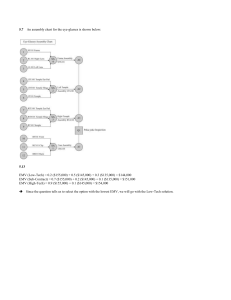

CHAPTER 3 Decision Analysis SOLUTIONS TO DISCUSSION QUESTIONS AND PROBLEMS 3-1. The purpose of this question is to make students use a personal experience to distinguish between good and bad decisions. A good decision is based on logic and all of the available information. A bad decision is one that is not based on logic and the available information. It is possible for an unfortunate or undesirable outcome to occur after a good decision has been made. It is also possible to have a favorable or desirable outcome occur after a bad decision. 3-2. The decision-making process includes the following steps: (1) define the problem, (2) list the alternatives, (3) identify the possible outcomes, (4) evaluate the consequences, (5) select an evaluation criterion, and (6) make the appropriate decision. The first four steps or procedures are common for all decision-making problems. Steps 5 and 6, however, depend on the decisionmaking model. 3-3. An alternative is a course of action over which we have complete control. A state of nature is an event or occurrence in which we have no control. An example of an alternative is deciding whether or not to take an umbrella to school or work on a particular day. An example of a state of nature is whether or not it will rain on a particular day. 3-4. The basic differences between decision-making models under certainty, risk, and uncertainty depend on the amount of chance or risk that is involved in the decision. A decisionmaking model under certainty assumes that we know with complete confidence the future outcomes. Decision-making-under-risk models assume that we do not know the outcomes for a particular decision but that we do know the probability of occurrence of those outcomes. With decision making under uncertainty, it is assumed that we do not know the outcomes that will occur, and furthermore, we do not know the probabilities that these outcomes will occur. 3-5. The techniques discussed in this chapter used to solve decision problems under uncertainty include maximax, maximin, equally likely, coefficient of realism, and minimax regret. The maximax decision-making criterion is an optimistic decision-making criterion, while the maximin is a pessimistic decision-making criterion. 3-6. For a given state of nature, opportunity loss is the difference between the payoff for a decision and the best possible payoff for that state of nature. It indicates how much better the payoff could have been for that state of nature. The minimax regret and the minimum expected opportunity loss are the criteria used with this. 3-7. Alternatives, states of nature, probabilities for all states of nature and all monetary outcomes (payoffs) are placed on the decision tree. In addition, intermediate results, such as EMVs for middle branches, can be placed on the decision tree. 3-8. Using the EMV criterion with a decision tree involves starting at the terminal branches of the tree and working toward the origin, computing expected monetary values and selecting the best alternatives. The EMVs are found by multiplying the probabilities of the states of nature by the economic consequences and summing the results for each alternative. At each decision point, the best alternative is selected. 3-9. A prior probability is one that exists before additional information is gathered. A posterior probability is one that can be computed using Bayes’ Theorem based on prior probabilities and additional information. 3-10. The purpose of Bayesian analysis is to determine posterior probabilities based on prior probabilities and new information. Bayesian analysis can be used in the decision-making process whenever additional information is gathered. This information can then be combined with prior probabilities in arriving at posterior probabilities. Once these posterior probabilities are computed, they can be used in the decision-making process as any other probability value. 3-11. The expected value of sample information (EVSI) is the increase in expected value that results from having sample information. It is computed as follows: EVSI = (expected value with sample information) + (cost of information) – (expected value without sample information) 3-12. The expect value of sample information (EVSI) and the expected value of perfect information (EVPI) are calculated. The ratio EVSI/EVPI is calculated and multiplied by 100% to get the efficiency of sample information. 3-13. The overall purpose of utility theory is to incorporate a decision maker’s preference for risk in the decision-making process. 3-14. A utility function can be assessed in a number of different ways. A common way is to use a standard gamble. With a standard gamble, the best outcome is assigned a utility of 1, and the worst outcome is assigned a utility of 0. Then, intermediate outcomes are selected and the decision maker is given a choice between having the intermediate outcome for sure and a gamble involving the best and worst outcomes. The probability that makes the decision maker indifferent between having the intermediate outcome for sure and a gamble involving the best and worst outcomes is determined. This probability then becomes the utility of the intermediate value. This process is continued until utility values for all economic consequences are determined. These utility values are then placed on a utility curve. 3-15. When a utility curve is to be used in the decision-making process, utility values from the utility curve replace all monetary values at the terminal branches in a decision tree or in the body of a decision table. Then, expected utilities are determined in the same way as expected monetary values. The alternative with the highest expected utility is selected as the best decision. 3-16. A risk seeker is a decision maker who enjoys and seeks out risk. A risk avoider is a decision maker who avoids risk even if the potential economic payoff is higher. The utility curve for a risk seeker increases at an increasing rate. The utility curve for a risk avoider increases at a decreasing rate. 3-17. a. Decision making under uncertainty. b. Maximax criterion. c. Sub 100 because the maximum payoff for this is $300,000. Equipment Sub 100 Oiler J Texan Favorable 300,000 250,000 75,000 Unfavorable Row Row Maximum Minimum 300,000 250,000 75,000 –200,000 –100,000 –200,000 –100,000 –18,000 –18,000 3-18. Using the maximin criterion, the best alternative is the Texan (see table above) because the worst payoff for this ($–18,000) is better than the worst payoffs for the other decisions. 3-19. a. Decision making under risk—maximize expected monetary value. b. EMV (Sub 100) = 0.7(300,000) + 0.3(–200,000) = 150,000 EMV (Oiler J) = 0.7(250,000) + 0.3(–100,000) = 145,000 EMV (Texan) = 0.7(75,000) + 0.3(–18,000) = 47,100 Optimal decision: Sub 100. c. Ken would change decision if EMV(Sub 100) is less than the next best EMV, which is $145,000. Let X = payoff for Sub 100 in favorable market. (0.7)(X) + (0.3)(–200,000) < 145,000 0.7X < 145,000 + 60,000 = 205,000 X < (205,000)/0.7 = 292,857.14 The decision would change if this payoff were less than 292,857.14, so it would have to decrease by about $7,143. 3-20. a. The expected value (EV) is computed for each alternative. EV(stock market) = 0.5(80,000) + 0.5(–20,000) = 30,000 EV(Bonds) = 0.5(30,000) + 0.5(20,000) = 25,000 EV(CDs) = 0.5(23,000) + 0.5(23,000) = 23,000 Therefore, he should invest in the stock market. b. EVPI = EV(with perfect information) – (Maximum EV without P, I) = [0.5(80,000) + 0.5(23,000)] – 30,000 = 51,500 – 30,000 = 21,500 Thus, the most that should be paid is $21,500. 3-21. The opportunity loss table is Alternative Good Economy Stock Market Poor Economy 0 43,000 Bonds 50,000 3,000 CDs 57,000 0 EOL(Stock Market) = 0.5(0) + 0.5(43,000) = 21,500* This minimizes EOL. EOL(Bonds) = 0.5(50,000) + 0.5(3,000) = 26,500 EOL(CDs) = 0.5(57,000) + 0.5(0) = 28,500 3-22. a. Market Alternative Good Fair Poor EMV Stock market 1,400 800 0 880 Bank deposit (CD) 900 900 900 900 0.4 0.4 0.2 Probabilities conditions Condition of market b. Best decision: deposit $10,000 in bank CD. 3-23. a. Expected value with perfect information is 1,400(0.4) + 900(0.4) + 900(0.2) = 1,100; the maximum EMV without the information is 900. Therefore, Allen should pay at most EVPI = 1,100 – 900 = $200. b. Yes, Allen should pay [1,100(0.4) + 900(0.4) + 900(0.2)] – 900 = $80. 3-24. a. Opportunity loss table Strong Fair Poor Max. Market Market Market Regret 0 19,000 310,000 310,000 Medium 250,000 0 100,000 250,000 Small 350,000 29,000 32,000 350,000 None 550,000 129,000 0 550,000 Large b. Minimax regret decision is to build medium. 3-25. a. Stock Demand (Cases) (Cases) 11 12 13 EMV 11 385 385 385 385 12 329 420 420 379.05 13 273 364 455 341.25 Probabilities 0.45 0.35 0.20 b. Stock 11 cases. c. If no loss is involved in excess stock, the recommended course of action is to stock 13 cases and to replenish stock to this level each week. This follows from the following decision table. Stock Demand (Cases) (Cases) 11 12 13 EMV 11 385 385 385 385 12 385 420 420 404.25 13 385 420 455 411.25 3-26. Manufacture (Cases) Demand (Cases) 6 7 8 9 EMV 6 300 300 300 300 300 7 255 350 350 350 340.5 8 210 305 400 400 352.5 9 165 260 355 450 317 Probabilities 0.1 0.3 0.5 0.1 John should manufacture 8 cases of cheese spread. 3-27. Cost of produced case = $5. Cost of purchased case = $16. Selling price = $15. Money recovered from each unsold case = $3. Supply Demand(Cases) (Cases) 100 200 300 100 100(15) –100(5) = 200(15) – 100(5) –100(16) 300(15) – 100(5) –200(16) 1000 = 900 = 800 200 100(15) + 100(3) – 200(15) – 200(5) = 2000 200(5) = 800 300 100(15) + 200(3) – 200(15) + 100(3) –300(5) 300(15) – 300(5) = 3000 300(5) = 600 = 1800 Prob. 0.3 0.4 b. Produce 300 cases each day. 300(15) – 200(5) –100(16) = 1900 0.3 EMV 900 1610 1800 3-28. a. The table presented is a decision table. The basis for the decisions in the following questions is shown in the table. The values in the table are in 1,000s. MARKET Decision Good Fair Poor Alternatives EQUALLY LIKELY OF CRIT. REALISM MAXIMAX MAXIMIN Row Max. Row Min. Row Ave. Weighted Ave. Small 50 20 –10 50 –10 20 38 Medium 80 30 –20 80 –20 30 60 Large 100 30 –40 100 –40 30 72 Very Large 300 25 –160 300 –160 55 208 b. Maximax decision: Very large station. c. Maximin decision: Small station. d. Equally likely decision: Very large station. e. Criterion of realism decision: Very large station. f. Opportunity loss table (values in the table are in 1,000s): MARKET Decision Good Alternatives Market MINIMAX Fair Poor Row Market Market Maximum Small 250 10 0 250 Medium 220 0 10 220 Large 200 0 30 200 0 5 150 150 Very Large 3-29. Note this problem is based on costs, so the minimum values are the best. a. For a 3-year lease, there are 36 months of payments. Option 1 total monthly payments: 36($330) = $11,880 Option 2 total monthly payments: 36($380) = $13,680 Option 3 total monthly payments: 36($430) = $15,480 Excess mileage costs based on 36,000 mileage allowance for Option 1, 45,000 for Option 2, and 54,000 for option 3. Option 1 excess mileage cost if 45,000 miles are driven = (45000 – 36000)(0.35) = 3150 Option 1 excess mileage cost if 54,000 miles are driven = (54000 – 36000)(0.35) = 6300 Option 2 excess mileage cost if 54,000 miles are driven = (54000 – 45000)(0.25) = 2250 The total cost for each option in each state of nature is obtained by adding the total monthly payment cost to the excess mileage cost. Total cost table Lease option 36000 miles driven 45000 miles driven 54000 miles driven Option 1 11,880 15030 18180 Option 2 13,680 13680 15930 Option 3 15,480 15480 15480 b. Optimistic decision: Option 1 because the best (minimum) payoff (cost) for this is 11,800 which is better (lower) than the best payoff for each of the others. c. Pessimistic decision: Option 3 because the worst (maximum) payoff (cost) for this is 15,480 is better (lower) than the worst payoff for each of the others. d. Select Option 2. EMV(Option 1) = 11,880(0.4) + 15,030(0.3) + 18,180(0.3) = 14,715 EMV(Option 2) = 13,680(0.4) + 13,680(0.3) + 15,930(0.3) = 14,355 EMV(Option 3) = 15,480(0.4) + 15,480 (0.3) + 15,480(0.3) = 15,480 (e) EVPI for a minimization problem = (Best EMV without PI) - (EV with PI) EV with PI = 11,880(0.4) + 13,680(0.3) + 15,480(0.3) = 13,500 EVPI = 14,355 – 13,500 = 855 3-30. Note that this is a minimization problem, so the opportunity loss is based on the lowest (best) cost in each state of nature. Opportunity loss table Lease option 36000 miles driven 45000 miles driven 54000 miles driven Option 1 11880 – 11880 = 0 15030 - 13680 = 1350 18180 - 15480 = 2700 Option 2 13680 – 11880 = 1800 13680 - 13680 = 0 15930 - 15480 = 450 Option 3 15480 – 11880 = 3600 15480 - 13680 = 1800 15480 - 15480 = 0 The maximum regrets are 2700 for option 1, 1800 for option 2, and 3600 for option 3. Option 2 is selected because 1800 is lower than the other maximums. EOL(option 1) = 0(0.4) + 1350(0.3) + 2700(0.3) = 1215 EOL(option 2) = 1800(0.4) + 0(0.3) + 450(0.3) = 855 EOL(option 3) = 3600(0.4) + 1800(0.3) + 0(0.3) = 1980 Option 2 has the lowest EOL, so this alternative is selected based on the EOL criterion. 3-31. a. P(red) = 18/38; P(not red) = 20/38 b. EMV = Expected win = 10(18/38) + (-10)(20/38) = -0.526 c. P(red) = 18/37; P(not red) = 19/37 EMV = Expected win = 10(18/37) + (-10)(19/37) = -0.270 d. The enjoyment of playing the game and possibly winning adds utility to the game. A person would play this game because the expected utility of playing the game is positive even though the expected monetary value is negative. 3-32. A $10 bet on number 7 would pay 35($10) = 350 if the number 7 is the winner. P(number 7) = 1/38; P(not seven) = 37/38 EMV = Expected win = 350(1/38) + (-10)(37/38) = -0.526 3-33. Payoff table with cost of $50,000 in legal fees deducted if suit goes to court and $10,000 in legal fees if settle. Win big Win small Lose EMV Go to court 250000 0 -50000 85000 Settle 65000 65000 65000 65000 Prob. 0.4 0.3 0.3 Decision based on EMV: Go to court 3-34. EMV for node 1 = 0.5(100,000) + 0.5(–40,000) = $30,000. Choose the highest EMV, therefore construct the clinic. 3-35. a. b. EMV(node 2) = (0.82)($95,000) + (0.18)(–$45,000) = 77,900 – 8,100 = $69,800 EMV(node 3) = (0.11)($95,000) + (0.89)(–$45,000) = 10,450 – $40,050 = –$29,600 EMV(node 4) = $30,000 EMV(node 1) = (0.55)($69,800) + (0.45)(–$5,000) = 38,390 – 2,250 = $36,140 The EMV for using the survey = $36,140. EMV(no survey) = (0.5)($100,000) + (0.5)(–$40,000) = $30,000 The survey should be used. c. EVSI = ($36,140 + $5,000) – $30,000 = $11,140. Thus, the physicians would pay up to $11,140 for the survey. 3-36. 3-37. a. EMV(node 2) = (0.9)(55,000) + (0.1)(–$45,000) = 49,500 – 4,500 = $45,000 EMV(node 3) = (0.9)(25,000) + (0.1)(–15,000) = 22,500 – 1,500 = $21,000 EMV(node 4) = (0.12)(55,000) + (0.88)(–45,000) = 6,600 – 39,600 = –$33,000 EMV(node 5) = (0.12)(25,000) + (0.88)(–15,000) = 3,000 – 13,200 = –$10,200 EMV(node 6) = (0.5)(60,000) + (0.5)(–40,000) = 30,000 – 20,000 = $10,000 EMV(node 7) = (0.5)(30,000) + (0.5)(–10,000) = 15,000 – 5,000 = $10,000 EMV(node 1) = (0.6)(45,000) + (0.4)(–5,000) = 27,000 – 2,000 = $25,000 Since EMV(market survey) > EMV(no survey), Jerry should conduct the survey. Since EMV(large shop | favorable survey) is larger than both EMV(small shop | favorable survey) and EMV(no shop | favorable survey), Jerry should build a large shop if the survey is favorable. If the survey is unfavorable, Jerry should build nothing since EMV(no shop | unfavorable survey) is larger than both EMV(large shop | unfavorable survey) and EMV(small shop | unfavorable survey). b. If no survey, EMV = 0.5(30,000) + 0.5(–10,000) = $10,000. To keep Jerry from changing decisions, the following must be true: EMV(survey) EMV(no survey) Let P = probability of a favorable survey. Then, P[EMV(favorable survey)] + (1 – P) [EMV(unfavorable survey)] EMV(no survey) This becomes: P(45,000) + (1 – P)(–5,000) $10,000 Solving gives 45,000P + 5,000 – 5,000P 50,000P P 10,000 15,000 0.3 Thus, the probability of a favorable survey could be as low as 0.3. Since the marketing professor estimated the probability at 0.6, the value can decrease by 0.3 without causing Jerry to change his decision. Jerry’s decision is not very sensitive to this probability value. 3-38. A1: gather more information A2: do not gather more information A3: build quadplex A4: build duplex A5: do nothing EMV(node 2) = 0.9(12,000) + 0.1(–23,000) = 8,500 EMV(node 3) = 0.9(2,000) + 0.1(–13,000) = 500 EMV(get information and then do nothing) = –3,000 EMV(node 4) = 0.4(12,000) + 0.6(–23,000) = –9,000 EMV(node 5) = 0.4(2,000) + 0.6(–13,000) = –7,000 EMV(get information and then do nothing) = –3,000 EMV(node 1) = 0.5(8,500) + 0.5(-3,000) = 2,750 EMV(build quadplex) = 0.7(15,000) + 0.3(–20,000) = 4,500 EMV(build duplex) = 0.7(5,000) + 0.3(–10,000) = 500 EMV(do nothing) = 0 Decisions: do not gather information; build quadplex. 3-39. I1: favorable research or information I2: unfavorable research S1: store successful S2: store unsuccessful P(S1) = 0.5; P(S2) = 0.5 P(I1 | S1) = 0.8; P(I2 | S1) = 0.2 P(I1 | S2) = 0.3; P(I2 | S2) = 0.7 a. P(successful store | favorable research) = P(S1 | I1) P ( S1 I1 ) = P ( S1 I1 ) = P ( I1 S1 ) P ( S1 ) P ( I1 S1 ) P ( S1 ) + P ( I1 S 2 ) P ( S 2 ) 0.8 ( 0.5 ) = 0.73 0.8 ( 0.5 ) + 0.3 ( 0.5 ) b. P(successful store | unfavorable research) = P(S1 | I2) P ( S1 I 2 ) = P ( S1 I 2 ) = P ( I 2 S1 ) P ( S1 ) P ( I 2 S1 ) P ( S1 ) + P ( I 2 S 2 ) P ( S 2 ) 0.2 ( 0.5 ) = 0.22 0.2 ( 0.5 ) + 0.7 ( 0.5 ) c. Now P(S1) = 0.6 and P(S2) = 0.4 P ( S1 I1 ) = 0.8 ( 0.6 ) = 0.8 0.8 ( 0.6 ) + 0.3 ( 0.4 ) P ( S1 I 2 ) = 0.2 ( 0.6 ) = 0.3 0.2 ( 0.6 ) + 0.7 ( 0.4 ) 3-40. I1: favorable survey or information I2: unfavorable survey S1: facility successful S2: facility unsuccessful P(S1) = 0.3; P(S2) = 0.7 P(I1 | S1) = 0.8; P(I2 | S1) = 0.2 P(I1 | S2) = 0.3; P(I2 | S2) = 0.7 P(successful facility | favorable survey) = P(S1 | I1) P ( S1 I1 ) = P ( S1 I1 ) = P ( I1 S1 ) P ( S1 ) P ( I1 S1 ) P ( S1 ) + P ( I1 S 2 ) P ( S 2 ) 0.8 ( 0.3) = 0.533 0.8 ( 0.3) + 0.3 ( 0.7 ) P(successful facility | unfavorable survey) = P(S1 | I2) P ( S1 I 2 ) = P ( S1 I 2 ) = P ( I 2 S1 ) P ( S1 ) P ( I 2 S1 ) P ( S1 ) + P ( I 2 S 2 ) P ( S 2 ) 0.2 ( 0.3) = 0.109 0.2 ( 0.3) + 0.7 ( 0.7 ) 3-41. a. b. EMV(A) = 10,000(0.2) + 2,000(0.3) + (–5,000)(0.5) = 100 EMV(B) = 6,000(0.2) + 4,000(0.3) + 0(0.5) = 2,400 Fund B should be selected. c. Let X = payout for Fund A in a good economy. EMV(A) = EMV(B) X(0.2) + 2,000(0.3) + (–5,000)(0.5) = 2,400 0.2X = 4,300 X = 4,300/0.2 = 21,500 Therefore, the return would have to be $21,500 for Fund A in a good economy for the two alternatives to be equally desirable based on the expected values. 3-42. a. b. S1: survey favorable S2: survey unfavorable S3: study favorable S4: study unfavorable S5: market favorable S6: market unfavorable P ( S5 S1 ) = 0.7 ( 0.5 ) 0.7 ( 0.5 ) + 0.2 ( 0.5 ) = 0.78 P(S6 | S1) = 1 – 0.778 = 0.222 P ( S5 S 2 ) = 0.3 ( 0.5 ) 0.3 ( 0.5 ) + 0.8 ( 0.5 ) = 0.27 P(S6 | S2) = 1 – 0.27 = 0.73 P ( S5 S 3 ) = 0.8 ( 0.5 ) 0.8 ( 0.5 ) + 0.1( 0.5 ) P(S6 | S3) = 1 – 0.89 = 0.11 = 0.89 P ( S5 S 4 ) = 0.2 ( 0.5 ) 0.2 ( 0.5 ) + 0.9 ( 0.5 ) = 0.18 P(S6 | S4) = 1 – 0.18 = 0.82 c. EMV(node 3) = 95,000(0.78) + (–65,000)(0.22) = 59,800 EMV(node 4) = 95,000(0.27) + (–65,000)(0.73) = –21,800 EMV(node 5) = 80,000(0.89) + (–80,000)(0.11) = 62,400 EMV(node 6) = 80,000(0.18) + (–80,000)(0.82) = –51,200 EMV(node 7) = 100,000(0.5) + (–60,000)(0.5) = 20,000 EMV(conduct survey) = 59,800(0.45) + (–5,000)(0.55) = 24,160 EMV(conduct pilot study) = 62,400(0.45) + (–20,000)(0.55) = 17,080 EMV(neither) = 20,000 Therefore, the best decision is to conduct the survey. If it is favorable, produce the razor. If it is unfavorable, do not produce the razor. 3-43. The following computations are for the decision tree that follows. EU(node 3) = 0.95(0.78) + 0.5(0.22) = 0.85 EU(node 4) = 0.95(0.27) + 0.5(0.73) = 0.62 EU(node 5) = 0.9(0.89) + 0(0.11) = 0.80 EU(node 6) = 0.9(0.18) + 0(0.82) = 0.16 EU(node 7) = 1(0.5) + 0.55(0.5) = 0.78 EU(conduct survey) = 0.85(0.45) + 0.8(0.55) = 0.823 EU(conduct pilot study) = 0.80(0.45) + 0.7(0.55) = 0.745 EU(neither test) = 0.81 Therefore, the best decision is to conduct the survey. Jim is a risk avoider. 3-44. a. P(good economy | prediction of good economy) = 0.8 ( 0.6 ) 0.8 ( 0.6 ) + 0.1( 0.4 ) = 0.923 P(poor economy | prediction of good economy) = 0.1( 0.4 ) 0.8 ( 0.6 ) + 0.1( 0.4 ) = 0.077 P(good economy | prediction of poor economy) = 0.2 ( 0.6 ) 0.2 ( 0.6 ) + 0.9 ( 0.4 ) = 0.25 P(poor economy | prediction of poor economy) = 0.9 ( 0.6 ) 0.2 ( 0.6 ) + 0.9 ( 0.4 ) = 0.75 b. P(good economy | prediction of 0.8 ( 0.7 ) good economy) = = 0.949 0.8 ( 0.7 ) + 0.1( 0.3) P(poor economy | prediction of good economy) = 0.1( 0.3) 0.8 ( 0.7 ) + 0.1( 0.3) = 0.051 P(good economy | prediction of poor economy) = 0.2 ( 0.7 ) 0.2 ( 0.7 ) + 0.9 ( 0.3) = 0.341 P(poor economy | prediction of poor economy) = 0.9 ( 0.3) 0.2 ( 0.7 ) + 0.9 ( 0.3) = 0.659 3-45. The expected value of the payout by the insurance company is EV = 0(0.999) + 100,000(0.001) = 100 The expected payout by the insurance company is $100, but the policy costs $200, so the net gain for the individual buying this policy is negative (–$100). Thus, buying the policy does not maximize EMV since not buying this policy would have an EMV of 0, which is better than a negative $100. However, a person who buys this policy would be maximizing the expected utility. The peace of mind that goes along with the insurance policy has a relatively high utility. A person who buys insurance would be a risk avoider. 3-46. EU(node 2) = (0.82)(0.99) + (0.18)(0) = 0.8118 EU(node 3) = (0.11)(0.99) + (0.89)(0) = 0.1089 EU(node 4) = 0.5(1) + 0.5(0.1) = 0.55 EU(node 1) = (0.55)(0.8118) + (0.45)(0.7000) = 0.7615 EU(no survey) = 0.9 The expected utility with no survey (0.9) is higher than the expected utility with a survey (0.7615), so the survey should be not used. The medical professionals are risk avoiders. 3-47. EU(large plant | survey favorable) = 0.78(0.95) + 0.22(0) = 0.741 EU(small plant | survey favorable) = 0.78(0.5) + 0.22(0.1) = 0.412 EU(no plant | survey favorable) = 0.2 EU(large plant | survey negative) = 0.27(0.95) + 0.73(0) = 0.2565 EU(small plant | survey negative) = 0.27(0.5) + 0.73(0.10) = 0.208 EU(no plant | survey negative) = 0.2 EU(large plant | no survey) = 0.5(1) + 0.5(0.05) = 0.525 EU(small plant | no survey) = 0.5(0.6) + 0.5(0.15) = 0.375 EU(no plant | no survey) = 0.3 EU(conduct survey) = 0.45(0.741) + 0.55(0.2565) = 0.4745 EU(no survey) = 0.525 John’s decision would change. He would not conduct the survey and build the large plant. 3-48. a. Expected travel time on Broad Street = 40(0.5) + 15(0.5) = 27.5 minutes. Broad Street has a lower expected travel time. b. Expected utility on Broad Street = 0.2(0.5) + 0.9(0.5) = 0.55. Therefore, the expressway maximizes expected utility. c. Lynn is a risk avoider. 3-49. Selling price = $20 per gallon; manufacturing cost = $12 per gallon; salvage value = $13; handling costs = $1 per gallon; and advertising costs = $3 per gallon. From this information, we get: marginal profit = selling price minus the manufacturing, handling, and advertising costs marginal profit = $20 – $12 – $1 – $3 = $4 per gallon If more is produced than is needed, a marginal loss is incurred. marginal loss = $13 – $12 – $1 – $3 = $3 per gallon In addition, there is also a shortage cost. Coren has agreed to fulfill any demand that cannot be met internally. This requires that Coren purchase chemicals from an outside company. Because the cost of obtaining the chemical from the outside company is $25 and the price charged by Coren is $20, this results in shortage cost = $5 per gallon In other words, Coren will lose $5 for every gallon that is sold that has to be purchased from an outside company due to a shortage. a. A decision tree is provided: b. The computations are shown in the following table. These numbers are entered into the tree above. The best decision is to stock 1,500 gallons. Table for Problem 3-49 Demand Stock 500 500 1,000 1,500 2,000 EMV 2,000 –500 –3,000 –5,500 –$1,500 1,000 500 4,000 1,500 –1,000 $1,800 1,500 –1,000 2,500 6,000 3,500 $3,300 2,000 –2,500 1,000 4,500 8,000 $2,400 2,000 4,000 6,000 8,000 $4,800 = EVwPI Maximum Probabilities 0.2 0.3 0.4 c. EVwPI = (0.2)(2,000) + (0.3)(4,000) + (0.4)(6,000) + (0.1)(8,000) = $4,800 EVPI = EVwPI – EMV = $4,800 – $3,300 = $1,500 0.1 3-50. If no survey is to be conducted, the decision tree is fairly straightforward. There are three main decisions, which are building a small, medium, or large facility. Extending from these decision branches are three possible demands, representing the possible states of nature. The demand for this type of facility could be either low (L), medium (M), or high (H). It was given in the problem that the probability for a low demand is 0.15. The probabilities for a medium and a high demand are 0.40 and 0.45, respectively. The problem also gave monetary consequences for building a small, medium, or large facility when the demand could be low, medium, or high for the facility. These data are reflected in the following decision tree. With no survey, we have: EMV(Small) = 500,000; EMV(Medium) = 670,000; and EMV(Large) = 580,000. The medium facility, with an expected monetary value of $670,000, is selected because it represents the highest expected monetary value. If the survey is used, we must compute the revised probabilities using Bayes’ theorem. For each alternative facility, three revised probabilities must be computed, representing low, medium, and high demand for a facility. These probabilities can be computed using tables. One table is used to compute the probabilities for low survey results, another table is used for medium survey results, and a final table is used for high survey results. These probabilities will be used in the decision tree that follows. For low survey results—A1: State of Nature P(Bi) P(Ai | Bj) P(Bj and Ai) P(Bj | Ai) B1 0.150 0.700 0.105 0.339 B2 0.400 0.400 0.160 0.516 B3 0.450 0.100 0.045 0.145 P(A1) = 0.310 For medium survey results—A2: State of Nature P(Bi) P(Ai | Bj) P(Bj and Ai) P(Bj | Ai) B1 0.150 0.200 0.030 0.082 B2 0.400 0.500 0.200 0.548 B3 0.450 0.300 0.135 0.370 P(A2) = 0.365 For high survey results—A3: State of Nature P(Bi) P(Ai | Bj) P(Bj and Ai) P(Bj | Ai) B1 0.150 0.100 0.015 0.046 B2 0.400 0.100 0.040 0.123 B3 0.450 0.600 0.270 0.831 P(A3) = 0.325 When survey results are low, the probabilities are P(L) = 0.339; P(M) = 0.516; and P(H) = 0.145. This results in EMV(Small) = 450,000; EMV(Medium) = 495,000; and EMV(Large) = 233,600. When survey results are medium, the probabilities are P(L) = 0.082; P(M) = 0.548; and P(H) = 0.370. This results in EMV (Small) = 450,000; EMV(Medium) = 646,000; and EMV(Large) = 522,800. When survey results are high, the probabilities are P(L) = 0.046; P(M) = 0.123; and P(H) = 0.831. This results in EMV(Small) = 450,000; EMV(Medium) = 710,100; and EMV(Large) = 821,000. If the survey results are low, the best decision is to build the medium facility with an expected return of $495,000. If the survey results are medium, the best decision is also to build the medium plant with an expected return of $646,000. On the other hand, if the survey results are high, the best decision is to build the large facility with an expected monetary value of $821,000. The expected value of using the survey is computed as follows: EMV(with Survey) = 0.310(495,000) + 0.365(646,000) + 0.325(821,000) = 656,065 Because the expected monetary value for not conducting the survey is greater (670,000), the decision is not to conduct the survey and to build the medium-sized facility. 3-51. a. Mary should select the traffic circle location (EMV = $250,000). b. Use Bayes’ Theorem to compute posterior probabilities. P(SD | SRP) = 0.78; P( SD | SRP) = 0.22 P(SM | SRP) = 0.84; P( SM | SRP) = 0.16 P(SC | SRP) = 0.91; P( SC | SRP) = 0.09 P(SD | SRN) = 0.27; P( SD | SRN) = 0.73 P(SM | SRN) = 0.36; P( SM | SRN) = 0.64 P(SC | SRN) = 0.53; P( SC | SRN) = 0.47 Example computations: P ( SM SRP ) = P ( SM SRP ) = P ( SC SRN ) = P ( SRP SM ) P ( SM ) ( ) ( ) P ( SRP SM ) P ( SM ) + P SRP SM P SM 0.7 ( 0.6 ) = 0.84 0.7 ( 0.6 ) + 0.2 ( 0.4 ) 0.3 ( 0.75 ) 0.3 ( 0.75 ) + 0.8 ( 0.25 ) = 0.53 These calculations are for the tree that follows: EMV(2) = $171,600 – $28,600 = $143,000 EMV(3) = $226,800 – $20,800 = $206,000 EMV(4) = $336,700 – $20,700 = $316,000 EMV(no grocery – A) = –$30,000 EMV(5) = $59,400 – $94,900 = –$35,500 EMV(6) = $97,200 – $83,200 = $14,000 EMV(7) = $196,100 – $108,100 = $88,000 EMV(no grocery – B) = –$30,000 EMV(8) = $75,000 EMV(9) = $140,000 EMV(10) = $250,000 EMV(no grocery – C) = $0 EMV(A) = (best of four alternatives) = $316,000 EMV(B) = (best of four alternatives) = $88,000 EMV(C) = (best of four alternatives) = $250,000 EMV(1) = (0.6)($316,000) + (0.4)($88,000) = $224,800 EMV(D) = (best of two alternatives) = $250,000 c. EVSI = [EMV(1) + cost] – (best EMV without sample information) = $254,800 – $250,000 = $4,800. 3-52. a. Sue can use decision tree analysis to find the best solution. In this case, the best decision is to get information. If the information is favorable, she should build the retail store. If the information is not favorable, she should not build the retail store. The EMV for this decision is $29,200. In the following results (using QM for Windows), Branch 1 (1–2) is to get information, Branch 2 (1–3) is the decision to not get information, Branch 3 (2–4) is favorable information, Branch 4 (2–5) is unfavorable information, Branch 5 (3–8) is the decision to build the retail store and get no information, Branch 6 (3–17) is the decision to not build the retail store and to get no information, Branch 7 (4–6) is the decision to build the retail store given favorable information, Branch 8 (4–11) is the decision to not build given favorable information, Branch 9 (6–9) is a successful retail store given favorable information, Branch 10 (6–10) is an unsuccessful retail store given favorable information, Branch 11 (5–7) is the decision to build the retail store given unfavorable information, Branch 12 (5–14) is the decision not to build the retail store given unfavorable information, Branch 13 (7–12) is a successful retail store given unfavorable information, Branch 14 (7–13) is an unsuccessful retail store given unfavorable information, Branch 15 (8–15) is a successful retail store given that no information is obtained, and Branch 16 (8–16) is an unsuccessful retail store given no information is obtained. Results for 3-52. a. Start Ending Branch Profit Node Node Node Node (End Node) Branch? Type Value Prob. Use Start 0 1 0 0 Dec 29,200 Branch 1 1 2 0 0 Ch 29,200 Branch 2 1 3 0 0 Dec 28,000 Branch 3 2 4 0.6 0 Dec 62,000 Branch 4 2 5 0.4 0 Dec –20,000 Branch 5 3 8 0 0 Ch 28,000 Branch 6 3 17 0 0 Fin 0 Branch 7 4 6 0 0 Ch 62,000 Branch 8 4 11 0 –20,000 Fin –20,000 Branch 9 6 9 0.9 80,000 Fin 80,000 Branch 10 6 10 0.1 –100,000 Fin –100,000 Branch 11 5 7 0 0 Ch –64,000 Branch 12 5 14 0 –20,000 Fin –20,000 Branch 13 7 12 0.2 80,000 Fin 80,000 Branch 14 7 13 0.8 –100,000 Fin –100,000 Branch 15 8 15 0.6 100,000 Fin 100,000 Branch 16 8 16 0.4 –80,000 Fin –80,000 Yes Yes Yes Yes b. The suggested changes would be reflected in Branches 3 and 4. The decision stays the same, but the EMV increases to $37,400. The results are provided in the tables that follow. In these tables, BR = Branch; Prob. = Probability; and for Node Type, Dec = Decision, Ch = Chance, and Fin = Final. Results for 3-52. b. Start Ending Branch Profit Node Node Node Node (End Node) Branch? Type Value Prob. Use Start 0 1 0 0 Dec 37,400 Branch 1 1 2 0 0 Ch 37,400 Branch 2 1 3 0 0 Dec 28,000 Branch 3 2 4 0.7 0 Dec 62,000 Branch 4 2 5 0.3 0 Dec –20,000 Branch 5 3 8 0 0 Ch 28,000 Branch 6 3 17 0 0 Fin 0 Branch 7 4 6 0 0 Ch 62,000 Branch 8 4 11 0 –20,000 Fin –20,000 Branch 9 6 9 0.9 80,000 Fin 80,000 Branch 10 6 10 0.1 –100,000 Fin –100,000 Branch 11 5 7 0 0 Ch –64,000 Branch 12 5 14 0 –20,000 Fin –20,000 Branch 13 7 12 0.2 80,000 Fin 80,000 Branch 14 7 13 0.8 –100,000 Fin –100,000 Branch 15 8 15 0.6 100,000 Fin 100,000 Branch 16 8 16 0.4 –80,000 Fin –80,000 Yes Yes Yes Yes c. Sue can determine the impact of the change by changing the probabilities and recomputing EMVs. This analysis shows the decision changes. Given the new probability values, Sue’s best decision is build the retail store without getting additional information. The EMV for this decision is $28,000. The results are presented below: Results for 3-52. c. Start Ending Branch Profit Node Node Node Node (End Node) Branch? Type Value Prob. Use Start 0 1 0 0 Dec 28,000 Branch 1 1 2 0 0 Ch 18,400 Branch 2 1 3 0 0 Dec 28,000 Branch 3 2 4 0.6 0 Dec 44,000 Branch 4 2 5 0.4 0 Dec –20,000 Branch 5 3 8 0 0 Ch 28,000 Branch 6 3 17 0 0 Fin 0 Branch 7 4 6 0 0 Ch 44,000 Branch 8 4 11 0 –20,000 Fin –20,000 Branch 9 6 9 0.8 80,000 Fin 80,000 Branch 10 6 10 0.2 –100,000 Fin –100,000 Branch 11 5 7 0 0 Ch –64,000 Branch 12 5 14 0 –20,000 Fin –20,000 Branch 13 7 12 0.2 80,000 Fin 80,000 Branch 14 7 13 0.8 –100,000 Fin –100,000 Branch 15 8 15 0.6 100,000 Fin 100,000 Branch 16 8 16 0.4 –80,000 Fin –80,000 Yes Yes Yes Yes d. Yes, Sue’s decision would change from her original decision. With the higher cost of information, Sue’s decision is to not get the information and build the retail store. The EMV of this decision is $28,000. The results are given below: Results for 35-2. d. Start Ending Branch Node Node Profit Use Node Node Probability (End Node) Branch? Type Value Start 0 1 0 0 Decision 28,000 Branch 1 1 2 0 0 Chance 19,200 Branch 2 1 3 0 0 Decision 28,000 Branch 3 2 4 0.6 0 Decision 52,000 Branch 4 2 5 0.4 0 Decision –30,000 Branch 5 3 8 0 0 Chance 28,000 Branch 6 3 17 0 0 Branch 7 4 6 0 0 Branch 8 4 11 0 –30,000 Final –30,000 Branch 9 6 9 0.9 70,000 Final 70,000 Branch 10 6 10 0.1 –110,000 Final –110,000 Branch 11 5 7 0 0 Branch 12 5 14 0 –30,000 Branch 13 7 12 0.2 Branch 14 7 13 Branch 15 8 Branch 16 8 Yes Yes Final Yes Chance 0 52,000 Chance –74,000 Final –30,000 70,000 Final 70,000 0.8 –110,000 Final –110,000 15 0.6 100,000 Final 100,000 16 0.4 –80,000 Final –80,000 Yes e. The expected utility can be computed by replacing the monetary values with utility values. Given the utility values in the problem, the expected utility is 0.62. The utility table represents a risk seeker. The results are given below. Results for 3-52. e. Start Ending Branch Profit Node Node Use Ending Node Prob. (End Node) Branch? Node Node Type Value Start 0 1 0 0 1 Dec 0.62 Branch 1 1 2 0 0 2 Ch 0.256 Branch 2 1 3 0 0 3 Dec 0.62 Branch 3 2 4 0.6 0 4 Dec 0.36 Branch 4 2 5 0.4 0 5 Dec 0.1 Branch 5 3 8 0 0 8 Ch 0.62 Branch 6 3 17 0 0.2 17 Fin 0.20 Branch 7 4 6 0 0 6 Ch 0.36 Branch 8 4 11 0 0.1 11 Fin 0.1 Branch 9 6 9 0.9 0.4 9 Fin 0.4 Branch 10 6 10 0.1 0 10 Fin 0 Branch 11 5 7 0 0 7 Ch 0.08 Branch 12 5 14 0 0.1 14 Fin 0.1 Branch 13 7 12 0.2 0.4 12 Fin 0.4 Branch 14 7 13 0.8 0 13 Fin 0 Branch 15 8 15 0.6 1 15 Fin 1 Branch 16 8 16 0.4 0.05 16 Fin 0.05 Yes Yes Yes Yes f. This problem can be solved by replacing monetary values with utility values. The expected utility is 0.80. The utility table given in the problem is representative of a risk avoider. The results are presented below: Results for 3-52. f. Start Ending Branch Profit Use Node Node Node Node Prob. (End Node) Branch? Type Value Start 0 1 0 0 Dec 0.80 Branch 1 1 2 0 0 Ch 0.726 Branch 2 1 3 0 0 Dec 0.80 Branch 3 2 4 0.6 0 Dec 0.81 Branch 4 2 5 0.4 0 Dec 0.60 Branch 5 3 8 0 0 Ch 0.76 Branch 6 3 17 0 0.8 Fin 0.80 Branch 7 4 6 0 0 Ch 0.81 Branch 8 4 11 0 0.6 Fin 0.60 Branch 9 6 9 0.9 0.9 Fin 0.90 Branch 10 6 10 0.1 0 Fin 0.00 Branch 11 5 7 0 0 Ch 0.18 Branch 12 5 14 0 0.6 Fin 0.60 Branch 13 7 12 0.2 0.9 Fin 0.90 Branch 14 7 13 0.8 0 Fin 0.00 Branch 15 8 15 0.6 1 Fin 1.00 Branch 16 8 16 0.4 0.4 Fin 0.40 Yes Yes Yes Yes 3-53. a. The decision table for Chris Dunphy along with the expected profits or expected monetary values (EMVs) for each alternative are shown on the next page. Table for Problem 3-53a Return in $1,000 NO. OF WATCHES EVENT 1 EVENT 2 EVENT 3 EVENT 4 EVENT 5 Probability 0.10 0.20 0.50 0.10 0.10 Expected Profit 100,000 100 110 120 135 140 119.5 150,000 90 120 140 155 170 135.5 200,000 85 110 135 160 175 131.5 250,000 80 120 155 170 180 144.5 300,000 65 100 155 180 195 141.5 350,000 50 100 160 190 210 145 400,000 45 95 170 200 230 151.5 450,000 30 90 165 230 245 151 500,000 20 85 160 270 295 155.5 b. For this decision problem, Alternative 9, stocking 500,000, gives the highest expected profit of $155,500. c. The expected value with perfect information is $175,500, and the expected value of perfect information (EVPI) is $20,000. d. The new probability estimates will give more emphasis to event 2 and less to event 5. The overall impact is shown below. As you can see, stocking 400,000 watches is now the best decision with an expected value of $140,700. Return in $1,000: NO. OF WATCHES EVENT 1 EVENT 2 EVENT 3 EVENT 4 EVENT 5 Probability 0.100 0.280 0.500 0.100 0.020 Expected Profit 100,000 100 110 120 135 140 117.1 150,000 90 120 140 155 170 131.5 200,000 85 110 135 160 175 126.3 250,000 80 120 155 170 180 139.7 300,000 65 100 155 180 195 133.9 350,000 50 100 160 190 210 136.2 400,000 45 95 170 200 230 140.7 450,000 30 90 165 230 245 138.6 500,000 20 85 160 270 295 138.7 Population Population Row Same Grows Average 3-54. a. Decision under uncertainty. b. Large wing –85,000 150,000 32,500 Small wing –45,000 60,000 7,500 0 0 0 No wing c. Best alternative: large wing. 3-55. a. Weighted Population Population Average with Same Grows α = 0.75 Large wing –85,000 150,000 91,250 Small wing –45,000 60,000 33,750 0 0 0 No wing b. Best decision: large wing. c. No. 3-56. a. No Mild Severe Expected Congestion Congestion Congestion Time Tennessee 15 30 45 25 Back roads 20 25 35 24.17 Expressway 30 30 30 30 Probabilities (30 days)/(60 (20 days)/(60 (10 days)/(60 days) = 1/2 days) = 1/3 days) = 1/6 b. Back roads (minimum time used). c. Expected time with perfect information: 15 × 1/2 + 25 × 1/3 + 30 × 1/6 = 20.83 minutes Time saved is 3 1 3 ; minutes. 3-57. a. EMV can be used to determine the best strategy to minimize costs. The QM for Windows solution is provided. The best decision is to go with the partial service (maintenance) agreement. Solution to 3-57a Probabilities 0.2 0.8 Maint. No Maint. Expected Row Row Cost ($) Cost ($) Value Minimum Maximum ($) ($) ($) No Service Agreement 3,000 0 600 0 3,000 Partial Service Agreement 1,500 300 540 0 1,500 500 500 500 500 500 500 0 500 Complete Agreement Column best Service The minimum expected monetary value is $500 given by Complete Service Agreement b. The new probability estimates dramatically change Sim’s expected values (costs). The best decision given this new information is to still go with the complete service or maintenance policy with an expected cost of $500. The results are shown in the table. Solution to 3-57b Probabilities 0.8 0.2 Does Not Expected Needs Repair Need Repair Value ($) ($) ($) No Service Agreement 3,000 0 2,400 Partial Service Agreement 1,500 300 1,260 500 500 500 Complete Agreement Service Column best 500 3-58. We can use QM for Windows to solve this decision making under uncertainty problem. We have shown probability values for the equally likely calculations. As you can see, the maximax decision is Option 4 based on the $30,000, and the maximin decision is Option 1 based on the 5,000. As seen in the table, the equally likely decision is Option 3 because the average value for this is $5750. Solution to 3-58 Prob. 0.25 0.25 0.25 0.25 Judge Trial Court Arbitration Equall y Row Row Likely Min. Max. Option 1 5,000 5,000 5,000 5,000 5,000 5,000 5,000 Option 2 10,000 5,000 2,000 0 4,250 0 10,000 Option 3 20,000 7,000 1,000 –5,000 5,750 –5,000 20,000 Option 4 30,000 15,000 –10,000 –20,000 3,750 –20,000 30,000 5,750 5,000 30,000 Column best SOLUTION TO STARTING RIGHT CASE This is a decision-making-under-uncertainty case. There are two events: a favorable market (event 1) and an unfavorable market (event 2). There are four alternatives, which include do nothing (alternative 1), invest in corporate bonds (alternative 2), invest in preferred stock (alternative 3), and invest in common stock (alternative 4). The decision table is presented. Note that for alternative 2, the return in a good market is $30,000 (1 + 0.13)5 = $55,273. The return in a good market is $120,000, (4 x $30,000) for alternative 3, and $240,000, (8 x $30,000) for alternative 4. Payoff table Laplace Event 1 Hurwicz Event 2 Average Value Minimum Maximum Value Alternative 1 0 0 0.0 0 0 0.00 Alternative 2 55,273 –10,000 22,636.5 –10,000 55,273 –2,819.97 Alternative 3 120,000 –15,000 52,500.0 –15,000 120,000 –150.00 Alternative 4 240,000 –30,000 105,000.0 –30,000 240,000 –300.00 Regret table Maximum Alternative Event 1 Event 2 Regret Alternative 1 240,000 0 240,000 Alternative 2 184,727 10,000 184,727 Alternative 3 120,000 15,000 120,000 Alternative 4 0 30,000 30,000 a. Sue Pansky is a risk avoider and should use the maximin decision approach. She should do nothing and not make an investment in Starting Right. b. Ray Cahn should use a coefficient of realism of 0.11. The best decision is to do nothing. c. Lila Battle should eliminate alternative 1 of doing nothing and apply the maximin criterion. The result is to invest in the corporate bonds. d. George Yates should use the equally likely decision criterion. The best decision for George is to invest in common stock. e. Pete Metarko is a risk seeker. He should invest in common stock. f. Julia Day can eliminate the preferred stock alternative and still offer alternatives to risk seekers (common stock) and risk avoiders (doing nothing or investing in corporate bonds). SOLUTIONS TO INTERNET CASES Drink-at-Home, Inc. Case Abbreviations and values used in the following decision trees: Normal—proceed with research and development at a normal pace. 6 Month—Adopt the 6-month program: if a competitor’s product is available at the end of 6 months, then copy; otherwise proceed with research and development. 8 Month—Adopt the 6-month program: proceed for 8 months; if no competition at 8 months, proceed; otherwise stop development. Success or failure of development effort: Ok—Development effort ultimately a success No—Development effort ultimately a failure Column: S— Sales revenue R— Research and development expenditures E— Equipment costs I—Introduction to market costs Market size and Revenues: Without With Competition Competition S—Substantial (P = 0.1) $800,000 $400,000 M—Moderate (P = 0.6) $600,000 $300,000 L—Low (P = 0.3) $500,000 $250,000 Competition: C6—Competition at end of 6 months (P = .5) No C6—No competition at end of 6 months (P = .5) C8—Competition at end of 8 months (P = .6) No C8—No competition at end of 8 months (P = .4) C12—Competition at end of 12 months (P = .8) No C12—No competition at end of 12 months (P = .2) The optimal program is to adopt the 6-month program. However, as the expected value is negative, perhaps another alternative of doing nothing should be considered. Ruth Jones’ Heart By-Pass Operation Case 1. Expected survival rate with surgery (5.95 years) exceeds the nonsurgical survival rate of 2.70 years. Surgery is normal. Ski Right Case a. Bob can solve this case using decision analysis. As you can see, the best decision is to have Leadville Barts make the helmets and have Progressive Products do the rest with an expected value of $2,600. The final option of not using Progressive, however, was very close with an expected value of $2,500. EXPECTE D POOR AVERAGE GOOD EXCELLENT VALUE Probabilities 0.1 0.3 0.4 0.2 Option 1—PP –5,000 –2,000 2,000 5,000 700 Option 2—LB and PP –10,000 –4,000 6,000 12,000 2,600 Option 3—TR, LB, and PP –15,000 –10,000 7,000 13,000 900 Option 4—CC and PP –30,000 –20,000 10,000 30,000 1,000 Option 5—LB, CC, and TR –60,000 –35,000 20,000 55,000 2,500 With Perfect Information –5,000 –2,000 20,000 55,000 17,900 The maximum expected monetary value is $2,600 given by Option 2 – LB and PP. b and c. The opportunity loss and the expected value of perfect information is presented. The EVPI is $15,300. Expected value with perfect information = $17,900 Expected monetary value = $2,600 Expected value of perfect information = $15,300 Opportunity loss table POOR MARKET AVERAGE GOOD EXCELLENT EXPECTED VALUE Probabilities 0.1 0.3 0.4 0.2 Option 1 0 0 18,000 50,000 17,200, Option 2 5,000 2,000 14,000 43,000 15,300, Option 3 10,000 8,000 13,000 42,000 17,000 Option 4 25,000 18,000 10,000 25,000 88,000 Option 5 55,000 33,000 0 0 15,400 d. Bob was logical in approaching this problem. However, there are other alternatives that might be considered. One possibility is to sell the idea and the rights to produce this product to Progressive Products for a fixed amount. STUDY TIME CASE Raquel must decide which of the three cases (1, 2, or 3) to study, and how much time to devote to each. We will assume that it is equally likely (a 1/3 chance) that each case is chosen. If she misses at most 8 points (let’s assume she is correct in thinking that) on the other parts of the exam, scoring 20 points or more on this part will give her an A for the course. Scoring 0 or 12 points on this portion of the exam will result in a grade of B for the course. The table gives the different possibilities – points and grade in the course. Case 1 Case 2 Case 3 on Exam on Exam on Exam EV Grade in Course Study 1, 2, 3 12 B 12 B 12 B 12 B Study 1,2 20 A 20 A 0B 40/3 A 2/3 chance or B 1/3 chance Study 1,3 20 A 0B 20 A 40/3 A 2/3 chance or B 1/3 chance Study 2,3 0B 20 A 20 A 40/3 A 2/3 chance or B 1/3 chance Study 1 25 A 0B 0B 25/3 A 1/3 chance or B 2/3 chance Study 2 0B 25 A 0B 25/3 A 1/3 chance or B 2/3 chance Study 3 0B 0B 25 A 25/3 A 1/3 chance or B 2/3 chance Thus, Raquel should study 2 cases since this will give her a 2/3 chance of an A in the course. Notice that this also has the highest expected value. This is a situation in which the values (points) are not always indicative of the importance of the result since 0 or 12 results in a B for the course, and 20 or 25 results in an A for the course.