Pellets, Plantation & Renewable Energy RS Business case and Plan

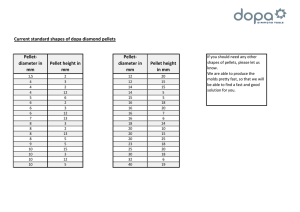

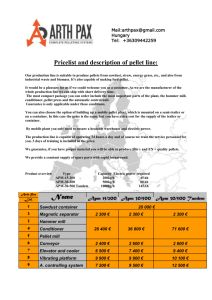

advertisement