Mega Fund LBO Case Study: Transportation Management Investment

advertisement

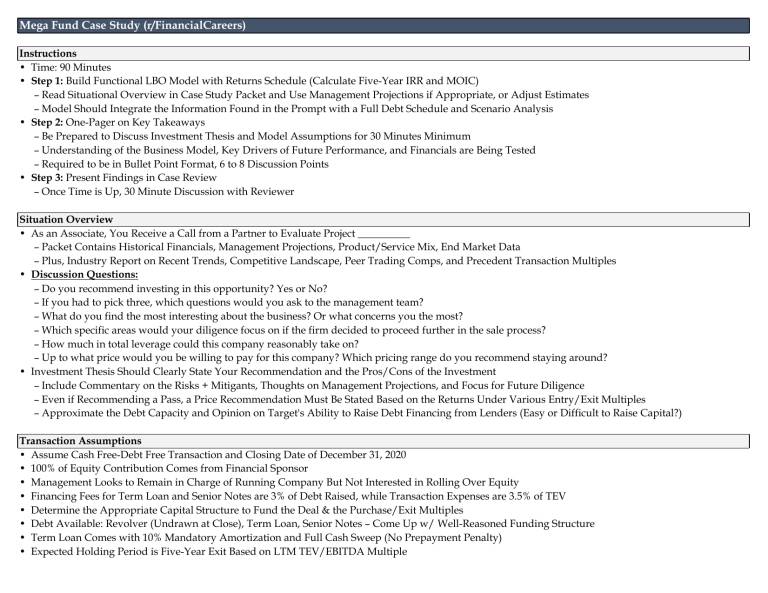

Mega Fund Case Study (r/FinancialCareers) Instructions • Time: 90 Minutes • Step 1: Build Functional LBO Model with Returns Schedule (Calculate Five-Year IRR and MOIC) – Read Situational Overview in Case Study Packet and Use Management Projections if Appropriate, or Adjust Estimates – Model Should Integrate the Information Found in the Prompt with a Full Debt Schedule and Scenario Analysis • Step 2: One-Pager on Key Takeaways – Be Prepared to Discuss Investment Thesis and Model Assumptions for 30 Minutes Minimum – Understanding of the Business Model, Key Drivers of Future Performance, and Financials are Being Tested – Required to be in Bullet Point Format, 6 to 8 Discussion Points • Step 3: Present Findings in Case Review – Once Time is Up, 30 Minute Discussion with Reviewer Situation Overview • As an Associate, You Receive a Call from a Partner to Evaluate Project __________ – Packet Contains Historical Financials, Management Projections, Product/Service Mix, End Market Data – Plus, Industry Report on Recent Trends, Competitive Landscape, Peer Trading Comps, and Precedent Transaction Multiples • Discussion Questions: – Do you recommend investing in this opportunity? Yes or No? – If you had to pick three, which questions would you ask to the management team? – What do you find the most interesting about the business? Or what concerns you the most? – Which specific areas would your diligence focus on if the firm decided to proceed further in the sale process? – How much in total leverage could this company reasonably take on? – Up to what price would you be willing to pay for this company? Which pricing range do you recommend staying around? • Investment Thesis Should Clearly State Your Recommendation and the Pros/Cons of the Investment – Include Commentary on the Risks + Mitigants, Thoughts on Management Projections, and Focus for Future Diligence – Even if Recommending a Pass, a Price Recommendation Must Be Stated Based on the Returns Under Various Entry/Exit Multiples – Approximate the Debt Capacity and Opinion on Target's Ability to Raise Debt Financing from Lenders (Easy or Difficult to Raise Capital?) Transaction Assumptions • Assume Cash Free-Debt Free Transaction and Closing Date of December 31, 2020 • 100% of Equity Contribution Comes from Financial Sponsor • Management Looks to Remain in Charge of Running Company But Not Interested in Rolling Over Equity • Financing Fees for Term Loan and Senior Notes are 3% of Debt Raised, while Transaction Expenses are 3.5% of TEV • Determine the Appropriate Capital Structure to Fund the Deal & the Purchase/Exit Multiples • Debt Available: Revolver (Undrawn at Close), Term Loan, Senior Notes – Come Up w/ Well-Reasoned Funding Structure • Term Loan Comes with 10% Mandatory Amortization and Full Cash Sweep (No Prepayment Penalty) • Expected Holding Period is Five-Year Exit Based on LTM TEV/EBITDA Multiple Lender Debt Terms Revolver ($80M Capacity) 1st Lien Term Loan 2nd Lien Senior Notes Pricing LIBOR + 400 LIBOR + 425 12.50% Tenor 6 Yrs. 6 Yrs. 9 Yrs. Other Assumptions LIBOR 2021E 1.50% Unused Revolver Fee Effective Tax Rate 0.25% 30.0% 2022E 1.60% 2023E 1.70% 2024E 1.90% Cash Interest (Annual) Min. Cash Balance Company Overview (LTM Data) • Target is a Leading Transportation Management (TM) Services Provider Offering Logistics Services and Secure Delivery Tracking (Monitoring) • Proprietary B2B SaaS Platform is Cloud-Based and Enables Transparency from Carriers to Customers • Customer Concentration: ~250 Customers LTM & Top Customer Accounted for 5% of Revenue while Top 5 Accounted for 18.5% of Revenue • Key End Markets: Food & Beverage (40%), Industrials (25%), Healthcare & Pharmaceuticals (20%), Consumer Discretionary (10%), Retail (5%) • 75% of Customer Relationships are > 5 Years & 40% > 10 Years • TM Platform Contracts Structured as Five-Year Contracts Typically (Freight Data Analytics Platform Enables Cost Savings for Management) • Brokerage Services Revenue Comes from % Fee for Connecting Shippers and Carriers, Fee Ranges from 10% to 15% • During Latest Recession, Net Revenue Grew 1.2% in 2008 and 0.8% in 2009 Management Commentary • Industry-Leader in SaaS for TM and Delivery Tracking/Fulfilment on Behalf of Customers • TM Platform is High-Margin (~80%) but Growth CapEx Moderately High to Further Build Out Capabilities (Still Projected CapEx < 5% Revenue) • Differentiated Positioning Relative to Competitors (SaaS-Oriented Business, not Services) • Target's Role in Freight Shipment Value Chain is Closer to Oversight (Provides Software, Largest Network for Brokers/Carriers, Growing Database) • Customers Unwilling to Invest into their own TM Technology (More Cost-Effective to Outsource to 3rd Party) • Competes on Software Quality and Services Related to Carrier Relationship Management – Higher Delivery Standards are Industry Tailwind • Market Share is Modest at ~16.5% in the Freight Brokerage Outsourcing Industry, Liability Concerns are Industry Constraint • Projected Revenue Growth Driven by ~95% Renewal Rate with Minimal Churn & Cross-Selling of Professional Fees with Platform On-Boarding • Largest Margin Improvement Expected in TM Platform Due to Operating Leverage as Division Matures Comps & Market Data • TM Platform Comps Trading Around Low to Mid Teens, Non-Cyclical Valuation Multiples • TM Brokerage Comps Trading Around Mid to High Single Digits, More Cyclical Valuation Multiples • Median TEV/LTM EBITDA: TM Platform Comps = 12.8x & TM Brokerage Comps LTM = 6.4x • SaaS TM Industry is Growing at a CAGR of 4.5% Over the Next 5 Years, whereas Standard Brokerage Industry is Growing at a CAGR of 1.8% 2025E 2.00% 0.25% $5M Income Statement ($ in millions) Historical 2018A 2019A 2020A 2021E Management Projections 2022E 2023E 2024E 2025E Net Revenue TM Platform Fees % YoY Growth (+) TM Professional Fees % YoY Growth (+) Standard Brokerage Services % YoY Growth Total Net Revenue % YoY Growth $56.5 N/A 34.8 N/A 54.6 N/A $145.9 N/A $60.0 6.2% 36.0 3.4% 64.2 17.6% $160.2 9.8% $64.2 7.0% 47.8 32.8% 71.2 10.9% $183.2 14.4% $71.5 11.4% 53.1 11.1% 78.0 9.6% $202.6 10.6% $86.5 21.0% 62.5 17.7% 86.4 10.8% $235.4 16.2% $95.0 9.8% 70.0 12.0% 97.1 12.4% $262.1 11.3% $104.5 10.0% 81.2 16.0% 108.7 11.9% $294.4 12.3% $118.2 13.1% 92.6 14.0% 116.4 7.1% $327.2 11.1% Contribution Per Segment TM Platform Fees % Segment Revenue (+) TM Professional Fees % Segment Revenue (+) Standard Brokerage Services % Segment Revenue Total CM % Total Net Revenue (-) Total OpEx % Total Net Revenue Adjusted EBITDA % EBITDA Margin (-) D&A % of Net Revenue Adjusted EBIT % EBIT Margin $25.0 44.2% 21.0 60.3% 24.0 44.0% $70.0 48.0% (23.0) 15.8% $47.0 32.2% (16.0) 11.0% $31.0 21.2% $27.0 45.0% 24.0 66.7% 28.0 43.6% $79.0 49.3% (24.0) 15.0% $55.0 34.3% (15.5) 9.7% $39.5 24.7% $30.0 46.7% 29.3 61.3% 30.0 42.1% $89.3 48.7% (25.0) 13.6% $64.3 35.1% (15.0) 8.2% $49.3 26.9% $34.6 48.4% 32.1 60.5% 34.0 43.6% $100.7 49.7% (26.0) 12.8% $74.7 36.9% (14.8) 7.3% $60.0 29.6% $42.8 49.5% 38.4 61.4% 36.0 41.7% $117.2 49.8% (30.0) 12.7% $87.2 37.0% (14.5) 6.2% $72.7 30.9% $46.5 48.9% 42.0 60.0% 43.0 44.3% $131.5 50.2% (38.0) 14.5% $93.5 35.7% (14.3) 5.4% $79.3 30.2% $52.4 50.1% 48.6 59.9% 47.0 43.2% $148.0 50.3% (40.0) 13.6% $108.0 36.7% (14.0) 4.8% $94.0 31.9% $62.4 52.8% 56.0 60.5% 53.0 45.5% $171.4 52.4% (42.0) 12.8% $129.4 39.5% (13.8) 4.2% $115.7 35.3% ($4.0) 2.7% (2.8) 1.9% ($6.8) 4.7% ($5.0) 3.1% (3.0) 1.9% ($8.0) 5.0% ($5.8) 3.2% (3.1) 1.7% ($8.9) 4.9% ($5.9) 2.9% (3.8) 1.9% ($9.7) 4.8% ($6.0) 2.5% (4.6) 2.0% ($10.6) 4.5% ($6.0) 2.3% (5.3) 2.0% ($11.3) 4.3% ($6.1) 2.1% (6.4) 2.2% ($12.5) 4.2% ($6.2) 1.9% (6.8) 2.1% ($13.0) 4.0% ($2.0) (1.4%) ($3.2) (2.0%) ($3.8) (2.1%) ($4.0) (2.0%) ($4.5) (1.9%) ($5.1) (1.9%) ($5.8) (2.0%) ($6.0) (1.8%) Maintenance CapEx % of Net Revenue (+) Growth CapEx % of Net Revenue Total CapEx % of Net Revenue Change in NWC % of Net Revenue CAGR '18 to '20 '21 to '25 6.6% 13.4% 17.2% 14.9% 14.2% 10.5% 12.1% 12.7% 9.5% 15.9% 18.1% 14.9% 11.8% 11.7% 12.9% 14.2% 17.0% 14.7% 26.1% 17.9%