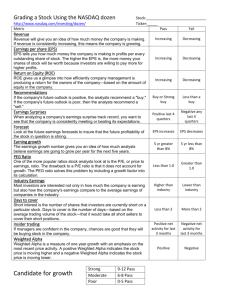

The NASDAQ Dozen: Analyzing a Stock in 12 Steps: • Do you have a stock you are interested in buying but you don't have the foggiest idea of where to even start a proper analysis? • Investing today is much different than it was 50, or even 20 years, ago. Back then, you could only get a limited amount of stock data in the daily newspaper, you have access to a seemingly unlimited amount of data on every publicly traded stock. This is both a blessing and a curse. • With access to so much information, many investors get lost in the details, but if you know where to look, you can make more informed investing decisions. • You can actually conduct a thorough analysis of any stock in 12 easy steps a process we call the Nasdaq Dozen. • As we get started, it is important to remember that the Nasdaq Dozen is neither a crystal ball nor a guarantee of success. Rather, it is a rational, repeatable process for analyzing the most important fundamental and technical aspects of any stock. • You also need to remember that no stock is perfect. If you look hard enough, you can always find something wrong with a stock. On the other hand, if you look hard enough, you can always find something good about a stock. • The trick is to invest in stocks that have more good qualities than bad. Here's where the Nasdaq Dozen comes in. How It Works: • By looking at 12 key aspects of any stock you are interested in, you can quickly determine if the stock is one worth pursuing or one better left alone. • To score the 12 factors of the Nasdaq Dozen, you need to assign each factor either a passing or a failing grade. • After you have scored all 12 factors, add up the passing grades and compare them to the failing grades. • If you have a high ratio of passing grades compared to failing grades, you can be more confident in the stock. • Conversely, if you have a low ratio of passing grades compared to failing grades, you would be less confident in the stock. 1 • For instance, you would feel more comfortable investing in a stock that had 10 passing grades and only two failing grades-a ratio of 10:2-than you would investing in a stock that only had four passing grades and eight failing grades-a ratio of 4:8. • Let's get started and learn how to score each of the 12 factors in the Nasdaq Dozen. INDICATOR #1 Revenue We start the Nasdaq dozen with an analysis of revenue because at its basic level, stock growth starts with a company making money. Fundamentally, if a company isn't bringing in any money, it can't pass profits along to its shareholders. In other words, it all starts with revenue. Why We Look at Revenue Revenue will give you an idea of how much money the company is making. If revenue is consistently increasing, this means the company is growing. As the company continues to grow, the stock price will appreciate in value. How to Score Revenue • Pass: Give revenue a passing score if revenue is increasing. Start first by comparing the annual totals. But if the most recent fiscal year is incomplete, compare the most recent quarter with the same quarter in the previous year. • Fail: Give revenue a failing score if revenue is decreasing Where to find it on NASDAQ Fundamentals -> Revenue/EPS INDICATOR #2 Earnings Per Share (EPS) The next fundamental factor in the Nasdaq Dozen is earnings per share. Why We Look at Earnings per Share If revenue tells us how much money is flowing into the company, EPS tells us how much of that money is flowing down to stockholders. EPS tells you how much money the company is making in profits per every outstanding share of stock. The higher the EPS is, the more money your shares of stock will be worth because investors are willing to pay more for higher profits. 2 How to Score Earnings per Share • Pass: Give EPS a passing score if the EPS are increasing. Start first by comparing the annual totals. But if the most recent fiscal year is incomplete, compare the most recent quarter with the same quarter in the previous year. • Fail: Give EPS a failing score if the EPS are decreasing Where to find it on NASDAQ Fundamentals -> Revenue/EPS INDICATOR #3 Return on Equity (ROE) The next fundamental factor in the Nasdaq Dozen is return on equity. Why We Look at Return on Equity ROE = Net income/Shareholders Equity ROE gives us a glimpse into how efficiently company management is producing a return for the owners of the company---based on the amount of equity in the company. To calculate ROE, divide the average shareholder’s equity during the past 12 months by the net profit the company has made during those same 12 months. How to Score Return on Equity • Pass: Give ROE a passing score if ROE has been increasing for two consecutive years. • Fail: Give ROE a failing score if ROE is decreasing. Where to find it on NASDAQ Fundamentals -> Income Statement -> Financial Ratios INDICATOR #4 Analyst Recommendations Now that you have determined the basic fundamental health of your stock, you will want to get an idea of what the professionals think about the stock by reviewing analyst recommendations. 3 Why We Look at Analyst Recommendations Analysts conduct extensive research on a stock and then issue a recommendation as to what they think the future holds for the company. If the company's future outlook is positive, the analysts recommend a "buy." If the company's future outlook is poor, then the analysts recommend a "sell." How to Score Analyst Recommendations • Pass: Give analyst recommendations a passing score if the consensus recommendation is a buy or strong buy. • Fail: Give analyst recommendations a failing score if the consensus recommendation is less than a buy. Where to find it on NASDAQ Stock Analysis – Analyst Research - Recommendations INDICATOR #5 Positive Earnings Surprises Earnings Surprises, is the next metric in your stock analysis Why We Look at Earnings Surprises Companies announce their earnings every quarter. Leading up to this event, analysts will make predictions as to what they think the earnings per share (EPS) will be. These predictions are often used as a benchmark by market participants. If the actual EPS comes in higher than the expected amount, this is generally good for the stock price. If the actual EPS comes in lower than the expected amount, this is generally bad for the stock price. When analyzing a company's earnings surprise track record, you want to see that the company is consistently meeting or beating its expectations. How to Score Earnings Surprises • Pass: Give the earnings surprises a passing score if the EPS surprises during the past four quarters have all been positive. • Fail: Give the earnings surprises a failing score if any of the EPS surprises during the past four quarters have been negative. Where to find it on NASDAQ Stock Analysis – Analyst Research – Earnings Surprise 4 INDICATOR #6 Earnings Forecast Earnings Forecast, is the next metric in your stock analysis Why We Look at Earnings Forecasts While it is very important to research a stock's past earnings reports, it is also important to look at the future earnings forecasts to insure that the future profitability of the stock in question is strong. How to Score Earnings Forecast • Pass: Give the earnings forecast a passing score if the consensus EPS forecast numbers increase year over year. • Fail: Give the earnings forecast a failing score if the consensus EPS forecast numbers do not increase year over year. Where to find it on NASDAQ Stock Analysis – Analyst Research – Forecast INDICATOR #7 Earnings Growth Why We Look at Earnings Growth The earnings growth number gives you an idea of how much analysts believe earnings are going to grow per year for the next five years. How to Score Earnings Growth • Pass: Give earnings growth a passing score if the Long Term 5-year number is greater than 8%. • Fail: Give earnings growth a failing score if the Long Term 5-year number is less than 8%. Where to find it on NASDAQ Stock Analysis – Analyst Research – Earnings Growth INDICATOR #8 PEG Ratio Why We Look at the PEG Ratio One of the more popular ratios stock analysts look at is the P/E, or price to earnings, ratio. The drawback to a P/E ratio is that it does not account for growth. A low P/E may seem like a positive sign for the stock, but if the company is not growing, its stock's value is also not likely to rise. The PEG ratio solves this problem by including a growth factor into its calculation. PEG is calculated by dividing the stock's P/E ratio by its expected 12 month growth rate. 5 How to Score the PEG Ratio • Pass: Give the PEG Ratio a passing score if its value is less than 1.0. • Fail: Give the PEG Ratio a failing score if its value is greater than 1.0. Where to find t on NASDAQ Stock Analysis – Analyst Research – PEG Ratio INDICATOR #9 Industry Price-Earnings Why We Look at Industry Earnings Most investors are interested not only in how much the company is earning but also how the company's earnings compare to the average earnings of companies in the industry. Typically, if a company is earning more than the average for the industry, it is a good sign for the company's stock. How to Score Industry Earnings • Pass: Give Industry Earnings a passing score if the company's P/E are higher than the industry's earnings. • Fail: Give Industry Earnings a failing score if the company's P/E are lower than the industry's earnings. Where to find on NASDAQ Stock Analysis – Analyst Research – Summary – Scroll to Bottom INDICATOR #10 Days To Cover Ratio (The Short Ratio) Why We Look at Days to Cover Short interest is the number of shares that investors are currently short on a particular stock. Days to cover is the number of days---based on the average trading volume of the stock---that it would take all short sellers to cover their short positions. For instance, if a stock has a short interest of 20 million shares and an average trading volume of 10 million shares, days to cover would be two days (20 million / 10 million = 2 days). How to Score Days to Cover • Pass: Give Days to Cover a passing score if the number of days is less than 2 days. • Fail: Give Days to Cover a failing score if the number of days is more than 2 days. Where to find on NASDAQ Fundamentals – Short Interest – Summary – Scroll to Bottom 6 INDICATOR #11 Insider Trading Why We Look at Insider Trading Insider trading can give you a glimpse into how confident the managers of the company are in the prospects for the company. If managers are confident in the company, chances are good that they will be buying stock in the company. Anytime you see insiders buying stock, it is typically a good sign. How to Score Insider Trading • Pass: Give Insider Trading a passing score if the net activity for the past 3 months has been positive. • Fail: Give Insider Trading a failing score if the net activity for the past 3 months has been negative. Where to find on NASDAQ Holdings – Insiders SEC Form 4 INDICATOR #12 Weighted Alpha Why We Look at Weighted Alpha Weighted Alpha is a measure of one year growth with an emphasis on the most recent price activity. A positive Weighted Alpha indicates the stock price is moving higher and a negative Weighted Alpha indicates the stock price is moving lower. Naturally, when you are looking at buying a stock, you want to see a stock that is increasing in value, not decreasing in value. Alpha, one of the most commonly quoted indicators of investment performance, is defined as the excess return on an investment relative to the return on a benchmark index. For example, if you invest in a stock and it returns 20% while the S&P 500 earned 5%, the alpha is 15. An alpha of -15 would indicate that the investment underperformed by 20%. Alpha is also a measure of risk. In the above example, the -15 means the investment was far too risky given the return. An alpha of zero suggests that an investment has earned a return commensurate with the risk. Alpha of greater than zero means an investment outperformed. How to Score Weighted Alpha • Pass: Give Weighted Alpha a passing score if the number is positive. • Fail: Give Weighted Alpha a failing score if the number is negative. Where to find on NASDAQ • Markets Tab at Top of Screen • Click on “Sector Analysis” from the drop down menu 7 Conclusion: • You have a positive score. But now that you’ve done all of this, what does it really mean? • Is it a guarantee the stock will go up? Certainly not. • Investing is an exercise of analyzing information and putting your money where you have the most confidence and the greatest likelihood of success. There are no guarantees. • Typically, stocks with Nasdaq Dozen ratios of 12:0 to 9:3 are strong candidates for growth, stocks with ratios of 8:4 to 6:6 are moderate candidates for growth and stocks with ratios below 6:6 are poor candidates for growth. • 12:0 - 9:3 Strong candidate for growth 8:4 - 6:6 Moderate candidates for growth Below 6:6 Poor candidates for growth Using the Nasdaq Dozen arms you with the data you need to make an informed decision and to put the odds of success in your favour. Abridged From: The Nasdaq Dozen. (n.d.). Retrieved from https://www.nasdaq.com/investing/dozen 8