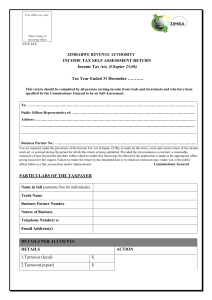

Philippine Taxpayer Classification & Income Tax Guide

advertisement