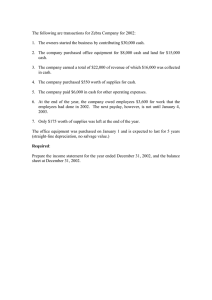

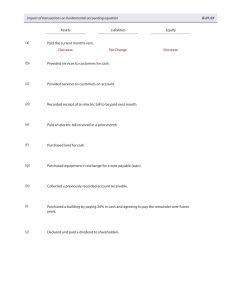

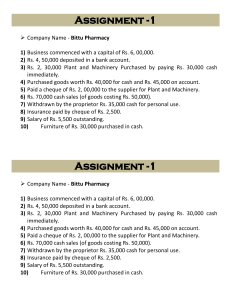

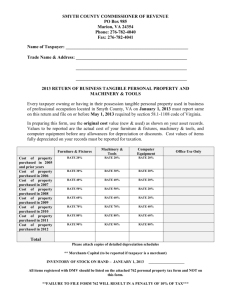

ACT 3101 – FINANCIAL ACCOUNTING AND REPORTING 1 Tutorial 5: PPE Question 1 Question 8: Application Exercises, FAR 1 (page 192) Question 2 Indicate whether each of the following expenditures should be classified as land (L), land improvements (LI), buildings (B), equipment (E), or none of these (X). _____ 1. _____ 2. _____ 3. _____ 4. _____ 5. _____ 6. _____ 7. _____ 8. _____ 9. _____10. Parking lots Electricity used by a machine Excavation costs Interest on building construction loan Cost of trial runs for machinery Drainage costs Cost to install a machine Fences Unpaid (past) property taxes assumed Cost of tearing down a building when land and a building on it are purchased Question 3 Identify the following expenditures as capital expenditures (ASSET) or revenue expenditures (EXPENSES). (a) Replacement of worn out gears on factory machinery. (b) Construction of a new wing on an office building. (c) Painting the exterior of a building. (d) Oil change on a company truck. (e) Replacing a computer chip with a larger chip, which increases productive capacity. No extension of useful life expected. (f) Overhaul of a truck motor. One year extension in useful life is expected. (g) Purchased a wastebasket at a cost of RM10. (h) Painting and lettering of a used truck upon acquisition of the truck. Question 4 DeLong Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, RM73,000; broker’s fees, RM6,000; title search and other fees, RM5,000; demolition of an old building on the property, RM5,700; grading, RM1,200; digging foundation for the road, RM3,000; laying and paving driveway, RM25,000; lighting RM7,500; signs, RM1,500. Required: List the items and amounts that should be included in the Land account. 1 Question 5 On March 1, 2019, Joyner Company acquired real estate on which it planned to construct a small office building. The company paid RM65,000 in cash. An old warehouse on the property was razed at a cost of RM7,600; the residual materials were sold for RM1,700. Additional expenditures before construction began included RM1,100 attorney's fee for work concerning the land purchase, RM4,000 real estate broker's fee, RM7,800 architect's fee, and RM14,000 to put in driveways and a parking lot. Required: Determine the amount to be reported as the cost of the land. Question 6 Kemp Company purchased factory equipment with an invoice price of RM85,000. Other costs incurred were freight costs, RM1,100; installation wiring and foundation, RM2,200; material and labor costs in testing equipment, RM700; oil lubricants and supplies to be used with equipment, RM500; fire insurance policy covering equipment, RM1,400. The equipment is estimated to have a RM5,000 residual value at the end of its 10-year useful service life. Required: Compute the acquisition cost of the equipment. Clearly identify each element of cost. Question 7 Waner Company exchanged an old machine (cost RM100,000 less RM60,000 accumulated depreciation) plus RM5,000 cash for a new machine. The old machine had a fair value of RM36,000. Required: Prepare the entry to record the exchange of assets by Waner Company. Question 8 Fisher Company trades old equipment (cost RM90,000 less RM54,000 accumulated depreciation) for new equipment. Fisher paid RM36,000 cash in the trade. The old equipment that was traded had a fair value of RM44,000. The transaction has commercial substance. Required: Prepare the entry to record the exchange of assets by Fisher Company. Question 9 On June 30, 2019, the company exchanged old office equipment and RM40,000 cash for new office equipment. The old office equipment originally cost RM80,000 and had accumulated depreciation to the date of disposal of RM35,000. It is estimated that the fair value of the old office equipment on June 30 was RM50,000. The transaction has commercial substance. Required: Prepare the entry to record the exchange of assets. 2 Question 10 Sejahtera Company acquired a piece of production equipment on 31 January, 2020, for use in producing tripod stands. The catalog listed the equipment cost at RM50,000 on the date of purchase. Sejahtera Company was granted a trade discount of 3%. Other information pertaining to the equipment is as follows: 1. The equipment had to be installed with a special attachment. The attachment cost RM2,400. An additional RM420 was paid to an installer who performed the installation. 2. Freight costs amounted to RM335 for shipping the equipment to Sejahtera manufacturing plant. 3. One of Sejahtera’s employees knocked the equipment against the wall prior to installation and caused damage to the equipment in the amount of RM200 and damage to the wall in the amount of RM225. 4. Sejahtera’s borrowed RM50,000 from the bank to pay for the equipment, with an agreement to repay the loan at RM10,000 per year beginning 31 January, 2020, plus accrued interest at 10%. 5. Sales taxes paid on the equipment are RM2,500. 6. Employees were provided a one-day training session to learn how to use the equipment. The training session cost RM600. Required: Determine the cost of the equipment for Sejahtera Company. Question 11: Robin purchased an item of plant. The details are as follows: RM List price Trade discount Shipping and handling Pre-production testing Maintenance for four years Site preparation: Concrete reinforcement Electrical cabling and wiring Labour cost RM 1,200,000 10% 16,000 25,000 60,000 12,000 34,000 36,000 Robin had specified wrong cables and the cost of correcting the error of RM12,000 is included in the electrical cabling costs. The plant is expected to last for five years, at the end of which Robin will incur compulsory dismantling costs of RM10,000 and site restoration cost of RM5,000. The present value of RM1 received in five years’ time is RM0.75, using a discount rate of 6%. The residual value of the plant is estimated at RM26,000. Required: (a) Calculate the amount that will be recognized as plant. (b) Show the extract of the statement of comprehensive income of Robin. (c) Show the extract of the statement of financial position at the end of year 1. 3 Question 12 On 1 January 2020 Rozabella Bhd. purchased an equipment for RM600,000, including RM50,000 refundable purchase taxes. The entity incurred costs of RM20,000 in transporting the equipment to the entity’s site and RM100,000 in installing the equipment at the site. At the end of the equipment’s 10-year useful life the entity is required to dismantle the equipment and restore the land upon which the factory is build. The present value of the cost of dismantling the equipment and restoring the environment is estimated to be RM100,000. In January 2020 the entity’s engineer incurred the following costs in modifying the equipment so that it can produce the products manufactured by the entity: Material – RM55,000 Labour – RM65,000 Depreciation of plant and equipment used to perform the modifications – RM15,000 In January 2020 the entity’s production staff were trained in how to operate the new item of equipment. Training costs included: Cost of an expert external instructor – RM7,000 Labour – RM3,000 In February 2020 the entity’s production team tested the equipment and the engineering team made further modifications necessary to get the equipment to function as intended by management. The following costs were incurred in the testing phase: Material – RM21,000 Labour – RM11,000 Depreciation of plant and equipment used to perform the modifications – RM5,000 The equipment was only ready for use on 1 March 2020. Required: Compute the total cost of the equipment. Question 13 Perkasa Trading Berhad purchased land as a factory site and contracted Waja Construction Berhad to construct a factory. Perkasa Trading Berhad made the following expenditures related to the acquisition of the land, building and machinery to equip the factory: Purchase price of the land Demolition and removal of old building Clearing and grading the land before construction Stamp duty and legal fees on the purchase of the land Architect’s fee for the plant for the new building Payments to Waja Construction for building construction Machinery purchased Trade discount for machinery – 5% Freight charges on machinery Cost to build special platforms and install wiring for the machinery Cost of trial runs to ensure proper installation of the machinery Maintenance charges for machinery for three years Fire and theft insurance on the factory for the first year of use General administrative costs RM 1,200,000 80,000 150,000 42,000 50,000 3,250,000 860,000 32,000 12,000 7,000 10,000 24,000 100,000 4 In addition to the above expenditures, Perkasa Trading Berhad purchased four forklifts from Sumi Engineering Sdn Bhd. In payment, Perkasa Trading Berhad paid RM16,000 cash and signed a noninterest-bearing note requiring the payment of RM70,000 in one year. An interest rate of 7% reflects the time value of money for this type of loan. Required: Determine the initial cost of each of the property, plant and equipment (i.e. land, building, machinery and forklifts) Perkasa Trading Berhad acquired in the above transactions. Question 14 a) You are working in the accounting department of Rozzalia Bhd, a company that specializes in the production and sales of products related to roselle. You have been asked by your supervisor to review several issues related to decisions made on the financial statement items of the company during the financial year 2019. The followings are the situations that require your consideration: i. On 1 January 2019, the company places an order for a machine from a company in Japan. The delivery of the machine is made on 31 January 2019. The list price of the machine is RM300,000 with a trade discount of 1% on the initial list price. Import duties and taxes amounted to RM15,000. The following costs are also incurred in relation to the purchase : – Delivery and transport costs from Port Klang to the factory amounted to RM2,500 – Installation and commissioning costs amounted to RM11,500 – Administrative costs incurred in processing the acquisition amounted to RM5,000 The expected useful life of the machine is 30 years. ii. On 1 July 2019, the company purchases a land for RM200,000. The land is to be used to plant the roselle (Hibiscus sabdariffa), to produce raw material for the production of the company’s products. To secure the purchase, the company incurs costs of RM20,000 for the legal fees. It is the company’s practice to restore land used as plantation area after the end of the expected usage of the land. Thus, at the end of the land’s 10-year useful life, the company will restore the land for environmental sustainability. The present value of the cost of land restoration is estimated to be RM50,000. The company uses straight line depreciation method for all property, plant and equipment. The company uses cost model for all property, plant and equipment. Required: Prepare journal entries for the initial recognition of items 1 and 2 above for Rozzalia Bhd. (Assume that all the payments are made by cash). b) Maram Bhd acquires a production equipment to be used in producing the company’s main product line, a 4D ultrasound machine. The production equipment is expected to be used for five years before being scrapped. Required: By citing relevant accounting standards, suggest the accounting treatment for the assets. 5 Question 15 Samudera Bhd. started business in early 2020. In the first few months of its operation, Samudera Bhd. acquired a land for the construction of a building. Operating equipment was purchased and installed and was ready for use. The company signed a 10 year long term loan with Bank Abadi Bhd of RM1,000,000. The company used most of the loan to buy land, equipment and to finance a self-constructed building. Recently, the company hired a young account executive, Miss Finna, to maintain accounting records of the company. After a few process of data gathering and analysis of documents, she has the following list of cost incurred: No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Description Cost of land purchased as a building site. Paid architect’s fee for design of new building. Paid for demolition of old building on building site purchased in (1). Paid tax on the land purchased as a building site in (1). Paid excavation cost for the new building. Made the initial payment to the building contractor. Received from sale of salvaged materials from demolishing the old building. Made final payment to the building contractor. Paid interest on loan used for construction of building. Medical cost for a worker involved in accident during the construction of building. Made payment for the purchase of equipment. Paid freight on the purchase of equipment. Paid for the installation of equipment. Paid for repair of damaged equipment after installation. Paid for a three-day training session for employees to learn how to use the equipment. RM 170,000 23,000 28,000 1,700 15,000 250,000 6,800 350,000 22,000 10,000 40,000 1,900 4,200 2,700 2,500 Required: a) Determine the cost to be capitalized in accordance with MFRS 116 for the following types of property, plant and equipment: i) Land ii) Building iii) Equipment b) Prepare journal entries for the initial recognition of land, building and equipment above assuming all payments are made by cash. 6