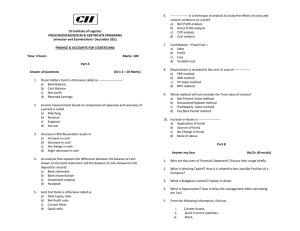

PAF – Karachi Institute of Economics and Technology City Campus Course: Managerial Accounting Faculty: Humayun Fareed Uddin Class ID: 106689 Examination: Final SPRING 2021 Date: 09-05-2021 Total Marks: 25 Max. Time: 3 Hours (10 M TO 1 PM) Q1 RELAVENT COST DM Sunbelt Company produces 100,000 automatic blenders per month, which is 80 percent of plant capacity. Variable manufacturing costs are $8 per unit. Fixed manufacturing costs are $400,000, or $4 per unit. The blenders are normally sold directly to retailers at $20 each. Sunbelt has an offer from Mexico Co. (a foreign wholesaler) to purchase an additional 2,000 blenders at $11 per unit. Acceptance of the offer would not affect normal sales of the product, and the additional units can be manufactured without increasing plant capacity. What should management do? (Marks -3) Q2 TARGET COST KRC Phones, Inc. is considering introducing a fashion cover for its phones. Market research indicates that 200,000 units can be sold if the price is no more than $20. If Fine Line decides to produce the covers, it will need to invest $1,000,000 in new production equipment. Fine Line requires a minimum rate of return of 25% on all investments. Determine the target cost per unit for the cover? (Marks -3) Q3 Comparison of traditional product costing with ABC Having knowledge and attended managerial accounting topic on activity based costing (ABC) you decide to experiment by applying the principles of ABC to the four products currently made and sold by your company. Details of the four products and relevant information are given below for one period. Product A B C D Output in units Cost per unit 120 Rs. 100 Rs. 80 Rs. 120 Rs. Direct Material Direct Labour Machine hours (per Unit) 40 28 4 50 21 3 30 14 2 60 21 3 The four products are similar and are usually produced in production runs of 20 units and sold in batches of 10 units. The production overhead is currently absorbed by using a machine hour rate, and the total of the production overhead for the period has been analysed as followed. ________________________________________________________ RS_____ Machine department cost (rent, business rates, depreciation And supervision) Set-up cost Stores receiving Inspection / Quality control Material handling and dispatch 10,430 5,250 3,600 2,100 4,620 You have ascertained that the “cost drivers” to be used are as listed below for the overhead cost shown. Cost Set up cost Stores receiving Inspection / Quality control Material handling and dispatch Cost Drivers Number of production runs Requisitions raised Number of production runs Orders executed The number of requisitions raised on the stores was 20 for each product and the number of orders executed was 42, each order being for a batch of 10 of a product. Required. (a) To calculate the total cost for each product if all overhead cost are absorbed on a machine hour basis. (b) To calculate the total cost for each product, using activity-based costing. (c) To calculate and list the unit product cost from your figures in (a) and (b) above, to show the differences and to comment briefly on your conclusions. (Marks -6) CVP ANANLYSIS / BREAK EVEN POINT / COGS & MANAGEMETN DEICISION. Q4 Battonkill Company, operating at full capacity, sold 112,800 units at a price of $150 per unit during 2019. Its income statement for 2019 is as follows: Sales . . . . . . . . . . . . . . . . . . . ……. . . . $16,920,000 Cost of goods sold . . . . . . . . . . . . . 6,000,000 Gross profit . . . . . . . . . . . . …... . . . . . $10,920,000 Expenses: Selling expenses . . . . . ……….. . . . . . . $3,000,000 Administrative expenses . . . . . . . 1,800,000 Total expenses . . . . . . . . . . . . 4,800,000 Income from operations . . . . . . . . . $6,120,000 The division of costs between fixed and variable is as follows: Fixed Variable Cost of sales 40% 60% Selling expenses 50% 50% Administrative expenses 70% 30% Management is considering a plant expansion program that will permit an increase of $1,500,000 in yearly sales. The expansion will increase fixed costs by $200,000, but will not affect the relationship between sales and variable costs. Required: a. Do you think the income statement presented above helps Battonkill Company to answer the following requirements if no how this income statement shall be presented b. Compute the break-even sales (units) for 2019. c. Compute the break-even sales (units) under the (proposed) program. d. Determine the amount of sales (amount) that would be necessary under the proposed program to realize the $6,120,000 of income from operations that was earned in 2019. e. Determine the maximum income from operations possible with the expanded plant. f. If the proposal is accepted and sales remain at the 2019 level, what will the income? or loss from operations is for 2020? (Marks -7) DM PROFIT OPIMIZATION LIMITING FACTOR Q5 (Marks -6) XYZ Corporation produces and sells three products: tablets, mobiles and watches. Data related to three products is as follows: Tablets Mobiles Watches Sales (Units) 800 200 200 Price per unit $100.00 $50.00 $40.00 Variable cost per unit 60.00 20.00 30.00 Machine hours per unit 10 Hours 5 Hours 4 Hours Labor hours per unit 15 Hours 10 Hours 5 Hours XYZ Corporation is available with 8,000 machine hours and 16000 hours of labor to meet the demand of all products. Fixed cost for the period is $ 45,000. Determine the best sales mix for XYZ Corporation by identifying the limiting factor and find out the profit. ___________________________________XXXXXXXXXX___________________________________