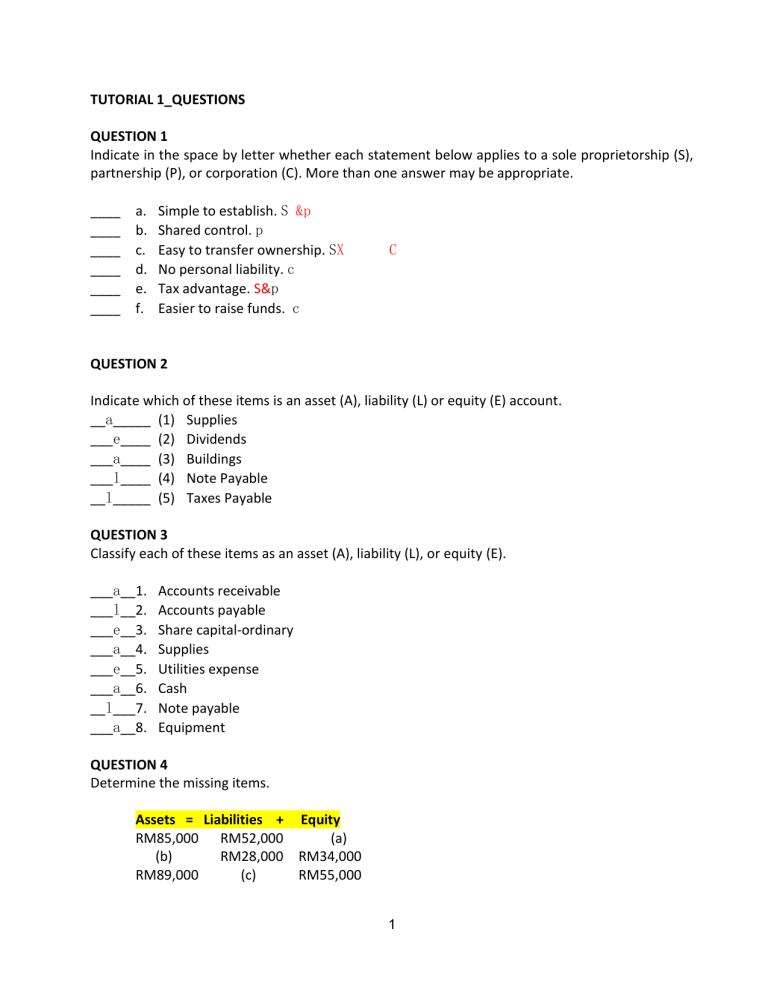

TUTORIAL 1_QUESTIONS QUESTION 1 Indicate in the space by letter whether each statement below applies to a sole proprietorship (S), partnership (P), or corporation (C). More than one answer may be appropriate. ____ ____ ____ ____ ____ ____ a. b. c. d. e. f. Simple to establish. S &p Shared control. p Easy to transfer ownership. SX No personal liability. c Tax advantage. S&p Easier to raise funds. c C QUESTION 2 Indicate which of these items is an asset (A), liability (L) or equity (E) account. __a_____ (1) Supplies ___e____ (2) Dividends ___a____ (3) Buildings ___l____ (4) Note Payable __l_____ (5) Taxes Payable QUESTION 3 Classify each of these items as an asset (A), liability (L), or equity (E). ___a__1. ___l__2. ___e__3. ___a__4. ___e__5. ___a__6. __l___7. ___a__8. Accounts receivable Accounts payable Share capital-ordinary Supplies Utilities expense Cash Note payable Equipment QUESTION 4 Determine the missing items. Assets = Liabilities + Equity RM85,000 RM52,000 (a) (b) RM28,000 RM34,000 RM89,000 (c) RM55,000 1 QUESTION 5 Use the accounting equation to answer the following questions. 1. Force 10 Sails Co. has total assets of RM120,000 and total liabilities of RM65,000. What is equity? 2. Marcy Fun Center has total assets of RM225,000 and equity of RM105,000. What are total liabilities? 3. Franco’s Restaurant has total liabilities of RM50,000 and equity of RM75,000. What are total assets? QUESTION 6 Presented below are items for Wilson Company at December 31, 2019. Accounts payable RM45,000 Accounts receivable 36,000 Cash 27,000 Equipment 62,000 Share capital-ordinary 30,000 Notes payable 50,000 Compute each of the following: 1. Total assets. 2. Total liabilities. QUESTION 7 Use the following information for questions 1-5 O' Hara Company began operations on December 1, 2019. Presented below is selected information related to O' Hara Company at December 31, 2019. Equipment Cash Service Revenue Rent Expense Accounts Payable Share Capital-ordinary RM 80,000 28,000 216,000 26,000 32,000 56,000 Utilities Expense Accounts Receivable Salaries and Wages Expense Notes Payable Dividends 1. At December 31, 2019, assets total C a. RM108,000. b. RM140,000. c. RM162,000. d. RM194,000. 2 RM 12,000 54,000 94,000 20,000 30,000 3 2. At December 31, 2019, liabilities total b a. RM32,000. b. RM52,000. c. RM74,000. d. RM82,000. 3. Net income for the month of December is b a. RM54,000. b. RM84,000. c. RM112,000. d. RM132,000. 4. Retained earnings at December 31, 2019 is c a. RM30,000. b. RM44,000. c. RM54,000. d. RM110,000. 5. Equity at December 31, 2019, is d a. RM296,000. b. RM242,000. c. RM186,000. d. RM110,000. QUESTION 8 Use the following information for questions 1-5 EI Greco Corporation began operations on January 1, 2019. Presented below is selected information related to EI Greco at December 31, 2019. Equipment Cash Service Revenue Rent Expense Accounts Payable Share Capital-Ordinary Supplies RM290,000 84,000 648,000 78,000 44,000 168,000 30,000 Utilities Expense Accounts Receivable Salaries and Wages Expense Notes Payable Dividends Salaries and Wages Payable Advertising Expense 4 RM36,000 82,000 242,000 96,000 90,000 16,000 40,000 1. The statement of financial position at December 31, 2019 reports total assets of a. RM320,000. b. RM404,000. c. RM456,000. d. RM486,000. 2. The statement of financial position at December 31, 2019 reports total liabilities of a. RM60,000. b. RM120,000. c. RM156,000. d. RM238,000. 3. Net income (loss) reported on the income statement for the month of December is A a. RM252,000. b. RM180,000. c. RM162,000. d. RM96,000. 4. Retained earnings reported on the statement of financial position at December 31, 2019 is a. RM330,000. b. RM252,000. c. RM168,000. d. RM162,000. 5. The statement of financial position at December 31, 2019 reports equity of a. RM420,000. b. RM330,000. c. RM180,000. d. RM162,000. 5 QUESTION 9 Sleep Dream is a private camping ground near the Boulder Peak Recreation Area. It has compiled the following financial information as of December 31, 2019. Services revenues (from camping fees) Sales revenues (from general store) Accounts payable Cash Equipment RM132,000 8,000 25,000 13,000 108,000 Dividends Notes payable Administrative expenses Supplies Share capital Retained earnings (1/1/2019) RM8,000 50,000 133,000 2,500 40,000 5,000 Instructions (a) Determine net income from Sleep Dream for 2019. (b) Prepare a retained earnings statement and a statement of financial position for Sleep Dream as of December 31, 2019. QUESTION 10 Identify the impact on the accounting equation of each of the following transactions. 1. Purchase office supplies on account. r 2. Paid secretary weekly salary. r 3. Purchased office furniture for cash. r 4. Received monthly utility bill to be paid at later time. liability QUESTION 11 Selected transactions for Tall Timber Tree Service are listed below. 1. Made cash investment to start the business. 2. Paid for monthly advertising. 3. Purchased supplies on account. 4. Billed customers for services performed. 5. Paid cash dividends. 6. Received cash from customers billed in (4). 7. Incurred utilities expense on account. 8. Purchased additional supplies for cash. 9. Received cash from customers when service was performed. Instructions 6 List the numbers of the above transactions and describe the effect of each transaction on assets, liabilities, and owner’s equity. For example, the first answer is: (1) Increase in assets and increase in equity. QUESTION 12 Identify whether the following items would be reported on the Statement of profit or loss (SPL) or statement of financial position (SOFP). 1. Cash 2. Service Revenue 3. Notes Payable 4. Interest Expense 5. Accounts Receivable QUESTION 13 Analyze the transactions of a business organized as a proprietorship described below and indicate their effect on the basic accounting equation. Use a plus sign (+) to indicate an increase and a minus sign (–) to indicate a decrease. Assets 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Received cash for services rendered. Purchased office equipment on credit. Paid employees' salaries. Received cash from customer in payment on account. Paid telephone bill for the month. Paid for office equipment purchased in transaction 2. Purchased office supplies on credit. Paid dividends. Obtained a loan from the bank. Billed customers for services rendered. = Liabilities + Equity +_______ +_______ -_______ ________ +_______ ________ +_______ ________ - _______ + -_____ -_______ ________ ________ +_______ - _______ -_______ +_______ -_______ +_______ +_______ -_______ +_______ ________ +_______ ________ ________ ________ -_______ ________ +_______ 7 QUESTION 14 Indicate in the space provided by each item whether it would appear on the Statement of profit or loss (SPL), Statement of Financial Position (SOFP), or Retained Earnings Statement (RES): a. _____ Service Revenue g. ___Accounts Receivable b. _____ Utilities Expense h. ___Retained Earnings (ending) c. _____ Cash i. d. _____ Accounts Payable j. __ Advertising Expense e. _____ Supplies k. __ Dividends f. _____ Salaries and Wages Expense l. __ Notes Payable ___ Equipment revenue 和 expense 只是 SPL purchase 和 sales (wages)没有 balance cd bd 只写成 SPL (因为只有 SPL 对面那一侧 有记录) 在 trial balance 与 ledger 对应(SPL 的对面那一侧) RES 里只有 RE 和 DIVIDENDS 剩下的都是 SOFP QUESTION 15 Use the following information to calculate for the year ended December 31, 2019 (a) net income (net loss), (b) ending retained earnings, and (c) total assets. Supplies RM 1,000 Operating expenses 12,000 Accounts payable 9,000 Accounts receivable 3,000 Beginning retained earnings 5,000 Revenues Cash Dividends Notes payable Equipment 8 RM21,000 13,000 1,000 1,000 6,000 QUESTION 16 Bill Phinnes decides to open a cleaning and laundry service near the local college campus that will operate as a corporation. Analyze the following transactions for the month of June in terms of their effect on the basic accounting equation. Record each transaction by increasing (+) or decreasing (– ) the dollar amount of each item affected. Indicate the new balance of each item after a transaction is recorded. It is not necessary to identify the cause of changes in equity. (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Issued ordinary shares in exchange for RM20,000 cash on June 1. Purchased laundry equipment for RM5,000 paying RM3,000 in cash and the remainder due in 30 days. Purchased laundry supplies for RM1,200 cash. Received a bill from College News for RM300 for advertising in the campus newspaper. Cash receipts from customers for cleaning and laundry amounted to RM1,500. Paid salaries of RM200 to student workers. Billed the Lion Soccer Team RM200 for cleaning and laundry services. Paid RM300 to College News for advertising that was previously billed in Transaction 4. Paid dividends of RM700. Incurred utility expenses for month on account, RM150. Cash 1 2 3 4 5 6 7 8 9 10 Account Receivable +20000 -3000 -1200 Supplies Equipment +5000 Account payable Share capital +20000 Retained earnings +2000 +1200 +300 +1500 -200 +200 -300 -700 -300 +1500 -200 +200 -300 +150 9 -700 -150 QUESITON 17 Kinney’s repair Ltd., was started on May 1. A summary of May transactions is presented below. 1. Shareholders invested RM10,000 cash in the business in exchange for ordinary shares. 2. Purchased equipment for RM 5,000 cash. 3. Paid RM400 cash for May office rent. 4. Paid RM700 cash for supplies. 5. Incurred RM250 of advertising costs in the Daily News on Account. 6. Received RM4,700 in cash from customers for repair service. 7. Declared and paid RM1,000 cash dividend. 8. Paid part-time employee salary RM1,000. 9. Paid utility bill RM160. 10. Performed repair service worth RM980 on account. 11. Collected cash of RM120 for services bill in transaction (10). Instructions a) Prepare a tabular analysis of the transactions, using the following column headings: Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Share Capital and Retained Earnings (with separate columns for Revenues, Expenses, and Dividends.). b) From an analysis of the Retained Earnings columns, compute the net income or net loss for May. ASSETS Date Cash LIABILITIES Account Supplies Equipment = Notes Accounts Share Receivable Payable Payable Capital 1 +1w 2 -5k 3 -400 4 -700 5 6 +4700 7 -1000 8 -1k 9 -160 10 +980 11 +120 -120 EQUITY RETAINED EARNINGS Rev Exp Div +1w +5k -400 +700 +250 -250 +4.7k -1k -1k -160 +980 10 Question 18 Matt Stiner started a delivery service, Stiner Deliveries Ltd., on June 1 2019. The following transactions occurred during the month of June. June 1 Shareholders invested RM10,000 cash in the business in exchange for ordinary shares. 2 Purchased a used van for deliveries for RM14,000. Matt paid RM2,000 cash and signed a note payable for the remaining balance. 3 Paid RM500 for office rent for the month. 5 Performed services worth RM4,800 on account. 9 Declared and paid RM300 in cash dividends. 12 Purchased supplies for RM150 on account. 15 Received a cash payment of RM1,250 for services performed on June 5. 17 Purchased gasoline for RM100 on account. 20 Received a cash payment of RM1,500 for services performed. 23 Made a cash payment of RM500 on the note payable. 26 Paid RM250 for utilities. 29 Paid for the gasoline purchased on account on June 17. 30 Paid RM1,000 for employee salaries. Instructions Show the effects of the previous transactions on the accounting equations using the following format. ASSETS Date Cash 1 +1w 2 -2k 3 -500 LIABILITIES Account Supplies Equipment = Notes Accounts Share Receivable Payable Payable Capital EQUITY RETAINED EARNINGS Rev Exp Div +1w +1.4w +1.2w -500 11 5 9 +4.8k -300 -300 12 15 +4.8k +150 +1250 +150 -1250 17 +100 20 +1500 23 -500 26 -250 29 -100 30 -1k -1500 -100 +1500 -500 +250 -250 -100 -1k 20 题主观代入导致错 还在复读吗??? 12 Question 19 Mandy Arnold opened a law office, Mandy Arnold, Attorney at Law Ltd., on July 1, 2019. In July 31, the balance of the relevant accounts showed Cash RM4,000, Accounts Receivable RM1,500, Supplies RM500, Equipment RM5,000, Accounts Payable RM4,200, Share capital RM6,000, and Retained Earnings RM800. during August, the following transactions occurred. 1. Collected RM1,400 of accounts receivable due from clients. 2. Paid RM2,700 cash for accounts payable due. 3. Recognized revenue of RM7,900 of which RM3,000 is collected in cash and the balance is due in September. 4. Purchased additional office equipment for RM1,000 paying RM400 in cash and the balance due in September. 5. Paid salaries RM3,000, rent for August RM900 and advertising expense RM350. 6. Declared and paid a RM450 cash dividend. 7. Received RM2,000 from Standard Federal Bank; the money was borrowed on a 4-month note payable. 8. Incurred utility expenses for month on account RM210. Instruction Prepare a tabular analysis of the August transactions beginning with July 31 Balances. The column heading should be as follows: Cash + Accounts Receivable + Supplies + Equipment = Notes Payable + Share Capital +Retained Earnings + Revenue – Expenses – Dividends ASSETS Date Cash LIABILITIES Account Supplies Equipment = Notes Accounts Share Receivable Payable Payable Capital 1 +1400 -1400 2 -2700 3 +3000 +4900 4 -400 5 -4250 开写) 6 -450 7 +2000 8 EQUITY RETAINED EARNINGS Rev Exp Div -2700 +7900 +1000 +600 -4250( 要 分 -450 +2000 +210 13 -210