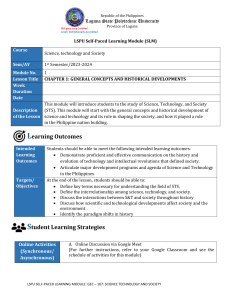

Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna LSPU Self-paced Learning Module (SLM) Course Fundamentals of Accounting 1 & 2 Sem/AY First Semester/2021-2022 Module No. Lesson Title Week Duration Date 1 DEFINITION OF ACCOUNTING, FUNDAMENTAL CONCEPTS AND BASIC PRINCIPLES Description of the Lesson 1 October 4 - 9, 2020 This lesson is a review for those Entrep I students who graduated from Senior HS with academic track in ABM. This lesson will discuss the definition of Accounting, importance of accounting in a business entity. This will also identify and describe the fundamental concepts and principles of Accounting. Learning Outcomes Intended Learning Outcomes Students should be able to meet the following intended learning outcomes: Define accounting. Explain the fundamental accounting concepts and principles Targets/ Objectives At the end of the lesson, students should be able to: Identify the functions of accounting. Enumerate the fundamental concepts and basic principles of accounting. Student Learning Strategies Online Activities (Synchronous/ Asynchronous) A. Online Discussion via Google Meet/FB Group Page (For further instructions, refer to your Google Classroom and see the schedule of activities for this module) B. 1. 2. 3. Learning Guide Questions: Give at least three definitions of accounting. Why is accounting often referred to as the language of business? What are some of the fundamental concepts that underlie the accounting process? 4. What are some of the accounting principles that guide the accounting practice? Note: The insight that you will post on online discussion forum using Learning Management System (LMS) will receive additional scores in class participation. LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna Lecture Guide (Refer to the textbook: Chapter 1- Accounting and Its Environment) Definitions of Accounting Offline Activities (e-Learning/SelfPaced) 1. Is a service activity. Its function is to provide quantitative information, primarily financial in nature, about the economic entities that is intended to be useful in making economic decisions. 2. Is an information system that measures, process and communicates financial information about an economic entity. 3. Is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the results thereof. Phases of Accounting 1. Recording business transactions Business transactions are the economic activities of a business. Recording these historical events is a significant function of accounting. Before the effects of the transactions can be recorded, they must be measured in terms of money. To measure a business transaction, the accountant must decide on three(3) issues: a. Recognition issue – when the transaction occurred b. Valuation issue – what value to place on the transaction c. Classification issue – how the components of the transaction should be classified 2. Classification Classification of recorded data reduces the effects of numerous transactions into useful group or categories 3. Summarization Summarization of financial data is achieved through the preparation of financial statements. 4. Interpretation The financial statements are analyzed to evaluate the liquidity, profitability and solvency of the business organization. Fundamental Concepts 1. Entity Concept. This is the most basic concept in accounting. It’s simply the accounting of business transactions of different entities should be accounted for separately. 2. Periodicity Concept. The life of an entity is divided into a time periods usually one year for financial reporting purposes. This is called the accounting period. 3. Stable Monetary Unit Concept. Since the information provided by accounting is financial in nature, a reasonable unit of measure is necessary to be able to do so. In the Philippines we use the Philippine peso, this is as if peso has the same purchasing power at any given time. 4. Going Concern. Financial information are generally presented on the assumption that the entity is established not for a limited period of time, hence going concern LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna is the underlying concept behind the depreciation of an asset. Basic Accounting Principles 1. Objectivity Principle. Accounting records are based on the most reliable data from valid source documents which can be verified by other user of financial information. 2. Historical Cost. This principle states that assets should be recorded at their actual cost at acquisition date and not on the fair market value as at reporting date. 3. Revenue Recognition Principle. Revenue/Income is to be recognized in the accounting period when goods are delivered or services are rendered or performed and not when cash or payment is received. 4. Expense Recognition Principle. Expenses should be recognized in the accounting period in which goods and services are used up to produce revenue and not when the entity pays for those goods and services. 5. Adequate Disclosure. Requires that all relevant information be disclosed in the financial statements. 6. Materiality. The size and nature of the item are evaluated together to determine it’s materiality in a particular circumstance. 7. Consistency Principle. Application of accounting method should be the same from accounting period to another to achieve comparability of financial reports of an enterprise. Engaging Activities Answer Fill in the blanks on page 51 LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna Performance Tasks PT 1 True of False ___________1. Accounting is a service activity whose function is to provide qualitative information, about economic entities that is intended to be useful in making economic decisions. ___________2. The measurement phase of accounting is accomplished by recording phase. ___________3. For reporting purposes, the personal assets and debts of a business owner should be combined with the assets and debts of the business. ___________4. Assets are usually valued under historical cost. ___________5. Objectivity principle requires relevant information to form part of financial statements for decision-making purposes. ___________6. The periodicity concept involves dividing the life of a business entity into accounting periods of equal length thus enabling the financial users to periodically evaluate the results of business operations. ___________7. Objectivity principle states that an accounting transactions should be supported by sufficient evidence to allow two or more qualified individuals to arrive at essentially similar conclusion. ___________8. Going concern concept assumes that the business has an indefinite economic life. ___________9. A business transaction is the occurrence of an event or of a condition that must be recorded. __________10. Interpretation of financial data is achieved through the preparation of financial statements. PT 2 Multiple Choice 1) Which of the following is an appropriate definition of accounting? a. A means of recording transactions and keeping records b. Collection, organization, and communication of vast amounts of information c. The interconnected network of subsystems necessary to operate a business d. The measurement ,processing, and communication of financial information about an identifiable economic entity 2) Accounting is a service activity. It's function is to provide LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna a. qualitative information b. quantitative and qualitative information c. quantitative information d. None of the above. 3) A business which prepares financial statements every year is following the __________concept. a. periodicity b. entity c. going concern d. stable monetary unit 4) The _________concept assumes that the business has an indefinite economic life a. periodicity b. entity c. going concern d. stable monetary unit 5) Which accounting concept should be considered if the owner of a business takes goods from inventory for his personal use? a. The substance over form concept b. The accrual concept c. The going concern concept d. The business entity concept 6) Which accounting principle states that omitting or misstating this information could influence users of the financial statements? a. Materiality b. Objectivity c. Historical cost 7) Which of the following accounting principle means that similar items should receive a similar accounting treatment? a. Materiality b. Objectivity c. Historical cost c. Consistency LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited 8) Province of Laguna Assets are usually valued under which basis? a. replacement cost b. Historical cost c. net realizable value d. fair market value 9) Which of the following accounting concepts states that an accounting transaction should be supported by sufficient evidence to allow two or more qualified individuals to arrive at essentially similar conclusion? a. b. c. d. 10) matching objectivity periodicity stable monetary unit Which of the following processes best defines accounting? a. b. c. d. Measuring economic activities Communicating results to interested parties Preventing fraud Both a and b Understanding Directed Assess LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA Republic of the Philippines Laguna State Polytechnic University ISO 9001:2015 Certified Level I Institutionally Accredited Province of Laguna Learning Resources Ballada, Win and Ballada, Susan. Basic Financial Accounting and Reporting- Made Easy. Win Ballada and Susan Ballada, 2019. https://www.youtube.com/watch?v=1924ois6Vn4 https://www.youtube.com/watch?v=fPOcUtfGtxQ LSPU SELF-PACED LEARNING MODULE: FUNDAMENTALS OF ACCOUNTING 1 & 2 Prepared by: MA. ALYN S. KARAGDAG, CPA