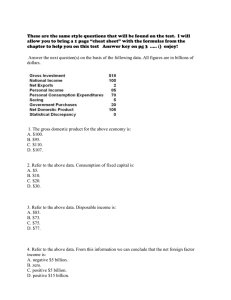

Ch01ST - ENTR-203

advertisement

Chapter 1 Financial and Economic Concepts 1 Chapter One Objectives 2 Opportunity Costs The highest value that is surrendered when a decision to invest funds is made. 3 Choices Available for Funds Table 1-1 Expected Financial Returns of Investment Opportunity Investment Opportunity Expected Annual Return (%) Purchase stock 11 Purchase home 9 Purchase bonds 6 Place money in bank savings account 2 Purchase new car -15 Examples of Opportunity Cost Decide to purchase car Opportunity cost = Stock However, if you decided to purchase stock rather than the car Opportunity cost = Home Income, Expenditures, and Taxes Gross income is all of the money received from all sources during the year. Wages Tips Interest earned on savings and bonds Income from rental property Profits to entrepreneurs 7 Basic Income Calculations Gross income - taxes = Disposable income For most of us, disposable income is take- home pay. Disposable income - Fixed expenses = Discretionary income Fixed expenses are contractual obligations like rent, utilities, insurance, and car payments. Discretionary income is that we can spend or save. 8 Income, SS, Household Gross Income & Medicare Name ($) Taxes ($) Jones 30,000 5,228 Roberts 50,000 9,758 Smith 70,000 16,502 Brown 90,000 23,432 Meeks 110,000 29,912 Adams 130,000 36,202 Charles 150,000 42,492 Federal Taxes Paid as a % of Gross Disposable Fixed Discretionary Income Income ($) Expenses ($) Income ($) 17.43% 24,773 19,673 5,100 19.52% 40,243 32,683 7,560 23.57% 53,499 40,179 13,320 26.04% 66,569 41,369 25,200 27.19% 80,088 41,208 38,880 27.85% 93,798 46,998 46,800 28.33% 107,508 49,620 57,888 Department of the Treasury, Internal Revenue Service, Publication 15 (Rev. January 2008). 9 Taxes Progressive taxes: larger percentage of tax paid as income increases. Regressive taxes: larger percentage of tax paid as income decreases. Proportional taxes: percentage of tax paid remains the same at all levels of income. 10 Example of Progressive Tax Formula for tax percentage paid: Tax payment in dollars Tax Percentage x 100 Income in dollars Income tax is progressive: $3,000 Tax percentage x 100 15% $20,000 $16,000 Tax percentage x 100 28% $60,000 11 Example of Regressive Tax Sales tax is regressive: › Income = $20,000; savings = 0; sales tax = 5% › Sales tax paid = $20,000 x 0.05 = 1,000 $1,000 Tax percentage x 100 5% $20,000 › Income = $60,000; savings = $10,000; sales tax = 5% › Sales tax paid = $50,000 x 0.05 = $2,500 $2,500 Tax percentage x 100 4.17% $60,000 12 Example of Proportional Tax Formula for tax percentage paid: Medicare tax is 1.45% Annual income $30,000 Medicare tax = $30,000 x 0.0145 = $435 Annual income $500,000 Medicare tax=$500,000 x 0.0145 = $7,250 13 Flat Tax Proposal Table 1-2 Flat Tax Proposal Gross Income ($) 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 120,000 130,000 140,000 Taxes Percentage of Income Paid ($) Paid in Taxes % 0.00 1,700 4.25 3,400 6.80 5,100 8.50 6,800 9.71 8,500 10.63 10,200 11.33 11,900 11.90 13,600 12.36 15,300 12.75 17,000 13.08 18,700 13.36 14 Factors Affecting Interest Rates The supply of money saved is primarily the total money that is placed in demand deposit (checking) accounts, savings accounts, and money market mutual funds. The demand for borrowed funds is all of the money that is demanded in our economy at a given price. 15 Factors Affecting Interest Rates (continued) Federal Reserve Policy The Federal Reserve is the central bank of the United States. Risk Systematic Risk: Risk associated with economic, political, and sociological changes that affect all participants on an equal basis. Unsystematic Risk: Risk unique to an individual, firm, or industry. 16 Table 1-4 Supply Table: Money Saved for Seven Sample Families Annual Savings ($000) Annual Interest Rate (%) Jones Roberts Smith Brown Meeks Adams Charles Total 0 $ - $ - $ - $ - $ - $ - $ - $ 2 4 500 780 1,940 5,790 9,010 6 670 1,250 1,940 2,720 7,530 14,110 8 100 200 930 1,760 2,020 3,890 12,000 20,900 10 200 500 1,500 3,000 3,500 7,000 16,000 31,700 12 250 750 2,500 5,000 6,000 10,000 20,000 44,500 14 300 1,000 3,250 9,000 12,000 15,000 25,000 65,550 16 400 1,200 4,500 12,000 18,000 23,000 31,000 90,100 18 500 1,500 6,000 15,000 25,000 28,000 38,000 114,000 20 500 1,700 8,000 18,000 30,000 32,000 40,000 130,200 22 500 1,700 8,000 18,000 30,000 33,000 41,000 132,200 24 500 1,700 8,000 18,000 30,000 33,000 41,200 132,400 17 18 Table 1-5 Ann Smith's Demand for Money Interest Rate (%) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Amount Financed ($) 180,000 155,454 135,274 118,595 104,731 93,141 83,396 75,154 68,142 62,141 56,975 52,503 48,609 45,200 42,199 39,543 37,181 35,071 33,177 31,468 29,922 28,516 27,233 26,059 24,980 Interest Paid ($) 0 24,546 44,726 61,405 75,269 86,859 96,604 104,846 111,858 117,859 123,025 127,497 131,391 134,800 137,801 140,457 142,819 144,929 146,823 148,532 150,078 151,484 152,767 153,941 155,020 19 20 21 Table 1-6 Money Rates, as of April 7, 2008 Type of Rate Definition Rate (%) The charge on loans to depository institutions by Discount the New York Federal Reserve Bank 2.50 The rate banks charge each other for overnight Federal Funds loans in minimum amounts of $1 million 2.23 T-bill, three months The rate on government treasury bills sold at a discount of face value in units of $10,000 1.33 The interest rate that banks charge their most Prime creditworthy customers 5.25 Source: Federal Reserve Statistical Release H.15 - April 7, 2008 22