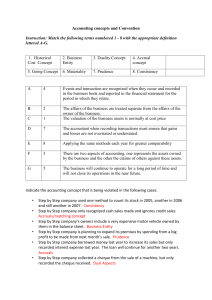

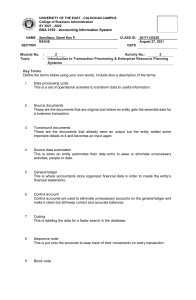

ACCOUNTING RULES Chapter 10 INTRODUCTION Accounting rules need to be applied in order for the preparers and users of accounting information to understand the information. Accounting rules also help in comparing the accounting information provided by different businesses. ACCOUNTING PRINCIPLES Accounting principles are also referred as concepts. A concept is a rule which sets down how the financial activities of a business are recorded. There are 10 Accounting principles that need to be applied by accountants while preparing the financial statements. 1. BUSINESS ENTITY The business entity principle means that the business is treated as being completely separate from the owner of the business. The personal assets and spending of the owner do not appear in the accounting records of the business. If there is a transaction concerning both the business and its owner, then it is recorded in the accounting records of the business. 2. CONSISTENCY The consistency principle means that accounting methods must be used consistently from one accounting period to another. The method that has the most realistic outcome should be selected and applied consistently by the business. If consistency principle is not applied, a comparison of the financial results cannot be made effectively. 3. DUALITY This principle means that every transaction is recorded twice – once on the debit side and once on the credit side. Also known as the dual aspect priniciple. 4. GOING CONCERN This principle means that the accounting records are maintained on the basis that the business will continue to operate for an indefinite period of time. The principle means that there is no intention to close down the business or reduce the size of the business by any significant amount. 5. HISTORIC COST The historic cost principle requires that all assets and expenses are initially recorded in the ledger accounts at the actual cost. For example: A computer equipment purchased for $5,000 would be recorded at the same amount in the financial statements and depreciation on the non-current asset would be accounted for separately.