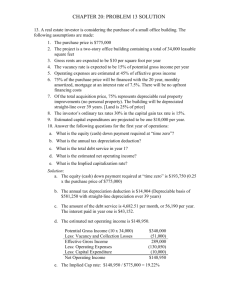

Weekly test no 3 Question 1 (40 Marks: 24 min) Information Figures extracted from the Pre-adjustment Trail Balance on 30 June 2013 Note: Not all accounts provided REQUIRED: Use the information below to prepare Income Statement for the year ended 30 June 2013. Debit Ordinary share capital Vehicles Equipment Accumulated depreciation on vehicles Accumulated depreciation on equipment Trading stock Debtors control Provision for bad debts Creditors control Mortgage loan from YZ Bank Consumables stores on hand (1 July 2012) SARS (income tax) Sales Cost of sales Debtors allowances Rent income Directors fee Audit fees Salaries and wages UIF contribution Consumables stores Bank charges Bad debts Sundry expenses Credit 2 800 000 320 000 154 000 155 000 76 200 219 546 43 000 1 900 78 900 300 000 1034 60 000 3 109 650 2 066 600 9 650 40 900 312 000 21 900 354 000 3 680 4 890 5 870 3 560 42 322 Adjustments and additional information 1. The rent income was increased by R800 on 1 March 2013. The tenant has not yet paid the rent for June 2013. 2. The bookkeeper forgot to write back consumable stores on hand on 1July 2012. 3. According to a physical stock taking done on 30 June 2012 the following were on hand: Trading stock R218 700 Consumables stores R1 320 4. The details of employee, R Subiso, who had been employed on 1 June 2013, was omitted from salaries journal for June 2013. The details were as follows: Gross salary Contribution UIF UIF Pension fund 11 000 1 760 900 150 150 5. The following appeared on the June bank statement, but had not been recorded in the books of the company: Bank charges, R523 A direct deposit by a debtor who had been written off as a bad debt in the previous financial year, R1 300 6. Provision for bad debt must be adjusted to R2 100 7. The following loan statement was received from YZ Bank on 30 June 2013. Interest on loan is capitalised. Balance on 1 July 2012 315 000 Interest capitalised ? Monthly payment of loan (R4000 x 12) 48000 Balance on 30 June 2013 300 000 8. Equipment was sold on 28 February 2013 for R 3000 cash. The details from the fixed Assets Register were: Cost price, R6 600 Accumulated depreciation at the beginning of the year, R3 465 Depreciation is calculated at 15% per annum on the cost price. This asset disposal has not been recorded. 9. Provide for depreciation as follows: On vehicles at 20% per annum on diminishing balance. A new vehicle was purchased on 1 April 2013 for R80 000 and correctly recorded. On equipment at 15% p.a on the cost price 10. A final dividend of 45 cents per share was declared on 30 June 2013. 11. Income tax is calculated at 28% of the net profit. PAYE WEEKLY TEST NO 3 MEMORANDUM Income statement of HB Ltd for the year ended 30 June 2013 Sales (3 109650 - 9650) Cost of sales Gross profit Other income Rent income (40 900 +4 3000) Bad debts recovered Profit on sale of assets (4 125 +3 000 -6600) 3 100 000 √√ (2 066 600) √ 1033 400 √ 47 205 √ 45 200 √√√ 1 300√ 525√√√ GROSS OPERATING PROFIT Operating expenses Directors fees Audit fees Salaries and wages (354 000 +11 000) UIF contribution (3680 +150) Consumables stores (4890 +1034 -1320) Bank charges (5870 +523) Bad debts Sundry expenses Trading stock deficit (219 546 – 218 700) Depreciation (660 + 22 110 + 17 000 + 4000) Provision for bad debts adjustment 1080 425 √ (804 425) √ 312 000√ 21 900√ 365 000√√ 3 830√√ 4 604√√√ 6 393√√ 3 560√ 42 322√ 846√√ 43 770√√√√ 200√ OPERATING PROFIT Interest income Profit before interest expense Interest expense Profit before taxation Taxation Net profit for the year 276 000√ 276 000√ (33 000) √ 243 000√ (68 040) √ 174 960√ WEEKLY TEST NO 3 ANSWERSHEET Income statement of HB Ltd for the year ended 30 June 2013 Sales Cost of sales GROSS PROFIT OTHER OPERATING INCOME GROSS OPERATING PROFIT OPERATING PROFIT Interest income Profit before interest expense Interest expense Profit before taxation Taxation Net profit for the year