Income Tax Schemes, Accounting Periods & Methods

advertisement

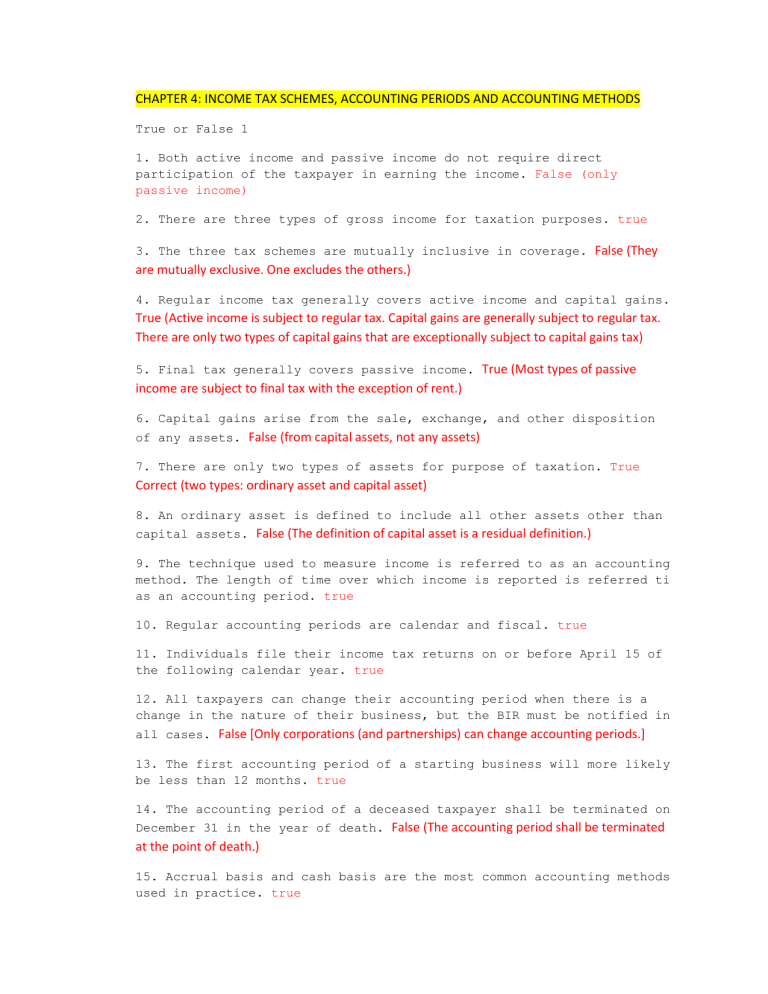

CHAPTER 4: INCOME TAX SCHEMES, ACCOUNTING PERIODS AND ACCOUNTING METHODS True or False 1 1. Both active income and passive income do not require direct participation of the taxpayer in earning the income. False (only passive income) 2. There are three types of gross income for taxation purposes. true 3. The three tax schemes are mutually inclusive in coverage. False (They are mutually exclusive. One excludes the others.) 4. Regular income tax generally covers active income and capital gains. True (Active income is subject to regular tax. Capital gains are generally subject to regular tax. There are only two types of capital gains that are exceptionally subject to capital gains tax) 5. Final tax generally covers passive income. True (Most types of passive income are subject to final tax with the exception of rent.) 6. Capital gains arise from the sale, exchange, and other disposition of any assets. False (from capital assets, not any assets) 7. There are only two types of assets for purpose of taxation. True Correct (two types: ordinary asset and capital asset) 8. An ordinary asset is defined to include all other assets other than capital assets. False (The definition of capital asset is a residual definition.) 9. The technique used to measure income is referred to as an accounting method. The length of time over which income is reported is referred ti as an accounting period. true 10. Regular accounting periods are calendar and fiscal. true 11. Individuals file their income tax returns on or before April 15 of the following calendar year. true 12. All taxpayers can change their accounting period when there is a change in the nature of their business, but the BIR must be notified in all cases. False [Only corporations (and partnerships) can change accounting periods.] 13. The first accounting period of a starting business will more likely be less than 12 months. true 14. The accounting period of a deceased taxpayer shall be terminated on December 31 in the year of death. False (The accounting period shall be terminated at the point of death.) 15. Accrual basis and cash basis are the most common accounting methods used in practice. true True or False 2 1. Advanced income is an item of gross income for accrual basis taxpayers. True (Advanced income is taxable upon receipt) 2. Generally, prepayments are non-deductible in the current accounting period. True (Deductible as they are used up or are expired in the business of the taxpayer.) 3. Prepayments are deductible but in the future period they expire or are consumed in the business or trade of the taxpayer. true 4. The use of different methods for different businesses of the same taxpayer is permitted by law. True (The mix of the different methods is referred to as hybrid method.) 5. Initial payment includes down payment and installments in the year of sale. true 6. Contract price is synonymous with selling price. False (Contract price is the total amount receivable in money or property from the buyer. This amount is usually the selling price but will differ when there is an encumbrance on the property to be assumed by the buyer.) 7. The crop year method is an accounting method. True (Crop year method is not an accounting period) 8. Under the percentage of completion method, gross income is reported based on the cash collections from the contract price. False (Based on percentage of progress of the construction project) 9. The depreciated value of the property upon termination of the lease constitutes income to the lessee. true 10. The withheld taxes on the income payments made by the taxpayers are tax credit against their income tax due. False (These are tax credits of the recipient of the income.) 11. There are three types of income tax return for each income tax scheme. False (Only capital gains tax and regular income tax has tax returns. Note that final income tax are withheld at source.) 12. All taxpayers, small or large, are encouraged to file their income tax return through the EFPS system of the BIR. False (Only large taxpayers that meet certain criteria are required to file through the EFPS. Small taxpayers shall file their returns in their respective Revenue District Office.) 13. Large taxpayers are under the supervision of the BIR Large Taxpayer Service. true 14. Non-filling and / or non-payment of tax is subject to penalties such as surcharges, interest, compromise, and imprisonment. False (The compromise is in lieu of criminal prosecution over a tax violation. It does not apply hand in hand with imprisonment.) 15. The interest on unpaid taxes is computed on the basic tax only excluding the surcharge. True (The imposition of a penalty upon another penalty is illegal. Hence, the BIR cannot impose the interest to the amount of the surcharge.) 16. Only large taxpayers shall file under eFPS. false 17. Both manual filing and filing through e-BIR forms makes use of manual payment. true 18. eFPS is fully electronic tax compliance. true 19. e-BIR forms makes use of electronic data entry and filing. true 20. eFPS filers may file manually when there is a BIR system downtime. true Multiple Choice- Theory: General Concepts 1. Which is not a scheme in taxing income? a. Ordinary gain taxation b. Regular income taxation c. Capital gains taxation d. Final income taxation 2. Which is correct statement regarding income taxes? a. An item of income subjected to final tax can still be subject to regular tax. b. An item of income exempted from final tax is nevertheless taxable to regular tax. c. An item of income subjected to capital gains tax may be subject to regular income tax. d. An item of income exempted from tax is likewise exempt from capital gains tax and regular income tax. 3. Which is not a feature of final tax? a. Covers certain passive income b. Covers all capital gains c. Withholding at source d. None of these 4. Which of the following properties when classified as capital asset is subject to capital gains tax? a. Domestic stocks sold directly to buyer b. Real property c. Both a or b d. None of these 5. Capital asset means a. Real properties used in business. b. Personal properties used in business. c. Real properties not used in business. d. Any property, real or personal, not used in business. 6. Which is not an item of passive income? a. Royalties b. Prizes c. Deposit interest income d. Professional income 7. Which of the following accounting method is most consistent with the lifeblood doctrine? a. Crop year method b. Cash basis c. Installment method d. Accrual method 8. These are accounting techniques or conventions used to measure income a. Accounting methods b. Accounting periods c. Accrual basis d. Cash basis 09. These are distinct and equal time periods which income is measured a. Accounting methods c. Crop year basis b. Accounting periods d. Cash basis 10. Income is recognized when received rather than when earned a. Cash basis c. Accrual basis b. Installment basis d. Deferred payment basis 11. Income is recognized when earned regardless of when received a. Cash basis c. Installment method b. Accrual basis d. Percentage of completion 12. Initial payment means a. Downpayment. b. Total collection within the year the installment sale was made. c. Installment payments, exclusive of downpayment, within the year installment sale was made. d. Total collections within one year from the date the installment sale was made. 13. Income is reported by reference to the extent of project completion in a. Deferred payment method b. Installment method c. Percentage completion method d. Completed contract method 14. Which statement is correct? a. Dealers of real properties can use installment method without limitation. b. Dealers of personal properties can use installment method without limitation. c. Non-dealers of properties can use the installment method if initial payment exceeds 25% of the selling price. d. Dealers of properties can use the installment method only if initial payment does not exceed 25% of the selling price. 15. Leasehold income is recognized over the lease term in a. Outright method c. Spread-out method b. Cash basis d. Percentage of completion method 16. Statement 1: The excess of mortgage assumed by the buyer over the basis of the properties sold is the amount of gain on the sale. Statement 2: Any collection from an installment contract where the mortgage exceeds the tax basis of the properties received constitutes collection of income. Which statement is true? Statement 1 only c. Both statements are true. Statement 2 only d. Neither statement is true. 17. Which is correct regarding the crop year method? a. Crop year method is an accounting period. b. Crop year method recognizes farming income when the next planting season commenced. c. Crop year method matches cropping expenses with the income upon harvest. d. Crop year method recognizes cropping expenses when incurred and harvest income when realized. 18. Which is an incorrect statement reagarding the use of accounting period? a. Individuals can either choose the calendar year or fiscal year accounting period. b. The regular accounting period for any taxpayer is 12 months. c. Individual taxpayers are not allowed to report income using fiscal accounting period. d. Corporations may opt to use either calendar or fiscal accounting period. 19. Under which of the following will short accounting period not arise? a. Change of accounting period by a corporate taxpayer b. Change of accounting period by an individual taxpayer c. Death of taxpayer d. Dissolution and liquidation of a business 20. Which is not a special feature of regular income taxation? a. Use of accounting methods c. Annual payment of income tax b. Use of accounting period d. Final withholding tax at source Multiple Choice-Problem 4-1: Accounting period 1. An individual income taxpayer shall file his or her income tax return on or before the 15th day of the fourth month of the same calendar year. 15th day of the fourth month of the following calendar year. 15th day of the fourth month of the same fiscal year. 15th day of the fourth month of the following fiscal year. 2. Anderson died on March 31, 2017. Which is a correct statement? a. Anderson’s 2017 income tax return shall cover January 1, 2016 to December 31, 2017. b. Anderson’s 2017 income tax return shall cover January 1, 2017 to December 31, 2017. c. Anderson’s 2017 income tax return shall cover January 1, 2017 to March 31, 2017. d. Anderson’s 2017 income tax return shall cover April 1, 2017 to December 31, 2017. 3. Mrs. Julian started business on July 15, 2016. What should be the coverage of her 2016 income tax return? a. January 1 to July 15, 2016 b. July 15, 2016 to December 31, 2016 c. July 16, 2016 to July 15, 2017 d. January 1 to December 31, 2016 4. A corporation reporting on a fiscal year ending every March 31 shall file its 2017 income tax return not later than a. April 15, 2017 c. July 15, 2017 b. June 15, 2017 d. April 15, 2018 5. Metersbonwe Corporation started business on April 5, 2016 and opted to report income tax on a fiscal year ending every October 31. Metersbonwe’s first income tax return shall cover a. April 6, 2016 to October 31, 2016 b. April 5, 2016 to October 31, 2016 c. April 5, 2016 to December 31, 2016 d. April 5, 2016 to April 5, 2017 6. Beneco Corporation reports on calendar year. On August 15, 2016, it stopped business due to persistent losses. Beneco Corporation’s last income tax return shall cover a. January 1 to December 31, 2016 b. Janaury 1 to August 15, 2016 c. August 15, 2013 to August 15, 2016 d. August 15 to December 31, 2016 7. Effective March 1, 2017, Jonah, Inc. changed its calendar year to a fiscal year ending every June 30. An adjustment return shall be filed covering the period a. March 1 to June 30, 2017 b. Janaury 1 to June 30, 2017 c. January 1 to March 1, 2017 d. January 1 to December 31, 2017 8. During 2017, Klein Corporation changed its accounting period to the calendar year. The adjustment return shall be filed on or before a. April 15, 2017 c. April 15, 2018 b. July 15, 2017 d. July 15, 2018 9. Effective July 2, 2016, Rofelson Company changed its fiscal year ending every March 31 to another fiscal year ending every August 31. An adjustment return shall be filed covering the period a. April 1 to July 2, 2016 c. April 1 to August 31, 2016 b. April to July 1, 2016 d. July 3 to August 31, 2016 10. Effective May 15, 2017, Tabuk, Inc. changed its fiscal year ending every April 30 to the calendar year. An adjustment return shall be filed covering the period a. May 1 to December 31, 2017 b. January 15 to December 31, 2017 c. January 1 to April 30, 2017 d. April 30 to December 31, 2017 Multiple Choice-Problems 4-2: tax schemes and accounting methods 1. Astercor, Inc. reported the following during the year: P400,000 proceeds of life insurance of an officer where Antercor is the beneficiary (P600,000 still uncollected.) P800,000 interest income, exclusive of P200,000 uncollected and accrued interest P300,000 increase in value of investment stocks Compute the gross income under basis. P800,000 P1,000,000 c. P1,200,000 d. P1,400,000 2. Compute the gross income under accrual basis. a. P800,000 c. P1,200,000 b. P1,000,000 d. P1,400,000 3. Berlin Corp. reported the following data for 2019: Total net sales made to customers were P2,000,000 in cash. Goods purchased for sale totalled P1,200,000 in cash. Beginning and ending inventory of goods for sale, respectively, were P200,000 and P300,000. 1-year advanced rent of P30,000 to apply for 2020 was received from a sublease contract. P40,000 total interest income from customers promissory note earned P30,000 of this was collected. Unrealized foreign exchange gains from foreign currency receivable totaled P60,000. Using cash basis, compute the total income subject to income tax. P990,000 c. P750,000 P960,000(P2M – P1.1M COGS + P30K + P30K) d. P690,000 4. Using accrual basis, compute the total income subject to income tax. a. P1,060,000 c. P960,000 b. P1,000,000 d. P970,000 (P2M – P1.1M COGS + P30K + P40K) 5. Santiago, Inc. has the following receipts during 2018: From service billings to client P400,000 Advances from clients 100,000 Total cash collection P500,000 The P100,000 advances refer to services which will be rendered next year. Total uncollected billing increased from P100,000 on December 31, 2017 to P150,000 on December 31, 2018. Compute the gross income using cash basis. P400,000 c. P500,000 P450,000 d. P550,000 6. Compute the gross income using accrual basis. P400,000 c. P500,000 P450,000 d. P550,000 [(P400K+P150KP100K)+P100K] 7. In 2019, Bright Inc. sold its parking lot for P2,400,000 payable on installment. The lot was previously acquired for P1,500,000. The buyer has an outstanding unpaid balance of P1,800,000 as of December 31, 2019, Bright’s year-end. Compute Exquisite’s gross income in 2019 using the installment method. P900,000 c. P225,000 [P900K GP x (P600K/P2.4M)] P675,000 d. P112,500 8. Exquisite Corporation sold its old warehouse with carrying amount (tax basis) of P600,000 for P1,000,000. A downpayment of 15% was collected on July 1,2019. Additional P150,000 installment payments were received as of December 31, 2019. Compute the gross profit to be reported for the year 2019. P60,000 c. P400,000 (P 1M-P600K) P120,000 d. P450,000 9. Lancelot is a dealer of household appliances. He reported the following in 2019 and 2020: 2019 2020 P500,000 P800,000 Cost of installment sales 250,000 440,000 Collections 300,000 600,000 Installment sales Lance’s 2020 collection is inclusive of P100,000 accounts from 2019. Using the installment method, compute Lancelot’s gross income subject to income tax 2020. P360,000 c. P250,000 P320,000 d. P275,000 [(P250K 2015GP x20%) + (P360K 2016GP x62.5%)] 10. Using the accrual basis of accounting compute Lancelot’s gross income subject to income tax in 2020. P360,000 c. P275,000 P320,000 d. P250,000 11. Merville is a dealer in real properties. Merville requires 20% downpayment, and the balance is payable over 36 monthly instalments starting on the last day of the month following the month of sale. Merville sold properties in 2019 and 2020 with terms as follows: House and Lot No. 1 was sold for P1,350,000 on November 11, 2019. House and Lot No. 2 was sold for P1,800,000 on July 5, 2020. Both properties were sold at a gross profit rate of 40% based on the selling price. Compute Merville’s gross income subject to income tax in 2019 and 2020, respectively. P120,000;P720,000 c. P540,000;P720,000 P120,000;P846,000 [P540K 2015GP x (P300K/P1.35M)];[(P540 K 2015GP x P360K/P1.35M)+P720K 2016GP] d. P540,000;P846,000 12. In 2020, Mr. Marangley, a dealer of car, disposed a brand new sports utility vehicle (SUV) which costs P800,000 for P1,200,000, inclusive or under the following terms: July 1, 2020-as down payment P100,000 Monthly installment thereafter 50,000 Mr. Marangley will choose whichever favourable permissible income reporting method for him. How much gross income is to be reported in 2020? P400,000 c. P116,667 (350K/1.2M x 400K) P250,000 d. P108,219 13. In the immediately preceding problem, assuming Mr. Marangley is not a dealer of car, how much gross income is to be reported in 2020? How much gross income is to be reported in 2020? P400,000 c. P116,667 P250,000 d. P108,219 14. Luccio accepted a P1,000,000 construction contract in early 2020. As of December 31, Luccio incurred total construction costs of P600,000 and estimates additional P200,000 to bring the project to completion. Per independent appraisal, the building is at its 80% stage of completion. Compute Luccio’s 2020 construction income using the percentage completion method. P40,000 c. P160,000 P200,000 (80% x P1M – P600K) d. P400,000 15. Crevar constructs residential properties for clients and reports income by the percentage of completion method. In 2019, Crevar started a P2,000,000 construction contract. Details of his 2019 and 2020 construction follow: 2019 Annual construction costs 2020 P200,000 P800,000 800,000 250,000 20% 80% Estimated cost to finish Extent of completion Compute the construction income in 2019 amd 2020. P200,000;P560,000 c. P400,000;P400,000 P200,000;P400,000 d. P400,000;P560,000 16. Oliver entered into a 40-year lease contract with Berna. Per agreement, Oliver will construct a building on Berna’s lot and operate the same for 40 years. Ownership of the building will transfer to Berna upon the termination of the lease. The lease will not commence until the building is completed. Oliver completed the building at a total cost of P40,000,000 on January 1, 2020. The building is expected to be used over 50 years. Compute Berna’s income from the leasehold improvement to be reported in 2020 using the spread-out method. P200,000 [(P40M x 10/50)/40] c. P8,000,000 P4,000,000 d. P32,000,000 17. In the immediately preceding problem, assume that the building was completed on July 1, 2020, what is the income using the outright method? P400,000,000 P8,000,000 c. P32,000,000 d. P40,000,000 18. Tomas leases an office space from Rafi, Inc. in a non-renewable 10 year lease contract. Just after the second year of the lease. Tomas renovated the premises and made improvements at a cost of P1,200,000. These improvements are expected to last for 12 years. Compute Rafi’s annual income from the leasehold improvement using the spread-out method. P50,000 [(P1.2M x4/12)/8] c. P30,000 P37,500 d. P20,000 19. Hassan started raising swine for sale by purchasing 5 gilts and a boar at a total purchase price of P50,000 on January 2020. As of December 31, 2020, Hassan’s herd grew to 15 gilts, 2 boars and 20 piglets. The total herd has a fair value of P196,000 when sold as is. During the year, Hassan earned P180,000 from selling piglets. How much should Hassan report as farming income in 2020? P326,000 c. P146,000 P180,000 d. P130,000 20. Pedro, a farmer, uses the crop-year method in reporting his income from long-term crops. The following data are relevant to his farming operations in 2020: Sales of crops harvested, P900,000 Expenses on harvested crops, P400,000 Expenses on maturing crops, P200,000 Expenses on newly planted crops, P100,000 Sales of tree branches for firewood, P50,000 Pedro uses the crop year method in reporting crop income. Compute Pedro’s total income subject to tax. P240,000 c. P540,000 P340,000 d. P550,000 (P900K SALES-P400K EXP +P50K) Multiple Choice-Problem 4-3:Tax compliance 1. A taxpayer filed his income tax return in October 28, 2018. The deadline for the return was April 15, 2018. If he has P40,000 net tax due, compute the penalties in the form of interest. P2,578 (196/365) x 12% x P40,000 = P2,278 c. P2,867 P2,611 d. P4,296 2. What is the total surcharge penalty? P0 c. P10,000 (P40,000 x 25%) P8,000 d. P20,000 3. A taxpayer received a notice from the BIR to file his 2016 income tax return not later than January 15, 2018. The tax due per his return is P100,000. What is the total surcharge penalty? P0 c. P25,000 P20,000 d. P50,000 (50% surcharge apply. There is a BIR prior notice.) 4. What is his total interest penalty? P6,500 c. P14,740 P7,900 d. P15,068 5. Compute the compromise penalty P10,000 c. P20,000 P15,000 (For unpaid tax amounting P50,000 but not exceeding P100,000, the compromise penalty is P15,000). d. P30,000 6. Mani Pakyaw failed to pay file his income tax return for the year 2019 which should have been filed on or before July 18, 2020. Mani Pakyaw filed a return showing a basic tax due of P1,000,000. Compute the total interest penalty. P35,836 c. P38,555 P37,644 d. P39,863 The problem has no answer. April 16, 2020 to July 18, 2020 is 94 days. P1M x 12% x 94/365) = P30,904. You may consider rewarding students who objectively answered P30,904. Good student should have identified the lack of answer and objectively indicated their correct answer. 7. Mr. Pakyaw must pay a surcharge of P0 c. P500,000 (50% apply since he received a notice from the BIR before filing) P250,000 d. P1,000,000 8. Rich Goma Corporation failed to file its income tax return for the fiscal year ending August 31, 2019. On June 6, 2020, it filed an income tax return with a basic tax still due and payable for the fiscal year amounting to P500,000. Compute the interest penalty to be imposed by the BIR. P28,603 (The return deadline is December 15, 2019. December 16, 2019 to June 6, 2020 is 174 days. Note that February 2020 is 29 days since 2020 is a leap year. Hence, P500,00 x 12% x 174/365 = P28,603. c. P45,873 P28,438 d. P46,207 9. Compute the total tax assessment to be paid, excluding compromise penalty. P653,603 (interest penalty + 500K + 25%xP500K) c. P689,275 P653,438 d. P660,873 CHAPTER 5: FINAL INCOME TAXATION 1. Generally, interest income from non-bank sources is subject to regular income tax. True (Final tax on interest covers only interest income from banks and trust funds) 2. Foreign income is subjected to final tax if the taxpayer is taxable on global income. False 3. Items of passive income from abroad are subject to final tax. False (Final tax applies only on identified passive income from sources WITHIN.) 4. Interest income on government securities are subject to final. True (They are considered deposits substitutes.) 5. All items of passive income are generally subject to final tax. False (Passive income are generally subject to final tax, but not ALL) 6. Final tax is collected at source; hence, there is no need to file an income tax return. True 7. Corporations are tax-exempt on inter-corporate dividends from any corporation. False (Only inter-corporate dividend from DOMESTIC corporation) 8. Individuals and corporations are tax-exempt on interest income on long-term deposits. False (Only individual taxpayers are exempt) 9. Dividends from resident corporations are subject to regular tax. True 10. Dividends from Real Estate Investment Trusts are exempt from final tax. False (REIT dividends are generally subject to 10% final tax.) 11. Stock dividends are always exempt from final tax. False (Stock dividend is generally exempt, except when it confers upon the recipient an interest different from what he previously owned or when the declaration of stock dividends amounts to a declaration of cash dividends.) 12. Corporations are subject to final tax on prizes. False (The NIRC did not contemplate final taxation of prizes on corporations, hence, corporate prizes is deemed subject to regular income tax.) 13. The share in the net Income of a business partnership is subject to a creditable withholding tax, not to final tax. False (subject to final tax of 10%) 14. General professional partnerships are subject to final tax but not to regular tax. False (They are exempt from any income tax.) 15. All non-residents are exempt from final tax on foreign currency deposits. True (Only resident aliens are subject to 7.5% final tax.) 16. Royalties, active or passive, are subject to regular income tax. False (Active royalties are subject to regular tax. Passive royalties are subject to final tax.) 17. The tax sparing rule is applicable to resident and non-resident foreign corporations. False (It applies only to non-resident foreign corporations) True or False 2 1 A government employee mar, claim the tax informer's reward. False 2 The final tar on winnings applies to corporations. False 3. individuais except corporations are subject to final tax on winnings abroad. False (Passive income abroad, including winnings are subject to regular tax.) 4. Winnings which are not more than P10,000 in amount are subject to the regular income tax. False (This rule applies to taxable price.) 5. PCSO or lotto winnings are exempt from all types of income tax. False (PCSO / lotto winnings are now generally subject to 20% final tax) 6. Special aliens do not file a regular income tax return on their compensation income. True 7. The final tax on interest on tax-free corporate covenant bonds applies only to resident individual or corporate taxpayers. False 8. NRA-NETB and NRFC are subject to final tax only to passive income from sources in the Philippines. False (Active or passive income are subject to final tax) 9. NRA-NETB and NRFCs are not required to file the regular income tax return. True 10. Residents shall withhold 10% final tax upon interest on foreign currency loans of FCDU banks and OBUS under the expanded foreign currency deposit system. True 11. A qualified employee trust fund is not subject to final tax. True 12. The income of FCDU banks from fellow depositary banks under the expanded foreign currency deposit system is subject to 10% final tax. False (It is exempt) 13. Petroleum service subcontractors are subject to 8% final tax on their income from petroleum service contractors. True 14. The final withholding tax return shall be filed by the withholding agent once before the 159 day of the month the final taxes were withheld. False (On the 10th day, not on the 15th day) 15. Foreign governments and foreign government-owned and controlled corporation are exempt from final tax. True (They are exempt from income tax: final tax, capital gains tax or regular income tax.) Multiple Choices - Theory 1 1. Which is correct with regard to the final income taxation? a. Taxpayers need not file an income tax return b. It covers all items of passive income from whatever sources. C. It applies to all items of gross income of any non-resident earned from sources within the Philippines. d. It applies to passive income earned abroad. 2. Which statement is correct regarding final income tax? a. Items of income subjected to final tax can still be subjected to regular tax b. Final tax applies only on certain passive income earned within the Philippines C.Items of income exempt under final tax are subject to regular tax. D. Final income tax applies to all passive income from Philippines sources. 3. Interest income from which of the following sources is subject to final income tax a Lending b. Mortgage loans c. Bond investment d. Money market placements 4. The final tax does not apply to interest on (select the best answer) a. Long-term deposit b. Trust funds c. Deposit substitute d. Promissory notes 5. The exemption on final tax on interest from long-term deposit is not applicable to a.Citizens individuals b. Corporations c. Resident corporation or individuals d. All of these 6. Which interest income is not subject to any income tax? a. Interest income from discount notes b. Interest income from bonds issued by a bank C. Imputed interest d. Interest income from deposit substitute 7. The final tax rates on pre-termination of long-term deposits is not relevant to a. any corporations. b. resident citizens c. resident aliens. d. non-resident citizens. 8. Which of the following is subject to 15% final tax on interest from foreign currency deposits made with Philippine banks? a. Non-resident corporation b. Non-resident alien engaged in trade or business C. Non-resident alien not engaged in trade or business d. Resident alien 9. The following are subject to final tax on all income from sources Philippines. Which is the exception? a. Non-resident foreign corporation b. Non-resident alien not engaged in trade or business c. Non-resident alien engaged in trade or business d. None of these 10. The interest income from long-term peso deposits made with foreign banks is a. subject to 20% final tax. b. exempt from any tax. C. subject to regular tax. d. None of these. 11. What is the final tax on interest income on 6-year deposit pre-terminated less than 2 years before maturity? a. 20% b. 12% c. 5% d. 0% 12. Which of the following recipients is exempt from final tax on dividends? a. Resident citizen b. Non-resident alien c. Resident corporation d. Resident alien 13. A dividend declaration in 2019 is subject to a final tax of a 6% b. 8%. ç 10%. d. 20% 14. Dividends declared by a resident corporation is a. exempt from any tax. b. subject to 10% final tax. C. subject to regular income tax d. subject to 20% final tax. 15. Between the date of declaration and the date of record. BCD, Inc. sold investment representing stock of ABC, Inc. a domestic corporation. Which statement is correct? a. ABC Inc. shall withhold 10% dividend tax if the buyer of the sale is an individual. b. ABC, Inc. shall withhold 10% dividend tax if the buyer of the sale is a corporation C. ABC, Inc. shall withhold 10% dividend tax if the seller of the sale is individual. d. ABC, Inc. shall withhold 10% dividend tax if the seller of the sale is, corporation Multiple Choices - Theory 2 1. Which is covered by final tax? a. Interest income from foreign banks b. Share in the net income of a joint venture C. P10,000 taxable prizes from the Philippines d. Share in the net income of a general professional partnership 2. Which is not subject to 20% final tax? a. Interest income from trust funds b. Royalties from musical compositions с. P11,000 worth of prizes d. Winnings 3. Which is not subject to 10% final tax? a. Royalties from literary works b. Dividends from a domestic corporation c. Share in the net income of a business partnership d. Royalties from a business trademark 4. Which of the following is taxable? a. Prize on sports competitions sanctioned by the national sports organization b. Prize from dance competition abroad c. Nobel prize d Any prize received without effort 5. Which winning is taxable to a final tax? a Winnings exceeding P10,000 b. Winnings not exceeding P10,000 C. Winnings from PCSO or lotto d. All of these 6. Prizes from sources abroad is subject to final tax D. 7. A This problem is a transition problem. Applying TRAIN law would result in multiple answers hence inconsistent with the problem. Student should use the law which gives the rational answer. That is, they should use the NIRC. 8. C 9. C 10. D 11. A 12. D 13. A 14. A 15. D 16. D 17. D 18. C Multiple Choices – Problems 1 1. D [(P2M X 180/360) X 8%X20%] 2. C (P80K X 25%) 3. A (P42,000/80%) X 20% 4. A 5. C [(P2M X 10% X 4.5) X 5%] 6. C (P80K/80% X 20%) 7. C [(P1M X 10%) X 80%] 8. D (P100K X 30%) 9. B [(P1M X 10% X 6/12) X 20%] 10. B [(P1M/4 X 10%) X 20%] 11. A 12. A 13. B [($1M X 8% X 15%)/2] 14. A 15. D [($1M X 10% X 15%) X P45] Multiple Choices – Problems 2 1. C If we assume the $46,250 as net of tax, there would be no answer [i.e. $46,250/85%) x 15%]. The next correct assumption is that $46,250 gross is credited then the account must be debited for $46,250 x 15%. 2. B 3. C (P1M X 60% X 10%) 4. D (A resident corporation is a foreign corporation) 5. A (P120K X 24%) 6. B (P100K/90%) X 10% 7. B (P200K X 40% X 10%) 8. D 9. C (P200K X 10%) 10. D 11. D 12. D 13. C (P1M X 40% X 10%) The problem is asking for final tax to be withheld to all not from the dividend income of Sison.) 14. A (P800K/80% X 20%) 15. B (P8M X 10% X 80%) Multiple Choices – Problems 3 1. B (P22,100 X 20%) 2. A (The P10K final tax threshold on prizes is on a per event and per organizer basis). 3. D 4. D 5. B (P500K X 20%) 6. D 7. D (P1M maximum x 90%) 8. A 9. C (P1M X 8.75%/70% X 30%) 10. C 11. D (Surcharge = P90,000 x 25%, interest is P90,000 x 20% x 10/360, compromise is P15,000 per table.) Total amount due is P90K+22.5K+500 + P 15K = P128,000 Note: This is an NIRC case not a TRAIN law case since compliance date is March 20, 2017. 12. C (The interest payment was actually P1,200,000 x 20% final tax rate = P240,000). The surcharges shall be P240,000 x 25% = P60,000. The interest shall be P240,000 x 20% x 30/360 or P4,000. Total penalties before compromise = P64,000. This is also an NIRC assessment era assessment case. CHAPTER 6: CAPITAL GAINS TAXATION TRUE OR FALSE 1 1. A vacant and unused lot is an ordinary asset to a real estate dealer. true 2. For taxpayers not engaged in business, assets shall cease to be ordinary assets when they are discontinued from active use for more than two years. true 3. Real and other properties acquired are ordinary assets to banks even if they are not engaged in the realty business. true 4. Capital assets will not become ordinary assets to banks even if they are not engaged in the realty business. false 5. An ordinary asset becomes automatically become a capital asset when it is withdrawn from active use. false 6. The sale of real property capital assets will never be subject to regular income tax. False (See sales of RFC and the RIT option on individual sale to government) 7. Donated assets become ordinary assets even if the done do not employ the same in business. False 8. An ordinary asset continues to be an ordinary asset even if idled for more than two years if the taxpayer is engaged in realty business. true 9. The real properties used by exempt corporations in their exempt operations are capital assets. true 10. Dealers in realties are subject to the regular tax on their sale of properties. true 11. Capital gains from assets other than domestic stocks and real properties are subject to regular income tax. true 12. Dealers in securities are not subject to the stock transaction tax but are subject to the regular income tax on gains realized upon the sale of stocks through the Philippine Stock Exchange. true 13. Unit of participations in golf, polo, and similar clubs are considered domestic stock. true 14. The excess premium on the re-issuance of treasury stock is subject to capital gains tax. False 15. The issuance of shares of stock for property is subject to capital gains tax. False 16. The sale of foreign stocks directly to a buyer is subject to capital gains tax. False (only domestic stocks) 17. The two-tiered final tax cannot apply unless and until there is a gain on the sale, exchange, and other disposition of stocks directly to a buyer. true 18. The stock transaction tax on the sale of stocks through the PSE cannot apply unless there is a gain on the transaction. False (tax is based on selling price) 19. The 6% capital gain tax cannot apply unless there is a gain on the sale of real property. False (tax is based on SP or FMV) 20. The sale of real properties located abroad is subject to the 6% capital gains tax. False (only real property capital assets within) TRUE OR FALSE 2 1. The annual capital gains tax return is simultaneously due with the annual regular income tax return. true 2. The basis of properties received by way of inheritance is the basis in the hands of the last owner who did not acquire the same by donation. False (or the fair value whichever is lower) 3. When specific identification is impossible, the cost of the stocks sold is determined by the weighted average method. False (by moving average method) 4. The basis of the stocks received in tax-free exchanges is the basis of the shares given. False (adjusted basis of the shares received) 5. The transactional capital gains tax return is required to be filed within 30 days from the date of sale. true 6. The gain on the sale of stocks for stocks pursuant to a plan of merger and consolidation is exempt if it is resulted in the transferor acquiring corporate control over the absorbed corporation. true 7. Installment payment of capital gains is allowed if the ratio of downpayment over the selling price of the sale does not exceed 25%. False (not downpayment but initial payment) 8. The spelling price is used to determine the propriety of using the installment method but the contract price is used to determine the capital gains tax payable in installment. true 9. The excess of mortage over the basis assumed by the buyer constitutes an indirect receipt which is part of the initial payment and the selling price. False (not selling price but contract price) 10. Wash sales occurs when there is a repurchase of shares within 30 days before and 30 days after the date of disposal of securities at a loss. true 11. Control means more than 50% ownership in the voting power of a corporation. true 12. The sale of delisted stock is subject to stock transaction tax and not to capital received.false 13. Gain and loss in a share-for-share swap pursuant to a plan of merger or consolidation shall be recognized up to the extent of the cash and other properties received. true 14. The sale by the National Housing Authority of commercial lots is subject to capital gains tax. true 15. If the assesor’s fair value is lower than the selling price, then the fair value of the property is the zonal value. False (Assessed Value and Zonal value are independent valuations) 16. Title to a property shall not be registered by the Registry of Deeds unless the Commissioner or his representatives has certified that the tax on the transfer has been paid. true 17. Domestic corporations are exempt from the capital gains tax on the sale, exchange, and other disposition of real properties.False (foreign corporations are exempt) 18. The sale of land pursuant to the Agrarian Reform Program is exempt from capital gains tax. true 19. Foreign corporations are required to pay capital gains tax on the sale of domestic stocks and on the sale of property capital assets. False (Only on domestic stocks.) 20. The alternative taxation on an expropriation sale is not applicable to corporate taxpayers. true MULTIPLE CHOICE-THEORY: PART 1 1. Which is an ordinary asset? a. Personal car c. Principal residence of the taxpayer b. Delivery truck d. Wedding ring of the tax payer 2. Which is not an ordinary asset? a. Personal laptop of the taxpayer c. Real property held for sale b. Machineries and equipment d. leasehold improvements 3. Which is a capital asset to a realty developer? a. Constructive equipment b. Domestic stocks c. Vacant lot held for the future development d. Head office building of the developer 4. Which is an ordinary asset? a. Home appliances b. Personal car c. Personal cellphone d. Office supplies 5. Which is the following assets, if not used in business, is subject to a regular tax? a. Real property b. Domestic stock rights c. Domestic stock option d. Taxpayer’s personal car 6. Domestic is a capital asset for a security dealer? a. Domestic stocks b. Domestic bonds c. Real property held for speculation d. Office equipment 7. Which is subject to the 5%-10% capital gains tax? a. Sale of domestic stocks to a buyer within or outside the Philippines b. Sale of domestic bonds directly to a buyer within the Philippines c. Sale of domestic stocks through the Philippines Stock Exchange d. All of the above 8. Who is not subject to capital gains tax on the sale of domestic stocks directly to a buyer? a. Dealer of cars b. Real property developer c. Dealer of securities d. Realty dealer 9. Which of the following, when sold, is not subject to capital gains tax? a. Boarding house b. Warehouse c. Dealer of securities d. Reality dealer 10. Which is not subject to the 6% capital gains tax? a. Donation property b. Foreclosure of a mortgaged property c. Exportation of one’s property in favor of the government d. Sale of property for an insufficient consideration 11. Statement 1: capital gains may arises from sale, exchange, and other disposition of movable properties used in business. Statement 2: ordinary gains may arises from sale, exchange, and other disposition of real properties not used in business. Which is true? a. Statement 1 is correct b. Statement 2 is correct c. Both statements are false d. Both statements are correct 12. Statement 1: The gain on sale of domestic stocks directly to a buyer is presumed. Statement 2: The gain on sale of real properties is presumed. Which of the following correct? a. Both statements are true b. Both statements are false c. Only statement 1 is true d. Only statement 2 is true 13. Which of the following properties when sold may be subject to capital gains tax? a. Domestic stock b. Foreign stock c. Patent d. Office Buildings 14. Statement 1: Only depreciable assets of business qualifies as ordinary assets. Statement 2: Land used in business is a capital asset since it is not subject to depreciation. Which of the following correct? a. Statement 1 is false b. Statement 2 is false c. Both statements are false d. A, B and C 15. Statement 1: Ordinary gains may arises from sale, exchange, and other dispositions of real properties in business. Statement 2: Capital gain may arise from sale, exchange, and other dispositions of real properties not used in business. Which is false? a. Statement 1 is correct b. Statement 2 is correct c. Both statements are false d. Both statements are correct MULTIPLE CHOICE- THEORY: PART 2 1. Which is the following properties, when sold, may be covered by regular income tax? a. Share options b. Preferred stocks c. Share warrants d. Promissory notes 2. Which is the following assets may be subject to capital gain tax upon disposal? a. Parking lot b. Dormitory c. Farm lot d. Office Supplies 3. The sale of an office building will be subject to a. 60% of 1% percentage tax. b. 6% capital gains tax. c. 15% capital gains tax d. Regular tax. 4. The term "other disposition" covers a. Foreclosure sales b. Auction sale c. Expropriation by the government d. Any of these 5. Which of the following sales of domestic stocks is subject to capital gains tax? a. Sale of domestic stocks through the PSE b. Issue of domestic stocks to subscribers C. Sale of domestic stocks directly to a buyer d. Exchange of stocks for stocks in a corporate merger 6. The sale of listed shares will never be subjected to be a. 6% capital gains tax only b. 60% of 1% percentage tax c. 15%capital gains tax d. Any of these 7. The sale of non-listed shares may be subjected to a. 6% capital gains tax only. b. 60% of 1% percentage tax only. c. 15% capital gains tax only. d. Any of these 8. Which of the following when sold may be exempted from the 6% capital gains tax? a. Unused land to the government b. Residential lot c. Developed residential properties for sale d. Principal residence 9. Statement 1: The sale or exchange must result to an actual gain before the 15% capital gains tax is imposed. Statement 2: The sale or exchange must result to an actual gain before the 6% capital gains tax is imposed. a. Both statements are correct c. Only statement 1 is correct b. Both statements are incorrect d. Only statement 2 is correct 10. When the annualized capital gains tax exceeds the transactional capital gains tax, the excess is a a. Tax credit c. Tax refundable b. Tax payable d. A or B 11. 1st statement: Properties acquired by real estate dealers are ordinary assets. 2nd statement: Properties of real estate dealers continue to be classified as ordinary assets even if they change the nature of their business. a. First statement is correct b. Second statement is correct c. Neither statement is correct d. Both statements are correct 12. 1st statement: When realty businesses discontinue use of assets for more than two years, the same shall be reclassified as capital assets. 2nd statement: When realty businesses discontinue use of assets for more than two years, the same shall be reclassified as capital assets. a. First statement is correct c. Neither statement is correct b. Second statement is correct d. Both statements are correct 13. Which is an incorrect statement? a. The capital gains tax on the disposition of capital stock presumes the existence of gain on the sales transaction. b. The buyer of real property capital asset shall with hold the tax at source and remit the same to the government. c. Capital gains tax is identified under the NIRC as a form of final tax. d. The capital gains tax on the disposition of real property presumes the existence of gain on the sales transaction. 14. Which of these shall pay the two-tiered capital gains tax? a. A real property developer b. A dealer in stocks c. A merchandiser or trader of goods d. A or B 15. The sale of real properties which would otherwise be subject to the 6% capital gains tax may nevertheless be subject to regular income tax if all of the following conditions are met, except one. Which is the exception? a. the seller must be an individual taxpayer b. the sale involves the principal residence of the taxpayer c. the buyer is the government d. the taxpayer opted to be subjected to regular tax 16. Which of these pay the 6% capital gains tax? a. Security dealer b. Real property developer c. Real property dealer d. d. None of these 17. The sale of a principal residence is exempt from the capital gains tax if all of the following conditions are met, except a. The proceeds is fully utilized in acquiring a new principal residence. b. The reacquisition must be by purchase. c. The reacquisition must have been made within 18 months from the date of the sale. d. The capital gains tax must be deposited in escrow. MULTIPLE CHOICE - THEORY: PART 3 1. The transactional 15% capital gains tax is to be paid a. Within 30 days from the date of sale or exchange. b. Within 30 days from the end of month of sale. c. On the 15th day of the fourth month following the close of the quarter when the sale was made. d. On the 15th day of the fourth month following the taxpayer's year-end. 2. The annual 15% capital gains tax return is due a. Within 30 days from the end of the month of sale. b. Within 30 days from the date of sale or exchange. c. On or before the 15th day of the fourth month following the taxpayer's year-end. d. on or before the 15th day of the fourth month following the close of the quarter when the sale was made 3. Capital gains tax that is not payable on installment basis is due a. within 30 days from the date of sale or exchange. b. within 30 days from the end of month of sale. c. on or before the 15th day of the fourth month following the close of the quarter when the sale was made. d. on or before the 15th day of the fourth month following the taxpayer's year- end. 4. Installment payments of the 6% capital gains tax is due a. Within 10 days from the date of each installment payment. b. Within 30 days from the date of each installment payment. c. Within 15 days from the date of each installment payment. d. Within 20 days from the date of each installment payment. 5. The installment payment of capital gains tax is applicable to the a. 15% capital gains tax only b. 6% capital gains tax only c. Both A and B d. Neither A nor B 6. The installment payment of capital gains tax is applicable to a. Individual taxpayers only c. Dealers in properties only b. Corporate taxpayers only d. A or B 7. Which of these capital gains is subject to capital gains tax? a. Gain on the sale of stock rights b. Gain on sale of interest in a professional partnership c. Gain on the sale of derivative financial instruments linked to commodity prices d. Gain on sale of bonds 8. Paulo indicated in his return his intent to avail of the exemption from the 6% capital gains tax. Under what condition will he be exempted? a. When the proceeds of the sale exceeds the cost basis of the property sold b. When the proceeds of the sale exceeds the acquisition price of the new residence c. When the cost basis of the property sold exceeds its selling price d. When the acquisition price of the new property exceeds the proceeds of the old property sold 9. Partial taxation under the 6% capital gains tax will result when a. The proceeds from the sale of the old property exceeds both its cost and the acquisition price of the new property. b. The proceeds of the sale exceeds its zonal value and Assessor's fair value. c. The proceeds of the old property exceeds the acquisition price of the new property regardless of the tax basis, zonal value, and Assessor's fair value of the old property. d. The zonal value is greater than the sales proceeds of the old property 10. The transactional capital gains tax on domestic stocks is a. not a final tax. b. included in the income tax return c. creditable to the regular income tax d. creditable to the annual capital gains tax due. 11. The 15% capital gains tax does not apply to a. Resident citizen dealers of stocks b. Non-resident citizen dealers of cars c. Resident alien dealers of computer parts d. Domestic corporations dealing in real properties 12. The documentary stamp tax on the sale of domestic stocks directly to a buyer is based on a. Selling price b. Fair Value c. Par value d. Cost 13. The documentary stamp tax on the sale of property is based on a. Selling price b. Fair value c. Cost d. A or B, whichever is higher 14. The 6% capital gains tax does not apply to a. Domestic corporations b. Resident aliens c. Non-resident citizens d. Foreign corporations 15. Who shall file the capital gains tax return for the sale, exchange, and other disposition of real property? a. Seller b. Buyer c. Transfer agent d. The registry of deeds Multiple Choice – Problem: Part 1 1. Mr. Dionisio sold domestic stocks directly to a buyer at a mark-up on cost of P200,000. He paid P5,000 broker’s commission and P8,000 documentary stamp tax on the sale. Compute the capital gains tax. a. P28,050 [The net gain is (P200K – P5K – P8K) x 15%] c. P14,200 b. P14,500 d. P13,700 2. Mr. Abdul, a non-resident alien, sold domestic stocks directly to a buyer at a net gain of P70,000. Compute the capital gains tax. a. P10,500 c. P4,000 b. P6,000 d. P3,500 3. Mr. Panay, directly to a gains tax. a. P30,000 c. b. P25,000 d. a non-resident citizen, sold domestic stock rights buyer at a net gain of P320,000. Compute the capital P27,000 P48,000 4. Mr. Digos sold shares of a resident foreign corporation directly to a buyer. The shares were purchased for P100,000 and were sold at a net selling price of P210,000. Compute the capital gains tax. a. P15,000 c. P5,500 b. P11,000 d. P0 5. Grace sold domestic shares directly to buyer. The following relates to the sale: Fair market value of shares P400,000 Selling price 300,000 Cost 150,000 Compute the capital gains tax. a. P7,500 c. P15,000 b. P9,925 d. P22,500 6. Texas Inc. exchanged its investments representing domestic shares for a piece of land owned by Eagle, Inc. Fair market value of shares P400,000 Fair market value of land 500,000 Par value of shares 300,000 Cost of shares 350,000 Compute the capital gains tax. a. P22,163 c. P11,000 b. P15,000 d. P9,988 7. Digong Inc. exchanged its share investment from Bee Inc., as payment of its P350,000 long outstanding loan from the latter. Digong acquired the shares for P300,000. Ignoring documentary stamp tax, compute the capital gains tax on the transaction. a. P0 c. P5,000 b. P7,500 [(P350K-300K) X 15%] d. P2,500 8. On January 5, 2020, Mercy, a stock dealer, diposed the following shares directly to a buyer: Shares Selling Price Cost Stock rights P200,000 P170,000 Common stocks 100,000 110,000 Ignoring the documentary stamp tax, the capital gains tax payable on the sale is a. P0 c. P1,500 b. P1,000 d. P3,000 9. Kidapawan, Inc., a domestic service company, has the following transactions on the sale of another domestic corporation: Transaction Quantity Net price Purchase 20,000 P40,000 Purchase 30,000 63,000 Sale 40,000 92,000 Assuming the first-in, first-out method, compute the capital gains tax on the sale. a. P0 c. P500 b. P480 d. P4,650 10. Assuming the moving method, compute the capita; gains on tax on the sale. a. P0 c. P500 b. P400 d. P1,440 11.Koron Company, a trading company, made the following transactions during the year involving the stocks of Xurpas, a domestic corporation: Date Transaction Shares Net price 6/15/2020 Purchase 10,000 P30 9/30/2020 Sale 8,000 28 10/3/2020 Purchase 15,000 25 12/7/2020 Sale 10,000 32 Koron uses the FIFO method in costing the Xurpas stocks. Compute the deductible loss on the September 30 sale. a. P20,000 c. P12,800 b. P16,000 d. P0 12. Compute the taxable gain on the December 7 sale. a. P64,118 c. P51,467 b. P60,000 d. P44,000 13. Mr. Trinidad has the following transactions during the year on the common stocks of Philippine Pines, a domestic non-listed company: Date Transaction Gain (Loss) 5/8/2020 Sale P120,000 8/5/2020 Sale (10,000) 9/8/2020 Sale 250,000 Compute the annual capital gains tax due for 2020. a. P54,000 c. P22,000 b. P29,000 d. P3,000 14. Mr. Kalibo shows the following transactions on the shares of Aklan Corporation, a closely held corporation: Date Transaction Quantity Price 2/8/2020 Buy 10,000 P120,000 4/5/2020 Sell 10,000 100,000 5/1/2020 Buy 20,000 240,000 What is the tax basis of the shares acquired on May 1,2020? a. P300,000 c. P240,000 b. P260,000 d. P220,000 15. Mrs. Aurora, a resident citizen, purchased 100,000 shares of PhilHotdogs, a domestic listed company. The shares were acquired at P200,000. She disposed the shares through the Philippine Stock Exchange at a fair value of P250,000. Compute the capital gains tax. a. P0 c. P7,500 b. P2,500 d. P10,000 16. Mr. Bosun disposed various stocks at a total consideration of P400,000 and paid thereon stock transactions tax of P2,000. Aggregate gains realized totaled P98,000 after the stock transaction tax. What is the capital gains tax? a. P0 c. P9,800 b. P4,900 d. P14,700 Multiple Choice – Problems: Part 2 1. A certain taxpayer shows the following over-the-counter transactions in the shares of a domestic corporation: Date Transaction Quantity Net price 2/8/2020 Purchase 10,000 P112,000 4/5/2020 Sale 10,000 110,000 5/1/2020 Purchase 8,000 80,000 6/7/2020 Sale 5,000 60,000 Compute the capital gain on June 7,2020 that is subject to capital gains tax. a. P4,000 c. P10,000 b. P5,000 d. P12,000 2. An investor sold domestic stocks directly to a buyer on October 1,2019 under the following terms: Selling price P 500,000 Cost 200,000 Downpayment 10% Installment in 2019 50,000 Compute the total capital gains tax in 2019. a. P45,000 c. P9,000 b. P25,000 d. P6,250 3. ABC realized the following gains or losses in selling various securities: Gain on sale of domestic stocks P300,000 Par value of domestic stocks sold 200,000 Gain on the sale of interest in a partnership 200,000 Gain on the sale of stocks of foreign corporations 150,000 Compute the capital gains tax. a. P45,000 c. P35,000 b. P44,775 d. P25,000 4. Compute the documentary stamp tax in the preceding problem. a. P1,500 c. P562.50 b. P1,125 d. P750 5. A wash sale of domestic shares wherein 20,000 shares where disposed at a loss of P40,000 were subsequently covered up within the 30day period by a purchased of 15,000 shares for P12/share. The deductible loss against capital gain on the wash sale is a. P0 c. P10,000 b. P13,333 d. P20,000 6. What is the cost of 15,000 shares acquired in the preceding problem? a. P150,000 c. P180,000 b. P160,000 d. P190,000 7. Isidro sold 1,500 shares of stocks of Achievers Corporation directly to a buyer. The share’s par value per shares was P85. Isidro purchased the shares for P90 each. On the date of sale, the shares had a selling price of P120 per share. What is the capital gains tax on the sale? a. P2,625 c. P6,607 b. P2,250 d. P11,375 8. Mr. Palangdon purchased domestic stocks which were priced at 150% above their par values. After two years, he sold the stocks when their fair value doubled. He paid, P7,500.00 documentary stamp and P10,000 in commission expenses on the sale. Compute the selling price of the stocks. a. P3,000,000 c. P1,500,000 b. P2,500,000 d. P1,000,000 9. Compute the capital gains tax. a. P143,625 c. P153,725 b. P152,750 d. P222,375 10. On June 20,2019, Mr. Lito filed the capital gains tax return involving the sale of domestic stocks on February 20, 2019. The net gain was P140,000. Compute the total amount due including penalties except compromise penalty. a. P26,880 c. P11,700 b. P21,500 d. P12,250 Multiple Choice – Problem: Part 3 1. A taxpayer purchased a building to be used as a future plant site. The building remained unused for 3 years due to a significant decline in customer’s demand in product of the taxpayer. The taxpayer eventually disposed the property. What is the classification of the property? a. Ordinary asset c. Either A or B at the discretion of the BIR b. Capital asset d. Either A or B depending on the intent of the buyer 2. Assuming the same data in the preceding number except that the property was not disposed of but the same was used as a sales after which it became vacant for more than two years. What is the classification of the property? c. Ordinary asset, regardless of the taxpayer d. Capital asset, regardless of the taxpayer e. Ordinary asset, if taxpayer is not engage in real estate business f. Capital asset, if the taxpayer is not engaged in real estate business 3. Anderson disposes a vacant lot for P3,000,000. The lot has an Assessor’s fair value of P2,800,000, a zonal value of P3,200,000, and an appraisal value P3,500,000. What is the capital gains tax? a. P0 c. P192,000 b. P180,000 d. P210,000 4. Puerto Princesa Company sold its parking lot for P2,000,000. The lot has a zonal value of P2,500,000 and appraisal value of P1,800,000. The capital gains tax on the sale of the lot is a. P0 c. P120,000 b. P108,000 d. P150,000 5. Mr. Antonio disposed his principal residence for P2,000,000 and immediately acquired a new one for P1,800,000. The old residence cost Mr. Antonio of P1,000,000 and had a fair market value of P2,500,000 on the date of sale. Compute the capital gains tax to be deposited in escrow. a. P0 c. P120,000 b. P60,000 d. P150,000 6. What would be the tax basis of Mr. Antonio’s new residence? a. P1,800,000 c. P900,000 b. P1,000,000 d. P800,000 7. How much is the capital gains tax will be released to the taxpayer? a. P150,000 c. P120,000 b. P135,000 d. P15,000 8. On August 15,2020, Ms. Mones sold a 500-square meter residential house and lot for P3,000,000. The house was acquired in 2005 at P2,000,000. The Assessor’s fair market values of the house and lot, respectively, were P1,500,000 and P1,000,000. The zonal value of the lot was P5,000 per square meter. What is the capital gains tax? a. P180,000 c. P150,000 b. P120,000 d. P240,000 9. Manny, a resident Filipino citizen, sold his principal residence (house and lot) at its original purchase price of P11,000,000. The property had a P13,000,000 fair value at that time. If the proceeds of the sale were not invested in the new principal residence but, instead, new funds of P15,000,000 were used to construct it, the capital gains tax is a. P0 c. P750,000 b. P660,000 d. P780,000 Numbers 10 through 12 are based on the following information: Mr. Pepito sold his residential land in Manila with fair market value of P12,000,000 for P10,000,000. 10. If Mr. Pepito utilized all of the P10,000,000 in buying a house and lot to be used as his new principal residence, the final tax due from him is a. P720,000 c. P120,000 b. P600,000 d. P0 11. If Mr. Pepito utilized only P7,000,000 from the proceeds of the sale in acquiring a new residence, the final tax due from him is a. P720,000 c. P180,000 b. P216,000 d. P0 12. The documentary stamp tax due on the sale is a. P179,895 c. P149,985 b. P180,000 d. P150,000 Multiple Choice – Part: 4 1. Mr. Quirino exchanged his stock investment in Carmen Corporation for the shares of stock of Dingalan Corporation. The stocks acquired by Mr. Quirino represent 60% of the stocks of Dingalan Corporation. Basis of the stocks given P3,000,000 Fair market value of stocks given 5,000,000 Fair market value of stocks received 4,500,000 What is the capital gains tax? a. P0 c. P145,000 b. P45,000 d. P225,000 2. In the immediately preceding problem, what is the basis of the stocks received by Mr. Quirino? a. P0 c. P4,500,000 b. P3,000,000 d. P5,000,000 3. Mr. Eller exchanged his DEF shares for to a plan of merger. Mr. Eller bought his The shares had a fair value of P1,500,000 Mr. Eller received EFG shares with a fair cash of P200,000. Compute the capital gains tax. a. P0 c. P30,000 b. P15,000 d. P45,000 the shares of EFG pursuant shares for P1,000,000. on the date of exchange. value of P1,300,000 plus 4. What is the basis of the shares received be Mr. Eller? a. P0 c. P1,200,000 b. P1,000,000 d. P1,300,000 5. What is the basis of the DEF shares received be EFG Company? a. P0 c. P1,200,000 b. P1,000,000 d. P1,300,000 6. Raymund exchanged his A Company shares pursuant to a plan of consolidation where A Company will be integrated with B Company. The following relates to the exchange. Basis of A Company shares given P1,200,000 Fair value of A Company shares given 1,300,000 Fair value of B Company shares received 1,100,000 Fair value of other properties received 250,000 Compute the capital gains tax. a. P0 c. P20,000 b. P10,000 d. P22,000 7. What is the tax basis of the B Company received by Raymund? a. P0 c. P1,200,000 b. P1,100,000 d. P1,350,000 8. What is the basis of the “boot” or the other properties received by Raymund? a. P0 c. P250,000 b. P150,000 d. P400,000 9. What is the basis of the A Company shares received by B Company? a. P0 c. P1,200,000 b. P1,100,000 d. P1,350,000 10. Mrs. Joson sold a residential lot in June 1,2019 for P2,000,000. The property had a zonal value of P2,500,000 and a Assessor’s market value of P1,000,000. On July 1, 2020, Mrs. Joson was compelled to pay the capital gains upon the request of the buyer. The compromise penalty was determined to be P20,000. Compute the total tax due. a. P150,000 c. P217,500 b. P180,000 d. P237,500 11. Basic Company paid P9,000 documentary stamp tax on the sale of a real property capital asset. Compute the capital gains tax on the sale. a. P9,000 c. P36,000 b. P16,000 d. P42,000 12. Mr. Bassit Unay sold a residential land P4,000,000. The land had a fair value of P3,500,000 and an Assessor’s fair value of P2,000,000. What is the total income tax and documentary stamp tax due? a. P0 c. P400,000 b. P300,000 d. P450,000