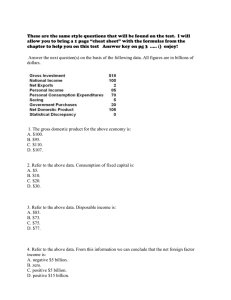

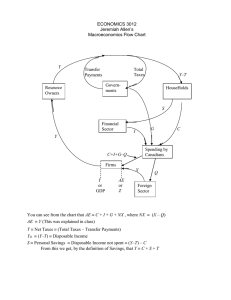

Finance LESSON 1: MONEY AND INCOME Mr . MacArthur Learning Goals Students will gain an understanding of basic finance skills so that: 1. Explain why the dollar’s purchasing power changes 2. Identify security features of banknotes and consider why they are there 3. Calculate gross, disposable and discretionary income 4. Explain why teens have more discretionary income than parents 5. Identify the five types of personal income What is Money? Class Brainstorming Forms of Legal Tender Under federal law, legal tender must be accepted as payment for goods and services. The two main forms of legal tender are coins and notes (or “bills”) at face value. Cheques and credit cards, although widely used and accepted as payment, are not legal tender. No law states that they must be accepted as payment, but they are seldomly refused. INFLATION In general, prices tend to rise (inflation), so the dollar buys less from one year to the next. inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Today, $10 buys much less than it did 30 years ago. You have probably noticed that the prices of clothing, magazines, and movie tickets have increased over the past few years. Money’s Changing Purchasing Power Money’s true value is its purchasing power. The paper used to print our currency is virtually worthless, as are the metals used to make coins. Our currency has almost no value in itself. It is worth something only because we accept that it has a specific value. Although money serves as a standard of value, its purchasing power changes as prices for goods and services change. Money’s Changing Purchasing Power Purchasing power is measured by the Consumer Price Index (CPI). It measures 600 products typically bought by households, which includes food, shelter, transportation, clothing, and recreation. What is Income? Income is money that an individual or business receives from various sources, such as wages, sales, interest, or dividends. Types of Personal Income Personal income comes in many forms. The major way people earn money is through a full-time job (employment). Forms of employment income include salary, wages, commission, piecework and profit sharing There are other sources of income as well. These include dividends from investments and interest from savings accounts (will make more sense later in the unit). Teenagers often receive income from a part-time job, or as allowance or gifts. How do you get your money? Gross Income The total amount of income received by a person is known as his or her gross income. For example, Nadira Sahota is a 35-year-old working as a sales manager. This pie chart shows the amounts that make up Nadira’s gross income. Nadira earns a total of $78 500 per year from her salary, her commission, her investments, and interest payments. That’s $6542 per month. This is her gross income. Disposable Income Nadira does not get to keep the total amount of her gross income. Before she receives her pay cheque, her employer deducts income tax, a portion for her Pension Plan and Employment Insurance. What is left is known as take-home-pay or disposable income. Discretionary Income HOWEVER, Nadira does not get to spend all of her disposable income on whatever she wants. She has to spend money on mortgage payments, food, car payments, insurance, electricity, and other necessities. The income that is left after necessities have been paid for is called discretionary income. Disposable vs Discretionary Disposable income is the amount of net income a household or individual has available to invest, save or spend after income taxes and other mandatory payments are made (depending on the country) On the other hand, discretionary income is the amount of income that a household or individual has to invest, save or spend after taxes and necessities are paid. Discretionary income is similar to disposable income because it's derived from it; however, there is one key difference. Disposable income does not take necessities into account. Necessities a household or individual may have are rent, clothing, food, bill payments, goods and services, and other typical expenses Example Show and describe the difference between gross, disposable, discretionary income by using the following information: Salary: RM70,000/year EPF: 8% Tax: 15% Expenses: RM2,800/month Answer Gross Income 70,000 Tax 15% 10,500 EPF 8% 5,600 Disposable Income 53,900 Expenses Per month 2,800 (x12) 33,600 Discretionary Income (yearly) or 1,691.66/month 20,300 Success Criteria I can complete the ending review questions that will prepare me for the Unit Quiz.