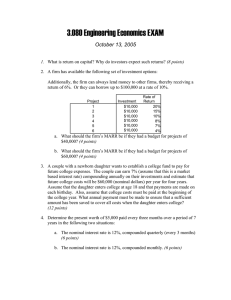

Engineering Economy Engineering Economy Topic 7 – Annuity Topic 8 – Gradient Topic 9 – Application of Money Time Relationship Topic 9.1 – Methods to Evaluate Profitability Topic 9.2 – Methods to Evaluate Liquidity Engineering Economy MINIMUM ATTRACTIVE RATE OF RETURN ( MARR ) Minimum Attractive Rate of Return (MARR) is usually organization-specific and determined based on the following: 1. Cost of money available for investment. 2. Number of good projects available for investment. 3. Risks involved in investment opportunities. Engineering Economy How to Use MARR Use it as an interest rate to convert cash flows into equivalent worth at some point in time. The proposed problem solution (project or alternative) is profitable if it generates sufficient cash flow to recover the initial investment and earn an interest rate that is at least as high as MARR. Engineering Economy Methods to Evaluate Profitability 1. Present Worth (PW) 2. Future Worth (FW) 3. Annual Worth (AW) 4. Internal Rate of Return (IRR) 5. External Rate of Return (ERR) Engineering Economy Methods to Evaluate Liquidity 1. Simple Payback Period 2. Discounted Payback Period Engineering Economy Present Worth (PW) Method Based on concept of equivalent worth of all cash flows relative to the present as a base. All cash inflows and outflows discounted to present at interest -- generally MARR. PW is a measure of how much money afforded for investment in excess of cost. can be PW is positive if dollar amount received for investment exceeds minimum required by investors. Engineering Economy Present Worth (PW) Method Discount future amounts to the present by using the interest rate over the appropriate study period 𝑘 PW = 𝑁 0 𝐹𝑘 ( 1 + 𝑖) − i = effective interest rate, or MARR per com. period k = index for each compounding period Fk = future cash flow at the end of period k N = number of compounding periods in study period interest rate is assumed constant through project The higher the interest rate and further into future a cash flow occurs, the lower its PWa Engineering Economy Present Worth (PW) Method 1. Compute the present equivalent of the estimated cash flows using the MARR as the interest rate. 2. If PW(MARR) ≥ 0, then the project is profitable. If PW(MARR) < 0, then the project is not profitable. Engineering Economy Sample Problem - Present Worth Consider a project that has the following cash flows over a study period of 5 years: Initial investment: $100,000 Annual revenues: $40,000 Annual expenses: $5,000 Salvage value: $20,000 MARR: 20%. PW(20%)= -100,000 + (40,000-5,000)(P/A,20%,5) + 20,000(P/F,20%,5) =$12,709. Is this a profitable project? Yes! Because: We recovered $100,000 (investment). We earned an interest rate of 20% which was desired. We even made a profit that has a present equivalent value of $12,709. Engineering Economy Future Worth (FW) Method FW is based on the equivalent worth of all cash inflows and outflows at the end of the planning horizon at an interest rate that is generally MARR. The FW of a project is equivalent to PW FW = PW ( F / P, i%, N ) If FW > 0, it is economically justified 𝑁 FW ( i % ) = FW = 𝑁 0 𝐹𝑘 ( 1 + 𝑖) Engineering Economy Future Worth (FW) Method 1. Compute the future equivalent of the estimated cash flows using the MARR as the interest rate. 2. If FW (MARR) ≥ 0, then the project is profitable. If FW (MARR) < 0, then the project is not profitable. Engineering Economy Sample Problem - Future Worth Consider a project that has the following cash flows over a study period of 5 years: Initial investment: $100,000 Annual revenues: $40,000 Annual expenses: $5,000 Salvage value: $20,000 MARR: 20%. FW(20%)= -100,000(F/P,20%,5)+(40,000-5,000)(F/A,20%,5) +20,000 = $31,624. Is this a profitable project? Yes! Because FW ≥ 0: We earned an interest rate of 20% which was desired. We even made a profit that has a future equivalent value of $31,624. Engineering Economy Annual Worth (AW) Method ◘ AW is an equal annual series of dollar amounts, over a stated period ( N ), equivalent to the cash inflows and outflows at interest rate that is generally MARR ◘ AW is annual equivalent revenues ( R ) minus annual equivalent expenses ( E ), less the annual equivalent capital recovery (CR) AW ( i % ) = R - E - CR ( i % ) AW = PW ( A / P, i %, N ) AW = FW ( A / F, i %, N ) ◘ If AW > 0, project is economically attractive ◘ AW = 0 : annual return = MARR earned Engineering Economy Capital Recovery (CR) CR is the equivalent uniform annual cost of the capital invested CR is an annual amount that covers: - Loss in value of the asset - Interest on invested capital ( i.e., at the MARR ) CR ( i % ) = I ( A / P, i %, N ) - S ( A / F, i %, N ) I = initial investment for the project S = salvage ( market ) value at the end of the study period N = project study period Engineering Economy Capital Recovery (CR) CR is also calculated by adding sinking fund amount (i.e., deposit) to interest on original investment CR ( i % ) = ( I - S ) ( A / F, i %, N ) + I ( i % ) CR is also calculated by adding the equivalent annual cost of the uniform loss in value of the investment to the interest on the salvage value CR ( i % ) = ( I - S ) ( A / P, i %, N ) + S ( i % ) Engineering Economy Sample Problem - Annual Worth Consider a project that has the following cash flows over a study period of 5 years: Initial investment: $100,000 Annual revenues: $40,000 Annual expenses: $5,000 Salvage value: $20,000 MARR: 20%. AW(i%)= R – E - CR(i%) AW(20%) = 40,000 - 5,000 - 30,752 = $4,249.62 Since AW(20%)≥ 0, the project is profitable. Is this a profitable project? Yes! Because AW ≥ 0: We earned an interest rate of 20% which was desired. We even made a profit that has an annual equivalent value of $4,249.62. Engineering Economy Practice Problem Uncle Tom’s ranch is now for sale for $30,000. Annual property taxes, maintenance and supplies, and so on are estimated to continue to be $3,000 per year. Revenues from the ranch are expected to be $10,000 next year then to decline by $400 per year thereafter through the 10th year. If you bought the ranch, you would plan to keep it for only 5 years and at that time to sell it for the value of the land , which is $15,000. If your desires MARR is 12%, should you become a rancher? Use PW, AW and FW Engineering Economy Uncle Tom’s ranch is now for sale for $30,000. Annual property taxes, maintenance and supplies, and so on are estimated to continue to be $3,000 per year. Revenues from the ranch are expected to be $10,000 next year then to decline by $400 per year thereafter through the 10th year. If you bought the ranch, you would plan to keep it for only 5 years and at that time to sell it for the value of the land , which is$15,000. If your desires MARR is 12%, should you become a rancher? Use PW,AW and FW Engineering Economy Practice Problem A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. Increased productivity attributable to the equipment will amount $8,000 per year after extra operating costs have been subtracted from the revenue generated by the additional production. If the firm’s MARR is 20% per year, is the proposal a sound one? Use the (1) PW (2) FW and (3) AW Method. Draw the cash flow diagram. Engineering Economy The investment cost $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. Increased productivity attributable to the equipment will amount $8,000 per year after extra operating costs have been subtracted from the revenue generated by the additional production. If the firm’s MARR is 20% per year, is the proposal a sound one? Use the (1) PW (2) FW and (3) AW Method. Engineering Economy Internal Rate of Return (IRR) IRR solves for the interest rate that equates the equivalent worth of an alternative’s cash inflows (receipts or savings) to the equivalent worth of cash outflows (expenditures) Also referred to as: • investor’s method • discounted cash flow method • profitability index IRR is positive for a single alternative only if: • both receipts and expenses are present in the cash flow pattern • the sum of receipts exceeds sum of cash outflows Engineering Economy Internal Rate of Return (IRR) The IRR method assumes recovered funds, if not consumed each time period, are reinvested at i ‘ %, rather than at MARR The computation of IRR may be unmanageable Multiple IRR’s may be calculated for the same problem The IRR method must be carefully applied and interpreted in the analysis of two or more alternatives, where only one is acceptable Engineering Economy Internal Rate of Return (IRR) IRR is i’ %, using the following PW formula: R k ( P / F, i’ %, k ) = E k ( P / F, i’ %, k ) R k = net revenues or savings for the kth year E k = net expenditures including investment costs for the kth year N = project life ( or study period ) If i’ > MARR, the alternative is acceptable To compute IRR for alternative, set net PW = 0 PW = R k ( P / F, i’ %, k ) - E k ( P / F, i’ %, k ) = 0 i’ is calculated on the beginning-of-year unrecovered investment through the life of a project Engineering Economy Sample Problem - IRR Consider a project that has the following cash flows over a study period of 5 years: Initial investment: $100,000 Annual revenues: $40,000 Annual expenses: $5,000 Salvage value: $20,000 MARR: 20%. Solution : We will use trial-and-error and linear interpolation. PW (il %) = -100, PW (il %) = -100, 000 + (40, 000 - 5, 000)(P/A, il%, 5) + 20, 000(P/F, il%, 5) = 0. Engineering Economy Cont Start trial-and-error PW(20%)=12,709. Therefore, iI > 20%. (Remember the inverse relation between PW and i) PW(25%)=679.5. Therefore, iI > 25%. PW(30%)=-9,368.48. Therefore, iI < 30%. Use linear interpolation to find iI: 25% < iI < 30%. i% PW 25% 679.50 i’ 0 30% -9368.48 i’ = 25.31% Calcu-shift solve i’ = 25.38% MARR(20%), therefore the project is profitable If i’ > MARR, the alternative is acceptable Engineering Economy External Rate of Return (ERR) ERR directly takes into account the interest rate ( ) external to a project at which net cash flows generated over the project life can be reinvested (or borrowed ). If the external reinvestment rate, usually the firm’s MARR, equals the IRR, then ERR method produces same results as IRR method Engineering Economy External Rate of Return (ERR) 1. All net cash outflows are discounted to the present (time 0) at % per compounding period. 2. All net cash inflows are compounded to period N at %. 3. ERR -- the equivalence between the discounted cash inflows and cash outflows -- is determined. The absolute value of the present equivalent worth of the net cash outflows at % is used in step 3. A project is acceptable when i ‘ % of the ERR method is greater than or equal to the firm’s MARR Engineering Economy Advantages of ERR over IRR The 1 ERR can be solved directly, without needing to resort 2 to trial and error. The ERR is not subject to the possibility of multiple rates of return. If the external investment rate (E) happens to equal the project’s IRR, then the ERR method produces results identical to those of the IRR method. Engineering Economy Sample Problem - ERR Consider a project that has the following cash flows over a study period of 5 years: Initial investment: $100,000 Annual revenues: $40,000 Annual expenses: $5,000 Salvage value: $20,000 = MARR: 20%. 100, 000(F/P, i’%, 5) = 35, 000(F/A, 20%, 5) + 20, 000 (F/P, i’%, 5) = 2.8046 (1 + i’)5 = 2.8046 ⇒ i’ = 22.9%. Therefor the project is profitable. Engineering Economy Sample Problem - ERR For the cash flows given below, find the ERR when the external reinvestment rate is ε = 12% (equal to the MARR). Year Cash Flow 0 1 2 3 4 -$15,000 -$7,000 $10,000 $10,000 $10,000 Expenses Revenue Solving, we find Engineering Economy Practice Problem a. Determine the IRR of the project. Is it acceptable b. What is the ERR for this project? Assume that = 15% per year. c. What is the simple payback period for this proposal? Proposal A Investment cost Expected life Market (salvage) value a Annual receipts Annual expense Engineering Economy $10,000 5 years –$1,000 $8,000 $4,000 Practice Problem A project is estimated to cost $100,000, last 8 years, and have a salvage value of $10,000. The annual gross income is expected to average $24,000 and annual expenses excluding depreciation is $6,000. If capital is earning 10% before income taxes, determine if this is desirable investment using PW, AW and IRR Engineering Economy Payback Period The simple payback period is the number of years required for cash inflows to just equal cash outflows. It is a measure of liquidity rather than a measure of profitability. Engineering Economy Payback Period Payback is simple to calculate. The payback period is the smallest value of θ (θ ≤ N) for which the relationship below is satisfied. For discounted payback future cash flows are discounted back to the present, so the relationship to satisfy becomes Engineering Economy Problems with the payback period method. It doesn’t reflect any cash flows occurring after θ, or θ'. It doesn’t indicate anything about project desirability except the speed with which the initial investment is recovered. Recommendation: use the payback period only as supplemental information in conjunction with one or more of the other methods in this chapter. Engineering Economy Sample – Payback Period Finding the simple and discounted payback period for a set of cash flows. The cumulative cash flows in the table were calculated using the formulas for simple and discounted payback. From the calculations θ = 4 years and θ' = 5 years. Engineering Economy End of Year Net Cash Flow Cumulative PW at 0% Cumulative PW at 6% 0 -$42,000 -$42,000 -$42,000 1 $12,000 -$30,000 -$30,679 2 $11,000 -$19,000 -$20,889 3 $10,000 -$9,000 -$12,493 4 $10,000 $1,000 -$4,572 5 $9,000 $2,153