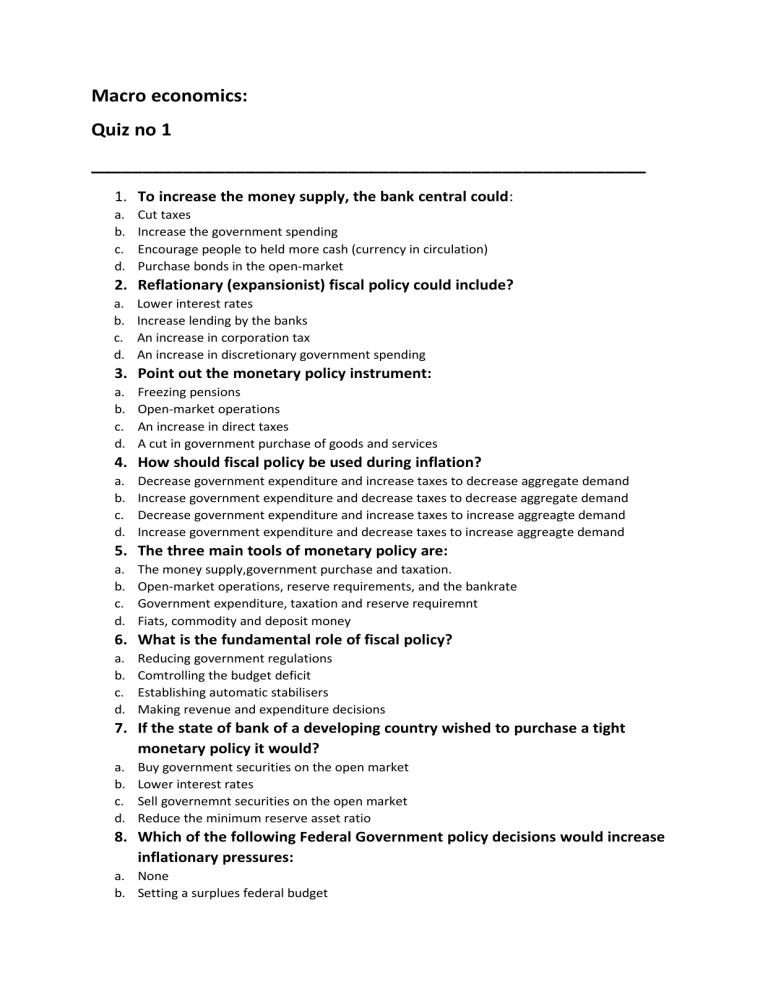

Macro economics: Quiz no 1 ______________________________________________________ 1. To increase the money supply, the bank central could: a. b. c. d. Cut taxes Increase the government spending Encourage people to held more cash (currency in circulation) Purchase bonds in the open-market a. b. c. d. Lower interest rates Increase lending by the banks An increase in corporation tax An increase in discretionary government spending a. b. c. d. Freezing pensions Open-market operations An increase in direct taxes A cut in government purchase of goods and services a. b. c. d. Decrease government expenditure and increase taxes to decrease aggregate demand Increase government expenditure and decrease taxes to decrease aggregate demand Decrease government expenditure and increase taxes to increase aggreagte demand Increase government expenditure and decrease taxes to increase aggreagte demand a. b. c. d. The money supply,government purchase and taxation. Open-market operations, reserve requirements, and the bankrate Government expenditure, taxation and reserve requiremnt Fiats, commodity and deposit money a. b. c. d. Reducing government regulations Comtrolling the budget deficit Establishing automatic stabilisers Making revenue and expenditure decisions a. b. c. d. Buy government securities on the open market Lower interest rates Sell governemnt securities on the open market Reduce the minimum reserve asset ratio 2. Reflationary (expansionist) fiscal policy could include? 3. Point out the monetary policy instrument: 4. How should fiscal policy be used during inflation? 5. The three main tools of monetary policy are: 6. What is the fundamental role of fiscal policy? 7. If the state of bank of a developing country wished to purchase a tight monetary policy it would? 8. Which of the following Federal Government policy decisions would increase inflationary pressures: a. None b. Setting a surplues federal budget c. Increaseing government expenditure d. Raising personal income taxes 9. Point out which of the following is not an instrument of fiscal policy: a. b. c. d. A cut in the marginal rates of IRPF An increase in tobacco taxes An increase in the interest rate A cut in unemplyment compensation a. b. c. d. Unemployemnt Reduction Expenditure and tax revenue Steel mill privatization None 10. Fiscal policy is the government programme with respect to it’s_______? Correct answers: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. D D B A B D C C C B