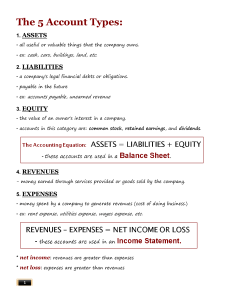

- BU127 MIDTERM REVIEW( CHAPTERS 1-4) 23 multiple choice, numerical and matching 10 marks short answer- will be provided account balances and asked to properly format a financial statement (statement of earning( income statement) or statement of financial position ( balance sheet)) and provide closing entries CHAPTER ONE Internal decisions makers: managers External Decision makers: shareholders and creditors Statement of financial position ( balance sheet): reports the economics resources it owns and the sources of financing for those resources( assets, liabilities and shareholders equity) Purpose of SFP: reports the economic resources and sources of financing of an accounting entity at ONE POINT IN TIME Main parts ( more at bottom) Assets: Resources owned by the company(cash, short-term investments, inventory etc.) Liabilities: Debts/Legal company’s obligations( Accounts Payable, Accrued Expenses, Notes payable etc.) Owners Equity: Part of company owned by Owners(includes common stock and retained earnings Step 1 1: Headings 1. Company Name 2. “Statement of Financial Position” 3. As of “the date” (Snapshot of financials at a point in time) Step 2: Assets 1. Make Assets Heading 2. List Assets in order of liquidity 3. Add up and list Total Assets Step 3: Liabilities 1. Make Liabilities Heading 2. List Liabilities in order of order they’re due 3. Add up and list Total Liabilities Step 4: Owners Equity 1. Make Owners Equity Heading 2. List Owners Equity 3. Add up and list Total Owners Equity Step 5: 1. Add together Liabilities and Owner's Equity and make sure they equal Total Assets Statement of earning ( income statement, statement of operations, statement of comprehensive income); :reports the accountant;s primary measure of performance of a business, revenues less expenses Purpose of SOE: reports net earnings achieved during the accounting period Step 1: Headings 1. Company Name 2. “Statement of Comprehensive Earnings” 3. Period ended “For the month ended” Step 2: Revenue 1. List all Revenues from biggest to smallest 2. Add up and list Total Revenues Step 3: Expenses 1. List all Expenses (preferably alphabetically) 2. Add up and list Total Expenses Step 4: Net Income 1. Subtract Total Revenue from Total Expenses to get Net Income Statement of changes in equity: changes in shareholders equity in an accounting period. Purpose of SOCIE: reports how income, dividends and changes 2 contributed capital affect the financial portions of a company Beginning Shareholders Equity + Net Income + Other comprehensive Income - Dividends - Drawings +/-Other changes End Shareholders Equity Statement of Cash flows: resorts ability to generate cash and how it was used Purpose of SOCF: reports inflows( receipt) and outflows ( payments) of cash during a accounting period, in the operating,investing and financing categories RELATIONSHIP BETWEEN FINANCIAL STATEMENTS 1. +net earning is the statement of earning= INC in ending retained earning in the statement of changes In equity 2. Ending retained earning from the statement of chinese in equity is one of the 3 components of shareholders equity on the statement of financial position 3. In the statement of Cash flows, the cash at the end of the year = the cash on the statement of financial position ACCOUNTING STANDARDS IFRS( International Financial Reporting Standard): guidelines for measurement rules used to develop the info in financial statements AcSb( Accounting Standards Board): The private sector body given the primary responsibility to set the detailed rules that become accepted accounting standards ACCRUAL BASED ACCOUNTING revenues are recorded in the period the event happens, not necessarily when cash is earned ( ie. you teach someone guitar in September 2019 but they pay you in March 2020 TYPES OF BUSINESSES CHAPTER TWO Relevance: accounting info can make a difference in users decision and have a predictive value and or feedback/ confirmatory value ( makes info more useful) Faithful representation: accounting info is complete, neutral, reasonable and free from errors FOUR ENHANCING QUALITATIVE CHARACTERISTICS Comparability: accounting info can be compared across companies( identity similarities or discrepancies in financial reports) Verfibilabilty: accounting information can be agreed by independent accounts Timeless: accounting info i available before losing its usefulness Understandability: easy to comprehend RECOGNITION AND MEASUREMENT CONCEPTS Separate entity assumption: activities of the business are separate from the activities owners ( ex. Building bought by a owner of a real estate agent for personal use should not be mixed with company assets) Stable monetary unit assumptions: accounting measurement will be int he national monetary unit ( ie. $CAD) with out any adjustments for changes in purchasing power Continuity ( going concern) assumption: the business is assumed to continue to operate into the foreseeable future Historical cost principle: Cash equivalent cost given up is the basis for the entail recording elements Current assets; turned into cash in 1 year ( inventories, receivables) Non current assets: turned into cash in more than one year (PP&E, intangible assets like patents) Prepaid expense: a type of ASSET on the balance sheet that results from a business making advance payments for goods or services to be received in the future. Notes receivable: receivable with a written promise Liabilities: debut or obligations,( there are current or non current liabilities) Accounts payable and trade payable: a company ahs to pay suppliers ( or other things) for a purchase of goods and services Shareholders Equity: financing provided by a company by both its shareholders and the operations of business (includes contributed capital and retained earning) Contributed capital: financing provided by shareholders Retained earnings- financing provided by operations ( stayed in business) Accounting will not record: - events that involved promises, no exchange of goods and services ( ie.singing a purchase contract, sending production order) - Transaction of company’s owners ( shareholders), one shareholder sold their shares to another person MEASURING AND REPORTING INFORMATION CONCEPTS 3 Assumptions • Separate Entity – Business activities are separate from the owners activities • Ex. If Jeff Bezos spend $10,000,000 on a yacht, this is not reported on Amazon’s financial statements • Continuity/Going Concern – The business is assumed to continue operating in the foreseeable future • Stable Monetary Unity - Accounting measurements are in the • national monetary unit ($CAD) and are not adjusted for inflation • 1 Principle • Historical Cost - Assets are recorded at the value the company originally acquired them for • Ex. A company buys land in 1999 in Toronto for $500,000. Now the land is worth $2,000,000. On the balance sheet the land will still be recorded at value ($500,000). - RECORDING TRANSACTIONS Use accounts, journal entry ( chart of accounts, list of accounts and their code) DEBIT AND CREDIT RULES 1. No rule of meaning( this is just notation) 2. Debit is left, credit is right 3. Which accounts increase Debit and which accounts increase credits ADExLER Assets Dividends Expense INC DEBIT Debit and credit Examples: - Inc in assets and expenses= DEBIT Liabilities Equity Revenue INC CREDIT - Dec in assets and expenses = CREDIT Dec in shareholders equity= DEBIT Dec in liabilities = DEBIT Dec in retained earnings=DEBIT a. A retail pool customer pays his outstanding balance of $9,000 to Pool Corporation.= DEBIT b. Supplies purchased in Cash amounting $580.= DEBIT supplies, CREDIT cash c. Pool Corporation purchases Product Inventory in Cash amounting to $5,600= DEBIT product inventory, CREDIT cash d. Paid wages in cash amounting to $9,100= DEBIT wages expense, CREDIT cash e. Pool Corporation purchased equipment worth $6,000 and paid immediately= DEBIT equipment, CREDIT cash f. Pool Corporation paid $2,400 cash for the premium on a 12th month insurance policy beginning from December 2020= DEBIT prepaid insurance, CREDIT cash g. Pool Corporation paid $200 towards general repairs in cash.= DEBIT repair expense, CREDIT cash h. Pool Corporation paid $3,700 cash towards Utilities.= DEBIT utilities expense, CREDIT cash i. Pool Corporation paid $260 towards transportation for one of the equipment as per the sale agreement.= DEBIT transportation expense, CREDIT cash j. Pool Corporation purchased Product Inventory for $29,000 Cash.= DEBIT product inventory, CREDIT cash k. Pool Corporation owed $900 wages to the office receptionist and three assistants for working the last two days in December 2020. The employees will be paid in January 2021.= DEBIT wages expense, CREDIT wages payable l. On October 1, 2020, Pool Corporation received $24,000 from customers who prepaid pool cleaning service for one year beginning on November 1, 2020.= DEBIT Cash CREDIT deferred revenue ( why not account receivable) m. Pool Corporation received a $620 utility bill for December utility usage. It will be paid in January 2021.= DEBIT utility expense, CREDIT payable n. Pool Corporation borrowed $31,500 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate. The note and interest are due on May 1, 2021.= DEBIT cash, CREDIT short term borrowings o. On December 31, 2020, Pool Corporation cleaned and winterized a customer’s pool for $12,000, but the service was not yet recorded on December 31.= DEBIT accounts receivable, CREDIT sales p. On August 1, 2020, Pool Corporation purchased a two-year insurance policy for $5,160, with coverage beginning on that date.= DEBIT prepaid insurance, CREDIT cash q. During 2020, Pool Corporation purchased supplies costing $21,000 from various suppliers for cash.= DEBIT supplies, CREDIT cash r. Pool Corporation estimated that depreciation on its buildings and equipment was $8,300 for the year. = DEBIT depreciation expense, CREDIT accumulated depreciation s. At December 31, 2020, $1,300 of interest on investments was earned that will be received in 2021.= DEBIT Interest receivable, CREDIT interest revenue t. Rent for December due to be paid in January 2020 of $1,600.= DEBIT rent, CREDIT rent payable u. Sold $41,000 of goods and received the amount on the same day.= DEBIT cash, Credit sales v. Record the expired insurance purchased (trans. f) for the month of December Pool Corporation paid $2,400 cash for the premium on a 12th month insurance policy beginning from December 2020.= 2400/12 , DEBIT $200 insurance expense, CREDIT prepaid insurance w. Sales worth $20,000 made to Penny’s Pool Service & ­Supply Inc. on Credit.= DEBIT Accounts receivable, CREDIT Sales x. Pool Corporation received utilities bill for $510 for December. Paid in cash when received.= DEBIT utilities expense, CREDIT cash y. Property tax paid $10,300 during the year.= DEBIT property tax expense, CREDIT cash z. Received partial payment from Penny’s Pool Service & ­Supply Inc amounting to $10,000 for the purchase made this year. (tras."w") DEBIT cash, CREDIT accounts receivable a1. Pool Corporation purchased equipment worth $5,000 on credit basis.= DEBIT equipment, CREDIT accounts payable b2. Pool Corporation received the remaining balance amount due towards the recent sale made to Penny’s Pool Service & ­Supply Inc. (trans "w") : DEBIT cash, CREDIT accounts receivable c3. Paid for the equipment purchased. (tran. A1): DEBIT accounts payable, CREDIT cash d4. On December 31, 2020, Pool Corporation had $26,000 of pool cleaning supplies on hand. Record the necessary adjusting entry.: DEBIT Supplies Expense, CREDIT Supplies e5. Property tax due and payable worth $14,000.= DEBIT property tax expense, CREDIT property tax payable ( thought it was just cash) e6. Recognize revenue earned (transaction L ( On October 1, 2020, Pool Corporation received $24,000 from customers who prepaid pool cleaning service for one year beginning on November 1, 2020.): DEBIT deferred revenue , CREDIT sales To Calculate: e7. Record interest accrued on bank loan (Transaction N) Pool Corporation borrowed $31,500 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate. The note and interest are due on May 1, 2021: * keep in mind that year end is December DEBIT Interest expense $1260, CREDIT interest payable $1260 To calculate(e7): 8 months from May to Dec. So 8/12 * 0.06 * 31,500 =$1260 e8. Record the adjusting entry to record expired insurance (Transaction P).(On August 1, 2020, Pool Corporation purchased a two-year insurance policy for $5,160, with coverage beginning on that date. ) Journal Entry: The general journal records all companies transaction in chronological order T account( ledger account): summarize the Inc and dec of debit and credits - T-accounts are primarily used as a more efficient way to determine account balances following transactions ( used after the journal entry) CHAPTER THREE The Operating (cash to cash) Cycle: The time it takes for a company to pay cash to suppliers, sell goods and services to customers and collect cash from customers. Periodicity Assumption: the idea that the long life of a company can be reported in shorter periods. Issues: 1. Recognition issues. When should the transactions and their effects of operating activities be recognized, classified and recorded? 2. Measurement issues. What amounts should be recognized and recorded for the transactions? Classified Statement of Earnings Operating Revenues: Revenues are defined as increases in assets or settlements of liabilities from ongoing operations. Operating revenues result from the sale of goods and services. Operating Expenses: Expenses are decreases in assets or increases in liabilities from ongoing operations and are incurred to generate revenues during the period. Expenditure is any outflow of cash for any purpose. An expense is more narrowly defined^ Not all expenditures are expenses. Expenses are necessary to create revenue. Gross Profit: Net sales (total revenue) - cost of goods sold Primary Operating expenses for most merchandising companies: 1. Cost of Sales: the cost of products sold to customers 2. Operating Expenses: the usual expenses other than the cost of sales, that are incurred in operating a business during a specific accounting period. Earnings from operations (operating income): Net sales - cost of sales and operating expenses Non-operating Items: ● Interest Income (interest revenue, investment income or dividend income) ● Financing Costs ● Gains (or losses) on disposal of assets Earnings before income taxes: Revenues - all expenses except income tax expenses (also known as pre tax earrings) Discontinued Operations: When the decision is made to discontinue a major component of a business, the net earnings or loss from that component, as well as any gain or loss on subsequent disposal, are disclosed separately on the statement of earnings as discontinued operations. Earnings per Share Simple earnings per share: Net earnings/average number of shares outstanding during the period Cash Basis Accounting: A method of accounting that records revenues when cash is received and expenses when cash is paid. Accrual Accounting: a method of accounting that records revenues when earned and expenses when incurred, regardless of the time of cash receipts or payments. The Revenue Recognition Principle: The idea that revenues are recognized when; the sufficient risks and rewards of ownership are transferred to the buyer, it is probable that future economic benefits will flow to the entity, and the benefits and the costs associated with the transaction can be measured reliably. 1. Cash is received before the goods or services are delivered 2. Cash is received in the same period goods or services are delivered 3. Cash is received after the goods and services are delivered The Matching Process: A method that requires expenses to be recorded when incurred in earning revenue. The costs of generating revenue include expenses incurred such as the following: ● Salaries of employees who worked during the period (wages expense) ● Utilities for the electricity used during the period (utilities expenses) ● Inventory items that are sold during the period (cost of sales) ● Facilities rented during the period (rent expense) ● Use of buildings and equipment for production purposes during the period (depreciation expense) 1. Cash is paid before the expense is incurred to generate revenue 2. Cash is paid in the same period as the expense is incurred to generate revenue 3. Cash is paid after the cost is incurred to generate revenue Unadjusted Trial Balance - A listing of individual accounts, usually in financial statement order (A, L, SE, R, E). - Ending debit or credit balances are listed in two separate columns. - Total debit account balances should equal total credit account balances. - If not, errors have occurred in preparing balanced journal entries, posting the correct dollar effects of a transaction, calculating ending balances in accounts, or in copying ending balances from the ledger to the trial balance. Deferred Revenues - When a customer pays for goods or services before the company delivers them, the company records the amount of cash received in a deferred revenue account. - Deferred revenue is a liability representing the company’s promise to perform or deliver the goods or services in the future. - Recognition of the revenue is deferred until the company meets its obligation. Accrued Revenues - Sometimes, companies perform services or provide goods before customers pay. Because the cash that is owed for these goods has not yet been received, the revenue that was earned cannot be recorded. - Revenues that have been recognized but have not yet been realized in cash and recorded at the end of the accounting period are called accrued revenues. Deferred Expenses - Assets represent resources with probable future benefits to the company. Many assets are used over time to generate revenues. - At the end of every period, an adjustment must be made to record the amount of the asset that was used during the period. Accrued Expenses - Numerous expenses are incurred in the current period without being paid until the next period. - They accumulate overtime but are not recognized until the end of the period in an adjusting entry. Property, Plant, and Equipment: - Increases when assets are acquired, and decreases when they are sold. - These assets are used overtime to generate revenue. Thus, a part of their cost should be expensed in the same period (the matching process). - They depreciate over time as they are used. - Depreciation - An allocation of an asset’s cost over its estimated useful life to the organization. - To keep track of the asset’s historical cost, the amount that has been used is not subtracted directly from the asset account. Instead, it is accumulated in a new kind of account, called a contra account. - Contra Account - An account that is an offset to, or reduction of, the primary account. It is directly related to another account, but has a balance on the opposite side of the T-account. - As a contra account increases, the net amount (the account balance less the contra-account balance) decreases. For property, plant, and equipment, the contra account is called accumulated depreciation. - Since assets have dr balances, accumulated depreciation has a cr balance. - On the statement of financial position, the amount that is reported for property, plant, and equipment is its carrying amount (book value or net book value), which equals the ending balance in the property, plant, and equipment account minus the ending balance in the accumulated depreciation account. Materiality and Adjusting Entries - Materiality - Describes the relative significance of financial statement information in influencing economic decisions made by financial statement users - Materiality suggests that minor items would not influence the decisions of financial statement users are to be treated in the most cost-beneficial way in compliance with accounting standards. - It’s a qualitative factor in the conceptual framework providing scope for accountants to apply the pervasive constraint that benefit to users must outweigh the cost of reporting accounting information when they record the effects of transactions and prepare financial disclosure. CHAPTER FOUR STEPS TO CLOSING ENTRIES 1. 2. 3. 4. ● Close revenues and gains to income summary Close expenses and losses into income summary Close the income summary into retained earnings Close dividends into retained earnings Credit expenses and Debit revenues Closing the Books Permanent (real) Accounts: the statement of financial position accounts whose ending balances are carried into the next accounting period. Temporary (nominal) accounts: statement of earnings (and sometimes dividends declared) accounts that are closed to retained earnings at the end of the period Closing Entries: transfer balances in temporary accounts to retained earnings and establish zero balances in temporary accounts. Income Summary: a temporary account used only during the closing process to facilitate closing temporary accounts. The Accounting Cycle: The process used by entities to analyze and record transactions, adjust the records at the end of the period, prepare financial statements, and prepare the records for the next cycle. Adjusting Entries: Entries necessary at the end of the accounting period to identify and record all revenues and expenses of that period. This ensures: ● ● ● ● Revenues are recorded when earned (the revenue recognition principle) Expenses are recorded when incurred to generate revenue during the same period (the matching process) Assets are reported at amounts that represent the probable future benefits remaining at the end of the period. Liabilities are reported at amounts that represent the probable future sacrifices of assets or services owed at the end of the period. Four Types of Adjustments Adjustment Summary Unadjusted Trial Balance Examples: Preparing Financial Statements EQUATIONS Basic accounting equation: Assets= liabilities + shareholders equity Net Earnings= revenue - expenses Ending Retained Earnings = beginning retained earnings -earnings - dividends Current Ratios= current assets/ current liabilities Sales Revenue= cost of sales- gross profit Earnings before income tax=Gross Profit- total expenses Net Earnings= earnings -income Cost of sales = sales revenue- gross profit Gross profit = earnings before income tax + total expenses Administrative Expense= ( Gross Profit- Earnings before income tax)- selling expense Sales Revenue= Costs of sales + Gross profit SE= A- L ACCOUNTS Income Statement( Statement of Earnings) Account Title Type Of Account Sales Revenue Cost of Goods Sold Cost of Goods Sold Advertising Expense Operating expense Amortization Expense Operating expense Insurance Expense Operating expense Rent Expense Operating expense Salaries and Wages Operating expense Utilities Expense Operating expense Marketing Expense Operating expense Gain on sale Other Income Interest Income Other Income Loss on sale Other Expense Interest Expense Other Expenses Income Tax Taxes Balance Sheet ( SOFP) Account Title Type Of Account Cash Current Assets Marketable Securities Current Assets Accounts Receivable Current Asset Inventory Current Assets Prepaid expenses Current Assets Allowance for Doubtful Accounts Current Assets Buildings Fixed Assets Equipment Fixed Assets Leasehold Improvements Fixed Assets Accumulated Depreciation Fixed Assets Land Fixed Assets Investment in Bonds Investments Investment in Stocks Investments Goodwill Intangible Assets Intellectual Property Intangible Assets Accounts Payable Current liability Cash Dividends Payable Current Liability Income Tax Payable Current liability Capital Stock Shareholders Equity Common Stock Shareholders Equity Dividends Shareholders Equity Paid-In Capital Shareholders Equity Preferred Stock Shareholders Equity Retained Earnings Shareholders Equity Treasury Stock Shareholders Equity Deferred Revenue Liability EQUATIONS Basic accounting equation: Assets= liabilities + shareholders equity Net Earnings= revenue - expenses Ending Retained Earnings = beginning retained earnings -earnings - dividends Current Ratios= current assets/ current liabilities Sales Revenue= cost of sales- gross profit Earnings before income tax=Gross Profit- total expenses Net Earnings= earnings -income Cost of sales = sales revenue- gross profit Gross profit = earnings before income tax + total expenses Administrative Expense= ( Gross Profit- Earnings before income tax)- selling expense Sales Revenue= Costs of sales + Gross profit Total Expense = total revenues -net income. CHAPTER ONE QUIZ QUESTIONS 1. Indicate which financial statement the following items would appear on: 1. 2. 3. 4. 5. 6. Investments= statement of financial position Cost of goods sold= statement of income Deferred Revenue= statement of financial position Repayment of debts= statement of cash flows Dividends declared = statement of changes in equity Cash from operations = statement of cash flows 2. Which of the following is a disadvantage of forming a corporation? Question Legal fees can be high and separate tax returns have to be filed for owners and the business. 3. What is the primary purpose of the statement of financial position? To report the financial position of the reporting entity at a particular point in time. 4. On January 1, 20X1, two individuals invested $150,000 each to form Hornbeck Corporation. Hornbeck had total revenues of $15,000 during 20X1 and $40,000 during 20X2. Total expenses for the same periods were $8,000 and $22,000, respectively. Cash dividends paid out to shareholders totaled $6,000 in 20X1 and $12,000 in 20X2. What was the ending balance in Hornbeck's retained earnings account at the end of 20X1 and 20X2? Beginning RE + Net income - Dividends = Ending Retained Earnings 20X1: +($15,0000 -$8,000) -$6,000 =$1,000 20X2: $1,000 ( ending retained earnings 20X2**) ( $40,000- $22,000) - $12,000 - =6000 SUPPOSED TO BE $7000 Question 3:2020 2021 Opening Retained earnings - $1,000 Add: Net profit $7,000 18,000 less: Cash dividend (6000) (12,000) Closing retained earnings $1,000 $7,000 5. The HAT Corporation had revenues of $210,000, expenses of $85,000, and an income tax rate of 20 percent in 20X2. What would profit after taxes be? $100,000 6.Brown Corporation reported the following amounts at the end of the first year of operations, December 31, 20X1: Share capital $20,000; Sales revenue $95,000; Total assets $85,000, No dividends, and Total liabilities $35,000. What would shareholders' equity and total expenses be? Shareholders equity= assets - liabilities $50,0000 = $85,000-$35,000 Expenses = $95,0000- CHAPTER TWO QUIZ QUESTIONS 1. Deferred revenue ( performance in two years) = non current liabilities 2. Prepaid expense= current assets 3. Equipment= non current asset 4. Contributed capital= shareholders equity 5. Salaries payable = current liabilities 6. Notes payable ( due in 3 months)= current liabilities 7. Retained earrings = shareholders equity 8. Short term investments= current assets 9. Cash = current assets 10. Bank loan ( duein 5 yrs)= non current liabilities 1. Willie Inc.'s shareholder's equity equals 50 percent of the company's assets. If Willie Inc.'s liabilities are $ 600000, how much is Willie Inc.'s shareholder's equity? SE = .5A L = 600,000 Let a = x .5x = x - 600,000 -.5x = - 600,000 X = 1, 200, 000 A = 1, 200, 000 SE = .5A thus, SE = $600,000 Or we know that SE is 50percent then liabilities would be the other 50% $600,000/ 0.5= $1,200,000 Then multiply by to 50% that is left over it would be $600,000 Say if SE was now 40%, you know that liabilities would be 60% $600,000/0.6= 1 million Then multiply by the 0.4 = $400,000 $400,000= 1 mill- $600,000 3. 722 000 Mine is slightly different but.. 1. Golden Hawks Inc. reported the following amounts on its statement of financial position at December 31, 2020. How much is land? Accounts receivable $ 100000 Cash 20000 Deferred revenue( L) 84000 Inventory 75000 Land ? Notes payable(L) 349000 Retained earnings 404000 Share capital 340000 A = L + SE A minus land = 195,000 L = 433,000 SE = 744,000 L + SE - A = land Land = 982,000 - Put land equal to x and solve SE= A-L 4. What is the primary purpose of financial statement - To help users make decisions CHAPTER THREE 1. 2. 3. 4. 5. 6. 7. Decrease in equipment= credit Inc in inventory = deb Decrease in Share capital = deb Inc in accounts payable = credit Dec in bank loan = deb Inc deferred rev= cred Dec accounts receivable= cred 2. Laurier Inc. had retained earnings at the end of the year of $210000. During the year Laurier Inc. earned net income of $80000 and declared and paid dividends of $14000. What was Laurier Inc.'s retained earnings at the beginning of the year? Beg RE Ending RE + Dividends - Net income 210 000 + 14 000 - 80 000 = 144 000 Ending RE 1. Laurier Inc. had retained earnings at the end of the year of $180000. During the year Laurier Inc. earned net income of $70000 and declared and paid dividends of $46000. What was Laurier Inc.'s retained earnings at the beginning of the year? Ending retained earnings + dividends paid during year - net income (or profits) = beg retained earnings $180,000 + 46000 - 70,000 = $156,000 3. The periodicity assumption is the basis for which of the following? dividing the activities of a business into a series of time periods for accounting and reporting purposes. 4. If total revenues are the same as total expenses, then a company has which of the following? Neither profit or loss 5. Financial analysts look to the statement of earnings to determine which of the following? whether the company has generated profits from operations CHAPTER 4 - Sample Questions 1. Hawkies Inc. has a November 30 fiscal year. On August 1, 2019 Hawkies Inc. paid $ 12000 for rent from August 1, 2019 to July 31, 2020. On August 1, 2020 Hawkies Inc. paid $ 54000 for rent from August 1, 2020 to July 31, 2021. Calculate rent expense for the year ended November 30, 2020. Round your answer to the nearest dollar. Rent expense from december 1, 2019 to july 31, 2020 (8 months) = 12,000 x 8/12 = 8,000 Rent expense for August 1m 2020 to November 30, 2020 (4 months) = 54,000 x 4/12 = 18,000 Total rent for year ended = 8,000 + 18,000 = 26,000 2. Hawks News Inc. sells a monthly magazine called "The Hawk". Hawks News Inc. has chosen a December 31 fiscal year end and began operations in 2020. During the year ended December 31, 2020 Hawks News Inc. received customer subscription payments as follows: Subscriptions for the period October 2020-September 2021 $ 3900 Subscriptions for the period November 2020-October 2021 $ 10680 Subscriptions for the period December 2020-November 2021 $ 11760 Hawks News Inc. delivered the magazine subscriptions for October, November and December. Calculate the amount of unearned subscriptions revenue at December 31, 2020. Round your answer to the nearest dollar. Not relevant to the question but may be useful for other questions Revenue to be recognized Oct. to Dec. - 3900x3/12 = 975 Nov. to Dec. - 10680x2/12 = 1780 Dec - 11760/12 = 980 Unearned revenue Oct to September - 3900 x9/12 = 2,925 sept (09) Nov to oct - 10680 x10/12 = 8,900 oct (10) Dec to nov - 11760x11/12 = 10,780 nov (11) Total unearned revenue = $22,605 - Could also see a question where you need to calculate accrued expense, if they told you how long the loan is for and the interest rate and when the loan occurred and when the fiscal year ends. Figure out how much interest expense for the period 3. The primary responsibility of an independent auditor who is a professional accountant is to: Evaluate the "fair presentation" of the company's financial reports. 4. Indicate the order in which the following tasks would be completed in the normal financial statement preparation process. 1. 2. 3. 4. 5. 6. Prepare journal entries for transactions occurring during the period Prepare adjusting journal entries Prepare adjusted trial balance Prepare statement of earnings Prepare a statement of financial position Prepare closing entries PRACTICE QUESTIONS 195-198 and p.p. 201-202. Similar problem styles in the text include E1-2, E1-6, P1-1, AP1-1, P3-1 and AP3-1.