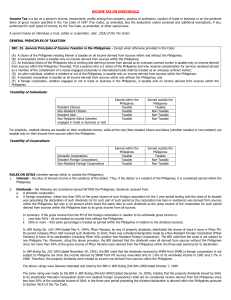

Philippines Tax System A Taxation presentation for ILA315 by: Jariyaporn Seenay 58-51024-25552 TABLE OF CONTENTS • Who pays taxes • Who are exempted to pay • Tax rates • Tax forms & Procedures • Personal Income Tax • Tax exempt income WHO PAYS TAXES Resident citizens receiving income from sources within or outside the Philippines: • Employees deriving purely compensation income from 2 or more employers, concurrently or successively at anytime during the taxable year • Self-employed individuals receiving income from the conduct of trade or business and/or practice of profession • Individuals deriving mixed income – Compensation income and income from the conduct of trade or business and/or practice of profession WHO PAYS TAXES • Marginal Income Earners • Non-resident citizens receiving income from sources within the Philippines • Aliens, whether resident or not, receiving income from sources within the Philippines WHO ARE EXEMPTED TO PAY • A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for employment on a permanent basis • A citizen of the Philippines who works and derives income from abroad and whose employment requires him to be physically present abroad most of the time during the taxable year / OFWs • A citizen who has been previously considered as a non-resident citizen and who arrives in the Philippines at any time during the year to reside permanently in the Philippines will likewise be treated as a non-resident citizen during the taxable year in which he arrives in the Philippines, with respect to his income derived from sources abroad until the date of his arrival in the Philippines. TAX RATES • Income Tax Rate 5% - 32% • Corporate Tax Rate 30% • Sales Tax/ VAT rate 12% TAX FORMS & PROCEDURES • BIR Form Nos. 1700 / 1701 / 1701Q / 1702 / 1702Q • 1700: Annual Income Tax Return for Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Income) • 1701: Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts • 1702: Annual Income Tax Return for Corporations, Partnerships and Other NonIndividual Taxpayers *Q = Quarterly PERSONAL INCOME TAX • Residents are taxed progressively • Up to 32% • The Philippine Annual Income Tax Return (BIR Form 1700) is filed and taxes are due to the Philippine Bureau of Internal Revenue on or before 15 April of the year following the applicable calendar year. • The tax year is a calendar year which ends 31 December of each year. PERSONAL INCOME TAX TAX EXEMPT INCOME • Statutory minimum wage • Damages received by an employee or his/her heirs following a judgment or agreement arising out of or related to an employer-employee relationship • Proceeds of life insurance policies • Gifts, bequests • Compensation for injuries or sickness • Retirement benefits, pensions, and gratuities • Interest on tax-exempt government securities • Thirteenth-month pay and other benefits such as productivity incentives and Christmas bonus subject to the PHP30,000 limit THANK YOU FOR YOUR ATTENTION