Coffee Industry Analysis: Production, Consumption, and Price Trends

advertisement

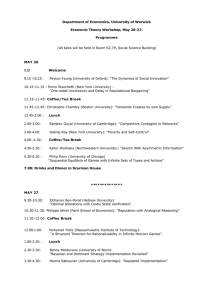

II. Overall about the Coffee industry 1. Production and Consumption of coffee in the world 1.1 Production In Coffee Market Report – April 2021, ICO (International Coffee Organization) stated that total production in coffee year 2020/21 is estimated to rise by 0,5% , with Arabica production increasing by 2.6% to 99.42 million bags. The production of Robusta coffee is expected to decrease by 2.4% to 70.21 million bags. At the regional level, a slight decrease of 0.8% is expected for Africa at 18.54 million bags in coffee year 2020/21 in comparison with 18.68 million bags in the previous coffee year. Production for Asia & Oceania is forecast to fall by 1.1% from 49.48 million bags in 2019/20 to 48.95 million in 2020/21. Production for Mexico & Central America is expected to decrease slightly by 0.1% at 19.54 million bags against 19.56 million bags in coffee year 2019/20. An increase of 1.8% in production is expected from South America at 82.59 million bags, compared with 81.12 million bags in 2019/20. According to Bloomberg, the supply sources of coffee in 2021/22 will insufficient about 11.6 million bags since the production of Brazil decreases. In which, the world will be suffer a loss of 7.5 million bags of Arabica coffee. Moreover, Conab – the Agricultural forecast and supply agency under the Brazilian Ministry of Agriculture, the 2021 crop of arabica coffee production is forecasted to decrease by 35.7% compared to the previous crop, to the lowest level in 12 years 31.35 million bags, due to the “two-year” cycle and adverse weather. According to the National Center for Socio-Economic Information and Forecast, the Colombian Coffee Association reported that this year's coffee output is stable at 840,000 tons, of which in the first 6 months of the crop year (to the end of March 2021) about 450,000 tons, up 2.3% over the same period in 2020. Colombia is the world's largest producer and exporter of wet processed arabica coffee, having a great influence on the New York floor. 1.2 Consumption According to ICO, In April World coffee consumption is projected to increase by 1.3% to 166.34 million bags in 2020/21 compared to 164.20 million bags for coffee year 2019/20. The negative impact on coffee consumption experienced during coffee year 2019/20 with the outbreak of the covid-19 pandemic is fading as consumption is regaining its normal trend. Consumption in importing countries and domestic consumption in exporting countries is expected to grow by 1.3% and 1.4% respectively. Consumption in Africa is expected to increase by 1.8% at 12.24 million bags. Consumption in Asia & Oceania will increase by 1.4% at 36.50 million bags. In the region of Mexico and Central America, consumption is expected to increase by 0.7% at 5.36 million bags. As a result, the surplus of total production over world consumption is expected to be reduced at 3.28 million bags, compared with 4.6 million bags in the previous coffee year. Figure. Production and Consumption in coffee year (Source: ICO) Export of roasted coffee is estimated reduced by 4% to 336.172 bags, while soluble coffee fell 3.4% to 5.72 million bags. However, cumulative from April/2020 to March, Global export of coffee reached 19.5 million bags, declined by 1% compared to 130.8 million bags recorded in period from April 2019 to March 2020. In the first half of coffee year 2020-2021, Brazil's total coffee exports reached 24.66 million bags, an increase of 23.3% compared to the 2019-2020 crop. In which, 96% of Brazil's coffee exports are Arabica coffee, with 23.66 million bags, up 19.2% compared to the first 6 months of the 2019-2020 crop year. Colombia's arabica exports in the first half of coffee year 2020-2021 also increased by 2.6% year-on-year to 7.75 million bags, while exports of other countries arabica decreased by 8.3 % down to 10.4 million bags. In the opposite direction, exports of robusta coffee in the first half of the 2020-2021 crop year decreased by 3.5% compared to the same period of the previous crop year, to 23.59 million bags. In which, exports of Vietnam, the world's second largest coffee exporter and also the world's largest robusta coffee exporter, reached 12.6 million bags, down 13.2% over the same period of the crop year. before. Figure. Total exports over the first half of coffee year in types of coffee (Source: ICO) 2. Analysis of fluctuation in price of Coffee In April, the International Coffee Organization (ICO) composite coffee price index continued to increase by 1.4% compared to March 2021 and increased by more than 12% compared to the same period in 2020, reaching an average of 122 US cent/pound (equivalent to USD 2,711/ton). The daily composite price indicator fluctuates between 114 - 131 US cents/lb. This has been the sixth consecutive month of price increases and the highest level in more than three and a half years. Figure. ICO composite indicator daily prices According to the ICO, the average price for all coffee groups increased in April. Specifically, the price of Colombian arabica and Brazilian arabica increased by 2.4% and 1.7% month-on-month, respectively, to reach 181 percent. , 7 US cents/pound (equivalent to 4,038 USD/ton) and 124.2 US cent/pound (equivalent to 2,760 USD/ton). The average price of arabica coffee elsewhere also increased 1% from March to 168.6 US cents/lb (equivalent to 3,746 USD/ton) in April. Similarly, Robusta coffee prices also increased by 1.7%. to 167 US cents/pound (equivalent to 3,711 USD/ton). In April 2021, world coffee prices fluctuated up. Compared to the previous month, the price of Robusta coffee delivered in May 2021 on the London market increased by 45 USD/ton to 1,387 USD/ton. Coffee prices rose as the world coffee market was concerned about supply, as Brazil began to harvest a new season this year with a forecast of a significant decrease in total production. Besides, according to the association of Brazilian coffee exporters (Cecafé), the country's coffee exports from April 2021 will gradually decrease due to very strong exports from the beginning of the 2020-2021 crop year, estimated at 32 ,61 million bags of coffee of all kinds, excluding roasted coffee and converted instant coffee. 3. Coffee industry in Vietnam The French brought coffee into Vietnam around 1850. At the beginning of 1900, coffee was grown in some northern provinces such as Tuyen Quang, Lang Son and Ninh Binh. Along with the policy of sedentary cultivation, many people in the delta have migrated to live and cultivate coffee in the Central Highlands. Coffee intensification on a large scale occurs most typically in the Central Highlands. Most of the new coffee plantations planted during this period were Robusta coffee. Daklak province became the province with the largest coffee area in Vietnam and Daklak's coffee production accounted for nearly half of total coffee production. nationwide. 3.1 Production According to data from the Ministry of Agriculture and Rural Development, Vietnam's coffee area in 2020 will be 680,000 hectares, down about 2% compared to 2019. Going into 2021, the Ministry of Agriculture and Rural Development estimates that the coffee area will decrease to about 675,000 hectares. The reason is that the price of coffee has been continuously low for a long time, so people have reduced the area and intercropped with other crops. In addition, many coffee areas are old, slow replanting speed leads to reduced coffee production. According to the Import-Export Department (Ministry of Industry and Trade), in the 2020-2021 crop year, Vietnam's coffee output is forecast to decrease by 15% due to the impact of floods in October 2020 and drought in May and June 2020. . However, this year's crop, post-harvest harvesting and drying techniques have been focused, and the quality has been improved. 3.2 Consumption According to estimates by the Department of Agricultural Product Processing and Market Development, coffee exports in April 2021 are estimated at 110 thousand tons with a value of 209 million USD, bringing the volume of coffee exports in the first 4 months of 2021 to reach 563 thousand tons and 1.02 billion USD, down 17.6% in volume and 11.6% in value over the same period in 2020. Germany, Italy and Japan continue to be the three largest coffee consuming markets of Vietnam in the first 3 months of 2021 with market shares of 14.7%, 8.1% and 7.7% respectively. According to the Import-Export Department, in the first quarter, Vietnam's coffee exports reached the lowest level in a quarter in the period of 2019 - 2021 due to the negative impact of the COVID-19 pandemic, reduced consumption demand and business activities. unfavorable view. The blockage of the Suez Canal in March slowed down the transport of Vietnamese coffee to European and American markets. III. Using Futures contract for hedging trategy of Coffee bean’s price 1. Trading Coffee Bean in Futures Market From 1997 up to now, there are 2 methods of overseas sales being used by many businesses at the same time. That is selling by Outright method (fixed price, fixed delivery time) and selling by Differentials or Price To Be Fixed method (selling minus, closing price later). Outright in the world coffee trading tradition means that the buyer and seller fix the price right at the time of signing the purchase contract without knowing how the coffee price at the time of delivery changes. This method was popularly applied by Vietnamese coffee businesses in the early 1990s, but if both sides agree on a price right away, it is quite possible that they face price risks, so the method later on is quite possible. This is replaced by the method of signing a contract but not fixing the price, but when delivery, the selling price is fixed based on the price of coffee traded on the London market (UK) and deducted a difference from the price in the London market. Donate at the time of delivery, also known as the method of selling deductions (Differentials). The popular method of selling backwards for more than ten years is usually applied to long-distance contracts where the importer usually advances 70% of the contract amount to the exporter, the rest is calculated on delivery and Price fixing based on the price of coffee traded on the London futures market. In previous years, this is an advanced method of selling coffee compared to the spot because it attaches the price of Vietnamese coffee to the world price, limiting losses compared to the spot method if the world price of coffee increases. In this way, businesses can win big and also lose big, depending on whether the world market price goes up or down at the time of delivery. In order to ensure that the coffee business in the domestic market does not suffer from a loss in price fluctuations, a coffee trader will buy and sell a large amount of coffee online, place a sell order as soon as the price is profitable, that is a form of futures contract transaction, in which the price of coffee is "locked" at the time of placing an order (the time when the price of coffee on the international market is most "satisfied" by the enterprise), while the goods are delivered at a later date. time agreed by both parties. It is important that, at the time of delivery of coffee, the price up or down is still delivered at the price that has been "locked" in the previous order. Information on world coffee prices has just been sent, and buying and selling decisions have also been made. Hundreds or even thousands of phone calls are made to businesses announcing their decision to sell when people see a reasonable price. An electronic exchange is set up for sellers and buyers to agree on prices and sign contracts. Coffee will be delivered at a time that both parties agree in the future. At that time, the price of coffee is higher or lower than the agreed price, the contract remains valid. Therefore, the buyer and the seller can calculate the profit and loss as soon as the decision is made. While trading like that, the coffee is virtual but the profit is real. This new form of buying and selling is essentially: signing contracts online and selling coffee over the phone. Usually, the trading session will be closed at midnight. After each such working day, coffee price charts and tables are also built so that coffee producers can predict future prices. The biggest advantage of this transaction is that one can in the future follow the current price – a price that businesses know is reasonable, thereby limiting risks, which is not a good way to do business. which traditional business is achieved. In addition to price hedging, this form is also used by companies as an investment channel (buying and selling futures contracts to profit from price differences) or using futures contracts as an real market pricing. From the selling price of coffee futures on LIFFE, it is possible to calculate the purchase price of coffee on the domestic market so that it is profitable. However, trading in the futures market is also very profitable but also has a lot of losses. Therefore, the trader must have a stop loss. In addition to businesses, farmers also benefit: In the past, if export prices were high, businesses would buy coffee from farmers at high prices. And the low export price will force the price of coffee growers. With the futures contract, businesses are willing to buy coffee from farmers at a price higher than the domestic market price when calculating to sell in the futures market at a profit. 2. Three main coffee futures markets and exchange coffee in LIFFE There are three main futures exchanges for coffee, with three different futures contracts which go some way to covering the diversity of global coffees: • the ICE exchange in New York trades the ‘C’ contract where the underlying coffee is washed arabica • the Liffe exchange in London trades a contract with robusta as the underlying • the BM&F exchange in Sao Paulo trades a natural Brazilian arabica futures contract. Since Vietnam exports mostly the Robusta, we focus on LIFFE (London International Futures and Options Exchange). The London market is currently the world's largest trading market for Robusta coffee, while Arabica coffee is traded mainly through the New York market. On the London market, buyers and sellers do not meet directly but transact through intermediaries, brokers are brokerage companies, banks and financial institutions. Coffee futures contracts on the London market are defaulted to a volume of 5 tons/lot, currently 10 tons/lot, the origin of coffee is very diverse but mainly concentrated in a few places. Southeast Asia, South America and Africa, in which Vietnam is currently the world's leading exporter of Robusta coffee, surpassing Brazil - which currently accounts for 30% of the world coffee market share. To be allowed to trade on the London market, coffee must meet the quality standards set forth in a guide on the exchange's website. Delivery months can be January, March, May, July, September and November. The minimum price change is 1 USD/ton ($5/lot). The last trading day is at 12.30pm the last business day of the delivery month. Trading hours from 9:00 a.m. to 5:30 p.m. Since 2004, the Government appointed Techcombank to cooperate with Singapore experts and Vietnam Coffee and Cocoa Association Vicofa, to implement a program to use financial instruments to hedge risks. The parties have trained businesses, and organized a pilot to bring Vietnamese coffee to the London Commodity Exchange. At the end of 2004, INEXIM Dak Lak was the first enterprise to participate in the futures market through Techcombank. Nowadays, we can trading coffee futures through MXV (Mercantile Exchange of Vietnam). Figure. Trading volume of coffee since 2019 (Source: MXV) 3. Use of Futures contracts for hedging price of Coffee a. Futures contracts in coffee trading are used as a hedge against price fluctuations, specifically: Case 1: Long Hedges (Buy Futures) This case is used by the company when there is an export - sale contract but no purchase contract from domestic manufacturers. When the price fluctuates in an upward direction, which is detrimental to the company, the company will decide to buy the corresponding amount of the commodity in the futures market that the company calculates will be reasonable. Case 2: Short Hedges (Sell Futures) This case is applied when the company has purchased a quantity of goods from the country but still has not had an export contract. future to preserve business profits. Typically, prices in the physical and futures markets move in the same direction and with a steady spread. When participating in futures contracts, importers and exporters can offset profits and losses through 2 markets, when in the real market, profits will offset losses in the futures market and vice versa. benefits importers and exporters in fixing prices with partners without fear of fluctuations in the market. b. Examples: Assume on 1/5/2021, Company A signed an export contract valued 380.000 USD delivered in August/2021. A anticipated that it needs 130 tons of coffee to export. A want to hedge its next 4 months of coffee price using Robusta futures contracts. Each lot contains 10 tons of coffee. A has to decide it should buy (long) or sell (short) the futures to initiate its position. If coffee price increases then expense of company increases. Hence, the net profit will decrease. A need a situation where its future position is going to increase in value when coffee price go up. So if A go Long Contract (buy futures), then A will make profits on those futures when coffee price goes up and that is going to offset A natural risk exposure. So A is go Long or Buy the Futures Contracts. Since A needs 130 tons of coffee and each contract contains 10 tons of coffee A needs 13 contracts. Scenario 1: Coffee Spot Price Rose on Delivery Date Coffee Futures Price for August delivery on 1/5/2021: 2.373 USD/ton Coffee Spot Price on 1/5/2021: 2.365 USD/ton Coffee futures price delivered after August on 15/8: 2.621 USD/ton Coffee Spot price on 15/8: 2.615 USD/ton Types Ingredient Extra Ingredients Spice Packaging Labor Cost General production cost COGS Gross profit Percentage 85% 3,7% 4% 1,1% 3,5% 2,7% Cost 308.490 13.469 14.569 4.124 12.645 9.621 362.918 17.082 Coffee price fluctuation: Change in % Future price Ingredients cost COGS Gross profit 0% 5% 7% 10,45% 2.373 2.492 2.539 2.621 308.490 323.914 330.084 340.730 362.918 378.343 384.512 395.158 17.082 1.658 -4.512 -15.158 When signing the contract, the price of raw coffee is 2,373 USD/ton. Four months later, at the time of delivery, the price increased by 10.45% to $2,621. This means that the cost of goods increases, but the delivery price of finished coffee is fixed at 380,000 USD. Therefore, if the raw material price is $2,373/ton, the company has a profit of $17,082. But the profit will gradually decrease with the increase in the price of raw materials. When the price of raw materials increased by 10.45%, the company lost $15,158. If the company does not hedge against the risk of raw material prices, the company will lose more than expected: 17,082 – (-15,158) = 32,240 When the company enters the futures market: Futures market - LIFFE Coffee spot market On 1/5/2021 buy 13 August contracts Company A signed a contract to buy price 2.373 USD/ton 130 tons of coffee with farmers delivered in Augst/2021. Spot price 2.365 USD/ton On 15/8/2021 sell 13 futures contracts, On 15/8/2021, buy 130 tons of coffee price 2.621 USD/ton with spot price 2.615 USD/ton Futures make profit: A lost: 130 * (2.621-2.373) = 32.240 USD 130 * (2.615-2.365)= -32.500 USD Net profit when participate in 2 market 32.240 + (-32.500) = -260 USD Profit from Futures market offset part of loss due to the increase of coffee’s price. Since, company still has profit of 17.082 + (-260) = 16.822 USD Scenario 2: Coffee Spot Price Fell on Delivery Date Coffee Futures Price for August delivery on 1/5/2021: 2.373 USD/ton Coffee Spot Price on 1/5/2021: 2.365 USD/ton Coffee futures price delivered after August on 15/8: 2.125 USD/ton Coffee Spot price on 15/8: 2.115 USD/ton Change in % Future price Ingredients cost COGS Gross profit 0% -5% -7% -10,45% 2.373 2.254 2.207 2.125 308.490 293.065 286.895 276.252 362.918 347.493 341.323 330.680 17.082 32.506 38.676 49.319 When the company enters the futures market: Futures market - LIFFE Coffee spot market On 1/5/2021 buy 13 August contracts Company A signed a contract to buy price 2.373 USD/ton 130 tons of coffee with farmers delivered in Augst/2021. Spot price 2.365 USD/ton On 15/8/2021 sell 13 futures contracts, On 15/8/2021, buy 130 tons of coffee price 2.125 USD/ton with spot price 2.115 USD/ton Futures suffer loss: A gain: 130 * (2.125-2.373) = - 32.240 USD 130 * (2.365-2.115)= 32.500 USD Net profit when participate in 2 market -32.240 + 32.500 = 260 USD Since , Company gain a profit: 17.082 + 260 = 17.342 USD If A didn’t sign a futures contracts, the magnificent drop of coffee price will make profit increase a lot to 49.319 USD (gross profit) Thus, when participating in futures contracts, allowing the company to minimize price risk. With price volatility of -10.45% to 10.45%, the company's profit remained stable between $16,822 and $17,342. Without measures to hedge against price fluctuations, the company's profit also increased or decreased according to market prices from a profit of $49,319 to a loss of $15,158. In general, participating in futures contract trading brings many benefits to the company such as protecting its goods, controlling the futures market price, limiting the risk of price fluctuations, and protecting profits. , linking the company's business activities close to the international market... 3. Risk and obstacle when participating Futures Market: * Risk: - The situation of complicated price fluctuations greatly affects the profits of enterprises. - Margin: the business is likely to suffer a loss and lose all of the initial margin or any other funds that have or are obligated to make a deposit to maintain its position in the commodity futures and commodities markets. spot goods. If the market moves against the company's position, the company must make additional margin to maintain the position. - Defer or restrict trading and pricing relationships: market conditions (liquidity) and/or operating market rules (some markets may stop any trading or any transaction month that exceeds the limit range of price movements) may increase the possibility of losses due to non-payment or failure to execute trades. - Currency risk: exchange rate fluctuations in the event of having to convert the specified cash flow in the contract to another cash flow can affect the profit or loss in futures contract transactions. * Obstacle: - Seizing the opportunity is very important for the coffee business because if you miss any opportunity, it can greatly affect the company's business, which depends subjectively on the delivery person. He or she must be really keen to monitor each market movement, price movement, and timely judgment to make the best decision, which the company is still lacking due to participating in this market in The time is too short, very few people have a thorough understanding of this market. - There is no market research and technical analysis department, which forecasts world and domestic market prices separately. REFERENCE: 1. Hull, J., 2015. Options, Futures, and Other Derivatives. Pearson. 2. Nguyễn, V., 2010. Thi ̣trường ngoa ̣i hố i và các sản phẩ m phái sinh. 5th ed. Vietnam: NXB Thố ng Kê. 3. Islam, M. and Chakraborti, J., 2015. 'FUTURES AND FORWARD CONTRACT AS A ROUTE OF HEDGING THE RISK', Risk governance & control: financial markets & institutions, vol. 5, no. 4, pp. 73-79. 4. ICO, I., 2021. 'Coffee Market Report April,2021', Coffee Market Report, vol. 4, no. 4, pp. 1-6. 5. cdn.vietnambiz.vn. 2021. No page title. [ONLINE] Available at: https://cdn.vietnambiz.vn/171464876016439296/2021/5/19/bao-cao-thi-truong-caphe-thang-thang-4-final-16214077609652020785480.pdf. [Accessed 24 May 2021]. 6. ico.org. 2021. No page title. [ONLINE] Available at: https://ico.org/prices/p1April2021.pdf. [Accessed 24 May 2021]. 7. ThemeBucket. 2021. Tình hình xuất khẩu chè và cà phê của Việt Nam năm 2020 . [ONLINE] Available at: http://asemconnectvietnam.gov.vn/default.aspx?ID1=1&ZID1=66&ID8=104593. [Accessed 24 May 2021]. 8. Hedging Against Falling Coffee Prices using Coffee Futures | The Options & Futures Guide . 2021. Hedging Against Falling Coffee Prices using Coffee Futures | The Options & Futures Guide . [ONLINE] Available at: https://www.theoptionsguide.com/coffee-futures-short-hedge.aspx. [Accessed 24 May 2021]. 9. Perfect Daily Grind. 2021. What Is Coffee Hedging & How Does It Impact Producers? - Perfect Daily Grind. [ONLINE] Available at: https://perfectdailygrind.com/2019/01/what-is-coffee-hedging-how-does-it-impactproducers/. [Accessed 24 May 2021]. 10. Perfect Daily Grind. 2021. What Is Coffee Hedging & How Does It Impact Producers? - Perfect Daily Grind. [ONLINE] Available at: https://perfectdailygrind.com/2019/01/what-is-coffee-hedging-how-does-it-impactproducers/. [Accessed 24 May 2021]. 11. volcafespecialty.com. 2021. No page title. [ONLINE] Available at: https://volcafespecialty.com/wp-content/uploads/2017/10/Dec-11-IS-Futures.pdf. [Accessed 24 May 2021]. 12. The Balance. 2021. How to Trade Coffee Futures. [ONLINE] Available at: https://www.thebalance.com/trading-coffee-futures-809346. [Accessed 24 May 2021]. 13. capital.com. 2021. No page title. [ONLINE] Available at: https://capital.com/trade-coffee. [Accessed 24 May 2021]. 14. Khối lượng giao dịch. 2021. Khối lượng giao dịch. [ONLINE] Available at: https://www.mxv.com.vn/khoi-luong-giao-dich.html?product=53-27&from=82019&to=05-2021&unit=1m. [Accessed 24 May 2021]. 15. www.vicofa.org.vn. 2021. No page title. [ONLINE] Available at: http://www.vicofa.org.vn. [Accessed 24 May 2021].