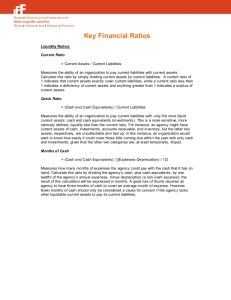

MOLO RYZI COMPANY’s NOTES TO FINANCIAL STATEMENTS 1) CORPORATE INFORMATION QUEEN’S DELIGHTS is a partnership business enterprise owned and managed by FIVE (5) people who contributed money, property and industry to a common fund. As partners, they will benefit from the profits as well as incur losses of the business. In establishing the business, the partners will contribute ₱100,000.00 each as initial contribution for the operation of the business. The Company is domiciled in the Philippines and the business will launch its first stall at the center of commerce in Diffun, Quirino. The location was chosen considering the consumers’ easy access and convenience. The location will also give the consumers perception of an affordable product. 2) BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE BASIS OF PREPARATION BASIS OF PREPARATION The financial statements have been prepared using the historical cost basis. The financial statements are presented in Philippine Peso (₱), which is the Company’s functional and presentation currency. All amounts are rounded to the nearest peso unless otherwise indicated. STATEMENT OF COMPLIANCE The financial statements of the company have been prepared the Financial Statements in accordance with Philippine Financial Reporting Standards (PFRS). 3) Changes in Accounting Policies and Disclosures The accounting policies adopted are consistent throughout the years and the Company has adopted the following new accounting pronouncements starting April 1, 2018. Unless otherwise indicated, the adoption did not have any significant impact on the Company’s financial statements. PFRS 15, REVENUE FROM CONTRACTS WITH CUSTOMERS PFRS 15 supersedes PAS 11, Construction Contracts, PAS 18, Revenue and related interpretations and it applies to all revenue arising from contracts with its customers. PFRS 15 establishes a five-step model to account for revenue arising from contracts with customers and requires that revenue be recognized at an amount that reflects the consideration to which an entity expects to be entitled in exchange for transferring goods or services to a customer. The five-step model is as follows: 1. Identify the contract(s) with a customer; 2. Identify the performance obligations in the contract; 3. Determine the transaction price; 4. Allocate the transaction price to the performance obligations in the contract; and 5. Recognize revenue when (or as) the entity satisfies a performance obligation. PFRS 15 requires entities to exercise judgment, taking into consideration all of the relevant facts and circumstances when applying each step of the model to contracts with their customers. The standard also specifies the accounting for the incremental costs of obtaining a contract and the costs directly related to fulfilling a contract. In addition, the standard requires extensive disclosures. The Company adopted PFRS 15 using the modified retrospective method of adoption with date of initial application. Contracts with customers generally include sale of goods specifically rice brownies. Contracts for sale of goods promise to deliver various goods that are capable of being distinct on their own and within the context of the contract, thus, the promises to deliver goods are viewed as distinct and separate performance obligations. Under its previous policy, revenue from sale of goods is recognized when it is probable that the economic benefits associated with the transaction will flow to the Company and the amount of the revenue can be measured reliably. Under PFRS 15, the Company concluded that revenue shall be recognized at a point in time with the satisfaction of the related performance obligation. The performance obligation is satisfied generally upon delivery of goods to customers where delivery is with reference to the agreed shipping terms. 1) NOTES TO CASH This account consists of Beginning balance, Cash 12/31/2021 ₱ 722,456.50 Net cash inflow from Operating Activities ₱ 969,924.10 Net cash inflow from Investing Activities ₱ 25,200.00 Net cash inflow from Financing Activities ₱ 200,000.00 Ending balance, Cash 12/31/2022 ₱ ₱1,917,580.60 The Company’s cash in banks have high grade credit quality since these are deposited with reputable banks. Since there has not been a significant increase in credit risk since initial recognition, the Company provides for credit losses on cash in banks. 2) NOTES TO ACCOUNTS RECEIVABLE This account consists of Beginning balance, Accounts Receivable ₱ 128, 800.00 plus: Net Sales ₱ ₱1,802,500.00 ₱ 0.00 ₱ 0.00 Collections ₱ 1, 716, 300.00 Recoveries ₱ 0.00 ₱ 215, 000.00 Recoveries less: Write-off Ending balance, Accounts Receivable The Company applies the PFRS 9 simplified approach in measuring ECL which uses a lifetime expected loss allowance for receivables. The ECL on receivables are estimated using a provision matrix by reference to past default experience of the debtor and an analysis of the debtor’s current financial position. The historical loss rates are adjusted to reflect current and forward-looking information on macroeconomic factors affecting the ability of the customers to settle the receivables. Generally, receivables are written-off if past due. The Company does not hold collateral as security. The credit quality of the financial assets was determined as follows: a. High grade - settlements are obtained from counterparties following the terms of the contracts without much collection effort. Cash are considered high grade as the Company transacts only with reputable banks. b. Standard grade - some reminder and follow-ups are performed to obtain settlement from the counterparties. Due from related parties and other receivables are considered as standard grade as these are settled on time or are slightly delayed. c. Sub-standard grade - constant reminder and follow-ups are performed to collect accounts from counterparties. Receivable from sale of scrap are determined to be substandard based on the Company’s collection experience. 3) NOTES TO INVENTORY This account consists of Beginning balance, Raw materials ₱ 149, 000.00 plus: Net purchases ₱ 116, 200.00 less: Ending balance, Raw materials ₱ 223, 500.00 Direct material used ₱ 41, 700.00 Direct labor ₱ 346, 320.00 Factory Overhead ₱ 22, 400.00 Beginning balance, WIP ₱ 91, 700.00 Ending balance, WIP ₱ 22, 459.00 Cost of Goods Manufactured (CGM) ₱ 484, 661.00 Beginning balance, Finished goods ₱ 425, 800.00 Cost of Goods Sold (CGS) ₱ 793, 461.00 Ending balance, Finished goods ₱ 425, 800.00 Since the business is manufacturing goods for the consumption of the public, they are much likely to spend money in their inventory. 4) NOTES TO PREPAID SUPPLIES This account consists of ₱ 45, 000.00 plus: Purchases ₱ 0.00 less: Prepaid supplies used ₱ 15, 000.00 ₱ 30, 000.00 Beginning balance, Prepaid supplies Ending balance, Prepaid supplies Prepaid supplies are the supplies purchased and used by the company overtime in their operation. 5) NOTES TO EQUIPMENT This account consists of COST ANNUAL DEPRECIATION EXPENSE STALL ₱ 24, 450.00 ₱ 4, 890.40 EQUIPMENTS ₱ 13, 390.00 ₱ 2, 678.00 ₱ 7, 568.00 TOTAL 6) Notes to SALARIES PAYABLE This account shows POSITION MONTHLY SSS SALARY Employer Employee PAG-IBIG Employer Employee PHIL HEALTH Employer Employee COOK 9, 620.00 800 400 1,200 192.4 192.4 384.8 144.3 144.3 288.6 CASHIER 9, 620.00 800 400 1,200 192.4 192.4 384.8 144.3 144.3 288.6 SALESPERS ON TOTAL 9, 620.00 800 400 1,200 192.4 192.4 384.8 144.3 144.3 288.6 28, 860.00 2,400 1,200 3,600 577.2 577.2 1, 154.4 432.9 432.9 865.8 Compensation is given monthly. The employees are compensated based on their position and they are deducted mandatory contributions required by law. They considered as assets by the company thus, they are treasured and kept. 7) NOTES TO UTILITIES PAYABLE This account consists of Water ₱ Electricity ₱ 12, 000.00 Internet ₱ TOTAL ₱ 25, 200.00 9, 600.00 3, 600.00 The annual dues of the company are presented above. These are paid every month. 8) NOTES TO INCOME TAX This account consists of 2024 Sales ₱ 1,802,500.00 less: Cost of Goods Sold (COGS) ₱ 793461.00 Gross Profit ₱ 1,009,039.00 less: Operating Expenses (OpEx) ₱ 435,481.00 Earnings Before Interest and Taxes ₱ 573,558.00 ₱ 0.00 (EBIT) less: Interest Expense are Earnings Before Tax (EBT) ₱ 573,558.00 less: Income tax (30%) ₱ 172, 067.40 EARNINGS AFTER TAX (EAT) ₱ 401,490.60 9) NOTES TO SSS PREMIUMS PAYABLE This account consists of POSITION EMPLOYER SHARE EMPLOYEE SHARE Cook ₱ 800.00 ₱ 400.00 Cashier ₱ 800.00 ₱ 400.00 Salesperson ₱ 800.00 ₱ 400.00 TOTAL ₱ 2, 400.00 ₱ 1, 200.00 These are mandatory contributions set by the government. 10) NOTES TO PAG-IBIG CONTRIBUTIONS PAYABLE This account consists of POSITION EMPLOYER SHARE EMPLOYEE SHARE Cook ₱ 192.40 ₱ 192.40 Cashier ₱ 192.40 ₱ 192.40 Salesperson ₱ 192.40 ₱ 192.40 TOTAL ₱ 577.20 ₱ 577.20 These are mandatory contributions set by the government. 11) PHILHEALTH CONTRIBUTIONS PAYABLE This account consists of POSITION EMPLOYER SHARE EMPLOYEE SHARE Cook ₱ 144.30 ₱ 144.30 Cashier ₱ 144.30 ₱ 144.30 Salesperson ₱ 144.30 ₱ 144.30 TOTAL ₱ 432.90 ₱ 432.90 These are mandatory contributions set by the government. 12) NOTES TO EQUITY This account consists of 2024 Beginning balance, Equity ₱ 500, 000.00 plus: Investments ₱ 200, 000.00 less: Withdrawals ₱ 0.00 Drawings ₱ 0.00 plus: Net income ₱ 401, 490.60 Ending balance, Equity ₱ 1, 101, 490.60 MOLO RYZI COMPANY’s FINANCIAL STATEMENT ANALYSIS Analysis Tools LIQUIDITY RATIOS Liquidity ratios are an important class of financial metrics used to determine a debtor's ability to pay off current debt obligations without raising external capital. Liquidity ratios measure a company's ability to pay debt obligations and its margin of safety through the calculation of metrics including the current ratio, quick ratio, and operating cash flow ratio. a. CURRENT RATIO The current ratio measures a company's ability to pay off its current liabilities (payable within one year) with its current assets such as cash, accounts receivable and inventories. The higher the ratio, the better the company's liquidity position: Current ratio= Current assets/ Current liabilities CURRENT RATIO= ₱ 2,279,580.60 / ₱830,008.60 =2.75 b. QUICK RATIO or ACID-TEST RATIO The quick ratio measures a company's ability to meet its short-term obligations with its most liquid assets and therefore excludes inventories from its current assets. It is also known as the "acid-test ratio": Acid-test ratio= (Cash + Receivables + Marketable Securities)/ Current liabilities QUICK RATIO= ₱ 2, 132, 580.6 / ₱830,008.60 =2.57 c. CASH RATIO The cash ratio is a measurement of a company's liquidity, specifically the ratio of a company's total cash and cash equivalents to its current liabilities. The metric calculates a company's ability to repay its short-term debt with cash or nearcash resources, such as easily marketable securities. Cash ratio= Cash and cash equivalents/ Current liabilities ₱ 1,917,580.60 CASH RATIO= / ₱830,008.60 = 2.31 d. CURRENT ASSETS TURNOVER (CATO) The asset turnover ratio measures the value of a company's sales or revenues relative to the value of its assets. The asset turnover ratio can be used as an indicator of the efficiency with which a company is using its assets to generate revenue. The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales. The asset turnover ratio uses the value of a company's assets in the denominator of the formula. To determine the value of a company's assets, the average value of the assets for the year needs to first be calculated. Current Assets Turnover (CATO) = (COS + OPEX (excluding depreciation and amortization)) / Average current assets CATO= ₱793, 461.00 + 435, 481.00 / 1, 627, 418.55 = .70 Liquidity risk Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company’s objective to managing liquidity risk is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking adverse effect to the Company’s credit standing. SOLVENCY RATIOS The solvency ratio is a key metric used to measure an enterprise's ability to meet its debt obligations and is used often by prospective business lenders. The solvency ratio indicates whether a company's cash flow is sufficient to meet its short-and long-term liabilities. a. DEBT RATIO The debt ratio is a financial ratio that measures the extent of a company’s leverage. The debt ratio is defined as the ratio of total debt to total assets, expressed as a decimal or percentage. It can be interpreted as the proportion of a company’s assets that are financed by debt. A ratio greater than 1 shows that a considerable portion of debt is funded by assets. In other words, the company has more liabilities than assets. A high ratio also indicates that a company may be putting itself at a risk of default on its loans if interest rates were to rise suddenly. A ratio below 1 translates to the fact that a greater portion of a company's assets is funded by equity. The debt ratio is also referred to as the debt-to-assets ratio. Debt Ratio= Total debt/ Total assets DEBT RATIO= ₱ 1,243,876.00 ₱ 2,345,366.60 = 0.46 b. FIXED ASSET TO LONG-TERM LIABILITIES RATIO The Fixed-assets- to long-term-liabilities ratio is a way of measuring the solvency of a company. A company's long-term debts are often secured with fixed assets, which is why creditors are interested in this ratio. This ratio is calculated by dividing the value of fixed assets by the amount of long-term debt. Fixed-assets- to long-term-liabilities ratio= Fixes assets/ long term debt c. FIXED ASSET TO TOTAL ASSETS Fixed assets to total asset ratio is a financial analysis technique that shows in percentage terms the portion of your company's total assets that is tied up with fixed assets. It shows the extent to which the company funds are frozen in the form of fixed assets, such as property, plant and equipment. It represents the portion of total assets that cannot be used as working capital. FIXED ASSET TO TOTAL ASSET RATIO= Fixed asset/ Total asset d. FIXED ASSET TURN-OVER The fixed asset turnover ratio (FAT) is, in general, used by analysts to measure operating performance. This efficiency ratio compares net sales (income statement) to fixed assets (balance sheet) and measures a company's ability to generate net sales from its fixed-asset investments, namely property, plant, and equipment (PP&E). FIXED ASSET TURN-OVER (FAT) = Net Sales/ Average Fixed Assets WORKING CAPITAL ACTIVITY TURNOVERS: a. ACCOUNTS RECEIVABLE TURN-OVER (ARTO) The accounts receivable turnover ratio is an accounting measure used to quantify a company's effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or is paid. The receivables turnover ratio is also called the accounts receivable turnover ratio. ARTO= Net Credit Sales/ Average Receivables ₱ 1, 802, 500.00 ARTO= / 171, 900.00 = 10.46 AVERAGE AGE OF ACCOUNTS RECEIVABLE The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies calculate the average collection period to make sure they have enough cash on hand to meet their financial obligations. The average collection period is calculated by dividing the average balance of accounts receivable by total net credit sales for the period and multiplying the quotient by the number of days in the period. Average age of A/R= 336 days or 48 weeks / ARTO AVERAGE AGE OF AR= 336 days/ 48 weeks / 10.46 32.12 / 33 days b. INVENTORY TURN-OVER (ITO) In accounting, the Inventory turnover is a measure of the number of times inventory is sold or used in a time such as a year. It is calculated to see if a business has an excessive inventory in comparison to its sales level. ITO= Cost of Goods Sold/ Average Merchandise Inventory ITO= ₱ 793, 461.00 / 58, 000.00 = 13.68 AVERAGE AGE OF INVENTORY= 336 days or 48 weeks/ ITO The average age of MOLO RYZY’s inventory is calculated by dividing the average cost of inventory by the COGS and then multiplying the product by 336 days. AVERAGE AGE OF INVENTORY= 336 days/ 48 weeks / 13.68 = 24.56 or 25 days c. TRADE PAYABLES TURN-OVER (APTO) The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payable turnover shows how many times a company pays off its accounts payable during a period. Accounts payable are short-term debt that a company owes to its suppliers and creditors. The accounts payable turnover ratio shows how efficient a company is at paying its suppliers and short-term debts. Accounts payables turn-over (APTO) = Net credit purchases/ Average Trade Payables ₱ 660, 000 ACCOUNTS PAYABLES TURN-OVER= / ₱ 76, 100.00 = 8.67 Average Age of A/P= 336 days or 48 weeks/ APTO AVERAGE AGE OF PAYABLES= 336 days/ 48 weeks / 8.67 = 38.75 or 39 days d. WORKING CAPITAL TO TOTAL ASSETS The working capital to total assets ratio compares the net liquid assets to the total assets of the firm. Working Capital is the difference between current assets and current liabilities, so the Working Capital to Total Assets ratio determines the short-term company's solvency. Working Capital to Total Assets= Working capital/ Total assets WC: TA= ₱ 1, 449, 572.00 / ₱ 2,345,366.60 = .62 e. WORKING CAPITAL TURNOVER (WCTO) The working capital turnover ratio is also referred to as net sales to working capital. It indicates a company's effectiveness in using its working capital. The working capital turnover ratio is calculated as follows: net annual sales divided by the average amount of working capital during the same year. Working Capital Turnover (WCTO) = Net Sales/ Average Working Capital WCTO= ₱ 1,802,500.00 / ₱ 950,709.00 = 1.90 OPERATING CYCLE The operating cycle is the average period of time required for a business to make an initial outlay of cash to produce goods, sell the goods, and receive cash from customers in exchange for the goods. It refers to the number of days a company takes in converting its inventories to cash. It equals the time taken in selling inventories (days inventories outstanding) plus the time taken in recovering cash from trade receivables (days sales outstanding). Operating Cycle= Average age of A/R + Average age of Inventory OPERATING CYCLE= 32.12 DAYS + 24.56 = 56.68 or 57 days CASH FLOW CYCLE The cash conversion cycle (CCC) is a metric that expresses the time (measured in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales. Also called the Net Operating Cycle or simply Cash Cycle, CCC attempts to measure how long each net input peso is tied up in the production and sales process before it gets converted into cash received. This metric takes into account how much time the company needs to sell its inventory, how much time it takes to collect receivables, and how much time it has to pay its bills without incurring penalties. CCC is one of several quantitative measures that help evaluate the efficiency of a company's operations and management. A trend of decreasing or steady CCC values over multiple periods is a good sign while rising ones should lead to more investigation and analysis based on other factors. One should bear in mind that CCC applies only to select sectors dependent on inventory management and related operations. CASH CONVERSION CYCLE (CCC) = Operating cycle- Average age of A/P CCC= 56.68 less: 38.75 = 17.93 days TEST OF PROFITABILITY RATIOS a. RETURN ON SALES Return on sales (ROS) is a ratio used to evaluate a company's operational efficiency. This measure provides insight into how much profit is being produced per dollar of sales. An increasing ROS indicates that a company is growing more efficiently, while a decreasing ROS could signal impending financial troubles. ROS is very closely related to a firm's operating profit margin. ROS= Operating Profit/ Net sales ₱ 573,558.00 ROS= / 1,802,500.00 = .32 b. RETURN ON ASSETS Return on assets (ROA) is a financial ratio that shows the percentage of profit a company earns in relation to its overall resources. It is commonly defined as net income divided by total assets. Net income is derived from the income statement of the company and is the profit after taxes. ROA= Net income/ Average assets ₱ ₱401,490.60 ROA= / ₱ 1,684,388.55 = . 24