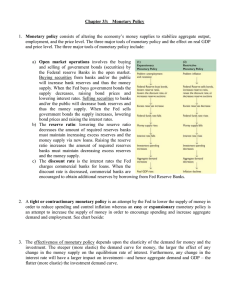

Discuss what might be the effects of monetary policy on employment and growth. Monetary policy affects employment and inflation through modifying the availability and cost of credit in the economy through its policy tools. Three basic monetary policy tools available to central banks are the reserve requirement ratio, open market operations, and the discount rate. The reserve requirement ratio is a proportion of initial deposits that must be retained by the central bank. They can either hold the reserves in their vaults or deposit them with the central bank. Banks can lend more of their deposits if the reserve requirement is low. Discount rate is when the central bank charges member banks a discount rate to borrow at its discount window. Banks only use it if they can't borrow funds from other banks because it's higher than the fed funds rate. Open market activities are the buying and selling of government bonds and securities to commercial banks and the public. These are bought from or sold to the private banks in the country. The central bank adds cash to the banks' reserves when it buys securities. This enables them to extend more credit. When the central bank sells securities, it adds them to the banks' balance sheets and lowers its cash reserves. The central bank employs monetary tools to implement expansionary and contractionary monetary policies. Contractionary monetary policy slows the economy and slows economic growth, whereas expansionary monetary policy helps to speed up the economy and increase economic growth. High unemployment rates during recessions are an example of expansionary monetary policy, while an overheating economy is an example of contractionary monetary policy. Monetary policy has three limitations. The first is the time lag, in which monetary policy actions affect output and employment for 3 months to 2 years, the second is interest rates, in which raising interest rates can have a negative impact on investment consumption, the exchange rate, and thus the balance of payments, and the third is the liquidity trap, in which interest rates are close to zero and the central bank is unable to lower the interest rate through expansionary monetary policy. In conclusion, monetary policy is effective at bringing the economy back into balance. It encourages maximum employment, price stability, and economic growth.