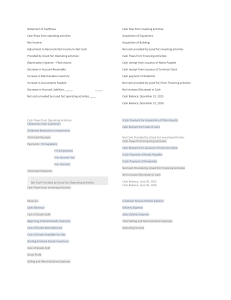

MODULE 2 CASH FLOW STATEMENT EXERCISES EXERCISE 1 The Delta company uses indirect method to prepare its statement of cash flows. The list of various activities performed by the company during the year 2019 is given below: 1. Purchase of treasury stock 2. Purchase of available for sale investment 3. Sale of equipment at a loss 4. Increase in accounts payable 5. Retirement of bonds 6. Issuance of bonds 7. Decrease in accounts payable 8. Increase in inventory 9. Loan from bank by signing a note 10. Increase in accounts receivable 11. Purchase of equipment by issuing a note 12. Purchase of land and building. 13. Decrease in accounts receivable. 14. Payment of dividends. 15. Issuance of stock for cash. 16. Sale of land at a gain. 17. Depreciation expense. 18. Sale of land at book value. Required: Explain the effect of each activity on the statement of cash flows of the Delta company for the year 2019. Exercise-2 The Big and Fast company provides the following information about its activities in the year 2019. Marketable securities purchased (Trading Securities): $45,000 Treasury stock purchased: $56,000 Inventory purchased: $412,000 Land sold: $95,000 Machinery purchased: $278,000 Common stock (Ordinary share) issued: $168,000 Required: Compute net cash provided/used by investing activities to be reported in the statement of cash flows of Big and Fast company. Exercise 3 The P&G company provides the following information for the year 2019: 1. 2. 3. 4. 5. Old plant asset sold for $164,000 and the gain on such sale was of $5,000. Treasury stock purchased for $42,000. Investment purchased for $25,000. A new plant asset purchased for $115,000. Common stock (Ordinary share) issued for $375,000 Required: Calculate net cash provided/used by investing activites for P&G company using above information. Exercise 4 The Lucky company uses direct method to prepare its statement of cash flows and wants your assistance in computing the total cash paid to suppliers of inventory during the year 2016. The company presents you the following information about its inventory, accounts payable and cost of goods sold for the year 2019: Inventory on January 1, 2016: $40,000 Inventory on December 31, 2016: $75,000 Accounts payable on January 1, 2016: $22,000 Accounts payable on December 31, 2016: $35,000 Cost of goods sold for the year 2016: $350,000 Required: Calculate total cash paid to suppliers of inventory by Lucky company during the year 2019. Exercise 5 The Metro company’s cost of goods sold for the current year is $145,000. The beginning and ending balances of its merchandise inventory and accounts payable are given below: Merchandise inventory at the beginning of the year: $40,000 Merchandise inventory at the end of the year: $32,000 Accounts payable at the beginning of the year: $29,000 Accounts payable at the end of the year: $15,000 Required: Compute the total cash paid to suppliers of inventory during the period using above information. ANSWERS and Solutions Exercise 1 1. Purchase of treasury stock is reported as cash outflow in financing activities section. 2. Purchase of available for sale investment is reported as cash outflow in investing activities section. 3. Sale of equipment at a loss will affect two sections – operating activities section and investing activities section. As the company uses indirect method, the loss on sale of equipment will be added back to the net operating income in the operating activities section and the total proceeds realized from the sale of equipment will be reported as cash inflow in investing activities section. 4. Increase in accounts payable is added to net income in the operating activities section to convert accrual based net income to net cash provided by operating activities. 5. The retirement of bonds is a financing activity and reported as cash outflow in financing activities section. 6. The issuance of bonds brings cash in the company. It is also a financing activity and reported as cash inflow in financing activities section. 7. Decrease in accounts payable is deducted from net income in the operating activities section to convert accrual based net income to net cash provided by operating activities. 8. Increase in inventory is deducted from net income in operating activities section. 9. Loan from bank by signing a note is a financing activity. It is reported as inflow of cash in financing activities section of statement of cash flows. 10. Increase in accounts receivable is deducted from net income in operating activities section. 11. Purchase of equipment by issuing a note is a non-cash investing activity. See non-cash investing and financing activities and their disclosure. 12. Purchase of land and building are investing activities and are disclosed as cash outflows in investing activities section. 13. Decrease in accounts receivable is added to net income in the operating activities section. 14. Payment of dividend is a financing activity and the outflow of cash resulting from such activity is reported in financing activities section of the statement of cash flows. 15. Issuance of stock is a financing activity, the resulting cash inflow is reported in financing activities section. 16. Sale of land at a gain is an investing activity. The total sale proceeds are reported under investing activities section. The amount of gain is deducted from net income in the operating activities section. 17. Depreciation expenses are non-cash expenses and are added back to net operating income in operating activities section to convert accrual based net income to net cash provided by operating activities. 18. Sale of land at book value is an investing activity, the inflow of cash resulting from the sale of land is reported in investing activities section. Exercise 2 Solution: Note: The following activities have not been included in the above computation because these are not investing activities. 1. Purchase of treasury stock – a financing activity. 2. Purchase of inventory – an operating activity. 3. Issuance of common stock – a financing activity. Exercise 3 Solution: Notes: 1. The sale proceeds of old plant asset of $164,000 include gain of $5,000. 2. Purchase of treasury stock and the issuance of common stock are not investing activities. Exercise 4 Solution: *Increase in inventory during the period: 75,000 – 40,000 = 35,000 **Increase in accounts payable during the period: 35,000 – 22,000 = 13,000 Exercise 5 Solution: *Decrease in inventory during the period: $40,000 – $32,000 = $8,000 **Decrease in accounts payable during the period: $29,000 – $15,000 = $14,000