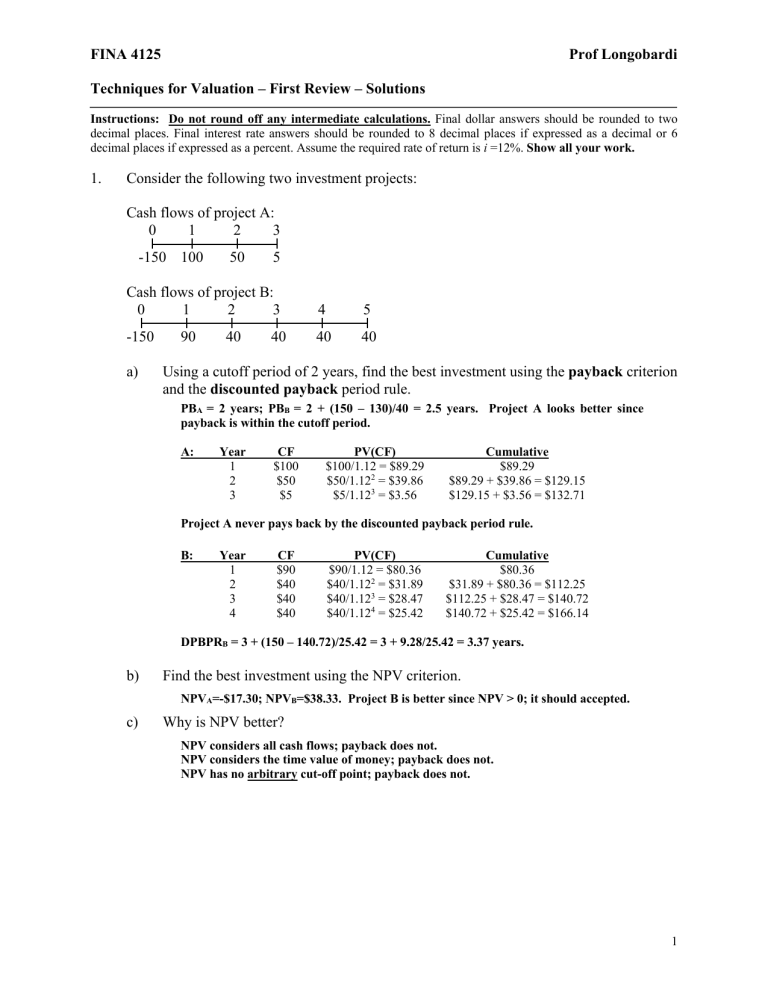

FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions Instructions: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Final interest rate answers should be rounded to 8 decimal places if expressed as a decimal or 6 decimal places if expressed as a percent. Assume the required rate of return is i =12%. Show all your work. 1. Consider the following two investment projects: Cash flows of project A: 0 1 2 3 -150 100 50 5 Cash flows of project B: 0 1 2 3 4 5 -150 40 40 a) 90 40 40 Using a cutoff period of 2 years, find the best investment using the payback criterion and the discounted payback period rule. PBA = 2 years; PBB = 2 + (150 – 130)/40 = 2.5 years. Project A looks better since payback is within the cutoff period. A: Year 1 2 3 CF $100 $50 $5 PV(CF) $100/1.12 = $89.29 $50/1.122 = $39.86 $5/1.123 = $3.56 Cumulative $89.29 $89.29 + $39.86 = $129.15 $129.15 + $3.56 = $132.71 Project A never pays back by the discounted payback period rule. B: Year 1 2 3 4 CF $90 $40 $40 $40 PV(CF) $90/1.12 = $80.36 $40/1.122 = $31.89 $40/1.123 = $28.47 $40/1.124 = $25.42 Cumulative $80.36 $31.89 + $80.36 = $112.25 $112.25 + $28.47 = $140.72 $140.72 + $25.42 = $166.14 DPBPRB = 3 + (150 – 140.72)/25.42 = 3 + 9.28/25.42 = 3.37 years. b) Find the best investment using the NPV criterion. NPVA=-$17.30; NPVB=$38.33. Project B is better since NPV > 0; it should accepted. c) Why is NPV better? NPV considers all cash flows; payback does not. NPV considers the time value of money; payback does not. NPV has no arbitrary cut-off point; payback does not. 1 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 2. Consider the following two mutually exclusive investment projects: Cash flows of project A: 0 1 2 3 -300 150 150 150 Cash flows of project B: 0 1 2 3 -1650 a) 750 750 750 4 5 150 150 4 5 750 750 Analyze each project individually using the profitability index. Which one of the mutually exclusive investments appears best? 540.7164 = 1.802388; appears bettter. 300 2,703.58215 PI B = = 1.638536 1,650 PI A = b) Now, look at the incremental flows using profitability index. Is it worth taking project B instead of project A? Cash flows of project B-A: 0 1 2 3 -1350 c) 600 4 5 600 600 600 600 PI B - A = 2,162.8657 = 1.6021. Yes, since PI B - A > 1 1,350 Repeat all of the analysis in (a) and (b) except now use NPV. NPVA = $240.74; NPVB = $1,053.58; NPVB- A = $812.86 Project B is the better project because it has the higher NPV. d) Which is the better investment? Explain. B is the better investment. NPVB is the higher of the two and PI B-A says that the additional value in B is worthwhile since PI B-A > 1; i.e., Project B adds the most worth to the firm. 2 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 3. Consider the following two investment projects: Cash flows of project A: 0 1 -15 30 Cash flows of project B: 0 1 2 -150 150 150 a) Analyze the projects individually using IRR. Which one looks better using only IRR? IRRA=100%; IRRB=61.80%. Project A looks better. b) Use IRR to analyze the incremental investment of taking project B instead of project A. What is your conclusion? IRRB-A=58.84%. The extra investment in B is worthwhile since IRRB-A> the hurdle rate of 12%. Therefore, B is better than A. c) Repeat all of the analysis in (a) and (b) except now use NPV. NPVA = $11.79; NPVB = $103.51; NPVB-A = $91.72; NPVB is the better project. d) Which is the better investment? Explain. B is better; NPVB > NPVA > 0. The incremental IRR B-A concludes that the investment in B (over A) is worthwhile; i.e., B adds more worth to the firm. 3 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 4. Consider the following two projects: Cash flows of project A: 0 1 2 3 150 150 150 150 4 5 150 -975 Cash flows of project B: 0 1 2 3 151 150 150 150 a) 4 5 150 -1100 Find the IRR’s of the two projects. Based on IRR, which initially looks like the better project? Which is actually better? Explain. IRRA=8.8769%; IRRB=12.9921%. B initially looks better since IRRB > the hurdle rate of 12%. A is actually better because these are “financing” types of projects, not investment projects. Hence, the IRR criterion must be reversed; i.e., IRRA < the hurdle rate of 12%; therefore, it’s better. b) Find the NPV’s of the two projects. Which one is better? NPVA=$52.36; NPVB=-$17.57. Accept A (better project) and reject B (NPVB < 0). c) Do the incremental IRR analysis of taking project B instead of project A. Does this match your NPV result? Explain. Cash flows of project B-A: 0 1 1 2 3 4 5 0 0 0 0 -125 IRRB-A=162.6527804%; NPVB-A=-$69.93. IRRB-A says extra investment in B is NOT worthwhile since the IRR > the hurdle rate of 12% (remember this is a financing project). Therefore, prefer A as the NPV indicates. 4 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 5. Consider the following investment project: Project cash flows: 0 1 2 -100 250 -300 a) Use your calculator’s NPV function to find the NPV of this project for 0 £ r £ 300%. Use 10% increments for r and calculate 31 NPV’s. Then use a graph with NPV on the vertical axis and r on the horizontal axis and plot the 31 points you determined. NPV 100% 200% 300% r - $50 - $100 - $150 b) What did you find about the project’s IRR and NPV? Explain. There is no IRR and NPV is always negative. 5 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 6. Consider the following investment project: Project cash flows: 0 1 2 -252.86 605 -360 a) What are the IRR’s of this project? Hint try NPV @ 11% and NPV @ 28.2622%. IRR = 11% and 28.3% (approximately). b) Compare the IRR’s to the hurdle (discount) rate. Does the IRR rule imply this is a good investment? Yes, since 12% is between 11% and 28.3% as seen in (c) below. c) Use a graph (like that in part (a) of question 7) to graph NPV, @ 5, 10, 15, 20, 25, and 30%. Given your discount rate, should this project be accepted? Explain. The project should be should be accepted as long as the hurdle rate is between 11% and 28.3%, which it is. NPV 10% 20% 30% r - $8 6 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions 7. Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow: Project A B-A C D Year 0 -400 + -200 -400 Year 1 100 100 140 Year 2 110 100 130 Year 3 120 100 120 Year 4 130 100 110 Year 5 140 100 100 a) Consider only projects A and B by examining the incremental project cash flows B-A. They are mutually exclusive opportunities. If the IRRB-A = 12% and the discount rate is 15% then what is your decision? B over A is analyzed as a financing project. So, where IRRB-A=12% and RRR=15% IRRB-A<RRR means invest in B. 12%<15% then we should invest in B. Accept project B; reject project A since IRRB-A<15% and B over A is evaluated as a financing project. b) Ignoring the information in question (a), assume instead that projects A and C are independent, Hardchoice is subject to capital rationing (i.e., it may not be able to afford both projects), and the relevant discount rate is 10%. i) What is the IRR of Project A? Project C? IRRA: 14.2975% 0 = −$400 + $100 $110 $120 $130 $140 + + + + 2 3 4 1+ IRRA (1+ RRA ) (1+ IRRA ) (1+ IRRA ) (1+ IRRA )5 IRRC: 41.0415% 0 = −$200 + ii) $100 $100 + 1+ IRRC 1+ IRR C ( 2 + $100 3 + $100 4 + $100 ) (1+ IRR ) (1+ IRR ) (1+ IRR ) C C 5 C How would you rank Project A compared to Project C? (1 mark) Both investment projects – so I would rank the one with the higher IRR (i.e., project C) as better – no issues of timing or scale. 7 FINA 4125 Prof Longobardi Techniques for Valuation – First Review – Solutions c) Consider the following statements and circle the Roman numeral corresponding to the one that is true. I The NPV of project D will be much more sensitive to changes in the discount rate than will the NPV of project A. II If projects C and D are mutually exclusive, incremental analysis indicates that one should reject project C and accept project D. III It is possible for projects A and D to have the same NPV. IV All of the above are true. V None of the above is true. 8