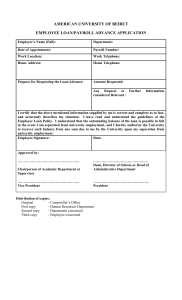

Prepare the journal entry for the wages and salaries paid. Dr. Salaries and wages expense 920,000; Cr. Withholding taxes payable 225,000, Social security taxes payable 60,800, Cash 634,200 Prepare the entry to record the employer's contributions. Dr. Payroll tax expense 60,800; Cr. Social security taxes payable 60,800 Exercise 2: Please refer to the image below for the next question/requirement. goods in transit from a vendor to Hershey on December 31, 20xx with an invoice cost of 100,000 purchased FOB shipping point was not yet recorded goods shipped FOB shipping point from a vendor to Hershey was lost in transit the invoice cost of 40,000 was not yet recorded Compute for the adjusted accounts payable on December 31, 2021. Jay Co. has a 10%, P4,000,000 loan payable as of December 31, 2021 that is maturing on July 1, 2022. Interest on the loan is due every July 1 and December 31. On February 1, 2022, BOA Co. entered into a refinancing agreement with a bank to refinance the loan on a long-term basis. Both parties are financially capable of honoring the agreement's provisions. BOA’s financial statements were authorized for issue on March 15, 2022. How much is presented as current liability in relation to the loan in BOA’s 2021 year-end financial statements? 4,000,000 Jay Co. has a 10%, P4,000,000 loan payable as of December 31, 2021 that is maturing on July 1, 2022. Interest on the loan is due every July 1 and December 31. On February 1, 2022, NAMAN Co. entered into a refinancing agreement with a bank to refinance the loan on a longterm basis. Both parties are financially capable of honoring the agreement's provisions. NAMAN has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2021 under an existing loan facility. NAMAN’s financial statements were authorized for issue on March 15, 2022. How much is presented as current liability in relation to the loan in NAMAN’s 2021 year-end financial statements? 0 Jay Co. has a 10%, P4,000,000 loan payable as of December 31, 2021 that is maturing on July 1, 2022. Interest on the loan is due every July 1 and December 31. On December 1, 2021, AYAWPALABI Co. entered into a refinancing agreement with a bank to refinance the loan on a long-term basis. The refinancing and roll over transaction was completed on December 31, 2021. How much is presented as current liability in relation to the loan in AYAWPALABI’s 2021 year-end financial statements? 0 NOE Co. has a 10%, P4,000,000 loan payable as of December 31, 2021 that is maturing on July 1, 2022. The loan is dated July 1, 19x1 and pays annual interest every July 1. On February 1, 2022, NOE Co. entered into a refinancing agreement with a bank to refinance the loan on a long-term basis. Both parties are financially capable of honoring the agreement's provisions. NOE has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2021 under an existing loan facility. NOE’s financial statements were authorized for issue on March 15, 2022. How much is presented as current liability in NOE’s 2021 yearend financial statements? On January 1, 2021, MAAWA-KANAMAN Co. took a 3-year, P4,000,000 loan from a bank. The loan agreement requires MAAWA-KANAMAN to maintain a current ratio of 2:1. If the current ratio falls below 2:1, the loan becomes payable on demand. As of December 31, 2021, MAAWA-KANAMAN’s current ratio is 1.8:1. On January 5, 2022, the bank agreed not to collect the loan in 2022 and gave MAAWA-KANAMAN 12 months to rectify the breach of loan agreement. How much is presented as current liability in relation to the loan in MAAWAKANAMAN’s 2021 year-end financial statements? On January 1, 2021, HWAGMONASILANGPAHIRAPAN Co. took a 3-year, P4,000,000 loan from a bank. The loan agreement requires HWAGMONASILANGPAHIRAPAN to maintain a current ratio of 2:1. If the current ratio falls below 2:1, the loan becomes payable on demand. As of December 31, 2021, HWAGMONASILANGPAHIRAPAN’s current ratio is 1.8:1. On December 31, 2021, the bank agreed not to collect the loan in 2022 and gave HWAGMONASILANGPAHIRAPAN 12 months to rectify the breach of loan agreement. How much is presented as current liability in relation to the loan in HWAGMONASILANGPAHIRAPAN’s 2021 year-end financial statements? Exercise 2 Irving Music Shop gives its customers coupons redeemable for a poster plus a Classic CD. One coupon is issued for each dollar of sales. On the surrender of 100 coupons and P5.00 cash, the poster and CD are given to the customer. It is estimated that 80% of the coupons will be presented for redemption. Sales for the first period were P700,000, and the coupons redeemed totaled 340,000. Sales for the second period were P840,000, and the coupons redeemed totaled 850,000. Irving Music Shop bought 20,000 posters at P2.00/poster and 20,000 CDs at P6.00/CD. Instructions: Prepare the following entries for the two periods, assuming all the coupons expected to be redeemed from the first period were redeemed by the end of the second period. To record coupons redeemed for period 1 Dr. Premium expense 10,200, Cash 17,000; Cr. Premium inventory 27,200 To record estimated liability for period 1 Dr. Premium expense 6,600; Cr. Premium liability 6,600 To record coupons redeemed for period 2 Dr. Premium liability 6,600, Premium expense 18,900, Cash 42,500; Cr. Premium inventory 68,000 To record estimated liability for period 2 Dr. Premium expense 1,260; Cr. Premium liability 1,260 Premiums again Exercise 3 Edwards Co. includes one coupon in each bag of dog food it sells. In return for 4 coupons, customers receive a dog toy that the company purchases for £1.20 each. Edwards's experience indicates that 60 percent of the coupons will be redeemed. During 2018, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 40,000 coupons were redeemed. During 2019, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed. Instructions: Determine the premium expense to be reported in the income statement and the premium liability on the statement of financial position for 2018 and 2019. Premium expense 2018 18,000 Premium expense 2019 21,600 Premium liability as of December 31, 2018 6,000 Premium liability as of December 31, 2019 9,600 Refer to the image below for the next requirements. 1. Prepare the journal entry to record the sale during 2020. 2. Assume the entity uses the expense as incurred approach. Prepare the journal to record the estimated warranty during 2020. 3. Assume the entity uses the expense as incurred approach. Prepare the journal entry to record the actual payment of warranty cost. 4. Assume the entity uses the accrual approach. Prepare the journal to record the estimated warranty during 2021 5. Assume the entity uses the accrual approach. Prepare the journal entry to record the actual payment of warranty cost during 2021. 6. Analyze the estimated liability account to ascertain if adjustment is necessary. The sales and warranty repairs are made evenly during the year. Prepare the adjusting entry, if any, to correct the estimated warranty liability on December 31, 2021.