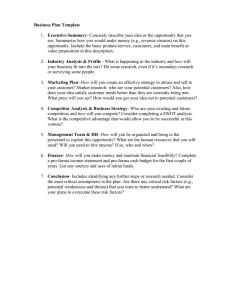

Financial Forecasting, Planning and Control Prof. Maricel R. Dizon, CPA, MPA, DipPM September 18, 2021 What and Why Financial Planning • A long-term financial plan represents a blueprint of what a firm proposes to do in the future. • Typically it covers a period of three to ten years. Naturally, planning over such an extended time horizon tends to be in fairly aggregative terms. 2 Planning System 3 What and Why Financial Planning While there is considerable variation in the scope, degree of formality, and level of sophistication in financial planning across firms, most corporate financial plans have certain common elements. These are: 1. Economic assumptions: The financial plan is based on certain assumptions about the economic environment (interest rate, tax rate, inflation rate, growth rate, exchange rate, and so on). 4 What and Why Financial Planning? Common Elements. These are: 2. Sales forecast: The sales forecast is typically the starting point of the financial forecasting exercise. Most financial variables are related to the sales figure. 3. Pro forma statements. The heart of a financial plan are the pro forma (forecast) statement of profit and loss and balance sheet. 4. Asset requirements. Firms need to invest in plant and equipment and working capital. The financial plan spells out the projected capital investments and working capital requirements over time. 5 What and Why Financial Planning? Common Elements. These are: 4. Asset requirements. Firms need to invest in plant and equipment and working capital. The financial plan spells out the projected capital investments and working capital requirements over time. 5. Financing plan. Suitable sources of financing have to be thought of for supporting the investment in capital expenditure and working capital. The financing plan delineates the proposed means of financing. 6 What and Why Financial Planning? Thus, the capital budgeting decision, working capital decision, capital structure decision, and dividend decision have to be established for developing an explicit financial plan. 7 What and Why Financial Planning? Companies spend considerable time and resources in financial planning. Hence, it is reasonable to ask: What are the benefits of financial planning? Recitation: 8 What and Why Financial Planning? Benefits of financial planning: 1. Identifies advance actions to be taken in various areas. 2. Seeks to develop a number of options in various areas that can be exercised under different conditions. 3. Facilitates a systematic exploration of interaction between investment and financing decisions. 9 What and Why Financial Planning? Benefits of financial planning: 4. Clarifies the links between present and future decisions. 5. Forecasts what is likely to happen in future and hence helps in avoiding surprises. 6. Ensures that the strategic plan of the firm is financially viable. 7. Provides benchmarks against which future performance may be measured. 10 Financial Forecasting: • Financial Forecasting is the basis for budgeting activities and estimating future financing needs. Financial forecasts begin with forecasting sales and their related expenses. 11 What and Why Financial Planning? A company’s annual financial plan is called a budget. The budget is a set of formal (written) statements of management’s expectations regarding sales, expenses, production volume, and various financial transactions of the firm for the coming period. 12 BUDGET Simply put, a budget is a set of pro forma statements about the company’s finances and operations. A budget is a tool for both planning and control. At the beginning of the period, the budget is a plan or standard; at the end of the period, it serves as a control device to help management measure the firm’s performance against the plan so that future performance may be improved. 13 THE COMPONENTS OF THE MASTER BUDGET 1. Operations Budget/Profit Plan. Composed of a detailed presentation of revenues, expenses, and net profit. This takes the form of the pro-forma or budgeted income statement. The operating budget consists of: a. Sales budget b. Production volume c. Cost of Raw Materials d. Number of Raw Materials units to be produced (next slide) 14 THE COMPONENTS OF THE MASTER BUDGET The operating budget consists of (con’t): e. Cost of direct labor f. Factory overhead g. Inventory levels h. Cost of good sold i. Selling Expenses j. Administrative Expenses k. Financing Charges 15 THE COMPONENTS OF THE MASTER BUDGET 1. Operations Budget/Profit Plan. 2. Financial Resources Budget. This is mainly made up of: a. Cash Budget b. Pro-forma or budgeted Statement of Financial Position c. Projected funds flow statement 3. Capital Expenditures Budget. This involves plans on material modification acquisition, and disposal of PPE or material Modification, and acquisition or renewal of a firm’s computerized accounting information system 4. Budget Financial Ratio. The ratios are taken from the pro-forma or budgeted financial statement prepared. Figures are estimated and budgeted. 16 PROCESS IN PREPARING THE MASTER BUDGET 1. Top management formulates the corporate objectives, plans, policies, and assumptions, which will give direction in the formulation of the budget estimates. 2. Establish or estimate sales projection or targeted sales. This will serve as a basis in determining the targeted number of units (volume) to be sold. 3. Heads or supervisors of different functional areas prepare individual budgets for their respective areas as well as sub-units or responsibility centers (production, marketing, research, finance) based on the planned volume of units to sold. 17 PROCESS IN PREPARING THE MASTER BUDGET 4. The corporate planning department of a firm consolidates the individual budgets to create a draft master budget. 5. Revision of the preliminary drafted master budget is done to come-up with the final draft subject to the approval of the top management. 6. Department heads or supervisors approve the final master budget. 18 CONSTRUCTION OF THE PRO-FORMA STATEMENTS One of the most thorough ways in preparing a budget or doing financial forecasting is by creating a series of pro-forma or projected or budgeted financial statements. 19 CONSTRUCTION OF THE PRO-FORMA STATEMENTS One of the most thorough ways in preparing a budget or doing financial forecasting is by creating a series of pro-forma or projected or budgeted financial statements. 1. Establish or estimates sales projection or targeted sales. This will serve as a basis in determining the targeted number of units (volume) to be sold. The sales budgets is considered as the cornerstone of budgeting. 2. Create the production budget schedule, which includes the raw materials costs, direct labor costs, and overhead. This will help in determining the gross profit. 20 CONSTRUCTION OF THE PRO-FORMA STATEMENTS One of the most thorough ways in preparing a budget or doing financial forecasting is by creating a series of pro-forma or projected or budgeted financial statements. 3. Create the schedule for selling, administrative and other expenses 4. Compute for the net income by preparing the pro-forma income statement 5. Create the pro-forma cash budget schedule where the estimated cash receipts and estimated cash disbursements are presented. 6. From the pro-forma income statement and cash budget schedule, create a pro-forma statement of financial position. 21 THE SALES BUDGET The sales budget is the starting point in preparing the operating budget, since estimated sales volume influences almost all other items appearing throughout the annual budget. The sales budget gives the quantity of each product expected to be sold. 22 Estimating Sales The following methods may be done in estimating or forecasting sales: 1. Sales Trend Analysis – Product life cycle is used in making the forecast. The growth commences at the introduction of the product and accelerates during its middle year and then plateaus then it declines. 2. Sales Force Composite Method – each salesman estimates the sales in his particular territory. 3. Executive Opinion Method – views of a number of top executives are culled to arrive at a sales estimate. (cont.) 23 Estimating Sales The following methods may be done in estimating or forecasting sales: 4. Industry Trend Analysis Method – relationship between expected industry sales and the company sales in terms of market share is determined. 5. Correlation Analysis Method – Uses regression analysis 6. Multiple Approach Method – Combination of the various methods 24 THE SALES BUDGET Basically, there are three ways of making estimates for the sales budget: 1. Make a statistical forecast on the basis of an analysis of general business conditions, market conditions, product growth curves, etc. 2. Make an internal estimate by collecting the opinions of executives and sales staff. 3. Analyze the various factors that affect sales revenue and then predict the future behavior of each of those factors 25 THE SALES BUDGET After sales volume has been estimated, the sales budget is constructed by multiplying the estimated number of units by the expected unit price. Generally, the sales budget includes a computation of cash collections anticipated from credit sales. 26 THE SALES BUDGET Assume that of each quarter’s sales, 70% is collected in the first quarter of the sale; 28% is collected in the following quarter; and 2% is uncollectible 27 THE SALES BUDGET 28 The Production Budget • After sales are budgeted, the production budget can be determined. The number of units expected to be manufactured to meet budgeted sales and inventory is set forth. • The expected volume of production is determined by subtracting the estimated inventory at the beginning of the period from the sum of units to be sold plus desired ending inventory. 29 The Production Budget Assume that ending inventory is 10% of the next quarter’s sales and that the ending inventory for the fourth quarter is 100 units 30 The Direct Materials Budget • When the level of production has been computed, a direct materials budget is constructed to show how much material will be required and how much of it must be purchased to meet production requirements. 31 The Direct Materials Budget • The purchase will depend on both expected usage of materials and inventory levels. The formula for computing the purchase is: • The direct materials budget is usually accompanied by a computation of expected cash payments for the purchased materials. 32 The Direct Labor Budget • The production budget also provides the starting point for the preparation of the direct labor cost budget. The direct labor hours necessary to meet production requirements multiplied by the estimated hourly rate yields the total direct labor cost. 33 The Direct Labor Budget: Example • Assume that 5 hours of labor are required per unit of product and that the hourly rate is P5. 34 The Factory Overhead Budget • The factory overhead budget is a schedule of all manufacturing costs other than direct materials and direct labor. • In developing the cash budget, remember that depreciation does not entail a cash outlay and therefore must be deducted from the total factory overhead in computing cash disbursements for factory overhead 35 The Factory Overhead Budget: Example • For the following factory overhead budget, assume that: 1. Total factory overhead is budgeted at P6,000 per quarter plus P2 per hour of direct labor. 2. Depreciation expenses are P3,250 per quarter. 3. All overhead costs involving cash outlays are paid in the quarter in which they are incurred 36 The Factory Overhead Budget: Example 37 The Ending Inventory Budget • The ending inventory budget provides the information required for constructing budgeted financial statements. • First, it is useful for computing the cost of goods sold on the budgeted income statement. • Second, it gives the value of the ending materials and finished goods inventory that will appear on the budgeted FS 38 The Ending Inventory Budget: Example • For the ending inventory budget, we first need to compute the unit variable cost for finished goods, as follows. 39 The Selling and Administrative Expense Budget • The selling and administrative expense budget lists the operating expenses involved in selling the products and in managing the business 40 The Selling and Administrative Expense Budget • The variable selling and administrative expenses amount of P4 per unit of sale, including commissions, shipping, and supplies; expenses are paid in the same quarter in which they are incurred, with the exception of P1,200 in income tax, which is paid in the third quarter 41 The Cash Budget • The cash budget is prepared in order to forecast the firm’s future financial needs. • It is also a tool for cash planning and control. Because the cash budget details the expected cash receipts and disbursements for a designated time period, it helps avoid the problem of either having idle cash on hand or suffering a cash shortage. However, if a cash shortage is experienced, the cash budget indicates whether the shortage is temporary or permanent, that is, whether short-term or long-term borrowing is needed. 42 The Cash Budget The cash budget typically consists of four major sections: 1. The receipts section, which gives the beginning cash balance, cash collections from customers, and other receipts 2. The disbursements section, which shows all cash payments made, listed by purpose 3. The cash surplus or deficit section, which simply shows the difference between the cash receipts section and the cash disbursements section 4. The financing section, which provides a detailed account of the borrowings and repayments expected during the budget period 43 The Cash Budget: Example 44 The Cash Budget: Example 45 The Budgeted Income Statement (Pro-forma) The budgeted income statement summarizes the various component projections of revenue and expenses for the budgeting period. For control purposes, the budget can be divided into quarters, for example, depending on the need. 46 The Budgeted Income Statement: Example 47 The Budgeted(Pro-Forma) Statement of FP The budgeted balance sheet is developed by beginning with the balance sheet for the year just ended and adjusting it, using all the activities that are expected to take place during the budget period. Some of the reasons why the budgeted balance sheet must be prepared are: 1. To disclose any potentially unfavorable financial conditions 2. To serve as a final check on the mathematical accuracy of all the other budgets 3. To help management perform a variety of ratio calculations 4. To highlight future resources and obligations 48 The Budgeted(Pro-Forma) Statement of FP: Example 49 The Budgeted(Pro-Forma) Statement of FP: Example 50 The Budgeted(Pro-Forma) Statement of FP: Example 51 PERCENT OF SALES METHOD • The percent of sales method for preparing the pro forma statement of profit and loss is simple. Basically, this method assumes that the future relationship between various elements of costs to sales will be similar to their historical relationship. 52 The Jawhead Corporation Income Statement and Vertical Analysis For the Years Ended December 31, 2020 and 2021 In thousand Pesos Particulars Sales Sales return and allowances Net sales Cost of good sold Gross Profit Operating Expenses (Other) Selling Expenses General Expenses Total Operating Expenses Earnings before interest, taxes and depreciation (EBITD) Depreciation Earnings before interest and taxes (EBIT) = operating income Interest Expense Earnings before taxes Income taxes (40%) Net Income % over sales 2021 2020 % %2 Amount Amount 100,000.00 100.00% 110,000.00 100.00% 20,000.00 20.00% 8,000.00 7.27% 80,000.00 80.00% 102,000.00 92.73% 50,000.00 50.00% 60,000.00 0.55 30,000.00 30.00% 42,000.00 38.18% 5,000.00 4,000.00 9,000.00 5.00% 4.00% 9.00% 12,000.00 7,000.00 19,000.00 10.91% 6.36% 17.27% 21,000.00 3,000.00 18,000.00 2,000.00 16,000.00 6,400.00 9,600.00 21.00% 3.00% 18.00% 2.00% 16.00% 6.40% 9.60% 23,000.00 1,000.00 22,000.00 2,000.00 20,000.00 8,000.00 12,000.00 20.91% 0.91% 20.00% 1.82% 18.18% 7.27% 10.91% 53 PERCENT-OF-SALES METHOD OF FINANCIAL FORECASTING The calculations for a pro forma FS are as follows: 1. Express balance sheet items that vary directly with sales as a percentage of sales. Any item that does not vary directly with sales (such as long-term debt) is designated not applicable (n.a.). 2. Multiply the percentages determined in step 1 by the sales projected to obtain the amounts for the future period. 54 PERCENT-OF-SALES METHOD OF FINANCIAL FORECASTING The calculations for a pro forma balance sheet are as follows: 3. Where no percentage applies (such as for long-term debt, common stock, and capital surplus), simply insert the figures from the present balance sheet in the column for the future period. 4. Compute the projected retained earnings as follows: Projected retained earnings = present retained earnings + projected net income - cash dividends paid (You will need to know the % of sales that constitutes net income and the dividend payout ratio) 55 PERCENT-OF-SALES METHOD OF FINANCIAL FORECASTING The calculations for a pro forma balance sheet are as follows: 5. Sum the asset accounts to obtain a total projected assets figure. Then add the projected liabilities and equity accounts to determine the total financing provided. Since liability plus equity must balance the assets when totaled, any difference is a shortfall, which is the amount of external financing needed. 56 PERCENT-OF-SALES METHOD OF FINANCIAL FORECASTING When constructing a financial forecast, the sales forecast is used traditionally to estimate various expenses, assets, and liabilities. The most widely used method for making these projections is the percent of-sales method, in which the various expenses, assets, and liabilities for a future period are estimated as a percentage of sales. These percentages, together with the projected sales, are then used to construct pro forma (planned or projected) SFS. 57 PERCENT-OFSALES METHOD OF FINANCIAL FORECASTING For the following pro forma FS, net income is assumed to be 5% of sales and the dividend payout ratio is 4%. 58 PERCENT-OFSALES METHOD OF FINANCIAL FORECASTING 59 PERCENT-OF-SALES METHOD OF FINANCIAL FORECASTING • One important limitation of the percent-of-sales method is that the firm is assumed to be operating at full capacity. On the basis of this assumption, the firm does not have sufficient productive capacity to absorb projected increases in sales and thus requires an additional investment in assets. • The major advantage of the percent-of-sales method of financial forecasting is that it is simple and inexpensive to use 60 Next meeting Working Capital Management 61 62