How To File The Claim Under Group Personal Accident Policy

advertisement

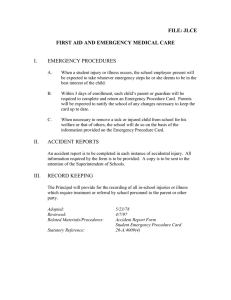

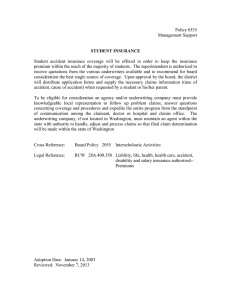

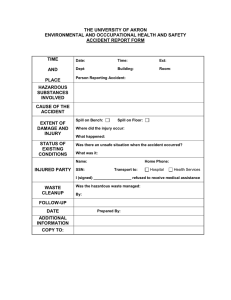

How To File The Claim Under Group Personal Accident Policy? A group personal accident insurance plan is an employee welfare policy that protects employees against unanticipated events such as accidents. This article will provide straightforward guidance to submitting a claim under the Group Personal Accident Insurance Policy. A slip or fall might result in severe fractures or injuries, interfering with an employee's ability to perform. The chance of a car accident is growing by the day. As a result, a business should offer employees group personal accident insurance to cover the medical costs of accidents. 2 Purchasing an employee's accident coverage demonstrates the employer's genuine concern for the well-being of its personnel. A group personal accident insurance policy that promotes a seamless claim settlement procedure is an appropriate employee protection plan. Here is a quick reference guide to help you settle a claim under the Group Personal Accident Insurance Policy. It would help if you Kept The Following Factors In Consideration While Filing A Claim: Types Of Events Covered: A group personal accident insurance policy covers a variety of claims. These include allegations originating from an accident's unintentional death, entire permanent disability, permanent partial disability, and temporary total disability. Furthermore, the insurance covers any road, rail, or air accident, injury from a fall or slip, or the bursting of a gas cylinder, snakebite or dog bite, burn injury, and so on. As a result, before submitting a claim, you should ensure that the accident is the cause of any such damage. 4 However, the policy does not cover any exclusion under it. One should not file the claim– ▸ ▸ ▸ ▸ ▸ ▸ ▸ ▸ ▸ Natural Death Self-Inflicted Injuries Intoxication HIV related injury Damage from war or terrorism Injury from adventure sport Pregnancy complications Intoxication Participation in criminal activity The above is the typical exclusions of a group personal accident insurance policy. Claim Intimation: You should report the occurrence to the insurance as soon as possible. Typically, the intimation TAT is three months. However, the insurer must notify within a week after the incidence. You should report employee information, employee code and policy number, date, and cause of a loss to the insurer. Furthermore, timely claim notification enhances the likelihood of speedy and smooth claim resolution. Conclusion: NGI offers various plans of medical insurance in multiple things. Our main motto is medical coverage, cashless claims, and saving your time and money. We help to get all of those. We provide you with the best insurance for you. You can contact us on +971 4 211 5800. Source Contact Us National General Insurance Co. PJSC (NGI) Address: PO Box 154, Levels Ground, 3, 5, 6, NGI House, Port Saeed Street, Deira Dubai Dubai – United Arab Emirates Phone: + 971 4 211 5800 Website: https://ngi.ae/ 8