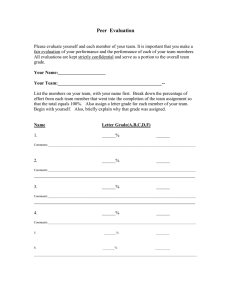

Legal disclaimer This document has been prepared by Plum Fintech Limited (the “Company”) exclusively for your personal use only. Your capital is at risk when you invest, especially when investing in startups and early stage businesses. The historical financial information contained herein is based solely on management reports and has not been audited. The Company does not make any representations as to any trends or activities continuing in the future. This document does not purport to be exhaustive or to contain all the information relating to the company that a prospective purchaser may require before participating in a transaction. The company does not make any representations or warranties, whether express or implied, and accepts no responsibility as to the accuracy, completeness or reasonableness of the information contained herein. Any prospective purchaser that is interested in participating in a transaction is recommended to seek and obtain independent advice from its own financial, tax and legal advisors. This document contains statements and projections with respect to the anticipated future performance of the Company and its subsidiaries. These forward-looking statements reflect the Company’s current expectations and projections, and necessarily involve a number of risks, uncertainties and assumptions. Such statements and projections reflect various assumptions made by the management of the Company concerning anticipated results, and are subject to amendments at any time without any prior notice. Past performance is not a reliable guide to future performance. This document does not purport to summarize all of the conditions, risks and other attributes of an investment in the company. Investment in the company entails a high degree of risk and is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in an investment in the company. Investors in the company must be prepared to bear such risks for an extended period of time. This document is strictly confidential and may not be communicated to any third party or copied in whole or in part, without the prior written consent of the Company. The reader of this document hereby undertakes to keep all information, documents and knowledge of whatever kind obtained by them of the Company and its subsidiaries through this document secret and confidential. Strictly Confidential 2 Plum is the ultimate savings and investment app that aims to effortlessly grow people’s wealth through automation, driven by the unique financial profile of the customer via Open Banking. We are built to improve financial outcomes for everyone by helping customers save, invest and spend smarter. We are building Plum for the masses – those that don’t want to manage their money every day for the next 40 years! Strictly Confidential 3 Our measure of success: people will have 20% more money with Plum Connect your bank account to Plum Save continuously Invest continuously Save more than you ever thought you could via automation and by reducing bills & expenses Investing continuously in all asset classes (Stocks, funds and crypto), riding the wave through dollar-cost averaging. We are giving 25-45 year olds the control and automation they need to self-manage their money with as little effort as possible. Strictly Confidential 4 Solving savings Problem Auto-saving Bill reduction Tailored budgeting People aren’t saving enough to consider themselves financially secure Solution ● Automated and rule-based savings algorithms to help set aside the optimal amount ● Best-in-class interest bearing products ● Native in-app switching tool and cash back to cut major expenses ● Dedicated card to never overspend again (Q4-21) Strictly Confidential 5 Solving money growth (investing) Problem Auto-investing Pension management Stocks/Crypto Low interest rates + high inflation make savings accounts loss-making Solution ● Automated allocation to a broad set of asset classes ● Investment funds under ISA tax wrapper (live for 2 years) ● Pension consolidation under SIPP tax wrapper (live) ● Commission–free and fractional stock trading (Q4-21) and crypto (Q1-22) Strictly Confidential 6 Unique in the market Key differentiators Relationship Play Plum Product Play (Money growth) Revolut (Transactional) Moneybox Freetrade ✓ ✓ ✓ ✓ ✓ ✓ ✗ ✗ ✗ ✗ ✓(US Only) ✓ ✗ ✗ ✗ ✓ ✓ ✓ ✗ ✗ ✗ ✗ ✗ ✗ ETFs only Insurance ✓ ✓ ✓ (Q4-21) ✓ (Q1-22) ✓ ✓ ✓ ✗ Payback Access to primary account data ✓ Maybe Maybe ✗ Platform approach with solid ARPU expansion leads to best-in-class payback Card proposition ✓ (Q4-21) ✓ ✓ ✓ ✗ ✓ ✗ ✗ UK, EU UK UK going to EU Acquisition Broad and non-competitive appeal – everyone wants to save money Low switching cost Plum connects to current account but doesn’t replace it. Easy customer onboarding and money movement – enabled by Open Banking. Strictly Confidential *Launching soon Savings Automation Direct integration with savings banks Long term money growth via mutual funds ISA & Pension (SIPP) Stock trading Crypto Loan panel Credit card panel Utility bill switching Cashback Geographic coverage UK, FR, SP, IR (IT, PT, NE, BE, FIN)* (Wealth) (Trading) ✓ ✓ ✗ ✗ ✗ ✗ ✗ 7 Market dynamics An inflection point in consumer finance Savings accounts no longer give returns 0 % Bank interest rates Avg retail interest rates in the EU fall between -0.2% and 0.8%, well below inflation rates. Strictly Confidential Retail investing is growing 19.5 % Millennials care where their money goes 61 % US equity trading volume driven by individuals of millennials want to direct their own investments In comparison to 9.8% in 2010. In comparison to 25% of Gen-Xers and Baby Boomers. Huge incoming wealth transfer $24 tn of wealth to be transferred to millennials The largest in history. Expected as result of inheritance, income growth and entrepreneurialism Sources: UBS – “Millennials – the global guardians of capital (2017)”; Accenture – Millennials and Money (2020); WSJ via Bloomberg Intelligence (2021); Raisin (2021) 9 The revenue opportunity $596 bn $15 UK retail wealth management market $101 bn EU retail wealth management market revenue Strictly Confidential $116 bn bn insurance and lending opportunity ($374 billion EU – retail deposits, mortgages and consumer finance + 122bn Insurance Brokerage) Wealth opportunity Sources: McKinsey Global Banking Annual Review 2020; Global Insurance Brokers & Agents Market Report 2021; Global Digital Payment Market Report 2021; Retail Banking Market Size & Share 2025 10 Comparables Company Latest pre-money valuation (£m) Date Customers (k)* Revenue Moneybox £113m Jun-20 450k £1.6m, FY19A Chip £80.0m (valuation cap) Sep-20 250k £0.2m, 2020E Curve £592m Jan-21 2,200k £8.0m, FY20A Emma £34m Jun-21 600k £0.3m, FY20A Freetrade £221m Mar-21 600k £12.5m, Dec-20 run rate Trade Republic £3,128m May-21 1000k n.a. Revolut £23,892m Jul-21 16,000k £222.1m, FY20A Monzo £1,240m Jun-20 4,800k £66m, FY20A N26 £2,523m Feb-21 7,000k £87.7m, FY19A Vivid Money £311m Apr–21 100k n.a. Lunar £724m Jul-21 325k n.a. Strictly Confidential Sources: Company info, TechCrunch, Crunchbase, CNBC *Most recent figure known at time of respective fundraises 11 Growth across the board User growth 8,356 Today 4,456 CAGR of 105% 139 Strictly Confidential 377 CAGR: Compound Annual Growth Rate 1,670 765 13 Revenue growth Today CAGR of 417% Strictly Confidential 14 Amount saved to date Today 1% 6 2 f o R CAG Strictly Confidential Converted from GBP into USD at a Sep-21 average FX rate of 1.3747 (USD/GBP from OFX) 15 Diverse user base Building for a mass-market mindset towards money This mindset is across multiple income levels, making the addressable market enormous. Plum’s user base as at Sep-21: The mainstream customer does not want to manage their money daily. Gender They want the hassle automated away. Annual gross income Strictly Confidential Age 17 It’s solving their money problems “Since I’ve got Plum in November 2018, my lifetime deposit reached nearly £7k and I don’t really know how it did it. It just feels amazing.” — Harriet, 27 4.7 52,900+ reviews “It’s everyone’s worst nightmare getting made redundant and having no money. It was such a relief to have that money for me to use.” — Maya “I love the fact that Plum gives me daily notifications telling how much money I’ve got in my accounts!.” “It gives me different opportunities and flexibility with money that, if I was using my bank account, I wouldn’t have.” — Karina, 28 — Mary, 36 Read more customer case studies here Strictly Confidential 18 Investment opportunity Clear plan multiply our existing business by 4x 1 2 Expanding investment offering Further expansion into Europe Enabling stock and crypto trading to a vast and engaged based of users – products with a (1) (2) combined ARPU potential of +£30 By mid 2022, Europe is expected to overtake the UK in terms of new user acquisition, opening up a revenue opportunity that’s 8x larger than the UK Strictly Confidential (1) (2) Stocks – Assuming £300 of monthly trading volume of which 60% is USD-denominated stocks + charging £1/trade for 10% of trades Crypto – Assuming £100 of monthly trading volume, expected net take rate of 1.4% 20 Looking to double monetization in the next year Today’s ARPU 2X Next year’s ARPU ● ARPU expansion driven by the launch of new products, and higher subscription rates in parallel ● We’re most excited about stocks & crypto, with +60% of our users already investing or wanting to start investing ● As result, payback periods will reduce which will in turn allow Plum to further accelerate marketing spend Strictly Confidential ARPU: Average Revenue Per User 21 Quickly ramping up coverage in Europe Expansion timeline H1-21 FR IR ES 448m people H1-22 Strictly Confidential IT NL PT FL DE AU BE H2-22 Sources: Eurostat, OECD, Credit Suisse Plum is already covering 26.6% of the EU population (119m people), and planning to cover 70.6% by the end of 2022 (316m people) 22 We're growing 6x faster in the EU Growing fast: In just 3 months, we have achieved what took us 19 months in the UK. Competitive Landscape: Unchallenged as the only holistic wealth management platform that uses Open Banking to optimise and automate people’s savings and investments Strictly Confidential Number of months since launch to yearly run rate of 100k new users 16 month di fference 23 Clear path to +£100m in revenues Strictly Confidential Revenue run rate is calculated by multiplying December gross revenue with a factor of twelve, in each respective calendar year 24 Unique team with a strong track record Victor Founder & CEO Paulo Head of Marketing Jess Product Manager – Growth Employee #5 at TransferWise London. Head of International Expansion, launching them in over 25 markets. Former Head of performance marketing at Uber Latam, and then for Revolut globally. Former CEO and founder of YC-backed startup with millions of users – founded and exited within 3 years. Previously Senior PM at Accenture. Mathieu Head of Strategic Finance Kish Head of Design Charlie Head of Partnerships Previously part of fundraising team at Checkout.com, helped raise $380m. Held roles at Rothschild and Rocket Internet First designer at TransferWise, lead design in multiple product areas. Successfully built the Plum app, now at a 4.7/5 rating. Previous head of marketplaces & partnerships at ClearScore (12m users), also launching their 1st international market, South Africa. Product Leads Engineering Leads Other Key Leads Elise Djordje Catarina Peter Andreas Aggregation Wealth Mobile Lead Head of Compliance Head of Brand Lefteris Pol Kostis Eugenio (PhD) Rish Savings Subscriptions Backend Lead Data Science Lead Operations lead +90 employees of which more than 40% are focused on product development and engineering Strictly Confidential 25 2022 & Beyond End Game Plum Saving Continuously building up the balance sheet for future lending activities Investing Access to all asset classes across UK/EU in a frictionless way Lost Money (Recommendations) Access to primary account data. We’re bank agnostic, connecting to multiple accounts/credit cards Debit Card The go-to impartial advisor for all your major costs Focused on saving money vs. spending via embedded budgeting and cash back Round details Backed by seasoned long-term institutional investors: Crowdcube investors will be investing at the same share price as our latest Series A investors that have recently backed us this month. Pre-money valuation: (1) £90m EBRD (2) Share price: £24.64 Increasing our pre-money valuation by 3x since our last round (3) in June 2020 Strictly Confidential (1) Series A latest pre-money valuation (2) Series A latest share price, calculated by dividing the pre-money valuation by the number of fully-diluted shares (incl. shares expected to be issued as part of CLN conversion) (3) Based on Plum Fintech’s latest pre-money valuation of £30m, set in the most recent bona fide equity financing round in June 2020 27 More and more people are trusting Plum to optimise their income and grow their wealth. We’re on our way to being the best place to do this. Join us on our mission. withplum.com