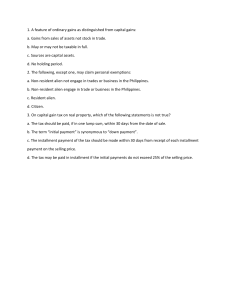

INTRODUCTION TO INCOME TAXATION I. II. HAND OUT 2 The concept of income -Best measure of taxpayer’s ability to pay. Income The tax concept of income is simply referred to as gross income under the NIRC. Gross income simply means taxable income in layman’s term. Under the NIRC, however, the term taxable income refers to certain items of gross income less deductions and personal exemptions (personal exemptions are repealed under TRAIN Law). Gross income is broadly defined as any inflow of wealth to the taxpayer from whatever source, legal or illegal, that increases net worth. It includes income from employment, trade or business, employment, profession, income from dealings in properties or casual transactions. Elements of Gross income: 1.) Return on Capital that increases net worth 2.) Realized Benefit 3.) Not exempted by law, contract or treaty. Return on Capital -Capital means any wealth or property. Gross income is A RETURN on WEALTH or PROPERTY that INCREASES the taxpayer’s net worth. Capital items with infinite value 1.) Life- immeasurable by money 2.) Health- any compensation in consideration of loss of health is a return OF capital, not a return ON capital. 3.) Human Reputation- Value of one’s reputation cannot be measured financially -Oral defamation/slander - Alienation of affection - Breach of promise to marry Realized benefit Benefit- form of advantage derived by taxpayer; increase in net worth. The following are not benefits 1.) Receipt of a loan 2.) Discovery of lost properties 3.) Receipt of money or property to be held in trust for or to be remitted to another person. If he is entitled to keep for his account a portion of a receipt, only that portion is a benefit. Not exempted by law, contract or treaty -The ff. items of income are exempted by law from taxation; hence, they are not considered as items of gross income: 1.) Income of qualified employee trust fund 2.) Revenues of non-profit, nonstock educational institutions. 3.) SSS, GSIS, PAG-IBIG or Philhealth benefits 4.) Minimum Wage earners’ salaries and qualified Senior Citizen. 5.) Regular income of Barangay Micro-Business Enterprises (BMBEs) 6.) Foreign governments and foreign government-owned and controlled corporations 7.) Income of international missions and organizations with income tax immunity. Types of Income taxpayers A. Individuals 1. Citizen a. Resident citizen b. Non-resident Citizen 2. Alien a. Resident Alien b. Non-resident a. Engaged in trade or business b. Not engaged in trade or business 3. Taxable estates and trusts B. Corporations 1. Domestic Corporations 2. Foreign Corporations a. Resident foreign Corporations b. Non-resident foreign Corporations Individual Income Taxpayers Citizens Under the constitution, citizens are Persons who were citizens of the Philippines at the time the Constitution was adopted (February 2, 1987) Persons whose parents are Filipino citizens; Those born before January 17, 1973, to Filipino mothers, who have chosen Filipino citizenship as an adult; and People who naturalize by the law. Classification of citizens A. Resident citizen- A Filipino citizen residing in the Philippines B. Nonresident Citizen includes- 1. A citizen of the Philippines who establishes to the satisfaction of the Commissioner the fact of his physical presence abroad with a definite intention to reside therein. 2. A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or f or employment on a permanent basis. 3. A citizen of the Philippines who works and derives income from abroad and whose employment thereat requires him to be physically present abroad most of the time during the taxable year. 4. A citizen who has been previously considered as nonresident citizen and who arrives in the Philippines at any time during the taxable year to reside permanently in the Philippines shall likewise be treated as a nonresident citizen for the taxable year in which he arrives in the Philippines with respect to his income derived from sources abroad until the date of his arrival in the Philippines. 5. The taxpayer shall submit proof to the Commissioner to show his intention of leaving the Philippines to reside permanently abroad or to return to and reside in the Philippines as the case may be for purpose of this Section. NOTE: A Filipino employed as a Philippine Embassy/Consulate service personnel of the Philippine Embassy/Consulate is not treated as a non-resident alien, hence his income is taxable. C. Alien A. Resident Alien- Section 22(F), NIRC: A resident alien is an individual whose residence is within the Philippines and who is not a citizen thereof, such as: 1. Staying in the Philippines with a definite purpose (e.g., employment, business, education, if you are married to a Filipino) which in its nature would require an extended stay and to that end makes his home temporarily in the Philippines, although it may be his intention at all times to return to his domicile abroad. 2. Staying in the Philippines for one year or more (take note that this was used in one case and by some authors; however, this is not a safe guideline and should not be the only factor to be considered in determining classification) 3. An alien who lives in the Philippines without definite intention as to his stay. An alien who has acquired residence in the Philippines retains his status as such until he abandons the same or actually departs from the Philippines. B. Nonresident Alien – an individual who is not residing in the Philippines who is not a citizen thereof 1. Non-resident Alien Engaged in Trade and Business (NRA-ETB) Section 25(A)(1): A nonresident alien individual who shall come to the Philippines and stay therein for an aggregate period of more than one hundred eighty (180) days during any calendar year shall be deemed a 'nonresident alien doing business in the Philippines', Section 22 (G) of this Code notwithstanding. Take note that it is more than 180 days OR at least 181 days. Since an NRA has no definite purpose, there is a need to determine the number of days he has been staying in the Philippines to verify if he can be classified as NRA -ETB. Unless he can prove that he has a definite purpose n extending his stay in the Philippines, then that is the time you classify him as RA; however, that is not automatic (i.e., documents should be submitted for support). 2. Non-resident Alien Not Engaged in Trade and Business (NRA-NETB) If your stay in the Philippines is 180 days or less and without a definite purpose, then you are classified as NRA-NETB. The general classification rule for individuals 1. Intention – the intention of the taxpayer regarding the nature of his nature within or outside the Philippines shall determine his appropriate residency classification. The taxpayer shall submit to the CIR of the BIR documentary proofs such as visas, work contracts and other documents indicating such intention 2. Length of stay- In default of such documentary proof, the length of stay of the taxpayer is considered: a. Citizens staying abroad for a period of at least 183 days are considered nonresident. b. Aliens who stayed in the Philippines for more than 1 year as of the end of the taxable year are considered resident. c. Aliens who are staying in the Philippines for not more than 1 year but more than 180 days are deemed nonresident aliens engaged in trade or business (ETB). d. Aliens who stayed in the Philippines for not more than 180 days are considered nonresident aliens NETB. Taxable Estates and trusts 1. Estate- Estate refers to the properties, rights, and obligations of a deceased person not extinguished by his death. Estates under judicial settlement are treated as individual taxpayers. The estate is taxable on the income of the properties of the estate under extrajudicial settlement is taxable to the heirs. 2. Trust- is an arrangement whereby one person (grantor or trustor) transfer (i.e. donates) property to another person (beneficiary), which will be held under the management of a third party (trustee or fiduciary). A trust that is irrevocably designated by the grantor is treated in taxation as if it is individual taxpayer. The income of the property held in trust is taxable to the trust. Trust that are designated as revocable by the grantor are not taxable entities and are not considered as individual taxpayers. The income of properties held under revocable trusts is taxable to the grantor not to the trust. When the trust agreement is silent as to revocability of the trust, the trust is presumed to be revocable. CORPORATE INCOME TAXPAYERS The term ‘corporation’ shall include partnerships, no matter how created or organized, joint-stock companies, joint accounts, association, or insurance companies, except general professional partnerships and a joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal, and other energy operations pursuant to an operating consortium agreement a service contract with the government. Hence, the term corporation includes profit-oriented and non-profit institutions such as charitable institutions, cooperatives, government agencies and instrumentalities, associations, leagues, civic or religious and other organizations. DOMESTIC CORPORATION A domestic corporation is a corporation that is organized in accordance with Philippine laws. FOREIGN CORPORATION A foreign corporation is one organized under a foreign law. TYPES OF FOREIGN CORPORATIONS: 1. Resident Foreign Corporation (RFC) - a foreign corporation which operates and conducts business in the Philippines through a permanent establishment. 2. Non-Resident Foreign Corporation- a foreign corporation which does not operate or conduct business in the Philippines. Special Corporations -domestic or foreign corporations which are subject to special tax rules or preferential tax rates. Other Corporate taxpayers 1.) PartnershipsA partnership is a business organization owned by two or more persons who contribute their industry or resources to a common fund for the purpose of dividing profits from the venture. Types of Partnerships a.) General Professional Partnership A GPP is a partnership formed for the exercise of common profession. All partners must belong to the same profession. A GPP is not treated as a corporation and is not a taxable entity. It is exempt from income tax, but the partners are taxable in their individual capacity with respect to their share in the income of the partnership. b.) Business Partnership A business partnership is one formed for profit. It is taxable as a CORPORATION. 2.) Joint Venture (JV) - A joint venture is a business undertaking for a particular purpose. It may be organized as a partnership or a corporation. Types of Joint Ventures: a. Exempt joint ventures Exempt joint ventures are those formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the government. Similar to a GPP, this type of joint venture is not treated as a corporation and is taxexempt on its regular income, but their venturers are taxable to their share in the net income of the JV. b. Taxable joint ventures All other joint ventures are taxable as corporations. 3.) Co-ownership A co-ownership is joint ownership of a property formed for the purpose of preserving the same and/or dividing its income. A co-ownership that is limited to property preservation or income collection is not a taxable entity and is exempt but to the co-owners are taxable on their share on the income of the co-owned property. However, a co-ownership that reinvests the income of the co-owned property to the other income-producing properties or ventures will be considered an unregistered partnership taxable as a corporation. The general rules in income taxation Taxable on income earned Within Without Individual Resident Citizen Nonresident Citizen Resident Alien Nonresident Alien Corporate Taxpayers Domestic Corporation Resident Foreign corporation Nonresident Foreign Corporation NIRC uses the term without to mean OUTSIDE the Philippines Situs of income -The situs of income is the place of taxation of income. It is the jurisdiction that has the authority to impose tax upon the income. Situs of income vs. Source of income Situs of income is important in determining WHETHER OR NOT THE INCOME IS TAXABLE IN THE PHILIPPINES. While, Source of income is the activity that produces the income. RULES ON SITUS (whether earned within or outside the Philippines): 1. Interest –the situs of interest income is the residence of the debtor. Thus, if the debtor is a resident of the Philippines, it is considered earned within the Philippines. 2. Dividends–received from: A domestic corporation; B. A foreign corporation, unless 50% of the gross income of such foreign corporation for the 3yearperiod ending with the close of its taxable year preceding the declaration of such dividends was derived from sources within the Philippines; but only in an amount which bears the same ratio to such dividends as the gross income of the corporation for such period derived from sources within the Philippines bears to its gross income from all sources. Example: Z Corporation received P10,000 dividends from X Corporation, a Japanese firm, which earned P200,000 from Philippine sources and P300,000 from Japan. The amount of dividends received by Z Corporation as from Philippine sources is only P4,000 . (P10,000 * P200,000/P500,000). 3. Services–where performed. Thus, if performed within the Philippines, it is considered earned herein. 4 .Rentals and Royalties–where the property is located or the place of use of the intangible. As such, if the property or any interest in such is located in the Philippines, rentals and royalties therefrom are considered earned within the Philippines. 5. Sale of real property–where the real property is located. As such, gains, profits and income from the sale of real property located in the Philippines are considered earned herein. 6. Sale of Personal Property Purchase: where the property is sold. If the personal property was purchased outside the Philippines, but sold herein, the gains, profits and income derived therefrom are considered earned within the Philippines. On the other hand, even if it was purchased in the Philippines and sold outside, gains therefrom shall be treated earned from outside the Philippines. Produced: if the personal property is produced in the Philippines and sold outside, it shall be treated as derived from sources partly within and partly without the Philippines. (see no. 7) Except: sale of shares of stock of a domestic corporation, which shall be considered entirely within the Philippines even if sold outside. 7. Income partly within and partly without the Philippines: aside from sale of personal property produced in the Philippines, income from transportation and other services rendered partly within and partly without, is covered by this number. In these cases, the net income may first be computed by deducting the expenses, losses, or other deductions apportioned or allocated thereto and a ratable part of any expenses, losses or other deductions which cannot definitely be allocated to some items or class of gross income; and the portion of such net income attributable to sources within the Philippines may be determined by processes and formulas of general apportionment prescribed by the Secretary of Finance.