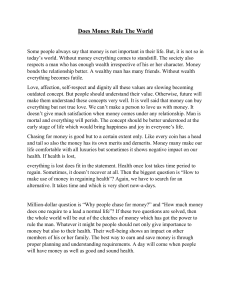

- Building Wealth Report Eric Tseng Tseng.eric611@gmail.com Completed: 02/21/2020 01:17 AM Cultivating Wealth Nannette Kamien nk@cultivatingwealth.com Overview Learn about your unique wealth-building characteristics here! The Building Wealth report is designed to help you understand your patterns of experiences and behaviors related to money management. In this report, you’ll get insights into how your competencies impact your ability to achieve short- and long-term financial goals. More importantly, you’ll get insights into how you can improve your outlook and decisions to improve your overall financial wellness. Building Wealth & Household Financial Management Over 40 years of research on self-made, affluent individuals has demonstrated the importance of several key characteristics when it comes to household financial management. These include: Frugality: a general orientation towards living below your means (Frugality) Confidence: belief in our effectiveness at managing money Control: experiences & behaviors that demonstrate your own view Focus: the ability & display of distraction-free work on financial matters Planning & Monitoring: setting aside time to manage finances and monitoring financial management Social Indifference: ignoring the consumption patterns of others Taken together, these factors are what we call Wealth Potential, or our potential for building and sustaining wealth. Regardless of your age or income, your Wealth Potential helps you understand whether you are on a clear path for building wealth, or if you need to enhance certain competencies to ensure we're financially successful. See how each factor impacts Wealth Potential below. 1 - Getting The Most Out Of The Building Wealth Report Are your financial behaviors similar to those who are exceptional at building wealth? The Building Wealth report answers that question and gives ideas on how you might change your behaviors to enhance your overall propensity to build and maintain wealth. Your gives you insights into how your patterns of behaviors and financial experiences may impact your long-term financial outlook. To get the most out of your report, keep the following tips in mind: You know your household and how it manages its finances better than anyone else. While the Building Wealth report offers some insight into certain characteristics, the value of completing the assessment and interpreting the report lies in considering the results in light of your own complete set of experiences and behaviors, most of which are not measured by the assessment! Make note of how the results impact how you manage your financial life today and the implications for your household's financial health in the future. Recognize how your financial decisions today can impact your financial fitness tomorrow. Read through some of the strategies for enhancing your competencies in the realm of managing finances. Some may appear relevant to you, while others might be less so. To make improvements, it’s critical to focus on a specific factor, and only one or two new habits within that factor. Note that making significant changes takes time. For example, most habits form over the course of several months. How we manage our financial lives is a combination of both our nature (the characteristics we’re born with) and nurture (our environment). The good news for building wealth is that many of the characteristics that are critical for building wealth can be enhanced through self-improvement efforts (building knowledge, changing habits) and working with Cultivating Wealth. Understanding Your Scores 2 - Each area, or Wealth Factor, included in the Building Wealth test addresses an area of behavior or experiences that impact how you accumulate and sustain wealth over time. Your responses to questions were analyzed against DataPoints’ database, and in turn provide you with a percentile score, essentially a mark that demonstrates where you fall on a scale from 0 to 99 in terms of particular experience areas that are critical to building wealth. For example, a score of 65 means that out of 100 respondents to the survey, you scored higher than approximately 65% of the sample. Factor Description Percentile Frugality High 67 Confidence High 70 Control High 70 Planning & Monitoring Low 10 Focus Low 15 Social Indifference High 75 Review the description of each factor and your scores to uncover how you can enhance your wealth-building potential. Working with Cultivating Wealth can help you use this knowledge and personalized recommendations to enhance your wealth potential. 3 - Frugality On a daily and even hourly basis, our spending habits affect our ability to accumulate and maintain wealth. Frugality refers to a general orientation towards being efficient with regards to consuming resources. Frugality can be thought of as a personality trait, mindset, or pattern of behaviors that is critical in building and sustaining wealth. When we think about financial management, frugality is often associated with the concept of “living below your means” spending less each month than your household brings in. Spending less money than your household makes is a critical first step in all other financial management decisions. Most self-made, financially successful individuals indicate that their economic achievement was built upon being frugal (optimizing spending habits and always spending less than they earn). By being consistently frugal when it comes to financial resources, savings can increase. Over time, increasing your savings can help your household reach goals for retirement, buy a home, or fund other large-scale purchases. Those who are frugal tend to spend less in most areas of consumption, especially early on in their wealthbuilding journey. “Being frugal is the cornerstone of wealth-building.” – The Millionaire Next Door, page 29. Your score: 67, High 67 Low Medium High Today Tomorrow You appear to have a firm grasp on what it means to be frugal, and you tend to embrace a more economical approach to spending. You're good at spending the right amount on the things that you need and want, and sometimes you may even define actual "needs" as "wants," allowing you to find ways to reduce spending with superhuman strength. You're better than your peers at consistently living below your means, and you more than likely view spending above your means as a clear “no.” One potential downside of a high score on Frugality is that you might be inclined to forego spending on necessary items or services: watch that your frugality is tempered with common sense. Living below your means will help your household build savings. The benefits of a frugal approach to household management include meeting retirement savings goals, being prepared for emergencies, and enjoying the savings you’ve built. If you have already achieved financial success, being frugal may be less critical than it was when you were first accumulating wealth. Continuing to exhibit frugal behaviors can provide those around you, including children and other people you care about, with a great role model for their own spending and saving habits. Occasionally, those who were frugal throughout their lifetimes find it hard to enjoy and use some of the wealth they’ve spent a lifetime building. If you are nearing or in retirement and have achieved your financial goals, it may be challenging for you to spend in a way that is more on the “wants” side rather than on the “needs” side. The good news? Frugality is both a mindset and specific actions, actions that you can alter to enjoy some of what you’ve earned over time. 4 - Frugality Strategies Consider the following ideas to keep your frugality muscles in shape: Develop and cultivate a sense of respect for consumption and spending discipline in yourself and those around you in a way that is respectful of others’ approach to spending. Be tempered, thoughtful, and moderate in the application of your frugality. Don’t look to optimize spending in situations where the financial benefit is small, but the personal or emotional cost is high. Some spending/consumption may not be strictly rational or optimized, but the sentimental value that you (or your spouse/partner) get from the spending may be worth it. Don’t be penny-wise and pound-foolish. Work with your spouse/significant other to support each other in smart spending behaviors and habits. To get him/her on board, you may need to take time to quantify the future value of money saved and invested today. 5 - Confidence Making money-related decisions can be challenging, especially when there are so many options and opinions about how to manage our financial lives. Those who can build and sustain wealth tend to be confident in their ability to make small and large financial choices and in their effectiveness at managing their financial affairs. Whether this confidence results from years of mentoring by parents, self-study, or trial and error, successful accumulators of wealth are confident in the decisions that they make regarding the financial management of their household. The Confidence factor refers to the level of assurance you have in your money-related choices and your ability to manage the financial details of your life. Your score: 70, High 70 Low Medium Today Compared to others, you tend to be confident in your ability to manage your financial life and in making financial decisions. In general, this confidence will help you build and maintain wealth over time. You generally feel as if you make better financial decisions than others, and you view yourself as a competent household financial manager. You tend to exhibit confidence in your ability to build and maintain wealth and may view your skills and money management as good if not better than professionals. In general, you see yourself as skilled and confident in financial management. High Tomorrow The confidence you have in your ability to manage your financial life and make financial decisions will help (or has helped) you build and sustain wealth. You tend to be more confident in your ability and your financial decision-making than others around you, which means you have a higher chance of achieving financial success over time. However, watch out for overconfidence in certain areas of financial management, particularly with investing activity. Overconfidence can negatively impact your financial decision-making (e.g., thinking that you can consistently beat the market). Maintain your confidence in your financial decisions by continuing to build knowledge while also having some “checks” on your decision-making. Are you relying too much on your own decisions in areas where you should seek out the knowledge and expertise of others? Or even just a second opinion? Ensure your confidence is financially beneficial by tempering your belief in your abilities with guidance and advice from others who exhibit sound decision-making in this field. 6 - Confidence Strategies Watch for high levels of overconfidence, especially in areas where a dose of humility can be a very positive thing. For example, overconfidence in your ability to consistently beat the market--or to pick advisors that can consistently beat the market--can be a costly mistake. Work with trusted family members, friends, and advisors to identify areas where you might possibly be overconfident. By identifying areas of overconfidence, you will be less likely to make decisions without a more sober or realistic view of the likelihood of success or failure. Undertake an objective look (with your advisor or other trusted, third-party) at your accepted assumptions and working principles related to investment strategy as a double-check on the approach that you are confident with. Cultivate an attitude of healthy skepticism and objectivity concerning your confidence in your own financial skills. Supreme overconfidence can lead to blind-spots in your planning approach, which can yield adverse results. 7 - Control Managing finances, investment decisions, and overall goals for a household requires making short-term decisions that have long-term implications. Although economically successful individuals may recognize that certain advantages and luck may play a part in financial success, more often than not, they tend to view money-related success as something entirely in their control through the decisions they make today. They tend to believe that their behaviors are more critical than circumstances, accept ownership of financial outcomes, and view external factors as having a minimal role in wealth accumulation. Those who place a greater emphasis on the influence of their actions (versus external forces) tend to be better at accumulating wealth than others. In contrast, those who tend to be less successful at accumulating wealth often view financial success as something controlled by or dependent upon someone or something else (e.g., past experiences, a government, a specific job or career). While our financial status today is more often than not a blend of both the past and the present, those who tend to be successful at transforming income into wealth often place greater emphasis on their actions than on external or uncontrollable forces. Your score: 70, High 70 Low Medium High Today Tomorrow When it comes to your financial status, you tend to see each action and decision contributing directly to that status. You attribute money-related outcomes to your actions and behaviors, as opposed to being the result of external forces such as past experiences, luck, or the actions of others. This characteristic (internal locus of control) tends to be related to building and maintaining wealth over time. By recognizing your influence on money-related outcomes, you tend to make financial decisions that align with your long-term goals. It may be challenging for you to understand, however, how others may view their past experiences or external factors when it comes to finances. With this recognition of your influence comes some amount of pressure you may place on yourself: those who are high on the Control factor may be challenged when strong, external forces shift the financial landscape. You tend to recognize the influence you have in achieving financial success. Therefore, over time, your financial decisions will more than likely reflect your future financial goals. You will tend to make spending, saving, and investing decisions that reflect your recognition that those actions can positively impact your financial future. Age and income being equal, those who are high on Control tend to have a higher net worth than those who view external factors as more important than their own decisions. Be careful, however, to avoid overestimating the scope of your influence on everything in the world of your personal finances. Assuming that you can impact factors or variables that are inherently outside of your control can be harmful (e.g., timing market fluctuations, predicting geopolitical events and outcomes). 8 - Control Strategies Too much “control” may lead you to feel that all financial conditions of your household were in your control. A balanced approach to understanding financial circumstances can ensure you have a sympathetic view of the financial circumstances or habits of those around you. Recognize that other members of your household, other family members, and friends may have a different set of experiences that had a significant impact on their financial status today. Consider your past experiences related to your financial status today. Our current status tends to be a combination of where we’ve come from, coupled with our decisions today. 9 - Planning & Monitoring With few exceptions, wealth accumulation is a focused and thought-out process: planning, setting goals, monitoring income and expenses, and ensuring that spending and savings plans are met. Being a disciplined planner is a crucial factor in the success of self-made multi-millionaires (see The Millionaire Mind, page 34), and it is also a vital characteristic of an economically productive household as it works to achieve financial goals. Those that are successful at building wealth are more likely to set and stick to financial plans and strategies. Likewise, those who achieve financial goals tend to monitor their income, expenses, savings, and investing status carefully and frequently: they know their financial health at any given time. This wealth factor captures activities related to planning, organization, and monitoring spending, saving, and investments. Your score: 10, Low 10 Low Medium Today When it comes to plans and attending to financial details, your approach is a little more laid back than others. You appear to spend less time planning your financial future than others, which may mean your financial decisions may not be tied to a long-term goal. You may be unaware of how you’re doing from a financial perspective (i.e., your financial health) unless someone (or something) shares an update with you. Keeping track of small details, like expenses and receipts, is something that you tend to leave to others or only tackle when it is absolutely necessary (for example, when a bill is past due). High Tomorrow Given your current approach to planning and monitoring your financial life, you may be less likely to build and sustain wealth than others. Most challenging tasks (like building wealth) require some amount of planning, as well as diligence in knowing how you’re doing related to those plans. By improving your financial planning and monitoring behaviors, you can increase the likelihood of consistently building and maintaining wealth over time. Additionally, ensuring your household is following a path towards achieving financial goals will lead to opportunities that may be critical to you (for example, starting a business, being comfortable in retirement, funding children’s or grandchildren’s college education). 10 - Planning & Monitoring Strategies Look to get your planning efforts started by implementing small but disciplined steps: create a basic spending plan; adopt an electronic tool to monitor compliance; establish a modest savings target. Set clear and reasonably achievable financial goals for each week and month, and monitor progress towards them. Consider sharing your goals, plans, and progress with friends and family as a way to hold yourself accountable. Implement a procedure to monitor your financial health that is easy to use and provides automated updates. Use technology as a tool to improve your financial health, track and maintain schedules, and set goals. 11 - Focus The surest way to reach a goal is to create a plan and stick to it. While that sounds easy enough, the pace of life leads many of us to have an overwhelming sense of “busyness,” and distractions take us off the clear path towards a goal. Setting and reaching financial goals requires a level of discipline to stick with our plans and focus on what is critical in achieving those goals. Often that means ignoring distractions from others, technologies, and everything else that might pull us away from ensuring we are on the path towards financial success. Those that are effective at building and sustaining wealth tend to meet goals through a disciplined approach that effectively manages (and often ignores) personal, technological, and other distractions in their daily lives. Your score: 15, Low 15 Low Medium High Today Tomorrow The world is full of distractions that can keep you from reaching your goals, and you may feel challenged when it's time to focus on a task, project, or other activity that requires a concentrated attention on details. Compared to others, you may look back at a particular day or week and feel as if you’ve wasted some of that time or be unsure of what you’ve accomplished. Distractions may lead you to take much longer to accomplish tasks and projects around the house, at work, or in other areas of your life. Being distracted may lead you may take on too many commitments and feel overwhelmed by them, especially at the last minute. You may overcommit financially, as well, to those around you asking for contributions. Building and sustaining wealth requires dedication to (often) small, detailed decisions or tasks. By not being able to focus on financial responsibilities, it may take you longer to complete them, lead to mistakes, or cause you to miss out on completing them all together. Likewise, distractions prevent us from focusing on financial decisions and lead to hasty choices that may not be in our best financial interest. You may end up spending above your means or outside of your budget because you’ve overcommitted to different causes or projects. Feeling overwhelmed by the things you’ve taken on when you were distracted, you may feel pressure to fulfill financial obligations as well as time obligations, which may end up costing you time, money, or both. You may miss out on achieving longterm savings goals because of the short-term decisions you made while being distracted. Even if you’re not naturally inclined to focus on the details of financial management, you can improve your focus over time. When it comes to finances, improving your concentration can ensure accuracy in the details of money management while also helping you to devote energy to longer-term financial projects. 12 - Focus Strategies Ignore the pressure to make financial or time-related decisions in haste. Instead, take time to commit and make those decisions in the context of your long-term goals. Avoid making quick decisions when you feel overwhelmed. Take time to consider the long-term financial goals associated with any choices you make. Create mechanisms that help you to ignore external distractions when working on financial planning tasks. For example, put the smartphone in another room and close all unrelated tabs in your Internet browser. Set aside a specific time each day and/or week to complete financial planning tasks. Stick to the schedule and do nothing during this time (however long it may be) except for financial planning tasks. Be conscious in allocating more extended periods to more complex and involved financial tasks such as tax planning and preparation, investment research, etc. Find a network of family, friends, others who can support you in your effort to stay focused on financial tasks. If your spouse/significant other understands and supports the objective of spending more concentrated time on managing personal financial affairs, you are much more likely to succeed in allocating this time. 13 - Social Indifference There is an unlimited amount of information available today regarding the lifestyles of our neighbors, coworkers, and celebrities. Whether communicated through social media, traditional advertising through television and other media, word-of-mouth recommendations and suggestions, or conversations with family and friends, there’s little to prevent learning about the latest consumer behaviors of those around us. Even with this avalanche of information, financially successful individuals tend to be indifferent and uninfluenced by what others are driving, buying, and wearing. Similarly, those who are successful at building wealth are not easily persuaded by advertisements for material goods, services, or investment opportunities. In this way, they are in control of their outflow of money: they tend to make spending decisions that align with their own financial goals, even if those decisions appear to be out of sync with what everyone else is doing. Your score: 75, High 75 Low Medium High Today Tomorrow Compared to others, you tend to ignore the consumption behaviors of others and messages from advertisers and the media. For better or worse--and the data indicate that it is very much for the better-you are not easily influenced by what others wear, drive, or otherwise buy. You feel comfortable and at ease with those around you that either appear to be or are wealthier than you. You tend to ignore daily advertisements and sales pitches that may prove irresistible to others. All of this is very good because it puts you in a position to make spending and consumption decisions based on your financial objectives, as opposed to the social status objectives of your neighbors. In other words, “keeping up with the Joneses” is not something you tend to do to any great extent. Your indifference to consumer trends and the buying behaviors of others will help you build and sustain wealth if that indifference is coupled with healthy financial decisions elsewhere (for example, in goal setting and planning). Those who ignore how others spend and shop tend to be successful, or prodigious, accumulators of wealth. Be cautious, though: your “indifference” could translate into a lack of empathy or understanding for those around you. In other words, ensure your lack of interest in the consumption behaviors of others over time doesn’t lead to an indifference about others in general. Too much “indifference” could lead to missing out on building relationships and achieving other types of life-related goals. 14 - Social Indifference Strategies Be aware of how far your indifference goes. Be guarded to ensure that your indifference to the purchases and material goods of others does not translate into emotional detachment toward your peers. Be careful not to confuse your lack of consideration of popular and passing trends with being uncaring toward others who may not have the same perspective. Use your keen insights into marketing and advertising to help those around you to make better purchasing and spending decisions, particularly those who come to you asking for advice regarding the acquisition of specific items (such as homes and cars). (But be careful here: make sure in advance that your audience will be receptive to such constructive input.) Be vocal about your preference for quality in goods and services instead of popularity. This behavior will reinforce positive financial actions in your life, and help support others around you as well. 15 - Additional Information The results in the report are based on the responses you provided on 02/21/2020 01:17 AM. For questions about this report, please contact Nannette Kamien with Cultivating Wealth at nk@cultivatingwealth.com. See DataPoints Privacy Statement and Terms of Use for information about how this data is used and maintained. Nothing contained herein constitutes investment advice. DataPoints is not a registered investment advisor or financial advisor. The assessment information provided by DataPoints should be used in consultation with a qualified financial professional. Building Wealth Assessment™, The Millionaire Next Door Test™, and Wealth Factors™ are trademarks of Data Points LLC. The Millionaire Next Door is used by permission. Copyright © 2020 Data Points, LLC. All rights reserved. 16

![-----Original Message----- [mailto:] Sent: Saturday, March 19, 2005 12:55 AM](http://s2.studylib.net/store/data/015586592_1-9284065775c2c8448f23d0ece525b0be-300x300.png)