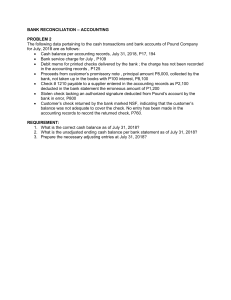

Blue Company purchased a machine on January 1, 2015, for P6,000,000. At the date of acquisition, the machine had a life of six years with no residual value. The machine was depreciated on a straight-line basis. On January 1, 2018, the entity determined that the machine had a useful life of eight years from the date of acquisition with no residual value. What is the depreciation of the machine for 2018? a. 750,000 b. 600,000 c. 375,000 d. 500,000 Answer: b Solution: Purchased price= P6,000,000 Residual value= 0 Useful life= 6 years Depreciation (SLM)= 6,000,000-0/6 years = 1,000,000 WDV as of (1/1/2018) 6,000,000 ->1,000,000 * 3 years = 3,000,000 Depreciation per annum = Remaining WDV/Remaining useful life = 3,000,000/ 8 years – 3 years = 3,000,000/5 years = P 600,000 On January 1, 2015, Flax Company purchased a machine for P5,280,000 and depreciated it by the straight-line method using an estimated useful life of eight years with no residual value. On January 1, 2018, the entity determined that had a useful life of six years from the date of acquisition and the residual value was P480,000. An accounting change was made in 2018 to reflect this additional information. What is the accumulated depreciation for the machine on December 31, 2018? a. 2,920,000 b. 3,080,000 c. 3,200,000 d. 3,520,000 Answer: a Acquisition cost- January 1, 2015 5,280,000 Accumulated depreciation for 2015, 2016 & 2017 (5,280,000/8*3) 1,980,000 Carrying amount- January 1, 2018 3,300,000 Accumulated depreciation- January 1, 2018 1,980,000 Depreciation for 2018 (2,820,000/3 years) 940,000 Accumulated Depreciation – December 31,2018 2,920,000 Carrying amount- January 1, 2018 3,300,000 Residual value (480,000) Depreciation amount 2,820,000 During 2018, Orca Company decided to change from the FIFO inventory valuation to the weighted average method. The income tax rate is 30%. FIFO Weighted Average January 1 inventory 7,100,000 7,700,000 December 31 inventory 7,900,000 8,200,000 What amount should be reported as the cumulative effect of this accounting change for 2018? a. 420,000 increase b. 420,000 increase c. 600,000 increase d. 600,000 decrease Answer: a and b Solution: FIFO inventory- January 1 7,100,000 Weighted average inventory- January 1 7,700,000 Cumulative effect 600,000 Cumulative effect after tax (70%*600,000) 420,000 The change from FIFO to weighted average is a change in accounting policy. The cumulative effect change accounting policy is an adjustment of retained earnings. Inventory 600,000 Retained earnings 420,000 Increase tax payable 180,000 Goddard Company had used the FIFO method of inventory valuation since it began operations in 2015. The entity decided to change to weighted average method for measuring inventory at the beginning of 2018. The income tax rate is 30%. The following schedule shows year-end inventory balances: Year FIFO Weighted Average 2015 4,500,000 5,400,000 2016 7,800,000 7,100,000 2017 8,300,000 7,800,000 What amount should be reported for 2018 as cumulative effect of the change in accounting policy? a. 500,000 decrease b. 350,000 decrease c. 500,000 increase d. 350,000 increase answer: b FIFO inventory- 2017 8,300,000 Weighted average inventory- 2017 Decrease in inventory 7,800,000 (500,000) Cumulative effect after tax (70%*500,000) 350,000 decrease