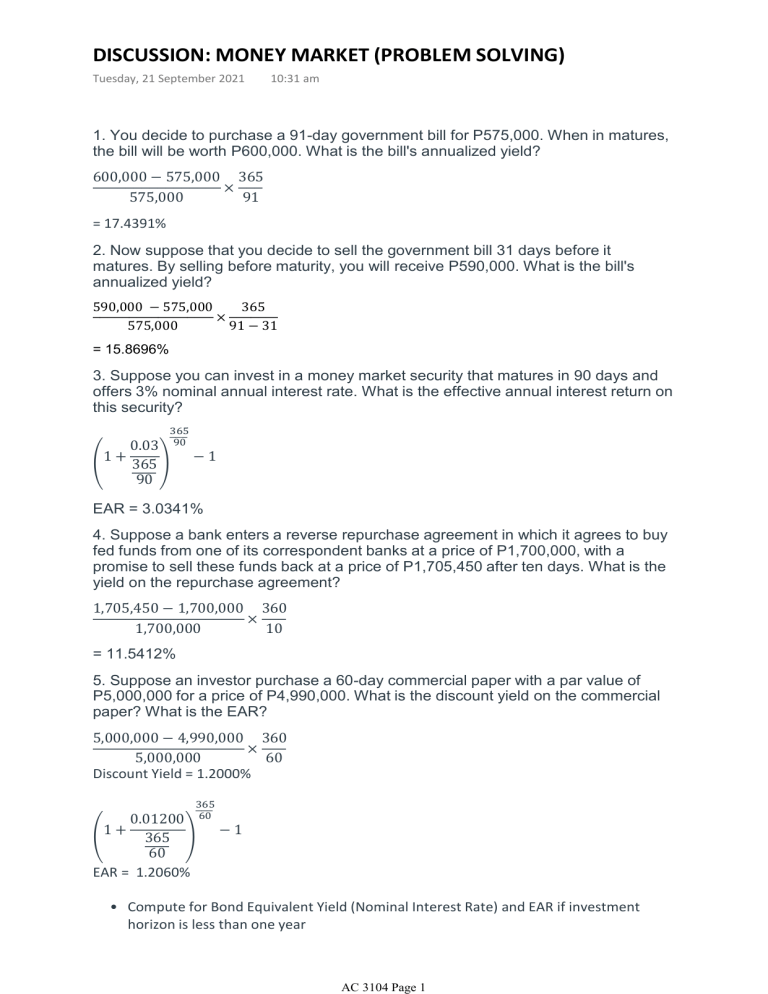

DISCUSSION: MONEY MARKET (PROBLEM SOLVING) Tuesday, 21 September 2021 10:31 am 1. You decide to purchase a 91-day government bill for P575,000. When in matures, the bill will be worth P600,000. What is the bill's annualized yield? = 17.4391% 2. Now suppose that you decide to sell the government bill 31 days before it matures. By selling before maturity, you will receive P590,000. What is the bill's annualized yield? = 15.8696% 3. Suppose you can invest in a money market security that matures in 90 days and offers 3% nominal annual interest rate. What is the effective annual interest return on this security? EAR = 3.0341% 4. Suppose a bank enters a reverse repurchase agreement in which it agrees to buy fed funds from one of its correspondent banks at a price of P1,700,000, with a promise to sell these funds back at a price of P1,705,450 after ten days. What is the yield on the repurchase agreement? = 11.5412% 5. Suppose an investor purchase a 60-day commercial paper with a par value of P5,000,000 for a price of P4,990,000. What is the discount yield on the commercial paper? What is the EAR? Discount Yield = 1.2000% EAR = 1.2060% • Compute for Bond Equivalent Yield (Nominal Interest Rate) and EAR if investment horizon is less than one year AC 3104 Page 1