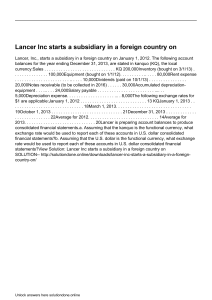

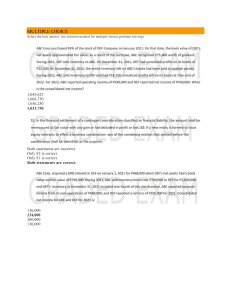

Chapter 15 Consolidated Financial Statements- Subsequent to Date of Acquisition IFRS 10 UNIFORM ACCOUNTING POLICIES IFRS 10 requires that "a parent shall prepare consolidated financial statements using uniform accounting policies for like transactions and other events in similar circumstances" Thus, all entities in the group shall ideally use the same accounting policies for like transactions and other events. For example, on the measurement of property, plant and equipment, if the group uses the revaluation model, then all entities in the group shall use the same valuation model to measure their property, plant and equipment. Sometimes a subsidiary may have to adopt an accounting policy that is different from those used by the parent. In such cases and for the purpose of consolidation, appropriate adjustments shall be made to the financial statements of the subsidiary to align its policy to those used in the consolidated financial statements. For example, a subsidiary may have used the cost model to measure the biological assets because they did not adopt LAS 41. Agriculture If the parent and its other subsidiaries all use the fair value model for biological assets in accordance with IAS 41, the financial statements of that subsidiary shall be adjusted from the cost model to the fair value model for biological assets, before they can be included in the consolidated financial statements. THE CONSOLIDATION PROCESS The approach followed to prepare a complete set of consolidated financial statements subsequent to acquisition is quite similar to that used to prepare a consolidated statement of financial position as of the date of acquisition. However, in addition to the Statement of Financial Position, the Statement of Comprehensive Income and Retained Earnings Statement of the consolidating companies must be combined. ACCOUNTING PROCEDURES When preparing consolidated financial statements, an entity must use uniform accounting policies for reporting like transactions and other events in similar circumstances. If a member of the group uses accounting policies other than those adopted in the consolidated financial statements for like transactions and events in similar circumstances, appropriate adjustments are made to that group member's financial statements in preparing the consolidated financial statements to ensure conformity with the group's accounting policies. Consolidated FS are prepared using the following basic accounting procedures: a) Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries. b) Eliminate the carrying amount of the parent's investment in each subsidiary and the parent's portion of equity of each subsidiary (IFRS 3 explains how to account for the difference) c) Eliminate in full intercompany assets and liabilities, equity, income, expenses and cash flows relating to transactions between entities of the group (profits or losses resulting from intercompany transactions that are recognized in assets, such as invertory and fixed assets Intercompany losses may indicate an impairment that requires recognition in the consolidated FS CONSOLIDATED COMPREHENSIVE INCOME Consolidated comprehensive income may be computed using two approaches: A. Parent company approach B. Entity approach In the consolidated statement of comprehensive income and retained earnings, consolidated comprehensive income is allocated to noncontrolling interests (NCT) and the controlling interest (equity holders of the parent company) Parent Company Approach Under the parent company approach, consolidated comprehensive income is that part of the total enterprise's income that is assigned to the parent company's stockholders For wholly owned subsidiary, all income of the parent and its subsidiaries accrue to the parent company. For partially owned subsidiary, a portion of its income accrues to its no controlling shareholders and is excluded from consolidated net income. *In simple cases, consolidated comprehensive income equals the total earnings for all companies consolidated, less any income recorded by the parent from the consolidating computes and any income assigned to NCL. Illustration Assume that P Company owns 80 percent of the stock of S Company which was purchased at book value. In 2017, S Company reported comprehensive income of P50,000, while P Company reported comprehensive income of P120,000 including dividend income from Company of P20,000. Consolidated comprehensive income for 2017 is computed as follows: P Company Comprehensive Income P120,000 Dividend Income (20,000) Comprehensive Income From own operations 100,000 S Company Comprehensive Income 50,000 Total P150,000 Less: NCI Comprehensive Income (P50,000x20%) Consolidated Comprehensive Income 10,000 P140,000 Entity Approach When a subsidiary is wholly owned by the parent, the consolidated CI computed similarly as that of the parent company approach. On the other hand, when a subsidiary is partially owned by the parent, the portion of its income accruing to NCI is included in the consolidated comprehensive income. Stated differenly. consolidated comprehensive income under the entity approach equals total earnings of all companies consolidated, less any income recorded by the parent from the consolidating companies. Using the data in the illustration for P Corporation and S Company, consolidated comprehensive income (CI) is computed and allocated as follows: P Company Comprehensive Income P120,000 Dividend Income (20,000) Comprehensive Income from own operations 100,000 S Company CI from own operations 50,000 Consolidated CI P150,000 Attribute to NCI (P50,000x20%) 10,000 Attribute to Parent P140,000 Consolidated Cl under parent company approach is the same as the income allocated to parent company stockholders under entity approach. Therefore, the difference between parent company and entity approaches lie solely in the manner of consolidating parent and subsidiary financial statements, and in reporting the financial position and results of operations in the consolidated financial statements. International Accounting Standard (IFRS 10) does not prescribe the approach to be used in computing consolidated CL However, since IFRS 3 provides that non-controlling interest (NCD) is to be presented in the consolidated statement of financial position as part of equity, then the entity concept will be used throughout the chapter (unless stated). ACCOUNTING FOR INVESTMENT IN SUBSIDIARY IAS 27 provides that in the separate financial statements of an entity who have investment in subsidiaries, joint ventures and associates it may elect to account for its investments either a.) at cost, or b.) at fair value in accordance with IFRS 9. financial instruments; or c.) using the equity method as described in PAS 28 Cost Method The cost method is used when the acquirer (Parent) owns directly or indirectly more than half of the voting power of the acquire (Subsidiary), thereby exercising control (AS 271). Under this method, the Investment in Subsidiary account is retained at its original cost-of acquisition balance Income on the investment is limited to dividends received from the subsidiary. This method is usually used in practice, therefore detailed explanation will be presented in this chapter involving the preparation of consolidated statements subsecquent to acquisition. Fair Value Method IRS 10, IFRS 12 and IAS 27 require a parent that is an investment entity to measure its investments in particular subsidiaries at fair value through profit or loss in accordance with IFRS 9 (or IAS 39) instead of consolidating those subsidiaries in its consolidated and separate financial statements. An investment entity is defined as an entity that: a) Obtains funds from one or more investors for the purpose of providing those investors with investment management services; b) Commits to its investors that its business purpose is to invest funds solely for returns from capital appreciation, investment income or both and c) Measures and evaluates the performance substantially all of its investments on a fair value basis of A parent of an investment entity has to consolidate all entities that it controls. Example Entity X a vehicle manufacturer is the parent company of investment entity B. B has holdings in various companies that are not active in the automobile sector. While X is not an investment entity pursuant to IRS 10, B is classed as an investment entity pursuant to IFRS 10. For purposes of this example, it should be assumed that both X and B must prepare consolidated financial statements, Analysis Since B is an investment entity, it must report companies in which it holds a controlling interest at fair value through profit or loss. Conversely, X must fully consolidate all its subsidiaries, including B. Equity Method The equity method is used when the investor/acquirer owns 20% or more (less than 50%) of the voting power of the investee/acquiree, thereby exercising significant influence over the operations of the investee. This method is applied to investments in associates and joint ventures. CONSOLIDATION: WHOLLY OWNED SUBSIDIARYAcquisition at Book Value FIRST YEAR AFTER ACQUISITION Assume that on January 2, 2017, Pete Corporation acquires all the common stock of Sake Company for P300,000. At that time, Sake Company has P200,000 of common stock outstanding and retained earnings of P100,000. Analysis of the acquisition is as follows: Price Paid P300,000 Less: Book Value of interest acquired (100%) Common Stock P200,000 Retained Earnings P100,000 Excess P300,000 P 0 On December 31,2017, Sake Company reported the following results of its operations: Net Income P50,000 Dividends Paid P30,000 Parent Company entries Using the cost Method, Pete Corporation would make the following entries: Jan. 2 Investment in Sake Company 300,000 Cash 300,000 To record the purchase of Sake Company stock Dec. 31 Cash Dividend Income 30,000 30,000 To record 100% of dividend from Sake Company After posting the above journal entries, Pete Corporation’s investment in Sake Company and Dividend Income accounts will have a balance of; Investment in Sake Company P300,000 Dividend Income P 30,000 Working Paper Elimination Entries When the acquisition of a subsidiary is at book value, the following working paper elimination procedures are used before the consolidation of the financial statements: (1) Eliminate Dividend Income account against the Dividend Declared by the Subsidiary (2) Eliminate the parent's equity in the subsidiary's stockholders' equity at date of acquisition Using the above procedures, the working paper elimination entries for Pete Corporation and subsidiary on December 31, 2017, one year after acquisition, are as follows: E(1) Dividend Income P30,000 Dividends Declared- Sake Company To eliminate inter-company dividends E(2) Common Stock- Sake Company Retained Earnings- Sake Company P30,000 Using the above procedures, the working paper elimination entries for Pete Corporation and subsidiary on December 31, 2017, one year after acquisition, are as follows: E(1) Dividend Income `P30,000 Dividends Declared- Sake Company P30,000 To eliminate inter-company dividends E(2) Common Stock- Sake Company Retained Earnings- Sake Company P200,000 100,000 Investment in Sake Company To eliminate investment and equity accounts at date of acquisition P300,000 Consolidation Working Paper-First Year A number of different working paper formats for preparing consolidated financial statements are used in practice. One of the most widely used format is the three section working paper, consisting of one section for each three basic financial statements: the Income Statement, the Statement of Retained Earnings, and the Statement of Financial Position (FP). Other format such as the trial balance approach format may also be used This fomat has the following columns: Trial Balances of the parent and the subsidiary, eliminations and adjustments. Statement of CI, NCI (if any), Controlling Retained Earnings, and the Consolidated Statement of Financial Position. Working Paper Relationships The following aspects of the working paper for consolidated financial statements of Pete Corporation and Subsidiary should be emphasized: 1 The two elimination entries have been entered in the working paper and the amounts totaled across and down to complete the working paper. 2. Each of the first two sections of the working paper "telescopes" into the section below in a logical progression. As part of the normal accounting cycle, net income is closed to retained earnings and reflected in the statement of financial position. Similarly, in the consolidation working paper the retained earnings is carried forward to the statement of financial position. 3. Using the double-entry bookkeeping, total debits must equal total credits for any single elimination entry and for the working paper as a whole. The totals of all debits and credits at the very bottom of the statement of financial position section are equal because the cumulative balances from the two upper sections are carried forward to the statement of financial position section. 4. Elimination (2) deals with the intercompany investment and subsidiary equity accounts on the date of acquisition. This accounting technique is necessary because the parent's Investment in Sake Company account is maintained at the cost of the original investment under the cost method. 5. The consolidated Cl and consolidated retained earnings in the working paper may be verified as follows, to assure their accuracy: Consolidated CI: Pete Corporation CI P170,000 Sake Company CI 50,000 Dividend Income Consolidated CI (30,000) P190,000 Consolidated Retained Earnings: Retained of Pete Corporation, December 31 P410,000 Add: Pete’s share of net increase in Sake’s Retained earnings [(P50,000-P30,000)x100%] 20,000 Consolidated Retained Earnings P430,000 CONSOLIDATED FINANCIAL STATEMENTS The consolidated statement of comprehensive income and retained earnings, and statement of financial position of Pete Corporation and Subsidiary for the year ended December 31, 2017, are presented on the next page. The amounts of the consolidated financial statements are taken from the consolidated column of the consolidation working paper (Illustration 151). SECOND AND SUBSEQUENT YEARS AFTER ACQUISITION The consolidation procedures to be used at the end of the second year, and in periods thereafter, are basically the same as those used at the end of the first year. In essence, each year's consolidation procedures begin as if there had never been a previous consolidation. Consolidation two years after combination is illustrated by continuing the example of Pete Corporation and Sake Company. On December 31, 2018, Sake Company reported net income of P75,000 and paid dividends of P40,000. Parent company entries Pete Corporation will only record the dividends received from Sake Company by the following entry on December 31, 2018: Cash Dividend Income P40,000 P40,000 To record dividends received from Sake (100%) On December 31, 2018, the balance of investment in Sake Company account and dividend income account are: Investment in Sake Company (at original Cost) Dividend Income 40,000 P300,000 Working paper elimination entries Two elimination entries to be presented in the working paper are as follows: E(1) Dividend Income 40,000 Dividend Declared-Sake Company 40,000 To eliminate inter-company dividends E(2) Common Stock- Sake Company 200,000 Retained Earnings- Sake Company 100,000 Investment in Sake company To eliminate investment and subsidiary’s equity accounts at date of acquisition 300,000 Take note that after posting the above elimination entries in the working paper, the Retained Earnings account of Sake Company is not fully eliminated. The difference of P20,000 represents Pete Corporation's share in the undistributed earnings of Sake Company in prior years [(P50,000-P30,000) x 100%). This is because the earnings of the subsidiary under the cost method are not recorded by the parent company. Consolidation Working Paper-Second year. After posting the elimination entries E(1) and E(2) in the consolidation working paper, the working paper as completed is shown below. All the working paper relationships discussed in relation with Illustration 15-1 continue in the second year as well CONSOLIDATION: PARTIALLY OWNED SUBSIDIARY - Acquisition at Book Value When a subsidiary is partially owned by the parent company, the consolidation procedures must be slightly modified from those discussed earlier to include recognition of non controlling interest (NCI). FIRST YEAR AFTER ACQUISITION Assume that on January 2, 2017, Pete Corporation purchases 80% of the common stock of Sake Company for P240,000. All other data are the same as those used in the previous example. The following D & A schedule was prepared on the date of acquisition: Consolidation Working Paper - First Year The working paper for consolidated statements for Pete Corporation and partially owned subsidiary for the year ended December 31, 2017 is shown on the next page (Illustration 15-3). The following should be noted in the working paper. 1. Although only 80% of Sake Company stock is owned by Pete Corporation, 100% of sales, cost of goods sold and operating expenses are carried to the consolidated column. This is because the financial statements are considered to be those of a consolidated entity. This approach requires that the NCI in Call of subsidiary of P10,000 be subtracted to arrive at the consolidated net income attributable to parent of P190,000. 2. Elimination entry (2) eliminates the investment account balance at its acquisition cost (P240,000). This results to the elimination of the equity accounts of Sake Company and the recognition of the NCI of P60,000. 3. Elimination entry (1) eliminate the inter-company dividends and NCI share of dividends paid by Sake Company. 4. Elimination entry (3) recognizes the NCI in CI of subsidiary for year 2017. CONSOLIDATION: PARTIALLY OWNED SUBSIDIARY - Acquisition at Other Than Book Value In some cases, the consideration given of the parent is not equal to the book value of the interest acquired from the subsidiary. This allocation must be made in the consolidation paper each time consolidated statements are prepared. In addition, if the allocation relates to assets subject to depreciation or amortization, appropriate entries must be made in the working paper for the depreciation or amortization to reduce consolidated net income accordingly. The following elimination procedures may be used to eliminate inter-company transactions when the investment cost is not equal to the book value of the interest acquired: (1) Eliminate intercompany dividends and recognize NCI share of subsidiary's dividends declared (2) Eliminate equity accounts of subsidiary at date of acquisition against investment account and NCI. (3) Allocate excess to the specific assets and liabilities of the subsidiary. The allocation should be in accordance with the principles discussed in Chapter 15. (4) Amortize the allocated excess except goodwill in accordance with accounting for the asset to which it is assigned. (5) Assign income of subsidiary to NCI. FIRST YEAR AFTER COMBINATION-2017 Using the data in our previous example, assume that Pete Corporation purchases 80% of the common stock of Sake Company on January 2, 2017, for P300,000. Assume further that on the date of the combination, all assets and liabilities of Sake Company have fair market values equal to their book values, except for the following: For the first year immediately after the acquisition, Sake Company reported the following: Comprehensive Income P50,000 Dividend Income 30,000 Parent Company Entries During 2017, under the cost method, Pete Corporations records the following entries on its books: Jan. 2 Investment in Sake Company Cash 300,000 300,000 To record purchase of Sake Company Stock Dec. 31 Cash 24,000 Dividend Income 24,000 To record dividend received from Sake Company (P30,000x80%) The working paper elimination entries for Pete Corporation and subsidiary on December 31, 2017, are as follows: E(1) Dividend Income NCI 24,000 6,000 Dividends Declared- Sake Company 30,000 To eliminate inter-company dividends and minority Interest share of dividends (P30,000x20%) E(2) Common Stock- Sake Company 200,000 Retained Earnings- Sake Company 100,000 Investment in Sake Company NCI 240,000 60,000 Consolidation Working Paper-First Year The working paper for consolidated financial statements for Pete Corporation and partially owned subsidiary, Sake Company for the year ended December 31, 2017 showing the five elimination entries. The following are the features of the working paper for the second year after acquisition: 1. Elimination entry (1) eliminates the total dividend declared by Sake Company against the dividend income recorded by the parent and the share of the NČI. 2. Elimination entry (2) eliminates the total equity accounts of Sake Company against the investment account (parent's interest) and NCI. 3. Elimination entry (3) allocates excess by adjusting the assets of Sake Company to fair values. 4. Elimination entry (4) amortizes the allocated excess. 5. Elimination entry (5) recognizes the NCI in the Cl of Sake Company, adjusted for amortization and depreciation. Second year after combination-2018 Consolidation procedures in the second year follow the same procedures in the first year. From our previous example, assume that on December 31,2018, Sake Company showed the following results of operations: Comprehensive Income P75,000 Dividends Paid P40,000 Parent company entries On December 31,2018, Pete Corporation under the cost method of accounting would record only the dividends received from Sake Company by the following entry: Cash 32,000 Dividend Income 32,000 To record dividends received from sake company SUBSIDIARY THAT HAS A DIFFERENT REPORTING DATE IFRS 10 generally requires that "the financial statements of the parent and its subsidiaries used in the preparation of the consolidated financial statements shall be prepared as of the same reporting date. When the reporting date of the parent is different from that of a subsidiary, the subsidiary prepares for consolidation purposes, additional financial statements as of the same date as the financial statements of the parent unless it is impracticable to do so." However, IFRS 10 permits consolidation of a subsidiary's financial statements with a different reporting date, provided that the difference between the reporting dates of the parent and any of its subsidiaries shall be no more than 3 months. For example, if the financial year ended of a parent is 31 December 2016, it may consolidate the accounts of a subsidiary with a financial year ended 30 September 2016 or with a financial year ended 31 March 2017 or any financial year ended in between those dates and the date of the parent's financial statements. In practice, one way of consolidating the financial statements of a subsidiary with a different reporting date is to adjust the subsidiary's financial statements (for the purpose of consolidation only) so that its revised financial statements have a financial year that coincides with the year end of the parent. For this purpose, management accounts for the period of the difference in dates may be required to make those adjustments. The alternative way is to consolidate the subsidiary's accounts as they stand and adjust only the effects of significant events or transactions that occurred in the period of the difference in dates. Irrespective of which way the financial statements of the subsidiary are to be consolidated, it is important that the length of the reporting period and any difference in reporting dates shall be the same from period to period. ACCOUNTING FOR LOSS OF CONTROL Whenever a parent ceases to have a controlling interest in a subsidiary, that subsidiary should be deconsolidated (eliminated from the consolidated financial statements). Usually, this would result from a sale of an interest in the subsidiary, which reduces the parent company share to less than 50% If a parent loses control of a subsidiary, the parent: (a) Derecognizes the assets and liabilities of the former subsidiary from the consolidated statement of financial position. (b) Recognizes any investment retained in the former subsidiary at its fair value when control is lost and subsequently accounts for it and for any amounts owned by or to the former subsidiary in accordance with relevant IFRS (c) Recognizes the gain or loss associated with the loss of control attributable to the former controlling interest. The gain or loss is included in net income attributable to the parent company. The gain or loss is the difference between a. The aggregate of 1. The fair value of any consideration 2 The fair value of any retained non-controlling investment in the former 3 subsidiary at the date the subsidiary is deconsolidated The carrying amount of the noncontrolling interest in the former subsidiary (including any accumulated other comprehensive income attributable to the non-controlling interest) at the date the subsidiary is deconsolidated b. The carrying amount of the former subsidiary's assets and liabilities. Sale of Interest Not Resulting in Loss of Control: A parent company may sell a portion of its investment in a subsidiary but still have an interest that provides control even after the sale. There can be no income statement gains or losses resulting from any stock issuances by the consolidated entity. Gain on sale of investment in a subsidiary is recorded as an addition to additional paid-in capital (APIC). Loss on sale of the investment in subsidiary is treated as a reduction from additional paid-in capital. If the additional paid-in capital is inadequate, the Retained Earnings should be debited.