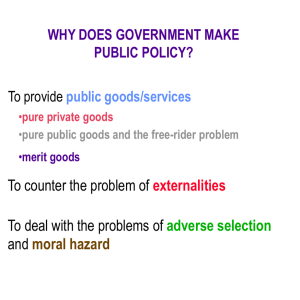

Lecture 4 What is an externality? James Sallee EEP 101/ECON 125 January 27, 2021 James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 1 / 25 Recap of Lecture 3 1 When should governments intervene in markets? - Three reasons: efficiency (market failure), equity (market distribution is unfair), or stability (market is volatile) 2 What is the social welfare function (SWF)? - The SWF is a hypothetical function that aggregates utility to describe society’s preferences over allocations. The social planner is a hypothetical actor who is supposed to maximize the SWF. - Today we will start our discussion of externalities, which are one potential cause of market failure and thus rationalize policy intervention for the sake of efficiency James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 2 / 25 Lecture 4 Outline 1 What is an externality? - One agent’s production/consumption directly (not through prices) influences the utility/production of another agent 2 Why do externalities cause market failure (inefficiency)? - Because market transactions do not reflect full costs and benefits to society James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 3 / 25 What are some examples of externalities? • • • • • Air pollution from burning coal Groundwater pollution from fertilizer use Loud music in a dorm room Aesthetic benefits from neighbor’s beautiful landscaping Knowledge spillovers - Many examples seem obvious and intuitive, but there are tricky cases, and we need a precise definition to help us James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 4 / 25 What is our definition of an externality? Definition: externalities A good causes an externality if the consumption (or production) of that good directly (not through prices or markets) affects the well-being of other people (or the costs of other firms) • An externality shifts utility function or production function - E.g., the same inputs produce less output because of a negative externality • Approximate rule for identifying an externality: if the effects on welfare or profit of the third party do not operate through a market/price, then it is probably an externality. Otherwise not. James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 5 / 25 Useful taxonomy of externalities Production Positive Bees and orchard Consumption Home improvement (spillovers) Negative Factory pollutes nearby river Cigarettes (second-hand smoke) • Externalities can be positive (good) or negative • Externalities can be associated with the production or consumption of a good (All of these have the same implication that market outcomes are not efficient) James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 6 / 25 Externality shifting production function Workers (x1) Chemicals (x2) Machines (x3) Laundry Production Function f(.) Output, Clean clothes (y) Building (x4) Smoke from Factory (z) • A production function specifies how a vector of inputs determines the quantity of output: y = f (x1 , x2 , ...xk ; z) • An externality exists when the actions of a third party shift the output, for a constant set of inputs. E.g., f (10, 7, ..., 100; 10) < f (10, 7, ..., 100; 0) James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 7 / 25 Externality shifting utility function • A utility function specifies how a vector of goods determines someone’s happiness U i = U(x1i , x2i , ..., xki ) • An externality exists when the consumption of person j changes the utility of person i, even when person i holds constant the amount they are consuming U i = U(x1i , x2i , ..., xki ; x1j , x2j , ..., xkj ) James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 8 / 25 Are these things externalities? a. You have always loved Chia seeds. Suddenly, everyone starts loving Chia seeds, and the price goes up so you have to pay more now. (Or, same, but with N95 masks.) b. You manage a Peet’s coffee. Starbucks opens a branch directly across the street, which lowers your profits. c. You run a factory in a small town. Another factory opens nearby and tries to hire some of your workers. Wages rise, which increases your cost. James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 9 / 25 Are these things externalities? a. Chia seed: b. Starbucks: c. Local labor market: - Our definition of an externality is designed so that any externality will create a market failure (market not Pareto efficient). There is no market failure in these examples. James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 10 / 25 Lecture 4 Outline 1 What is an externality? - One agent’s production/consumption directly (not through prices) influences the utility/production of another agent 2 Why do externalities cause market failure (inefficiency)? - Because market transactions do not reflect full costs and benefits to society James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 11 / 25 Externalities cause market failure Markets for an externality-generating good that is uncorrected by policy will generally not be efficient. • Specifically, we mean that markets are not Pareto efficient. A reallocation exists that could make everyone better off. • But, we might not be able to achieve a Pareto improvement via policy. Often we will only produce a Kaldor-Hicks improvement. • We will illustrate how externalities impact efficiency in three ways: - Voluntary exchange intuition - Mathematical optimization - Graphical representation James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 12 / 25 1. Voluntary exchange intuition • How many cigarettes will this smoker buy in a free market? • Value creation through exchange: - She buys until marginal benefit (MB) equals the price (= cigarette maker’s marginal cost (MC) in competitive equilibrium) - This maximizes value creation if there is no externality James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 13 / 25 1. Voluntary exchange intuition • Second-hand smoke externality ⇒ MB=MC does not maximize value creation for society because smoker and cigarette maker are ignoring some costs • A Pareto improvement could occur if people harmed paid smoker to reduce smoke • Why doesn’t this happen? Market for clean air is missing James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 14 / 25 2. Mathematical optimization (spherical cow) • Consider the market for a good Q that creates a negative production externality (e.g., cigarettes) • For illustration, suppose total externality = φQ, with φ > 0 • Assume constant returns to scale, perfectly competitive supply ⇒ P = MC ≡ marginal cost • Representative consumer has fixed income Y • Assume there is a quasi-linear numeraire good, X, so utility is: Ũ(Q, X ) = U(Q) + X (quasi-linear numeraire means X has price of 1 and consumer spends remaining income on X , after choosing Q) • Consumer maximizes utility, subject to budget constraint by solving: max Ũ(Q, X ) = U(Q) + (Y − PQ) Q • The consumer is ignoring the externality James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 15 / 25 2. Mathematical optimization • Social planner wants to maximize total social welfare, including the externality (by subtracting externality from utility) - (Under our assumptions, there is no producer surplus and no revenue, which we introduce later) • So, the planner solves max SWF = U(Q) + (Y − PQ) − φQ Q FOC: UQ0 = P + φ • This differs from consumer’s behavior: max Ũ(Q, X ) = U(Q) + (Y − PQ) q FOC: UQ0 = P • The planner and representative consumer act differently ⇒ inefficiency James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 16 / 25 3. Graphical version: market with no externality Market for Apples Price Consumer Surplus Pm=P* S=MC Producer Surplus D=MB Qm=Q* Quantity • Market equilibrium for a good with no externality will maximize consumer plus producer surplus • Market price (Pm ) and ideal price (P ∗ ) are the same James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 17 / 25 3. Graphical version: market with externality Market for Cigarettes Price marginal externality=Hq MSC P* S=MC Pm D=MB Q* • • • • • Qm Quantity Negative production externality (second-hand smoke) Market supply is MC; ignores pollution Marginal social cost (MSC ) is MC + (marginal) externality Ideal allocation is where MSC = MB Market price (Pm ) and ideal price (P ∗ ) are NOT the same James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 18 / 25 3. Graphical version: the SWF in a graph • We introduced the Social Welfare Function last lecture thinking only about consumers • But we will also have producers, and sometimes government revenue, and we have decide how to incorporate externalities • Our typical solution, especially for graphs, is to assume Consumer Surplus is independent of the externality • We then will put equal weight on Producer Surplus (PS) and Consumer Surplus (CS), and also equal weight on Government Revenue (which can be given to someone) • In sum, we will use a graphical interpretation that the Social Welfare Function is: SWF = CS + PS - Externality + Government Revenue James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 19 / 25 3. Graphical version: market with externality Market for Cigarettes Price DWL MSC P* S=MC Pm D=MB Q* Qm Quantity • Oversupply of good leads to deadweight loss (DWL) • For each unit between Q ∗ and Qm , true marginal cost exceeds benefit; each unit sold here destroys value; an allocation with lower Q could make everyone better off • Total welfare (=CS+PS-Externality) is lower at Qm than at Q ∗ • The difference in total welfare is DWL James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 20 / 25 Summary • The (1) voluntary exchange intuition, (2) mathematical optimization, and (3) graphical version are three different methods of conveying the same point, which is that the market outcome of a good with an externality is not efficient • In these examples, the market will choose an amount of the good that creates deadweight loss and is therefore not Pareto efficient • (Note however that it may prove tricky to actually achieve a Pareto improvement in practice via policy. More on this later in the course.) • Supplemental video after class: the slides next discuss a numerical example. You will do related numerical examples in problem set 1 James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 21 / 25 Numerical example: Negative consumption externality • Total benefit: TB = 12Q − Q 2 • Total cost: TC = 12 Q 2 • Total externality: TEC = 3Q • D=MB =12 − 2Q • S=MC = Q • Marginal externality costs= MEC = 3 • What is the social loss that results from the market equilibrium? • Often call marginal externality marginal damages or marginal external damages (or benefits) • Will use MED or MEC, or for benefits, MEB James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 22 / 25 Numerical example: Results • Social optimum: MB = MSC → 12 − 2Q = Q + 3 → Q ∗ = 3. (MSC is marginal social cost = private MC + MEC) • Competitive equilibrium: MB = MC → 12 − 2Q = Q → Qm = 4. • Too much is being consumed under free market! • How do we calculate DWL? - It is a triangle: area = 1/2 base × height - DWL = (7−4)(4−3) 2 James Sallee (EEP 101/ECON 125) = 1.5. (the shaded area) Externalities January 27, 2021 23 / 25 Numerical example: Graph • DWL is shaded area • DWL= (7−4)(4−3) = 1.5 2 MED×∆Q • DWL= = 1.5 2 P MB MSC =MC+MEC DWL =1.5 MC 6 4 3 MEC 3 James Sallee (EEP 101/ECON 125) Externalities 4 6 Q January 27, 2021 24 / 25 Lecture 4 Outline 1 What is an externality? - One agent’s production/consumption directly (not through prices) influences the utility/production of another agent 2 Why do externalities cause market failure (inefficiency)? - Because market transactions do not reflect full costs and benefits to society James Sallee (EEP 101/ECON 125) Externalities January 27, 2021 25 / 25