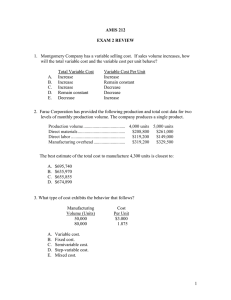

MODULE 1: Strategic Cost Management – the process of reducing total cost while improving the strategic position of the business. - company goals can be achieved by having thorough understanding of costs and which of these costs support or weaken the company’s strategic position. Cost Management Techniques a. Total Quality Management (TQM) – developed by William Deming - continual process of detecting and reducing errors in manufacturing, streamlining supply chain management, improving customer experience and ensuring that employees are up to speed with training. b. Just- In- Time (JIT) – an inventory system which aligns raw material orders from suppliers directly with production - work-in-process inventory is eliminated to lessen entity’s product cost c. Kaizen – a Japanese term which means ‘change for better’ or ‘continuous improvement' - a Japanese business philosophy regarding processes that continuously improve operations and involve all employees Administrative functions of Management a. Planning – involves setting of goals and budget preparation b. Control – analysis of financial statements c. Decision-making – performance of CVP analysis, relevant costing, variable costing and other measurement techniques Finance and Accounting Organizational Chart Chief Financial Officer Controller Treasury Director (Head of Accounting) (Head of Treasury) Financial Accounting Cash Management Management Accounting Investments Taxation Differences between Branches of Accounting Branches of Accounting Position End Product Users Time focus Basis Financial Accounting Financial Accountant Financial Statements External Taxation Government Management Auditing Accounting Management External Auditor Accountant Management reports Audit opinion and budgets Internal External Historical Historical Future PFRS/ PAS NIRC, rulings Tax Specialist Tax Returns BIR Management policy Historical PSA Take Note: Auditing is not under the organizational chart since it is not under control by the controller yet coordinates directly with it. Classifications of Costs A. As to nature a. Product cost – inventoriable or capitalizable costs Direct materials Direct Labor Manufacturing Overhead b. Period cost – cost related to support production Selling expenses Administrative expenses General expenses B. As to behaviour a. Variable cost – varies directly proportional to activity level b. Fixed cost – remains constant regardless of activity level High – low Method – used by management accountant to determine and separate fixed and variable costs in cases where costs incurred are mixed and difficult to distinguish variable from fixed costs. Activity Level Amount Highest xx xx Less: Lowest xx xx XX XX Change Change in amount xx Divide: Change in activity level xx Variable cost per activity level XX Total Highest Amount xx Less: Variable Cost Highest Activity Level xx Multiply: Variable cost per activity level xx Fixed Cost xx xx Absorption Costing and Variable Costing Variable Costing Net Sales Absorption Costing xx Less: Variable cost (xx) Contribution Margin xx Less: Fixed Cost Net Operating Income Net Sales Less: COGS Gross Margin xx (xx) xx (xx) Less: S&A expenses (xx) XX Net Operating Income XX Cost Differences Absorption Costing Variable Costing Direct materials Direct labor Product Cost Product Cost Variable FOH Fixed FOH Variable S&A expenses Period Cost Period Cost Fixed S&A expenses Take Note: Both income statements are correct but variable costing income statement caters more to the needs of the management. Under variable costing, total fixed manufacturing overhead is an outright expense regardless of units sold. Under absorption costing, total fixed manufacturing overhead is deducted based on the number of units sold. In absorption costing, if total fixed OH is given, divide it by units produced and multiply to units sold to get the fixed OH included in COGS. Reconciliation of Net Income Take Note: Reconciliation Net Operating Income, Absorption costing xx Relationship Net Income Add: Fixed OH in beginning inventory xx 1. Production = Sales AC = VC Total xx 2. Production > Sales AC > VC (xx) 3. Production < Sales AC < VC Less: Fixed OH in ending inventory Net Operating Income, Variable costing XX MODULE 2: Cost, Volume and Profit (CVP) Analysis - Under CVP Analysis, variable costing is used. Concepts of cost according to behavior: 1. 2. 3. 4. Total variable cost varies directly proportional to the activity level. Total fixed cost is constant regardless of activity level. Fixed cost per unit varies inversely proportional to the activity level. Variable cost per unit is constant regardless of activity level. Break-even point – the point where total sales is equal to total costs - total costs disregard tax consequences, therefore, what should be equal to zero is the net operating income. Break-even assumptions Contribution margin per unit is constant (as well as SP and VC). If multiple products, sales mix is also constant. Units sold is equal to units produced. Common formulas: Break-even units Fixed costs Divide: CM per unit Break-even (units) xx x XX Break-even sales Fixed costs xx Divide: CM ratio x% Break-even sales XX Take note: All ratios under CVP analysis has generally a denominator based on sales. Hence, to know CM ratio, the formula is CM divide by Sales. Target net income is different from target net operating income as the former is net of tax. In finding the target sales in unit and in peso, it can be solved using the formula below: Target sales in units Target Net Income xx Divide: 1 - tax rate x To get the target sales amount: a. Divide the total xx target amount by CM ratio, or Target net operating income Add: Fixed costs xx Total target amount xx b. Multiply the target Divide: Cm per unit x sales in units to the selling price per unit. Target sales in units XX Margin of safety – indicates the amount by which a company’s sales could decrease before the company will have no profit. - the amount of peso-sales or the number of units by which actual or budgeted sales may be decreased without resulting into a loss. Actual sales Less: Break even sales Margin of safety The margin of safety in units is simply converted by dividing the margin of (xx) safety by the selling price per unit. xx XX Operating leverage – the extent to which a company uses fixed costs in its cost structure. - leverage is achieved by increasing fixed costs while lowering variable costs. Degree of operating leverage (DOL) – the degree at any level of sales, how the percentage change in sales volume affects profit - used to measure the extent of the change in profit before tax resulting from change in sales Total contribution margin Divide: Net operating income Degree of operating leverage xx (xx) XX % change in net operating income % change in sales Degree of operating leverage xx (xx) XX Example: Quantity Per Unit Total Sales 10,000 5 50,000 Total contribution margin Less: Variable costs 10,000 3 30,000 Divide: Profit before tax Contribution margin 10,000 2 20,000 Degree of operating leverage Fixed costs 20,000 8,000 2.50 12,000 Net operating income 8,000 It means that for every percentage increase in contribution margin, the effect on net income is 2.5 times higher. To prove that this is true, let’s increase the sales by 10% Quantity Per Unit Total Sales 11,000 5 55,000 Less: Variable costs 11,000 3 33,000 Contribution margin 11,000 2 22,000 Fixed costs 12,000 Net operating income 10,000 % change in NOI 25% % change in sales 10% Degree of operating leverage 2.50 Comparison: Case 1 Case 2 Change Sales 50,000 55,000 5,000 Less: Variable costs 30,000 33,000 3,000 Contribution margin 20,000 22,000 2,000 Fixed costs 12,000 12,000 - 8,000 10,000 2,000 Net operating income If sales increase by 10% (5,000 ÷ 50,000), the effect in net income is 2.5 times or 25%. It can be computed by 10% times 2.5 or 2,000 change in net operating income divide 8,000. Product mix – happens when a company has multiple products - the only difference in computation of break-even is that the contribution margin and ratio is the weighted average in other ways, the computation can be based on total amount and pro-rated on segments or divisions using their actual amounts (sales, VC, CM). MODULE 3: Budgeting – the act of preparing a budget Budgetary control – the use of budget to control the company's operation Budget - a quantitative plan for acquiring and using financial and other resources to project the company’s financial performance and financial position in the forthcoming period. - a financial plan of the resources needed to carry out tasks and meet financial goals Budgeting encompasses: a. Planning – developing objectives and preparing budgets to attain firm’s objectives b. Control – actions taken by the management to mitigate risk and ensure the attainment of objectives. Master budget – an overall financial and operating plan for a coming fiscal period and the coordinated program for achieving the plan, usually prepared on a quarterly or an annual basis. The master budget is composed of interrelated budgets (in order of priority): a. Sales budget Cash receipts budget b. Production budget Direct materials budget Direct labor budget Manufacturing overhead budget c. Ending inventory budget d. Selling and admin expense budget e. Cash budget f. Financial budget Budgeted balance sheet Budgeted income statement Formulas: Cash receipts budget: Sales budget: Budgeted sales (in units) Multiply: Sales price per unit Budgeted sales xx x XX A/R, beginning xx Credit sales xx Cash sales xx Less: A/R, ending Cash receipts/collection (xx) XX Production budget (in units) Budgeted sales xx Materials budget: Add: Desired ending inventory xx Required production xx Total needs xx Multiply: Material per unit xx Production needs xx Add: Desired ending inventory xx Total needs xx Less: Beginning inventory Required production (xx) XX Less: Beginning inventory Direct labor budget Materials to be purchased Required production xx Multiply: Labor hour per unit xx Labor hours required xx Multiply: Hourly rate xx Direct labor costs XX (xx) XX Cash disbursement budget: A/P, beginning xx Purchases xx Less: A/P, ending Cash disbursements Take note: If there is guaranteed labor hours to be paid, there will be a variation in DL costs. (xx) XX Manufacturing Overhead Budget Budgeted direct labor hours xx Multiply: Variable OH rate xx Variable overhead cost Regardless of guaranteed labor hours, overhead cost is based on xx budgeted labor hours applied Fixed overhead cost xx Total manufacturing overhead xx Example of noncash overhead are depreciation and amortization of xx factory assets. Less: Noncash overhead Overhead cash disbursements XX Ending inventory budget Quantity Unit Cost Total Direct materials xx xx xx Direct labor xx xx xx Manufacturing overhead xx xx xx Product cost per unit xx xx xx Multiply: Ending inventory (units) x Ending inventory XX Selling and Admin expense budget Budgeted sales xx Multiply: Variable SAE per unit xx Variable selling and admin Fixed selling and admin Total selling and admin expense Less: Noncash item SAE cash disbursements The cash budget and budgeted xx financial statements varies depending on the company policy as to cash xx maintenance, financing agreements and xx other factors which could affect its presentation. xx XX But regardless of items that may arise, it must be properly accounted so that the balance sheet items will be balanced accordingly. MODULE 4: Decentralization – lower-level managers can decide with their accountability and have the authority for decision-making Benefits Top management can concentrate more on strategy Lower-level managers can quickly respond to customers Authority on making decisions gives job satisfaction to lower-level managers Disadvantage Lower-level managers may decide without seeing the complete picture Lower-level managers’ objectives may not be aligned to the entire organization Lack uniformity and coordination in operation Responsibility Centers 1. Cost center – managers focus on controlling costs 2. Profit center – managers focus on controlling costs and revenues 3. Investment center – managers focus on controlling revenue, costs and investments in operating assets. Measures of performance of an investment 1. Return on Investment (ROI) – measured net operating income earned relative to the investment in average operating assets. Long cut formula: Net operating income xx xx Net operating income xx Divide: Average operating assets Divide: Sales xx Return on investment Margin XX Sales xx Divide: Ave. operating assets xx Turnover XX XX Margin xx Multiply: Turnover xx Return on Investment XX Take note: Net operating income = Earning before interest and taxes Average operating assets includes cash, receivables, inventory, PPR and other productive assets In general, use book values/carrying values to compute for average operating assets 2. Residual income – encourages managers to make profitable investments from those that would be rejected by managers using Return on Investment (ROI) - measures net operating income earned less minimum required return on average operating assets - it can’t be use to compare performance of segments with different sizes Net operating income xx Less: Average operating assets xx Multiply: Minimum required rate of return xx xx Residual Income XX 3. Economic Value Added – a business unit’s income after taxes and after deducting cost of capital Net operating income xx Less: Income tax expense (xx) Net operating profit after tax / EAT xx Less: Total Assets Less: Current liabilities Invested capital / Noncurrent liabilities Multiply: Cost of capital Economic Value Added xx (xx) xx x xx XX Segment reporting – disclosure of financial information about the products and services an entity and emphasizes the performance of a segment rather than the company as a whole - statements of income designed to focus on various segments of the firm Segment 1 Sales Less: Variable expenses Contribution margin Less: Traceable fixed expenses Divisional segment margin Less: Unallocated/ non-traceable fixed costs Net operating income Segment 2 Total xx xx xx (xx) (xx) (xx) xx xx xx (xx) (xx) (xx) xx xx xx (xx) XX Take note: Traceable fixed expenses are deducted from each segment while non-traceable costs are deducted in total divisional segment margin. Segment reporting highlights the financial status of the company on a per segment’s basis. a. Traceable fixed expense – costs incurred as a consequence of the existence of the segment. b. Segment margin – margin available after a segment has covered all its own costs and best measure of long-run profitability of a segment. Module 5: Relevant costing – Relevant costs – costs which differ between alternatives Relevant benefit – benefit that differs between alternatives Avoidable cost – are costs that can be eliminated in whole or in part in choosing alternatives between two alternatives – are relevant costs. Irrelevant costs – costs that do not matter between alternatives a. Sunk costs – costs incurred from the past and cannot affect the courses of action. b. Future costs – costs that do not differ in alternatives c. Unavoidable costs – costs which still be incurred regardless of alternative to be chosen Opportunity cost – benefits that is foregone as a result of pursuing some course of action - does not represent actual cash flows, yet important to decision making - not recorded in financial statements Approaches in evaluating alternative courses of action a. Incremental/Differential analysis approach – contrasts choices by comparing differential revenues, differential costs and differential contribution margins. Steps: 1. Gather all costs and benefits associated with each alternative. 2. Drop sunk costs and non-differential costs 3. Select the alternative that has the greatest advantage based on the cost data made. b. Total project analysis approach – shows the income statement under different alternatives and compares the net income results. Common cases where relevant costing is used a. Make or buy – determination of whether a component of a product being manufactured is to be made or be bought on outside supplier b. Drop or not to drop a segment – to decide whether a segment is to be added, dropped or maintained by the firm c. Accept or not to accept special order – evaluating the benefit that may be generated by the entity from special sales pricing offered by a buyer d. Profitable use of constraint resources – finding the best way to utilize scarce resource and how to get the highest contribution margin from constraint use of it e. Sell now or Process further – having the highest profit possible by knowing whether a product is to be sold at split-off point or be processed further Take note: Regardless of the case, the most important thing is you know how to determine which costs and benefits are relevant and which are irrelevant. By doing this, determination of its effect would be easier to determine. Cost may be relevant from one case and maybe irrelevant to the other. This means that costs have different implication depending on the situation. In utilization of scarce resources, the basis for priority is the one which yields higher contribution margin PER UNIT OF SCARCE RESOURCE USED and not per unit.