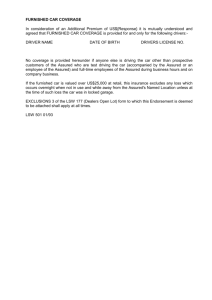

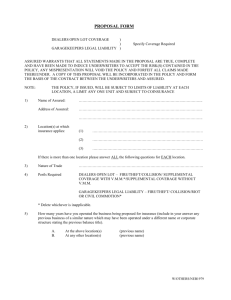

INSURANCE DOCUMENTS AND TERMINOLOGY PROPOSAL A to the insurers to provide cover. POLICY A document setting out the terms to the insurance contract which provides evidence of the contract. CERTIFICATE An additional document used in Motor, Marine and Employer Liability incorporating elements of the contract and without which the insurance is not legal. CLAIMS FORM A form setting out the grounds for a claim, so that the company can decide whether it comes under the terms of the policy. SCHEDULE Within a given class of business (e.g. Life, Fire, Accident, Motor) each company issues standard policies, identical to each other, and divided into defined sections. The schedule contains all the information that is peculiar to that individual risk. COVER NOTE It normally takes some time between a proposal and the exact definition of the policy by the underwriters; during this time, legally there is no cover. This is supplied by the issue of a memorandum from the company which gives temporary legal cover. SUM ASSURED In some forms of insurance, eg Life, there can be no indemnity as such, as the financial loss of life cannot be estimated. Therefore a sum assured is covered related not to damage sustained but directly to premium. This is the sum assured.