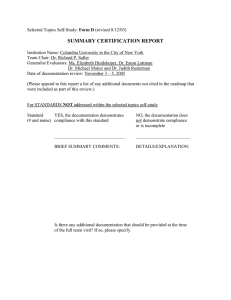

Systems Dynamics and Complexity HS2019 Self-Study 4: PEST and SWOT Analysis Gozde Duru Aksoy Johan Ruetsch Ege Tezerisener Kemeng Zhang System Dynamics and Complexity HS2019 Self-Study 4 - Group 25 | 19.10.2019 | 1 The PEST Analysis P E S T Political Economic Social Technological Political stability Economic growth, inflation Language and religion R&D activity Type of government Interest and exchange rates Population growth Technological infrastructure Extension : PESTELI • • • Ecological analysis Legislative analysis Industry analysis Purpose Trade restrictions and tariffs Per capita income Age distribution New technologies for distribution Tax and employment laws Unemployment level Life expectancy Rate of technological change System Dynamics and Complexity HS2019 Conduct PEST analysis to identify external factors (threat and opportunities) used in the SWOT framework to help companies making better business decisions! Self-Study 4 - Group 25 | 19.10.2019 | 2 The SWOT Analysis Internal Factors Helpful Goal: Harmful Strength Weakness What do we do very well? What are our competitive advantages? What could be done better? Where are we vulnerable? • • • • Focus on strength Minimize weakness Address threats Take advantage of opportunities External Factors Purpose Opportunity Threats What are the emerging trends we can utilise? What external obstacles affect our progress? System Dynamics and Complexity HS2019 Combine the analysis of external and internal factors to identify the overall position and outlook of the firm! Self-Study 4 - Group 25 | 19.10.2019 | 3 BCG Matrix Generate high revenues at large investments Require cash and potential growth S T&O Generate high revenues at small investments Gain low market share with less potential to grow System Dynamics and Complexity HS2019 W Self-Study 4 - Group 25 | 19.10.2019 | 4 The Portfolio Analysis Purpose Examples Conduct Portfolio Analysis to formulate strategies for a company. It is based on the philosophy that organizations should develop strategy much as they handle investment portfolios. Market Share vs. Market Growth (BCG Matrix) Competitive Strength vs. Industry Attractiveness (GE Nine Cell Matrix) Supply Risk vs. Profit Impact System Dynamics and Complexity HS2019 Figure 1. Two Graphs for Portfolio Analysis • • Left: Accommodation sector AirBnB Right: Electrical and ICE cars BMW Self-Study 4 - Group 25 | 19.10.2019 | 5 A Portfolio with Different Products at Different Stages Star high Question Mark Market Growth Apple • low Dog low 4 different products with each at different stages in the BCG Matrix categorized by the relative market share and growth Cash Cow Market Share System Dynamics and Complexity HS2019 high Self-Study 4 - Group 25 | 19.10.2019 | 6