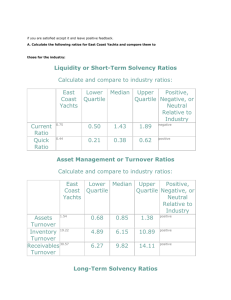

Question No. 1: Calculate all of the ratios listed in the industry table for East Coast Yachts. Ratio Current Ratio Quick Ratio Total Asset Turnover Ratio Inventory Turnover Ratio Receivable Turnover Ratio Debt Ratio Debt-Equity Ratio Equity Multiplier Interest Coverage Profit Margin Formula 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑆𝑎𝑙𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 Calculation 14.651.000 19.539.000 14.651.000 − 6.316.000 19.539.000 167.310.000 108.615.000 𝐶𝑂𝐺𝑆 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 117.910.000 6.136.000 𝑆𝑎𝑙𝑒𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 167.310.000 5.437.000 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 108.615.000 − 55.342.000 108.615.000 𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 53.274.000 55.341.000 108.615.000 55.341.000 𝐸𝐵𝐼𝑇 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 23.946.000 3.009.000 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠 12.562.200 167.310.000 Answer 0.74 Times 0.43 Times 1.54 Times 19.2 Times 30.57 Times 0.49 Times 0.96 Times 1.96 Times 7.96 Times 7.5% Return on Assets 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 Return on Equity 11.5% 12.562.200 108.615.000 12.562.200 55.341.000 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 22.6% Question No. 2: Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you interpret this ratio? How does East Coast Yachts compare to the industry average? Liquidity Ratios Comparison ( Times) Quick Ratio Current Ratio 0% 10% 20% 30% 40% 50% 60% 70% 80% Current Ratio 0,5 Quick Ratio 0,21 MEDIAN 1,43 0,38 UPPER QUARTILE 1,89 0,62 EAST COAST YACHTS 0,75 0,44 LOWER QUARTILE 90% 100% Interpretation: Current Ratio of East Coast is high as compared to Lower Quartile means better ability to pay current liabilities but very low as compared Median and Upper Quartile which means low solvency position. Quick Ratio is high than Lower Quartile but low than Median and Upper Quartile showing that less solvent if inventory is deducted from Current Assets. Turnove Ratios Comparison Receivables Turnover Inventory Turnover Total Asset Turnover 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total Asset Turnover 0,68 Inventory Turnover 4,89 Receivables Turnover 6,27 MEDIAN 0,85 6,15 9,82 UPPER QUARTILE 1,38 10,89 14,11 EAST COAST YACHTS 1,54 19,22 30,57 LOWER QUARTILE Interpretation: Total Asset Turnover Ratio is high as compared to all industry ratios which mean that East Coast is utilizing its assets very well to generate revenues. Inventory Turnover Ratio is high as compared to all industry ratios which mean that East Coast is converting its inventory into cash maximum times a year. Receivable Turnover Ratio is also high as compared to all industry ratios which mean that East Coast is receiving cash from receivables maximum times a year. Long Term Solvency Ratios Comparison Equity Multiplier Debt-Equity-Ratio Debt Ratio 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Debt Ratio 0,44 Debt-Equity-Ratio 0,79 Equity Multiplier 1,79 MEDIAN 0,52 1,08 2,08 UPPER QUARTILE 0,61 1,56 2,56 EAST COAST YACHTS 0,49 0,96 1,96 LOWER QUARTILE Interpretation: According to Debt Ratio, East Coasts is less able to pay its liabilities than Upper and Median Quartile but more than Lower Quartile. Debt to Equity Ratio is less than Upper and Median Quartile means portion of equity is more than debt showing good solvency position of East Coasts. And Vice Versa comparison to Lower Quartile. Equity Multiplier shows that East Coasts equity is 1.96 times of the assets which is low as compared to Upper and Median Quartile but more than Lower Quartile. Coverage Ratios Comparison Interest Coverage 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Interest Coverage 5,18 LOWER QUARTILE MEDIAN 8,06 UPPER QUARTILE 9,83 EAST COAST YACHTS 7,96 Interpretation: According to the Ratio, East Coast can pay interest payments 7.96 times which is low / not favorable than Upper and Median Quartile but high than Lower Quartile. Profitibility Ratios Comparison ROE ROA Profit Margin 0% LOWER QUARTILE 20% Profit Margin 4,05% 40% 60% ROA 6,05% 80% ROE 9,93% MEDIAN 6,98% 10,53% 16,54% UPPER QUARTILE 9,87% 13,21% 26,15% EAST COAST YACHTS 7,51% 11,57% 22,70% 100% Interpretation: Profit Margin of East Cost is high than Lower Quartile and Median showing high return on sale but low as compared to Upper Quartile. Return on Assets of East Cost is high than Lower Quartile and Median mean high revenues in sale of assets but low as compared to Upper Quartile. Return on Equity of East Cost is high than Lower Quartile and Median but low as compared to Upper Quartile. Overall Comparison To Industry Ratio Positive /Negative Reason Liquidity Ratios Positive Short Term Solvency Position of East Coast is good as compared to Industry. Turnover Ratios Positive Coverage Ratios Negative Turnover Ratios are all positive as compared to Industry Interest Paying Ability is not very good Overall. Long Term Solvency Ratios Profitability Ratios Negative Long Term paying ability is not too good as compared to Industry. Positive Al are positive as compared to Industry. Question No. 3: Calculate the sustainable growth rate of East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe? Sustainable Growth rate: 𝑹𝑶𝑬 ∗ ( 𝟏 − 𝑫𝑰𝑽𝑰𝑫𝑬𝑵𝑫 𝑷𝑨𝒀𝑶𝑼𝑻 𝑹𝑨𝑻𝑰𝑶) ROE = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 ÷ 𝐸𝑞𝑢𝑖𝑡𝑦 ROE = 12562200 / 55341000 = 22% Dividend Payout = Total Dividend / Net Income = 75, 37,320/ 125, 62,200 = 0.6 Sustainable Growth Rate = 22% * (1 - 0.6) = 9.08% INCOME STATEMENT FOR THE YEAR ENDED 2009 Particulars Sales Cost of Goods Sold Other Expenses Depreciation (No Change) EBIT Interest (No Change) Taxable Income Taxes (40%) Net Income Dividends Addition to RE Amount By Growth Rate of 9.08% 18,25,01,748 (12,86,16,228) (2,18,09,455.2) (5,460,000) 26616064.8 (3,009,000) 2360,70,64.8 (94,42,826) 14,16,42,39 88,21,708.6 53,42,530 BALANCE SHEET AS ON 2009 Assets Current Asset Cash Account Receivables Inventory Total Current Asset Fixed Assets Net Plant & Equipment Total Assets Amount Liabilities & Equity Current Liability 33,18,213.6 Account Payable 59,69,948.4 Notes Payable 66,93,148.8 Total Current Liability 1,29,81,301.8 Long Term Debt (No Change) 10,24,95,931.2 SHAREHOLDER'S EQUITY Common Stock Retained Earnings Total Equity 11,84,77,242 Total Liabilities & Equity Amount 70,47,658.8 1,42,65,482.4 2,13,13,141.2 3,37,35,000 56,72 160 5,56,93,802.8 6.03.65,962.8 11,54,14,104 Calculation of External Fund Needed: External Funds needed will be the value that a firm needs to take loan. Here Long Term Debt is constant so External Fund Needed will be calculated as follows: External Fund Needed = Total Assets – Total Liabilities & Equity = 11,84,77,242 - 11,54,14,104 = 30, 63,186 RATIO ANALYSIS WITH SUSTAINABLE GROWTH RATE OF 9.08% Ratio Current Ratio Quick Ratio Total Asset Turnover Ratio Inventory Turnover Ratio Receivable Turnover Ratio Debt Ratio Debt-Equity Ratio Equity Multiplier Interest Coverage Profit Margin Return on Assets Return on Equity Formula 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 Calculation 1,29,81,301.8 2,13,13,141.2 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 1,29,81,301.8 − 66,93,148.8 2,13,13,141.2 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑆𝑎𝑙𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 18,25,01,748 11,84,77,242 𝐶𝑂𝐺𝑆 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 12,86,16,228 66,93,148.8 𝑆𝑎𝑙𝑒𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 18,25,01,748 59,69,948.4 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 11,84,77,242 − 6.03.65,962.8 11,84,77,242 𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 2,13,13,141.2 + 3,37,35,000 6.03.65,962.8 11,84,77,242 6.03.65,962.8 𝐸𝐵𝐼𝑇 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 26616064.8 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠 14,16,42,39 18,25,01,748 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 14,16,42,39 11,84,77,242 14,16,42,39 6.03.65,962.8 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 Answer 0.60 Times 0.29 Times 1.54 Times 19.2 Times 30.57 Times 0.49 Times 0.91 Times 1.96 Times 7.96 Times 3,009,000 7.76% 11.9% 23.46 % Comparison of Ratios with and without Sustainable Growth Rate Ratio Without Sustainable Growth Rate With Sustainable Growth Rate (9.08%) Effect 0.74 Times 0.60 Times A Little Bit Change 0.43 Times 0.29 Times A Large Change Total Asset Turnover Ratio 1.54 Times 1.54 Times No Effect Inventory Turnover Ratio 19.2 Times 19.2 Times No Effect Receivable Turnover Ratio 30.57 Times 30.57 Times No Effect Debt Ratio 0.49 Times 0.49 Times No Effect Debt-Equity Ratio 0.96 Times 0.91 Times A Little Bit Change Current Ratio Quick Ratio Equity Multiplier 1.96 Times 1.96 Times No Effect Interest Coverage 7.96 Times 7.96 Times No Effect Profit Margin 2.5% 7.76% A Large Change Return on Assets 11.5% 11.9% No Effect Return on Equity 22.6% 23.46 % A Little Bit Change 11,90% 11,50% 0,12 0,1 7,76% 0,08 0,06 0,04 2,50% 0,02 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Without Sustainable Growth Rate With Sustainable Growth Rate (9.08%) Analysis: Sustainable Growth Rate which is used to check to Firm’s ability of growing without taking Loan. After calculating Sustainable Growth Rate, Long Term Debt, Interest and Dividends are kept Constant to check it. According to the above analysis, it is shown that Sustainable Growth Rate have no effect on Turnover, Coverage, Equity Multiplier Ratios and Long Term Solvency Position but have an effect on Profits and Equity Returns. Question No. 4: As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital, in part because the owners don’t want to dilute their existing ownership and control positions. However, East Coast Yachts is planning for a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast’s expansion plans? Here, the given Sustainable Growth Rate is 20%.Now according to that rate we will form a new Balance Sheet and Income Statement. INCOME STATEMENT FOR THE YEAR ENDED 2009 Particulars Sales Cost of Goods Sold Other Expenses Depreciation (No Change) EBIT Interest (No Change) Taxable Income Taxes (40%) Net Income Dividends Addition to RE Amount (Growth Rate 20%) 20,07,72,000 14,14.92,000 2,39,92,800 54,60,000 2,98,27,200 30,09,000 2,68,18,200 1,07,27,280 1,60,90,920 96,54,552 64.36,368 BALANCE SHEET AS ON 2009 Assets Current Asset Cash Account Receivables Inventory Total Current Asset Fixed Assets Net Plant & Equipment Amount Liabilities & Equity Current Liability 36,50,400 Account Payable 65,67,600 Notes Payable 73,63,200 Total Current Liability 1,75,81,200 Long Term Debt (No Change) 11,27,56,800 SHAREHOLDER'S EQUITY Common Stock Retained Earnings Total Equity 13,03,38,000 Total Assets Total Liabilities & Equity Amount 77,53,200 1,56,3,600 2,34,46,800 3,37,35,000 52,00,000 5,65,77,368 6,17,77,368 11,89,59,168 Calculation of External Fund Needed: External Funds needed will be the value that a firm needs to take loan. Here Long Term Debt is constant so External Fund Needed will be calculated as follows: External Fund Needed = Total Assets – Total Liabilities & Equity = 13,03,38,000 - 11,89,59,168 = 1,13,78,832 Conclusion: If the East Coast Firm have a growth rate of 20% then its profit will be $ 2,68,18,200 without taking loan and extra fund they will need is of $ 1,13,78,832 Question No. 5 Most assets can be increased as a percentage of sales. For instance, cash can be increased by any amount. However, fixed assets often must be increased in specific amounts because it is impossible, as a practical matter, to buy part of a new plant or machine. In this case a company has a “staircase” or “lumpy” fixed cost structure. Assume that East Coast Yachts is currently producing at 100 percent of capacity. As a result, to expand production, the company must set up an entirely new line at a cost of $30 million. Purchase of Fixed Asset will cause changes in Depreciation in Income Statement and in Total Fixed Assets in Balance Sheet. Effect on Fixed Asset: New Asset Purchased = 3 million New Total Fixed Assets = 93,964,000 + 30,000,000 = 12,39,64,000 Effect on Depreciation New Depreciation will be calculated on the basis of old depreciation percentage. Old Depreciation Percentage = 5,460,000 ÷ 93,964,000 = 5.8% New depreciation= 12,39,64,000 * 5.8% = 7,203,221 INCOME STATEMENT FOR THE YEAR ENDED 2009 Particulars Sales Cost of Goods Sold Other Expenses Depreciation EBIT Interest (No Change) Taxable Income Taxes (40%) Net Income Dividends Addition to RE Amount (Growth Rate 20%) 20,07,72,000 (14,14.92,000) (2,39,92,800) (72,03,221) 2,80,83,979 (30,09,000) 2,50,74,979 (1,00,29,992) 1,50,44,988 (96,54,552) 60,17,995 BALANCE SHEET AS ON 2009 Assets Current Asset Cash Account Receivables Inventory Total Current Asset Fixed Assets Net Plant & Equipment Total Assets Amount Liabilities & Equity Current Liability 36,50,400 Account Payable 65,67,600 Notes Payable 73,63,200 Total Current Liability 1,75,81,200 Long Term Debt (No Change) 12,39,64,000 SHAREHOLDER'S EQUITY Common Stock Retained Earnings Total Equity 14,15,45,200 Total Liabilities & Equity Amount 77,53,200 1,56,3,600 2,34,46,800 3,37,35,000 52,00,000 5,65,77,368 6,17,77,368 11,89,59,168 Calculation of External Fund Needed: External Funds needed will be the value that a firm needs to take loan. Here Long Term Debt is constant so External Fund Needed will be calculated as follows: External Fund Needed = Total Assets – Total Liabilities & Equity = 14,15,45,200 - 11,89,59,168 = 2,25,86,032 . Conclusion: East Coast Yachts in increasing its fixed assets due to which there is cash out flow but the growth rate for all is same 5.8% which means no cash inflow. It will have to focus on generating more cash revenues to survive because debt loan is already constant