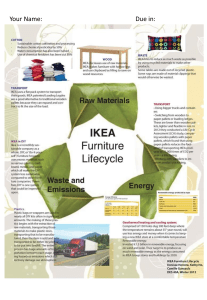

1.0. Introduction The focus of this report is on the supply chain management practices of a single organisation IKEA. IKEA is a multinational conglomerate who is a leader in a DIY (doit-yourself) and ready-to assemble furniture and kitchen appliance industry. Founded in 1943, in Sweden it has expanded to over 52 countries around the world. This report intends to assess the efficacy of planning and engagement within IKEA. SCM is a process where a unified planning, alignment and management of all the business operations and activities within the supply chain takes place. This is mainly initiated to provide high-class consumer value at low cost and to keep the other stakeholders within the supply chain contended at the same time. This report intends to assess the key strengths and limitations within the IKEA supply chain to arrive at relevant recommendations for the organisation. 2.0. IKEA Scenario Evaluation In a supply chain, the products and services flow from the suppliers who are at the top of the supply chain to the consumers who are at the bottom-level in a supply chain. A number of facilities, companies, supply points, and service providers help in connecting these two participants at various stages within the supply chain (). The success of the IKEA supply chain is its ability to reduce supply chain risks by using customer centric co-creation. IKEA (2020) evidence on the value chain within IKEA has shown that it is important to work together with customers and engage customer at every stage of the design process. There are lot of benefits as well as risks when it comes to tiered work and when these pros and cons of such tiered supply chain which are centralised are not thought through conscientiously, it can lead to bigger risks (). IKEA has a detailed centralised supply chain strategy. IKEA was working with a proven sustainable supply chain operation which are in line with different stakeholder groups. Another benefit within the IKEA supply chain is its overall management and integration of manufacturing (). Though they have different stakeholders who are able to provide the supplier support, IKEA continues to maintain manufacturing integration capabilities. Despite these positives, there continue to remain key challenges. Large stores and warehouse style structures: The statistics are clear and the revenue for every store that Ikea usually produces is increasing as every year passes by. In order to increase the revenue, it seems that Ikea needs to work on expanding its current number of stores. However, this is only part of their strategy (). The visits of people to physical stores has dropped drastically this year to values similar to 2017 which is close to 837 million visits. Ikea cannot continue to believe that their customers would spend more than their allotted time to buy the things they need by walking through rows of things they would not need (). A challenge with the existing supply chain within IKEA is that there is focus on the DIY store-centric model which rests on large experience centres and significant time spent by the customer in these stores. In many cases this cannot be achieved. Though, IKEA has in the past few years opened up more compact experimental stores in the heart of popular cities such as London and New York that majorly only portray Ikea products under different uses and applications and to match the online touchpoints these are limited. They need to focus on this model across different countries including emerging economies like INDIA and UK. This is a key challenge that exists within IKEA. Lack of Integrated Digital Supply chain: They need to serve for a higher digitallyoriented buying experience and with more than 2.5 billion online visitors, Ikea can presume that most of their store visitors love to visit their websites for a virtual experience too. The current digital operations at IKEA face important challenges. The store visit also needs to give them a feeling of the online experience too with similar capacities to understand customised information and easy ways to gain access to the total set of abilities. In particular, digital model has failed in the context of the recent pandemic. There were surges in sales for IKEA home office furnishings and they were struggling to maintain an online business model. In particular, the services offered post- purchase and the delivery schedules and protocols should aid in unleashing the new market that will in turn boost the revenue of this compact but more costlier store estate. There is a need for IKEA to transform its value chain to adapt to the digital model. Lack of Supply Chain Resilience: Ikea has definitely executed a commendable job of introducing innovative and advanced products to the market such as solar powered lamps and shelves and dog beds with even colour-changing light bulbs that have turned the global market around. Therefore, there has been product diversity. There is however, lack of resilience. Supply chain resilience is the ability of the supply chain to be prepared for unexpected risk events and ensure ability to overcome potential risks (). However, evidence has shown that IKEA has been unable to match demand needs and unable to manage overall risks. For example, as Collinson (2020) identified, IKEA has been unable to finish remodelling of different services offered. This has led customers frustrated with lack of awareness of underlying opportunities to succeed. Recommendations Improve Store Format and Create Integrated Value Chains through Supply Chain Flexibility: Customers still love to enjoy physically touching and examining the objects or things they want to but before they invest their money in furnishing their house. IKEA needs to focus more on the store concepts to help them approach a larger audience such as people who have no cars, people who live in far-off places and who live at home and some even working from home always (). This can be achieved by improving access to smaller stores and experience centres which could be autonomous. However, their physical and online stores also need to exist together and serve as a dual experience to consumers that will match the frequency of recent consumers who want to furnish their homes. There can be small retail stores where the customer is able to experience the product and make an order through the store computers/tablets. These products can either be picked up or delivered to their house. This can be achieved through support in the form of flexible supply chains. Supply chain flexibility is identified as a key strategy which can aid in managing and mitigating overall risks and uncertainties within supply chains (Chiang et al., 2012). Flexibility within the supply chain is required to reduce avoidable processes and underlying behavioural risks (Kortmann et al., 2014). The improvement of flexibility is possible by ensuring that there is supplier-buyer interaction an identifying way to reduce lead time in inventory planning. One way to manage supply chain flexibility can be achieved through standardisation of processes, codification and tactile outsourcing (Stevenson and Spring, 2009). Improve Product Portfolio based on Region Specific Evaluation: Evidence has shown that based on regional needs consumer expectations from the furniture industry has changed. Furthermore, evidence has also shown that IKEA faced major challenges in China. This could be because of its standardised product portfolio. There is a need for supply chains to address independent needs in different regions. Similarly, as () argue, the new generations are least expected to own, or purchase property and they love to be exploring new places by being nomadic and even prefer to live in smaller and compact homes. The target of IKEA in this case is to manufacture household items and furnishings that would be suitable for such people. The baby boomers have now become older and also require their restrictions to be designed properly. This shall eventually put pressure on merchandising and predicting the marketing of right products into the right locations and ensuring that they have a higher understanding of the population around these small and experimental stores. There is a higher probability to get the format and the assortment wrong primarily and having to very rapidly change into the store protocol till they are appropriate. However, Ikea has learnt all its lessons and taken its feedbacks very seriously with its newly launched stores in China and India. Improve Supply Chain Resilience: Supply chain resilience can be built by focusing on different enablers. For example, there is a need for sharing of information and collaborative creation of products. According to Richey and Autry (2009), there is a need for supply chain partners to share information at different stage of the sourcing process which can help in reducing risks. Similarly, Simatupang and Sridharan (2008) also contend that there should be decision synchronisation and incentive alignment. At IKEA there should be efforts made to increase supply chain integration at different levels. 3.0. Project Planning Achieving Supply Chain Flexibility and Integration: In order to redesign the SCM process for better results and achieve joint supply chain objectives, () contend that there needs to be clear processes in place. These include redesign the roles and activities taking place within the supply chain, modifying or bringing down the number of participants within the supply chain by increasing engagement, conducting a rework on the roles and responsibilities of supply chain partners (), speeding up the order delivery process by bringing down the customer order lead times, cutting down on waiting time by improving manufacturing efficiency; and carrying out information exchange and decision support in a more effective manner (). These can be achieved only if IKEA takes a clear supply chain audit process examining key areas of improvement. It is suggested that IKEA undertake a multilevel audit of existing supply chain processes including degree of information exchange. There is need for strategic sourcing where production is assessed in line with available sourcing opportunities and check for viability of contract manufacturing. It is suggested that this project is carried out over a period of one year with different value chains being evaluated independently. There are some risks which are associated with this project planning process. These include, potential lack or loss of competitive advantage due to information sharing risks, there is also potential security challenges linked with the use of integrated information systems. Other risks include cost risk of conducting the supplier audit and potential reputation risks which may be associated with contract manufacturing activities. Improve digitalisation of supply chain to manage portfolio variety needs: Although production times can be worked out in order to reduce the lead times, the process of shipping goods become a hindrance to this and lead to increased lead times in omnichannel retail. Therefore, if the goal is to improve digitalisation and implement integrated supply chains then it is important to accept the role of artificial intelligence. This challenge of delays and management of multiple product portfolios will be solved with more automation and robotic incorporation inside the store to render this method cost-effective which then raises the query on how consumers and robots can work together in the warehouse space if necessary. AI can help in managing omnichannel supply chain through prediction of region specific needs. This project however can be achieved over a long-term project timeline of five years. It is expected that there will be higher risks of costs, reputation and operations due to the fact that the entire value chain may be changing. The following tables identify the timeline and risks associated with this implementation process. Risk Management Description of Risk Reputation risk Financial risk Information risk Privacy risk Operation risk Risk Level Potential delays in product deliveries which can cause major problems High Impact Cost of implementing digitalisation as well as improving information integration can lead to loss of profitability High cost of operations may reduce available funding for other treatment decisions Integration of information systems across the supply chain can cause privacy risks Delay in operations due to automation efforts High High High Low Timeline of Proposed change Qtr 1 Supply chain flexibility and integration Conducting supply chain audit focusing on information flow Evaluating the challenges and strengths of suppliers Assessing key supplier capabilities and options for information integration Evaluating if contract manufacturing is possible Implementing pilot testing Digitalisation Evaluate existing omnichannel supply chain and identify challenges Identify AI solutions Evaluate alternatives based on region specific needs Conduct customer level evaluation Implement the right strategy in terms of pilot testing in one location 2020 Qtr 2 Qtr 3 Qtr 4 Qtr 1 2021 Qtr 2 Qtr 3 Qtr 4 Qtr 1 2022 Qtr 2 Qtr 3 Qtr 4 4.0. References