Trading Psychology: Mindset, Risk, and Emotional Control

advertisement

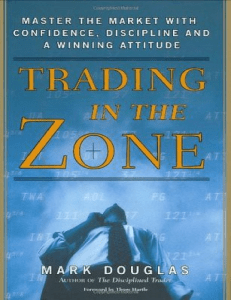

Trading in the zone Acquire and develop trader’s mind set Psychological, consistent winner thinks differently from everyone else Stop digesting information that reenforce the fears Three things you need to believe o You don’t need to know what’s going to happen next o Anything can happened o Every moment is unique, trade either works or didn’t (So you get in the trade and set your risk. If it doesn’t then get out and wait til you next opportunity) It’s the state and attitude of your mind that determines the result Must learn to trust your edge. Edge means higher probability of one outcome than another Ch1 Road to Success o Almost all traders use some forms of TA o Form collective behavior patterns and form statistical reliability to identifiable so can be anticipate that was generated in previous moment o Individually mental psychology, intelligent isn’t the most important thing. The best trader thinks different from the rest o Defining character separates consistent winner from others o Trading is paradox. Contracting theory. o All outcomes are probable, not guarantee o The best traders learn to take the risk and embrace the risk. The best trader can put on a trade without hesitation and conflicts even get out of trades if it isn’t working with slightest emotions o How do we remain focus , confidence in time of uncertainty, until learn how to be a trader o Learn to accept risk is a trading skill. It is the most important skill. Once you learn how to accept risk. Market will not generate information that will cause you the pain o The market is neutral. The best traders aren’t afraid. They have develop an attitude to flow in n out of trade based on what the market is telling o 95% losing is from your attitude towards losing, attitude about being wrong, FOMO and leaving money on the table. The four primary trading fears o Fear is immobilizing. Mentally is causing us to narrow thinking. Source of the problem is internal o We need technique to achieve consistency. Learn how to trade effectively. If you are afraid to lose and being wrong then you will never learn enough to compensate o Market analysis is not the path to consistent result it will not solve the problem create by lack of confidence and focus o Trust yourself. To be confidence, requires absolute of trusting yourself. However you won’t be able to trust yourself until you have trained your mind to overcome your natural inclination to think ways that are counterproductive. o 2 ways of defining eliminating risk. #1 learning as much as market variables as possible. “ Market Black Holes” #2 or redefining your way of trading activities so that you accept the risk and no longer afraid. When you truly accept the risk in your state of mind, you won’t jump the gun, tendency to rationalized or hope the market will save you from losing money, hesitating. o Appropriate attitude is a must. Solution is adjusting your attitude to a point to trade with the slightest fear but in the same time keep the framework that doesn’t let me become reckless o The future of the trade of yourself is the projection that you want to grow into Ch 2 The lurk and dangerous of trading o Creating internal mental structure that provides that creates the greatest balance o Passionate interest comes of the level of our being our true identity o Internal / mental environment vs exterior environment. Our desires, needs that generates in out mental environment and fulfil in exterior environment. If they are correspondence with each other we are in balance. If not we are in constant emotional pain. Necessity is the mother of all invention. o Ex. Baby told not to do certain things. Denial Impulse that based our needs to learn. Impulses that are based on inter needs and natural selection process. Need to put our mental environment back into balance o Denied impulses are never reconcile. They are usual accumulates. Whatever we are deprived of in childhood becomes addiction in adulthood o We need rule and boundary to safeguard our trading. We need to create internal structure to form of special internal discipline and perspective to guide our behavior so we always act in our own best interests. This structure has to exist in all of us because the market isn’t going to provide one. o Trading has no formal ending, until you have the mental structure that end the trade that always ends in your best interest. You can become a passive loser which in a way the market will take everything you own. We are in complete control. The willingness to create set of rules. The create rule and the mental capacity to abide by them. o One of the major problem is the failure to take responsibility.