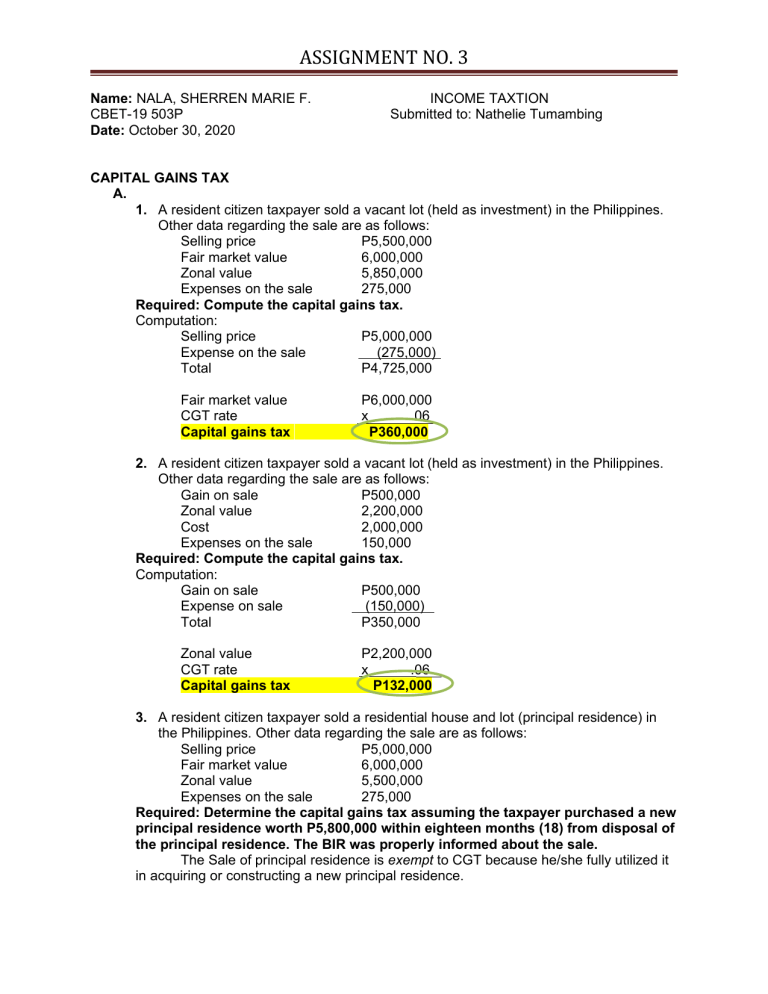

ASSIGNMENT NO. 3 Name: NALA, SHERREN MARIE F. CBET-19 503P Date: October 30, 2020 INCOME TAXTION Submitted to: Nathelie Tumambing CAPITAL GAINS TAX A. 1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data regarding the sale are as follows: Selling price P5,500,000 Fair market value 6,000,000 Zonal value 5,850,000 Expenses on the sale 275,000 Required: Compute the capital gains tax. Computation: Selling price P5,000,000 Expense on the sale (275,000) Total P4,725,000 Fair market value CGT rate Capital gains tax P6,000,000 x .06 P360,000 2. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data regarding the sale are as follows: Gain on sale P500,000 Zonal value 2,200,000 Cost 2,000,000 Expenses on the sale 150,000 Required: Compute the capital gains tax. Computation: Gain on sale P500,000 Expense on sale (150,000) Total P350,000 Zonal value CGT rate Capital gains tax P2,200,000 x .06 P132,000 3. A resident citizen taxpayer sold a residential house and lot (principal residence) in the Philippines. Other data regarding the sale are as follows: Selling price P5,000,000 Fair market value 6,000,000 Zonal value 5,500,000 Expenses on the sale 275,000 Required: Determine the capital gains tax assuming the taxpayer purchased a new principal residence worth P5,800,000 within eighteen months (18) from disposal of the principal residence. The BIR was properly informed about the sale. The Sale of principal residence is exempt to CGT because he/she fully utilized it in acquiring or constructing a new principal residence. ASSIGNMENT NO. 3 4. Using the same data in the preceding number, determine the capital gains tax assuming the taxpayer utilized only 80% of the proceeds in acquiring his new principal residence. Computation: Selling price P5,000,000 x .80 Total P4,000,000 Taxable Income= P1,000,000/P5,000,000xP6,000,000 =0.2xP6,000,000 Taxable Income=P1,200,000 Taxable Income CGT rate Capital gains tax B. Assume the following data: Selling price of Building No. 1 Selling price of Building No. 2 Cost of Building No. 1 Cost of Building No. 2 Expenses on sale of Building No. 1 Expenses on Building No. 2 Fair market value of Building No. 1 Fair market value of Building No. 2 P1,200,000 x .06 P72,000 P15,000,000 20,000,000 10,000,000 30,000,000 200,000 300,000 12,000,000 8,000,000 Required: a. Compute the capital gains tax on Building No. 1 Computation: Selling price of Building No. 1 P15,000,000 Expenses on sale of Building No. 1 (200,000) Total P14,800,000 Cost of Building No. 1 Fair market value of Building No. 1 10,000,000 12,000,000 Selling Price CGT rate Capital gains tax P14,800,000 x .06 P888,000 b. Compute the capital gains tax on Building No. 2 Computation: Selling price of Building No. 2 P20,000,000 Expenses on Building No. 2 (300,000) Total P19,700,000 Cost of Building No. 2 Fair market value of Building No. 2 30,000,000 8,000,000 ASSIGNMENT NO. 3 Cost of Building No. 2 CGT rate Capital gains tax P30,000,000 x .06 P1,800,000 c. Compute the capital gains tax on Building No. assuming the Building is situated abroad. 0 The 6% capital gains tax on real properties sold are applicable only on real properties “held as capital assets” situated in the Philippines. The property sold is located abroad and classified as an ordinary asset. C. The taxpayer is a resident citizen: Selling rice at prevailing market value on a direct sale to buyer of shares of stock of a domestic corporation – P600,000 Cost of the shares sold – 650,000 Required: Compute the capital gains tax. Computation: Selling price P600,000 Cost of the shares sold 650,000 Total -P50,000 It will not be subject to CGT because it will result to a capital loss. D. The taxpayer is a resident alien: Selling rice on a direct sale to buyer of shares of stock of a domestic corporation – P310,000 Expenses on sale – 10,000 Cost of the shares sold – 200,000 Required: Compute the capital gains tax. Computation: Domestic corp. P310,000 Expense on sale (10,000) Cost of the shares sold (200,000) Total P100,000 CGT rate x .15 Capital gains tax P15,000 E. The tax payer is a resident alien: Selling rice on a direct sale to buyer of shares of stock of a domestic corporation – P310,000 Expenses on sale – 10,000 Cost of the shares sold – 150,000 Required: Compute the capital gains tax. Computation: Domestic corp. P310,000 Expense on sale (10,000) Cost of the shares sold (150,000) ASSIGNMENT NO. 3 Total CGT rate Capital gains tax P150,000 x .15 P22,500 F. The taxpayer is a nonresident alien engaged in trade or business: Selling rice on sale of shares of stock of a domestic corporation through the local stock exchange– P550,000 Expenses on sale – 50,000 Cost of the shares sold – 300,000 Required: Compute the capital gains tax. P0 Subject to 6/10 of 1% stock transaction tax, not CGT.