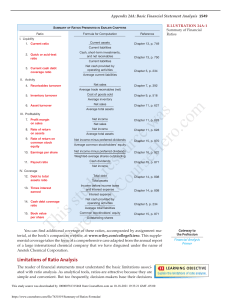

MUHAMMAD ALI JINNAH UNIVERSITY, KARACHI ASSIGNMENT NO. 03 (TASK 1) Corporate Reporting Last 3 years Ratio Analysis of Abbot Laboratories Pakistan Ltd. SUBMITTED TO: SIR. GHAYAS UL HASSAN Prepared and Submitted by: Hunain Ali Banani FA18-MBAR-0026 To: The Management (Abbot Laboratories Pakistan Ltd.) From: Mohammad Hammad Qureshi FA18-MBAP-0030 Date: Jan 08th, 2021 Subject: Explanation of Financial Ratio of Last 3 years of Abbot Laboratories Pakistan Ltd. This report is completed as part of my Master's degree program in Corporate Reporting. The report is based on the company's three-year annual financial statements from 2018 to 2020. In this report I will present Abbot company`s ratio analysis. Ratio Analysis By examining financial accounts such as the balance sheet and income statement, ratio analysis is a quantitative approach of acquiring insight into a company's liquidity, operational efficiency, and profitability. Ratio analysis can be used to track a company's progress over time and compare it to other companies in the same industry or sector. While ratios provide useful information about a company, they should be used in conjunction with other measures to provide a more complete view of its financial health. Various Kind of Ratio Analysis Based on the data sets they supply; the various types of financial ratios can be broadly classified into the following categories. Liquidity Ratio The ratio shows the extent to which the firm can meet its financial obligations. Used to gauge a company's ability to pay off its debts in short term. a- Current Ratio b- Quick Ratio Profitability Ratio It is a measure of a company's ability to produce a profit, and a profit is the amount of money left over after all costs and expenses have been eliminated. These ratios relate to profits to sales and assets. a- Gross Profit Ratio b- Operating Profit Ratio c- Net Profit Ratio d- Return on Capital Employed Solvency Ration A solvency ratio assesses a company's ability to cover long-term debt with cash flow. a- Debt Equity Ratio b- Interest Coverage Ratio Turnover Ration The turnover ratios are used to assess a company's efficiency in terms of how it uses its assets to generate income. The assets are compared to the sales figure (different assets). This metric determines how much of the assets are utilized to produce sales. a- Fixed Asset Turnover Ratio b- Inventory Turnover Ratio c- Receivable Turnover Ratio Leverage Ratio A set of statistics known as a leverage ratio highlights a company's financial leverage in terms of assets, liabilities, and equity. They show how much of a company's capital comes from debt, which is a useful indicator of whether it will be able to meet its financial obligations. Below are 4 most common used leverage ratios. a- Debt-to-Assets Ratio = Total Debt / Total Assets b- Debt-to-Equity Ratio = Total Debt / Total Equity c- Debt-to-Capital Ratio = Today Debt / (Total Debt + Total Equity) d- Asset-to-Equity Ratio = Total Assets / Total Equity Table of Accounting Data of Abbott Laboratories Pakistan Ltd. Accounts Heads 2020 000 2019 000 2018 000 Current Assets 15,701,737 12,337,862 12,998,131 Current Liabilities Inventory GP Revenue / net sales Operating Profit Net Profit EBIT Total Assets Total Liabilities Total Equity 6,833,822 4,981,489 12,221,851 35,283,377 6,320,464 4,535,249 6,320,464 24,915,744 9,325,492 15,590,252 5,787,320 6,049,215 8,527,740 30,155,875 2,563,831 1,299,885 2,563,831 20,752,680 7,380,287 13,372,393 5,961,423 4,428,893 9,801,442 29,719,279 4,359,375 2,694,333 4,359,375 20,281,257 7,046,246 13,235,011 Capital Employed Total Equity and Liabilities 18,081,922 24,915,744 14,965,360 20,752,680 14,319,834 20,281,257 7,488,881 2,757,519 5,678,136 Cash and cash equivalents at the end of the year Calculation of Ratios S.No. Ratio 1 Liquidity Ratio 1.1 - Current Ratio 1.2 - Quick Ratio 1.3 - Cash to Current Liabilities 2 Profitability Ratio 2.1 - Gros profit margin 2.2 - Operating Profit ratio 2.3 - Net Profit Ratio - Return on Capital 2.4 Employed 3 Leverage Ratio 3.1 - Debt-to-Assets Ratio 3.2 - Debt-to-Equity Ratio 3.3 - Debt-to-Capital Ratio 3.4 - Asset-to-Equity Ratio Formulae 2020 2019 2018 Current assets / Current Liabilities (Current Assets-Inventory) / Current Liabilities Cash and Equivalent / Current Liabilities 2.298 2.132 2.180 1.57 1.10 1.09 0.48 1.44 0.95 Gross Profit / Sales Operating Profit / Net sales *100 Net profit / revenue 34.6% 17.9% 12.9% 28.3% 8.5% 4.3% 33.0% 14.7% 9.1% EBIT/capital employed 35.0% 17.1% 30.4% Total Debt / Total Assets Total Debt / Total Equity Total Debt / (Total Debt + Total Equity) 0.374 0.598 0.374 0.356 0.552 0.356 0.347 0.532 0.347 Total Assets / Total Equity 1.598 1.552 1.532 COMMENTS ON FINANCIALRATIOS 1. LIQUIDITY RATIOS Operating cash inflows increased compared to the previous year, owing to higher profitability and favorable working capital improvements. The Corporation has as of 31 Dec 2021, there was Rs. 7,488.88 million in cash and cash equivalents. To accomplish its investment and operational cash requirement, the company must meet the deadline of December 31, 2020. Current ratio (2020: 2.30, 2019: 2.13), quick / acid test ratio (2020: 1.57, 2019: 1.09) and cash to current liabilities (2020: 1.10, 2019: 0.48) have improved versus last year mainly on account of higher cash and bank balances. Current ratio (2019: 1.80, 2018: 1.96), quick / acid test ratio (2019: 0.92, 2018: 1.30) and cash to current liabilities (2019: 0.40, 2018: 0.86) have declined versus last year mainly on account of lower cash and bank balances. 2. PROFITABILITY RATIOS Profitability ratios of the Company, in general, have improved versus last year In 2020, Gross profit margin improved to 34.6% versus 28.3% last year. Net profit margin increased to 12.9% versus 4.3% last year in line with the reasons mentioned above. In 2019, Profitability ratios of the Company, in general, have declined versus 2018. Gross profit margin declined to 28.3% versus 33% last year. Net profit margin declined to 4.3% versus 9.1% during 2018. 3. Leverage Ratio Here you can see that debt to asset ratio is increasing gradually in every year which is not a good sign. A high ratio also indicates that a company may be putting itself at risk of defaulting on its loans if interest rates were to rise suddenly. A high percentage of debt-to-equity ratio also suggests that if interest rates rise quickly, a company may be at risk of defaulting on its loans. As you can see that debt to capital Ratio in increasing. If all other factors are equal, a corporation with a higher debt-to-capital ratio is riskier. This is because the higher the debt-to-equity ratio, the more the company is supported by debt rather than equity, implying a higher obligation to repay the debt and a higher risk of loan forfeiture if the debt is not paid on time. A high asset to equity ratio can indicate that a business can no longer access additional debt financing, since lenders are unlikely to extend additional credit to an organization in this position.