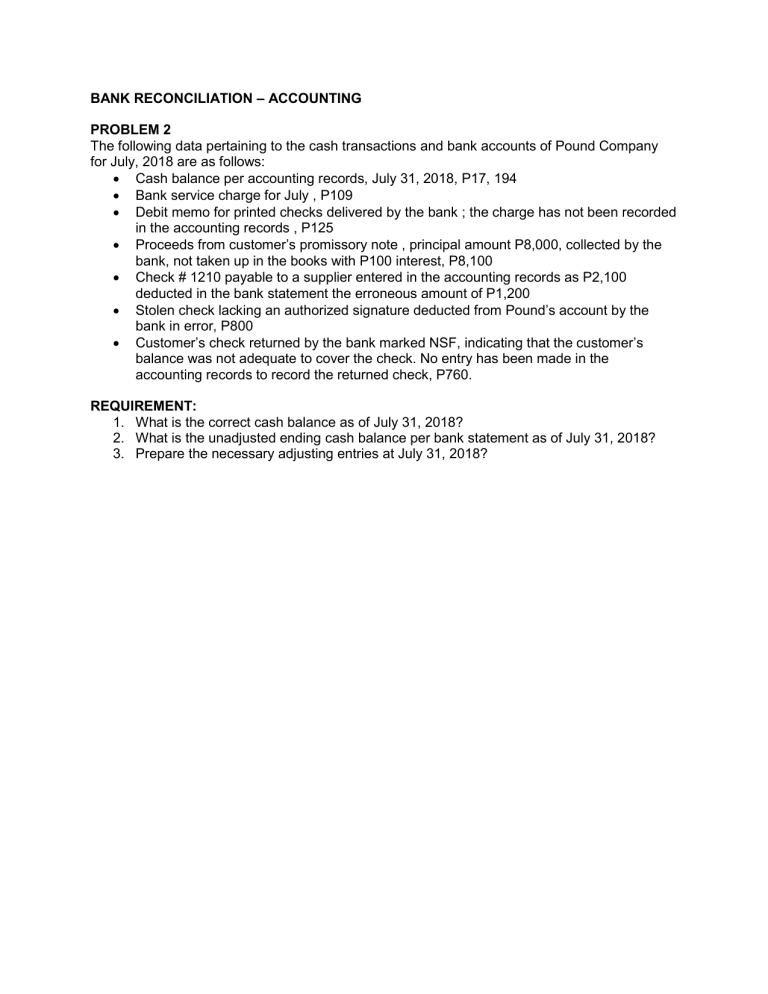

BANK RECONCILIATION – ACCOUNTING PROBLEM 2 The following data pertaining to the cash transactions and bank accounts of Pound Company for July, 2018 are as follows: Cash balance per accounting records, July 31, 2018, P17, 194 Bank service charge for July , P109 Debit memo for printed checks delivered by the bank ; the charge has not been recorded in the accounting records , P125 Proceeds from customer’s promissory note , principal amount P8,000, collected by the bank, not taken up in the books with P100 interest, P8,100 Check # 1210 payable to a supplier entered in the accounting records as P2,100 deducted in the bank statement the erroneous amount of P1,200 Stolen check lacking an authorized signature deducted from Pound’s account by the bank in error, P800 Customer’s check returned by the bank marked NSF, indicating that the customer’s balance was not adequate to cover the check. No entry has been made in the accounting records to record the returned check, P760. REQUIREMENT: 1. What is the correct cash balance as of July 31, 2018? 2. What is the unadjusted ending cash balance per bank statement as of July 31, 2018? 3. Prepare the necessary adjusting entries at July 31, 2018?