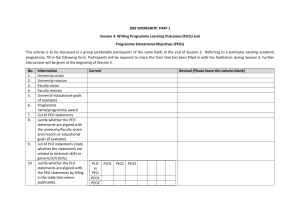

CCNserves.com/HR Small biotech company sees 6-figure annual savings... PEO Extraction Case Study Professional Employer Organizations (PEOs) can be a terrific option for smaller companies without an in-house human resources team. Outsourced HR services like payroll, benefits, workers’ compensation, and 401(K) administration are an important part of getting started and growing momentum. At some point, however, the costs will outweigh the benefits. How do you know when your company has outgrown its PEO? Especially for high-growth companies, this is a critical question. Often companies stay too long with a PEO when their HR team can ultimately achieve the intended goal for less money: attracting and retaining a high-quality, diverse workforce. The business case for PEO extraction As companies grow, their needs change. PEOs are effective at creating cookie cutter benefits packages, but their one-size-fits-all approach generally isn’t conducive for growth as companies scale and require more tailored programs. To compete for talent, companies require cost-effective HR programs customized to their specific needs. Tech companies, for example, often have different HR and benefits requirements than manufacturing companies. They need different strategies to compete and win. “PEOs are effective at creating cookie cutter benefits packages, but their one-size-fits-all approach generally isn’t conducive for growth.” Cost is another key reason firms leave their PEO. PEOs generally structure their fees based on a percentage of an employer’s total payroll. For organizations with a large and growing payroll (and/or highly compensated employees), PEO fees can get very expensive. Likewise, 401(K) and workers comp fees charged by PEOs can be higher than those sourced through brokers. Case Study: Life Science Company In 2017, I performed a PEO analysis for a growing biotech company. At the time, they were around five years old and had 40 employees. They needed to find out if they had outgrown their PEO. (continued on next page...) © Cox Consulting Network, all rights reserved page 1 CCNserves.com/HR Defining key business objectives In order to determine whether their PEO was still a good fit for the company’s business goals, we first needed to understand their main objectives: 1. Attracting Talent: In the highly competitive biotech industry, attracting and retaining top talent is paramount. This company had a real need to provide an exceptional workplace experience and to provide competitive compensation and benefits. 2. Reducing Costs: Reducing costs and increasing profitability are always key considerations, but they were particularly top-of-mind for a company in growth mode when labor dollars were increasing. “For organizations with a large and growing payroll, PEO fees can get very expensive.” Addressing growing concerns After almost three years with their PEO, the company was starting to experience symptoms that made them wonder if a PEO was still the right fit… • The incumbent PEO continued to make repeated payroll errors impacting employees’ pay. This was clearly diminishing HR credibility. • The PEO’s technology platform did not provide the leadership team with visibility into key HR metrics to drive business decisions. • The company was unable to analyze health care expenditures because they didn’t have access to their own healthcare cost data. • Renewal rates increased by double-digits year over year. The company absorbed a 20% increase in 2017 and faced a 16% increase in 2018. • The PEOs HR services focused on compliance and risk, not people, employee engagement, or company missions and goals. The company needed a more customized solution to scale, not a one-size-fits-all approach. Analyzing and comparing PEO costs From the beginning, we were able to look at the bigger picture to complete a thorough analysis… 1. We identified competitive brokers and service providers for each component that was migrated from the PEO, including workers’ compensation coverage, risk management, payroll, payroll reporting, employee benefits, and HR technology. 2. We evaluated and compared current PEO costs with new proposed service providers. 3. We evaluated the cost of leaving the PEO The results of the analysis were clear. We were able to clearly demonstrate that the company would benefit from cost savings and other advantages from leaving their PEO. Transition from a PEO to new HR solutions Following the analysis phase, I then served as project manager through the PEO extraction and transition process. We were able to implement a comprehensive HR solution with a full suite of reporting capabilities, providing management with the HR insights needed. © Cox Consulting Network, all rights reserved page 2 CCNserves.com/HR The company invested a portion of the savings to provide more robust benefits, including… • 100% employer-paid employee coverage: medical, dental, and vision • Increased contributions to health savings accounts (HSA) • Company-paid short-term disability and long-term disability • Increased life insurance coverage Once the transition was complete, open enrollment was held, employees were trained on the new HRIS system, and carrier connections were put in place to reduce overall process redundancies. PEO extraction results In the end, the company successfully migrated from a PEO to an “unbundled” service model with minimal disruption to the organization. The company benefited from new relationships with trusted vendors, and employees received improved benefits and customized HR services. Ultimately, the company reduced annualized costs by more than $125,000 ($3,125 savings per employee). Is your company ready for a PEO extraction? By taking a complex problem and applying a simple but thorough solution, we were able to un-bundle and do what was best for this biotech company and its employees. This is what strategic HR consulting is all about: aligning your people with your business objectives. Are you interested in exploring a PEO extraction? We have helped companies ranging in size from 40-500 employees, and we can help you too. Give us a call or send us a message to schedule your first no-obligation meeting. Ready to get started? We’re here to help you analyze the value of your PEO and if necessary, facilitate a smooth extraction. Call 512-422-0890 email tammy@CCNserves.com About the Author: Tammy McCarty, President, Strategic HR Tammy has a wealth of experience in HR and the business acumen to go with it. She has always been a partner to the CFO and a servant leader to her teams. © Cox Consulting Network, all rights reserved page 3