provide option for presentation of dividends. There are no specific guidelines. Same as in full PFRS but does not require a restated statement of financial position as at the beginning of the prior year. There is no requirement for restatement of comparative prior period. The cumulative amount is shown as adjustment to the beginning balance of equity of the current period. The balances of the assets and liabilities of the current period are adjusted. There is no requirement for restatement of comparative prior period. The cumulative amount is shown as adjustments to the beginning balance of equity of the current period. The balances of the assets and liabilities of the current period are adjusted. Not required Same as in full PFRS except that the following are not required to be disclosed: a. Sensitivity analysis b. Key sources of judgements c. Key sources of estimation uncertainty Correction of prior period errors Same as in full PFRS but does not require a restated statement of financial position as at the beginning of the prior year. Earnings per share presentation Notes to financial statements Not required Same as in full PFRS except sensitivity analysis is not required. Disclosure requirements Substantially reduced due to the following reasons: • Some topics are not included in PFRS for SMEs; • Some measurement principles are simplified; • Some opinions are omitted; and • Cost-benefit is considered 2|P a g e Mobile R.SORIANO | B.C.VILLALUZ|J.P.BINALUYO No. 125 Brgy. San Sebastian Lipa City, Batangas, Philippines Element/ Transaction Inventories Investments in associates Elements in associations and joint ventures (continued) Investment in jointly controlled entities Basic equity investments (neither investment in associates nor investment in joint ventures) Debt instruments Investment property Mobile : 0927 283 8234 Telephone : (043) 723 8412 Gmail : icarecpareview@gmail.com ACCOUNTING TREATMENTS FOR FINANCIAL STATEMENT ELEMENTS PFRS for SMEs PFRS for Small Entities Same as in full PFRS Costing procedures are the same as in full PFRS, except inventories are subsequently measured at the lower of cost of market value. Market value is the probable selling prince to willing buyers as of reporting date. Use either the equity model or Same as in PFRS for SMEs except small entities can choose freely (a) The cost model for investments with no published price quotations and measurement at fair between the cost model and the fair value model. value is impracticable, and (b) The fair value model for investments with published price quotations and fair value can be determined reliably without undue cost and effort. Under both fair value model and cost model, dividends are reported as income without regard to the sources of dividends Use either the equity model or No such account is used, as an entity with investment in jointly controlled (a) The cost model for investments with no published price quotations and measurement at fair entities may not qualify as small entity. value is impracticable, and (b) The fair value model for investments with published price quotations and fair value can be determined reliably without undue cost and effort. Under both fair value model and cost model, dividends are reported as income without regard to the sources of dividends. Designed as at FV through profit or loss, for instruments with published price quotations and FV can Initially measured at cost, including transaction cost. be determined reliably without undue cost and effort, accounted for at cost. Subject to impairment, which is taken in profit or loss. At reporting date, they are measured at the lower of cost or fair value, with impairment taken to profit or loss. Initially recognized at transaction price and subsequently amortized using the effective interest Same as in PFRS for SMEs. method. Impairment loss and reversal of impairment are recognized based on objective of impairment and recovery, respectively. Same as in full PFRS for immediate recognition, except borrowing costs are expensed. Same as in the PFRS for SMEs. Investment property held under operating lease is initially measured at the lower between fair value and present value of minimum lease payments. 3|P a g e R.SORIANO | B.C.VILLALUZ|J.P.BINALUYO No. 125 Brgy. San Sebastian Lipa City, Batangas, Philippines Research and development costs Intangible assets whose estimated useful life cannot be determined reliably. Income tax Leases : 0927 283 8234 Telephone : (043) 723 8412 Gmail : icarecpareview@gmail.com Investment property whose fair value can be determined reliably without undue cost or effort shall be subsequently measured using the fair value model. All other investments shall be measured using the cost model. Recognized as expense when incurred. Same as in PFRS for SMEs, except that no further requirement to disclose fair value under the cost model. Same as in PFRS for SMEs. Amortized based on management’s best estimate, but not to exceed 10 years. Same as in PFRS for SMEs. Same as in full PFRS Choice between accrual of (a) Current tax only (payable or receivable) and (b) Current and deferred income tax. Account as finance lease when the lease transfers substantially the risks and rewards of ownership to the lessee. Otherwise, record the lease (based on old PAS 16 under full PFRS). However, under operating leases, there is no requirement to account for lease payments under the straight-line approach. Borrowing costs Recorded as expenses Employee benefits Same as in PFRS except that the use of projected unit credit method (PUCM) may be waived if entity is not able to use it without undue cost or effort. A simplified approach that ignores future salary increases, future services and mortality of current employees is used in lieu of PUCM. Option may be exercised to treat actuarial gains and losses in (a) Profit or loss or (b) Partly in profit or loss and partly in OCI. Disclosure requirements Substantially reduced Source: Empleo, P.M. (2020). Intermediate Financial Reporting. La Limariza Printing Press. 4|P a g e Mobile When (b) is opted, both the current and deferred taxes are recognized in profit or loss. Account for all leases as operating lease. Same as in PFRS for SMEs. All employee benefit costs are taken to profit or loss, unless it forms part of an asset account. Substantially reduced R.SORIANO | B.C.VILLALUZ|J.P.BINALUYO