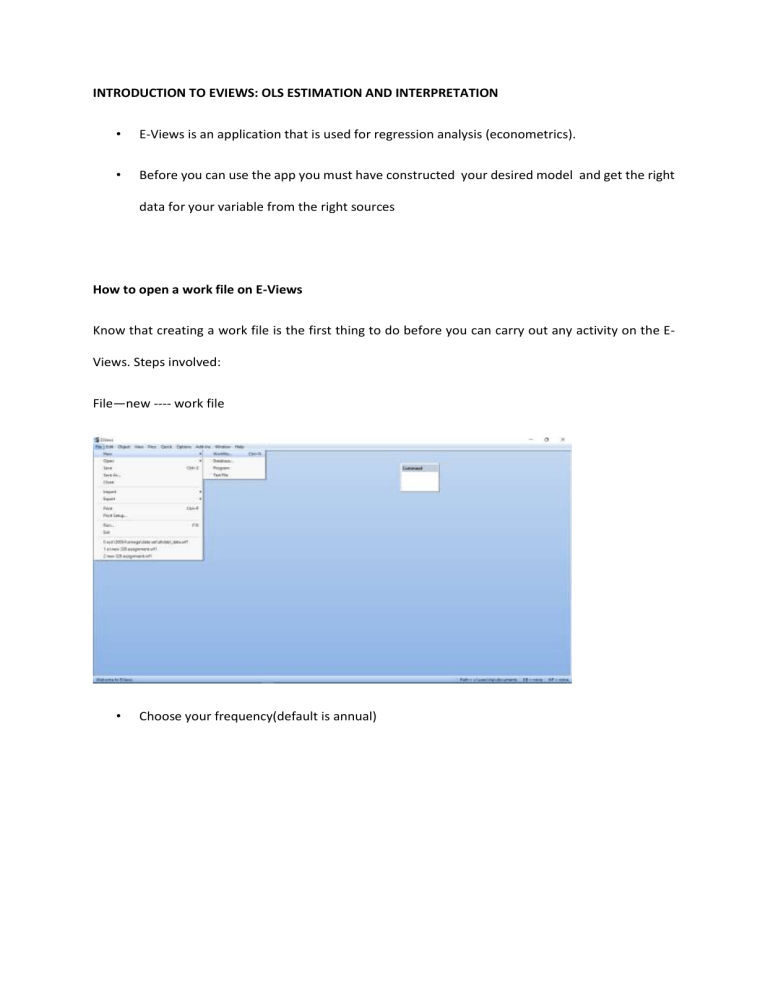

INTRODUCTION TO EVIEWS: OLS ESTIMATION AND INTERPRETATION • E-Views is an application that is used for regression analysis (econometrics). • Before you can use the app you must have constructed your desired model and get the right data for your variable from the right sources How to open a work file on E-Views Know that creating a work file is the first thing to do before you can carry out any activity on the EViews. Steps involved: File—new ---- work file • Choose your frequency(default is annual) • Input the start and end dates of the data you have collected • Note; c-constant resid-error term How to import data • Make sure you have an open excel worksheet with your data • Copy the data from excel; do not copy the years • Go back to the E-Views • Go to quick --- empty group(edit series) • Always scroll up to the very first row then paste Generating your equation • Go to your work file---- click on the dependent variable first( anyone variable you click first is assumed to be the dependent variable, so make sure you click your dependent variable first). • When you do that, click on Ctrl press it down while you click on the other variables • On the highlighted part right click then click on open----- as equation • Do not click on the constant or the residual • Before estimating your residual is unobservable, it is quiet till you estimate. • The diagram below should look like your result Dependent Variable: RGDP Method: Least Squares Date: 02/23/18 Time: 01:51 Sample: 1970 2011 Included observations: 42 Variable Coefficient Std. Error t-Statistic Prob. OILP INTR GFCF EXR C 5087.663 7518.312 -0.591644 1467.617 -30153.42 680.2053 1681.375 0.348262 275.0485 38931.17 7.479599 4.471527 -1.698848 5.335846 -0.774532 0.0000 0.0001 0.0977 0.0000 0.4435 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) 0.941973 0.935700 57951.66 1.24E+11 -517.5629 150.1585 0.000000 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion Hannan-Quinn criter. Durbin-Watson stat 281644.8 228538.7 24.88395 25.09081 24.95977 1.530247 Checking if your variables are significant • After estimating your equation, the question is – is the result significant? • You could use the p- value or the t- statistic • If the absolute value of your t- stat is greater than two, your variable is statically significant • If your p-value is less than 0.05, then it is statistically significant • N.B; if more than 50% of your variables (exclude the constant) are insignificant then there is a problem Your summary Analyses • T-stat is used for statistical significance, while the signs economic significance. Normally we focus on 3 things; • R squared and adjusted R squared • Durbin- watson stats • Probability of F-statistics R-squared • This measures the goodness of fit, it measures how much of the changes in your dependent variable can be jointly explained by your explanatory variables. • It measures how well your estimated regression line fits the data • On the summary if r- square is greater than 0.6 then your estimated regression line is a good fit vice-versa F-stat • This measures the joint significance of your explanatory variables • If the probability of the f- stat is less than 0.05 then your explanatory variables are jointly statistically significant • For the Durbin- Watson stat, if it is less than 1.8 (which is very close to 2) or greater than 2, then there might be a presence of positive and negative autocorrelation respectively, but if it is 2 or approx. 2 (between 1.8 and 2) then it is fine PRACTICE Now let’s practice our analysis on the estimation output displayed above. Economic significance: OILP is economically significant because the positive sign that the coefficient takes agrees with a priori expectation of there being a positive relationship between oil price and real GDP. INTR is economically insignificant because its coefficient has a positive sign and this goes against the a priori expectation that there is a negative relationship between real GDP and interest rate. GFCF (gross fixed capital formation) is economically insignificant because its coefficient has a negative sign which goes the a priori expectation of there being a positive relationship between capital stock and real GDP. EXR is economically significant because it is positively signed and therefore it is in agreement with the a priori expectation is that there is a positive relationship between exchange rate and real GDP; as exchange rate increases, exports become cheaper and hence the demand for them increases causing GDP to rise ceteris paribus. Statistical significance: OILP is statistically significant because the p- value is less than 0.05 (absolute value of t-stat is greater than 2) INTR is statistically significant because the p-value is less than 0.05 (absolute value oft-stat is greater than 2) GFCF is statistically insignificant because the p-value is greater than 0.05 (absolute value of t-stat is less than 2) EXR is statistically significant because the p-value is less than 0.05 (absolute value of t-stat is greater than 2) Finally, since 75% of the explanatory variables are statistically significant (that is higher than 50%) we can move on with our data analysis. Summary statistics The estimated regression line is a very good fit for the data with an R squared and adjusted R squared of 94.12% and 93.57% respectively. The explanatory variables are jointly significant at 150.16 because the probability of F-stat is less than 0.05. Finally, from the Durbin- Watson statistic, there is an indication of positive autocorrelation because the value is less than 1.8.