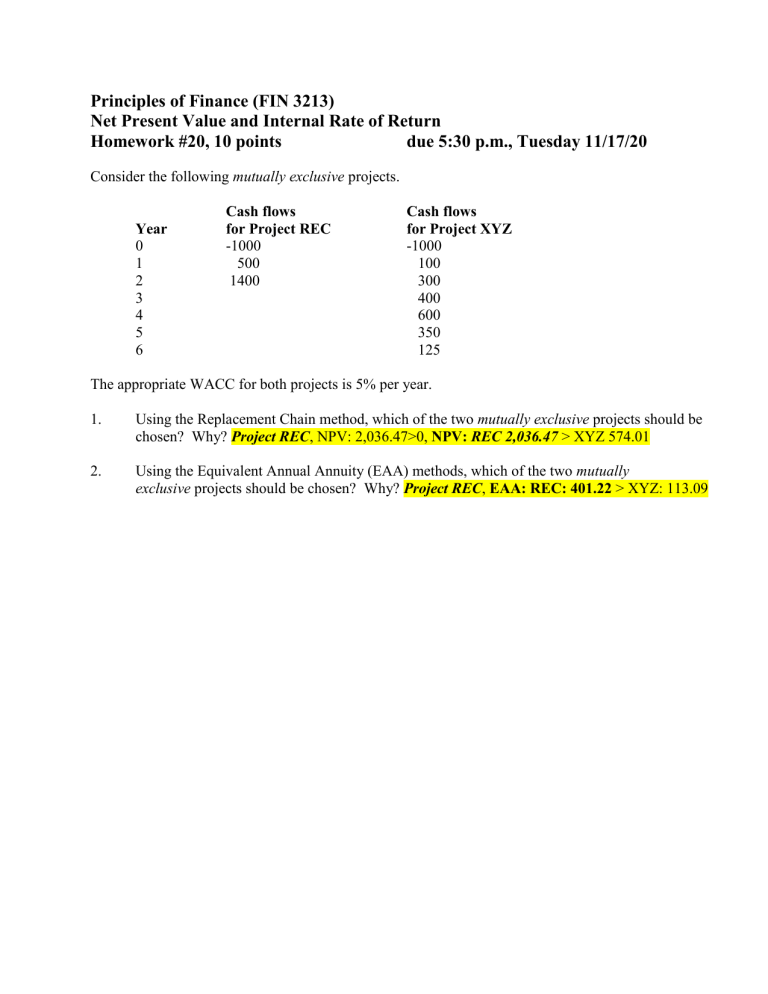

Principles of Finance (FIN 3213) Net Present Value and Internal Rate of Return Homework #20, 10 points due 5:30 p.m., Tuesday 11/17/20 Consider the following mutually exclusive projects. Year 0 1 2 3 4 5 6 Cash flows for Project REC -1000 500 1400 Cash flows for Project XYZ -1000 100 300 400 600 350 125 The appropriate WACC for both projects is 5% per year. 1. Using the Replacement Chain method, which of the two mutually exclusive projects should be chosen? Why? Project REC, NPV: 2,036.47>0, NPV: REC 2,036.47 > XYZ 574.01 2. Using the Equivalent Annual Annuity (EAA) methods, which of the two mutually exclusive projects should be chosen? Why? Project REC, EAA: REC: 401.22 > XYZ: 113.09