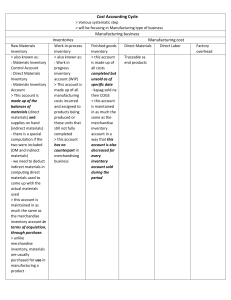

Acc 2302 Fall 2019 Final Exam Note Sheet Basic Concepts Product Cost = DM + DL + VOH + FOH Costs = All Manufacturing Costs Period Costs = Selling and Administrative Costs = Non-Manufacturing Costs Product Cost is attached to inventory and expensed only when product sold as COGS. Period Cost is not attached to inventory and is expensed as incurred i.e. in the same period that the cost is incurred. The elements of product cost flow through WIP and Finished Goods Inventory accounts. Beginning DM Inventory Cost + Cost of DM Purchases – Cost of DM Used in Production = Ending DM Inventory Cost Beginning WIP Cost + Cost of DM Used + Cost of DL Used + OH Cost – Cost of Goods Made = Ending WIP Cost Beginning FG Cost + Cost of Goods Made – COGS = Ending FG Cost High Low Method Variable cost component or rate = Difference in total costs / Difference in activity of cost driver Fixed cost = Total cost – Variable costs (may use either High or Low activity point of cost driver) Cost Volume Profit Analysis Unit CM = Selling Price – Unit Variable Cost Breakeven Sales Volume = Fixed Costs / Unit CM Sales Volume to attain Targeted Profit = [Fixed Costs + Targeted Profit] / Unit CM Dollar Breakeven Sales Revenue = Breakeven Sales Volume times Selling Price = Fixed Costs / CM Ratio CM Ratio = Unit CM / Selling Price Operating Leverage = Contribution Margin / Operating Income Margin of Safety Units = Current or Expected Sales Volume – Breakeven Sales Volume For a multiple product scenario, the first step is constructing a representative single product to come up with selling price, unit variable cost and unit CM for the representative product using the sales mix provided. Job Order Costing Under Normal Costing, it is Applied OH, not Actual OH that enters WIP. Beg WIP Cost + Actual Cost of DM Used + Actual Cost of DL Used + Applied OH – Cost of Completed Jobs = End WIP Cost Beginning FG Cost + Cost of Completed Jobs – Unadjusted COGS = Ending FG Cost Applied OH = Predetermined OH Rate times Actual Activity of Cost Driver Predetermined OH Rate = Budgeted OH Cost / Budgeted Activity of Cost Driver Actual OH Cost > Applied OH Cost means OH was underapplied by the difference between Actual OH Cost and Applied OH Cost. For underapplied OH, COGS is adjusted by adding the difference to unadjusted COGS. The opposite scenario is overapplied OH with opposite adjustment to unadjusted COGS. Process Costing (Only WA method was covered) WA EUP = EUP in Ending Inventory + Units Completed or Transferred Out EUP in Ending Inventory = Units in Ending Inventory times % Completion of Ending Inventory Units WA Cost per EUP = [Cost of Beginning Inventory + Current Period Costs] / WA EUP Cost of Ending Inventory = WA Cost per EUP times EUP in Ending Inventory Cost of Goods Manufactured or Transferred Out = WA Cost per EUP times Units Completed or Transferred Out 1 Absorption Costing All manufacturing costs, including fixed manufacturing costs, are included in product cost. FOH is another name for fixed manufacturing costs. Unit product cost = All manufacturing costs incurred / Total Units Produced Unit product cost is also = [DM Cost + DL Cost + VOH + FOH]/Total Units Produced COGS = Unit product cost times Units sold So when units sold < Units produced, a portion of the FOH incurred does not enter COGS in the same period, and instead remains in ending inventory. Gross Margin = Sales Revenue – COGS Operating Income = Gross Margin – Period Costs (both fixed and variable) Variable Costing Fixed Manufacturing Costs are not included in product cost and instead treated as period costs. Unit Variable product cost = [All manufacturing costs incurred – FOH] / Total Units Produced Unit Variable product cost is also = [DM Cost + DL Cost + VOH]/Total Units Produced Variable COGS = Unit Variable product cost times Units sold CM = Sales Revenue – Variable COGS – Variable Selling and Admin Costs Operating Income = CM – Fixed Costs (both manufacturing and non-manufacturing) So entire FOH incurred is always expensed in the same period. Profit Planning and Operational Budgeting • • • • Use Sales Budget and desired ending inventory of finished product to come up with Production Budget. Use Production Budget, quantity of RM needed to make one unit of finished product, and desired inventory of RM to come up with RM Purchase Budget. Use Sales Budget, percentage of cash sales, percentage of credit sales and collection policy or experience with credit sales to come up with Cash Receipts Budget. Use RM Purchase Budget, percentage of cash purchases, percentage of credit purchases and payment policy on credit purchases to come up with Cash Payments or Disbursements Budget. Variance Analysis Flexible Budget Cost for Actual Output = Std Cost Per Unit of Output times Actual Output Variance = Actual Cost vs Flexible Budget Cost for Actual Output DM Price Variance = |AP – SP| times AQ DM Usage Variance = |AQ – SQ for Actual Output| times SP DL Rate Variance = |AR – SR| times AH DL Efficiency Variance = |AH – SH for Actual Output| times SR DL Rate Variance = |AR – SR| times AQ of Cost Driver DL Efficiency Variance = |AQ of Cost Driver – SQ of Cost Driver for Actual Output| times SR FOH Spending Variance = Actual Cost vs Budgeted Cost FOH Volume Variance = Applied FOH vs Budgeted Cost Performance Evaluation 𝑅𝑂𝐼 = 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠 = 𝑡𝑖𝑚𝑒𝑠 = 𝑀𝑎𝑟𝑔𝑖𝑛 𝑡𝑖𝑚𝑒𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 Residual Income = Operating Income – [Cost of Capital times Average Assets] 2