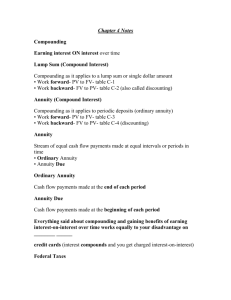

Introduction to Module 4 “Time is more valuable than money. You can get more money, but you cannot get more time”. – Jim Rohn Many would agree that our peso or dollar today will not be worth the same after, five or 10 years, or even just after a year. Money’s value is measured by the quantity of goods and services is can afford. Perhaps, when we were kids, we were so happy receiving P50 pesos because we can buy a lot of things then. Receiving the same amount now, will we feel the same excitement? Probably, not. Things have gone expensive and we’ll have less now for the same amount that we had ten years ago. Indeed, time is one key element that determines money’s value. However, is it all that there is? In this module, we will uncover the importance of time as an element in determining one’s worth. We will also uncover other elements that underlie money valuation. This module is intended for the students to achieve the following outcomes: 1. Use proper decision tools including information and communication technology, to critically, analytically and creatively solve problems and drive results. 2. Resolve business issues and problems, with a global perspective and particular emphasis on matters confronting financial statement preparers and users, using their knowledge and technical proficiency in the areas of financial accounting and reporting, cost accounting and management, management accounting, auditing, taxation, and accounting information systems, and finance. At the end of this module, you will be able to: 1. Explain how the time value of money works and why it is such an important concept in finance 2. Calculate the present values and future values of lump sum and annuities 3. Explain the difference between nominal, periodic, and effective interest rates 4. Develop a loan amortization schedule for long term borrowings Explain: Time Value of Money Chapter 5 – Time Value of Money Essentials of Financial Management 4th Edition by Brigham, F., Houston, F., Hsu, J., Kong, Y & BanyAriffin, AN. (2019). Pg. 155 - 188 Time value of money is a concept that adhere to the principle the money today is not worth the same in the future. It expounds that money can earn some sort of return (in terms of interest) and that, if not taken advantage of, will decrease the value of any some in the future. In a way, this encourages investments. The longer is the investment time, the greater interest is earned. Time Lines - Show the timing of cash flows. Tick marks occur at the end of periods, so Time 0 is today; Time 1 is the end of the first period (year, month, etc.) or the beginning of the second period. Clarifying the terms above, lumpsum means a single payment while an annuity is a series of equal amounts paid or received on fixed regular intervals. There are instances however that the amounts received per period are not equal. This is called an uneven cash flow stream and is illustrated as follows: FUTURE VALUE (Simple) Interest is the return earned on money investment Future Values - Amount to which an investment will grow after earning interest. Compound Interest - Interest earned on interest. Simple Interest - Interest earned only on the original investment. Example - Simple Interest Interest earned at a rate of 6% for five years on a principal balance of $100. Computing the future value using the step by step approach is tedious, thus the formula approach is recommended. The general formula to computer for the future value of a single sum is: Where: FV – Future Value; PV – Present Value (a single sum); i – interest per period; n – no. of compounding period Applying the formula, the following is determined: FV = 100 (1+.06) ^5 FV = 133.82 PRESENT VALUE (Simple) Present Value - Value today of a future cash flow. Discount Factor - Present value of a $1 future payment. Discount Rate - Interest rate used to compute present values of future cash flows. The present value is just the reciprocal of future value, thus, its general formula is: Where: PV – Present Value; FV – Future Value; interest per period; n – no. of compounding period Example: What is the present value (PV) of $100 due in 3 years, if I/YR = 4%? Finding the PV of a cash flow or series of cash flows is called discounting (the reverse o of compounding). The PV shows the value of cash flows in terms of today’s purchasing power. o = 100 (1+.04)^-3 PV = = $88.90 Solving for Interest (I) In certain cases, the problem may ask about the interest. Depending on the given, the general formula provided can be referred to and algebra is applied to compute for the unknown. Example: What annual interest rate would cause $100 to grow to $119.10 in 3 years? Solving for n (compounding period) Similar to finding the interest rate, when the compounding period is asked, the general formula will still be utilized and algebra will be used. However, to do away with the derivation, when the compounding period is unknown, the following formula is suggested: n = ln (FV/PV) / ln (1 + i) ln (in scientific calculator) – Natural Logarithm Example: If sales grow at 10% per year, how long before sales double? n = ln (2 / 1) / ln (1+.10) n = 0.69314718 / 0.0953101 n = 7.27 years ANNUITIES In the previous examples, a single sum of money was the focus. In practice however, annuities are more used. Annuity refers to a series of payments made at equal intervals. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, etc. An annuity has two requisites: first, there is a regular payment of fixed amount; second, the payment is done on a regular interval. There are two types of annuity: Ordinary Annuity and Annuity Due. In an ordinary annuity, the payment is made at the end of the period while in annuity due, the payment is made at the beginning of the period. Graphically, the difference between the two can be illustrated as follows: Future Value of an Ordinary Annuity Computing the future value of an annuity involves the determination of the total value of a series of cash flow at a certain time in the future. That is, its total value at end of X number of years. Once again, ordinary annuity means, the cash flow is received/paid at the end of the period. The formula to compute for the future value of an ordinary annuity is given as follows: Where: FVOA – Future Value of all payments PMT – regular annuity payments i – interest n – compounding period Example: Find the future value of a 3-Year Ordinary Annuity of $100 at 4% FVOA = 312.16 Future Value of An Annuity Due Just like the present value of an annuity due, future value of an annuity due begins the first payment at the start of each period, giving it an additional period of compounding. Therefore, the formula is just an extension of the future value of ordinary annuity, multiplied by the additional compounding period, summarized below: FVAD = 312.16 (1.04) FVAD = 324.65 DISCOUNTING vs. COMPOUNDING Compounding method is used to know the future value of present money. Conversely, discounting is a way to compute the present value of future money. In other words, they are the reverse of each other. To be technically correct, when asked to compute for the present value, we refer to the process as discounting. Compounding on the other hand is appropriate term for solving future values. Perpetuity A stream of level cash payments that never ends, in other words, FOREVER. Present value of a Perpetuity is determined using the following formula: Where: PV is the present value PMT is the regular cash flow i is the interest rate Example: In order to create an endowment, which pays $100,000 per year, forever, how much money must be set aside today in the rate of interest is 10%? Solution: PV = 100,000 / 0.10 PV = 1,000,000 Example: Continuing the preceding example, if the first perpetuity payment will not be received until three years from today, how much money needs to be set aside today? Solution: PV = 1,000,000 (1+.10)-3 PV = 751,315 Uneven Cash Flow Streams In certain instance, cash flows are not even per period. If this is the case, computation of either the present value or future value will use the simple formula, and not the annuity. Consider the following example: Year Cash Flow 1 0 2 100 3 300 4 300 5 -50 The present value of the series of cash flow above at 4% interest is determined as follows: PV = FV (1+i)-n 100 (1+.04)-1 = 96.15 300 (1+.04)-2 = 277.37 300 (1+.04)-3 = 266.70 -50 (1+.04)-4 = -42.74 Total 597.48 (Present Value) Using the same example, the future value of the series of cash flow above at 4% interest is determined as: FV = PV (1+i)n 100 (1+.04)3 = 112.49 300 (1+.04)2 = 324.48 300 (1+.04)1 = 312.00 -50 (1+.04)0 = (50.00) Total 698.97 (Future Value) Note: The “n” in the equation is determined by the distance of each cash flow to the end point. In the case of present value, the end point is Year 0. Hence, 100 will travel one period back, 300 will travel two years back, and so on. Notice also that the exponent is negative since it goes back to year zero. For the future value, the end point is Year 4. So 100 in the first year will move three periods to reach year 4, the 300 in year two by two periods, the 300 in year three by one period and the -50 by 0 since, it is on the same period. Compounding/Discounting Period The “n” in the formula does not necessarily indicate the time. It is the number of compounding periods. Time is normally measured in years and the timing of cash flow may not always be annually. It is therefore necessary to identify the compounding period or the number of times in a year cash flow is received or paid. For ease of understanding, the following are provided: Timing No. of Compounding Annual 1 Semi-Annual 2 Quarterly 4 Monthly 12 Bi-monthly 24 Weekly 52 Daily 365 Note: The more frequent is the compounding, the greater is its effect on the value of a sum of money. Classification of Interest Rates Nominal rate (INOM): also called the quoted or stated rate. An annual rate that ignores compounding effects. o INOM is stated in contracts. Periods must also be given, e.g. 4% quarterly or 4% daily interest. Periodic rate (IPER): amount of interest charged each period, e.g. monthly or quarterly. o IPER = INOM/M, where M is the number of compounding periods per year. M = 4 for quarterly and M = 12 for monthly compounding. Effective (or equivalent) annual rate (EAR = EFF%): the annual rate of interest actually being earned, considering compounding. o EFF% for 4% semiannual interest EFF% = (1 + INOM/M)M – 1 = (1 + 0.04/2)2 – 1 = 4.04% o Should be indifferent between receiving 4.04% annual interest and receiving 4% interest, compounded semiannually. Why is it important to consider effective rates of return? Investments with different compounding intervals provide different effective returns. To compare investments with different compounding intervals, you must look at their effective returns (EFF% or EAR). See how the effective return varies between investments with the same nominal rate, but different compounding intervals. EARANNUAL 4.00% EARSEMIANNUALLY 4.04% EARQUARTERLY 4.06% EARMONTHLY 4.07% EARDAILY (365) 4.08% When is each rate used? INOM: Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines. IPER: Used in calculations and shown on time lines. If M = 1, INOM = IPER = EAR. EAR: Used to compare returns on investments with different payments per year. Used in calculations when annuity payments don’t match compounding periods. Example: What is the FV of $100 after 3 years under 4% semiannual compounding? Quarterly compounding? Can the effective rate ever be equal to the nominal rate? Yes, but only if annual compounding is used, i.e., if M = 1. If M > 1, EFF% will always be greater than the nominal rate. Timing of Cash Flow Does Not Coincide with Compounding Period There may be cases where the timing of the cash flow does not coincide with the compounding period. In such instance, the normal annuity valuation cannot be used. Let’s take for example the following illustration: Example: What’s the FV of a 3-year $100 annuity, if the quoted interest rate is 4%, compounded semiannually? Observation: Payments occur annually, but compounding occurs every 6 months. Graphically, it can be shown as: Loan Amortization Amortization tables are widely used for home mortgages, auto loans, business loans, retirement plans, etc. Financial calculators and spreadsheets are great for setting up amortization tables. EXAMPLE: Construct an amortization schedule for a $1,000, 4% annual rate loan with 3 equal payments. The first issue in constructing an amortization table is the determination of the key elements. Amortization table, such as any loan, or mortgage is always a problem of present value. The principal amount is the present value and more often, we will be asked to compute for the regular payments. In the problem above, the following are dissected: Present Value – 1,000 Interest Term - 4% - 3 years Compounding - Annual PMT - Unknown To compute for the PMT, the present value of an ordinary annuity formula will be used: Elaborate: Time Value of Money Sample Problems The following are additional illustrations to help further digest the topics on time value of money. Example 4. Ordinary annuity future value You are planning on investing $3,500 in the stock market every year for your retirement. You will make your first investment at the end of this year. The average rate of return you expect to earn is 7%. How much money do you expect to have when you retire forty years from now? Example 5. Annuity due future value Your parents are giving you $3,000 at the beginning of each year for four years. You are saving this money and earning a 2.5% rate of return on your savings. How much money will you have at the end of the four years? Solution: Example 6. Annuity – annual payments You plan on retiring at age 60 and then living another 25 years. Your goal is to have $500,000 in your retirement savings on the day you retire and spend it all by the time you die. During your retirement, you expect to earn 5% on your savings. a. How much money can you withdraw from your savings each year during your retirement if you withdraw the funds on the last day of each year? b. What if you withdraw the money on the first day of each year? Solution: Example 7. Annuity – monthly payments You currently owe $3,780 on your credit card. You are not charging any more on the account. The interest rate is 1.5% per month. How much do you have to pay each month if you want to have this bill paid off within two years? Solution: In the example above, notice that the payment occurs on a monthly basis. The general formula presented above is for the per period interest and “n” corresponds to the number of periods. The interest therefore remains at 1.5% (monthly rate). The annual rate is 1.5% x 12, which is 18%. There are 24 months in 2 years, thus, “n” is 24. The computed payment is the monthly amortization. Also, since this is a loan problem, present value is to be used. Example 8. Annuity – quarterly payments Your company recently borrowed $12,000 to buy some office equipment. The financing terms call for eight equal quarterly payments. The interest rate is 10%. What is the amount of each quarterly payment? Example 9. Annuity time periods You own a landscaping business. Your goal is to purchase a professional lawnmower costing $7,500. To do this, you are saving $2,000 a year. Your savings account pays 3% interest. How long will you have to wait to buy the lawnmower if you want to pay cash for the purchase? Solution: Example 10. Effective annual rate You have a credit card with a quoted annual percentage rate of 17.9%. Interest is applied to your account monthly. What is the effective annual rate? Solution EAR = (1 + 0.179/12)12 – 1 EAR = 0.1944 = 19.44% Example 11. Continuous compounding What is the effective annual rate of 14.9% compounded continuously? Solution: Formula for EAR using continuous compounding: EAR= ei – 1 EAR = e 0.149 – 1 EAR = 2.71828 0.149 – 1 EAR = 0.16067 = 16.07% Note: The “e” in continuous compounding is constant and is found in scientific calculators.